SPAC Boom 2020 saw a historic boom in investor sentiment towards Special Purpose Acquisition Companies (SPACs), also known as “blank check firms”. SPACs are investment vehicles that go to market without an underlying business, instead using its funds to merge with another company after its IPO.

Source: BDCs Provide Opportunities for Retail Investors as SPAC Boom Continues into 2021

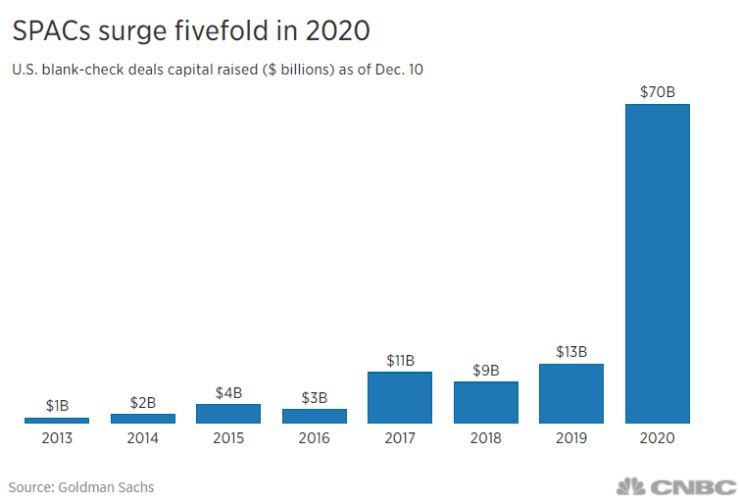

Blank check capital deals doubled between the years 2019 and 2020, with over $70 billion raised in 2020 alone — and some investment strategists believe that this boom will continue for years to come.

While sentiment remains strong for SPACs heading into 2021, investors are also turning towards Business Development Companies (BDCs). Strict sponsor requirements may provide a SPAC with as little as two weeks to find a company to merge with. If this requirement isn’t met, the money will be returned to investors. SPACs have gained a negative reputation among some investors because “the lifespan of a typical SPAC is usually not long or successful,” says BB&T Capital Markets' Vernon Plack. This is where BDCs may present an interesting opportunity for investors to access privately held companies.

A good analogy: SPACs represent private equity and BDCs represent private credit. SPACs are a way for investors to position themselves for equity in the potential participation in an IPO of a single company, whereas BDCs are a way for individuals to gain exposure to multiple private companies via private credit.

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

What Makes BDCs Standout

SPACs are created with the mission to acquire a single private company and take it public; on the contrary, BDCs provide capital to multiple small-mid size private companies primarily via debt financing through floating rate loans. It is important to note that these rates are subject to change dependent on if the Fed is required to increase rates.

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

BDCs have a portfolio already in place when they come to market, which offers exposure to many companies versus SPACs, which if successful in the merger, only provide exposure to one company. BDCs are currently the closest thing to SPACs that private companies have to rely on in terms of private credit. They are regulated by the Securities and Exchange Commission (SEC) per the Investment Company Act of 1940, offering shareholders the protections intended within the act. This allows retail investors to buy into companies that are not large enough to enter the public market, and with investment types which are not typically accessible to …

Full story available on Benzinga.com