Summary

- The banking sector has still not recovered from March lows despite playing a crucial role in the recovery process.

- Banks have made significant provisions for bad debts amid an uncertain economic environment.

- Still, VFH's portfolio also includes investment banks which have performed better than retail ones.

- For investors looking more towards dividends and asset diversification instead of share price performance, the more diversified VFH is better when compared to a peer.

- The ETF is a buy in the $67-68 range, especially following the recent nomination of Janet Yellen for the post of Treasury Secretary.

Source: Vanguard Financials ETF: Better For Dividends, After Risk Assessment

Amid a relatively resilient stock market, many in the investment community seem to have forgotten about the fiscal measures due to be voted by Congress. However, this is not the case with Jamie Dimon, JP Morgan Chase’s (JPM) CEO.

He recently criticized lawmakers in Congress for “months long deadlock” over a second round of coronavirus relief amounting to $1.5 trillion or $2.2 trillion, in order to help unemployed Americans and struggling businesses.

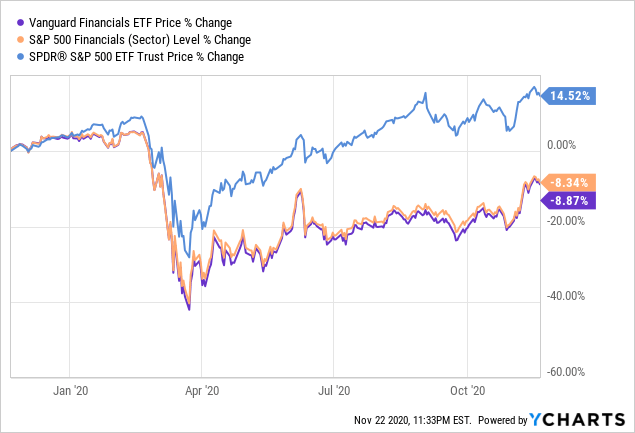

The reason for the CEO being so critical is evident when taking a glance at the share price performance of the Vanguard Financials ETF's (VFH) which includes many banking stocks.

Figure 1: Lack luster performance of the financial sector including the VFH compared to the broader S&P 500 ETF (SPY).

This underperformance with respect to the wider market is not aligned with the high level of trust bankers currently enjoy in comparison to 2008 when they were accused of reckless lending resulting in the economic crash. In 2020, with the overall monetary oversight of the FED together with the previous round of fiscal stimulus voted by Congress in March, banks have been instrumental at avoiding an economic depression.

Also, when looking carefully, there are opportunities for both retail and investment banking stocks under VFH's banner which have been preparing for the worst ever since the first quarter of this year.

Prepared for the worst

With the U.S. Federal Reserve being concerned about the ability of major banks to cope with the coronavirus crisis, there have been strict guidelines concerning dividend payment and share buyback programs until the end of the year. This is aimed at preserving liquidity, absorbing customers' delinquencies and continuing to lend money.

In the second quarter, three of the largest banks, JP Morgan, Citigroup (C) and Wells Fargo (WFC) made an aggregate amount of $28 billion as provisions for bad debts. For banks, uncertainty stems mainly from the difficulty in predicting the end of the COVID-19 pandemic.

The constitution of provisions weighed down on the net margins.

JP Morgan saw its net income decline by 51% to $4.7 billion compared to 2019 while for Citigroup, the fall was 73% to $1.3 billion. As for Wells Fargo, which does not have a well-developed trading division, it reported a net loss for the quarter.

This string of bad results prompted some to predict that as a result of the coronavirus epidemic and collapse in oil prices, further declines could be expected in the third quarter.

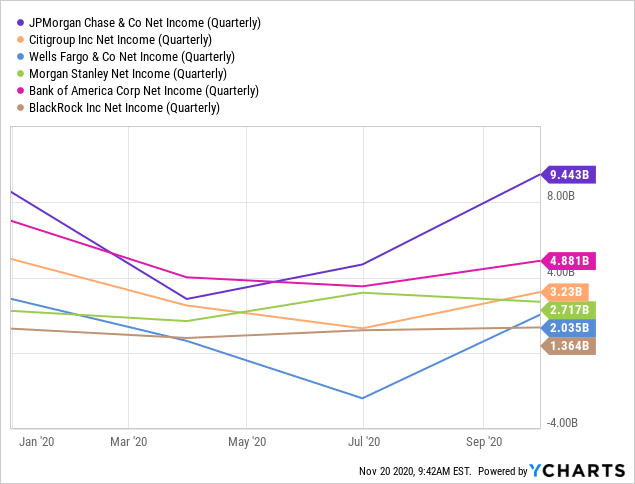

However, this gloomy prediction did not materialize and banks's net income did recover after the COVID slump.

Figure 2: Quarterly net income evolution

This outperformance is explained by strong mortgage results offsetting headwinds constituted by consumer and commercial lending adversely being impacted by lower interest rates.

Also, those banks with large capital markets activities as part of their investment banking (“IB”) units benefited from corporations issuing high levels of corporate bonds as they braced for liquidity. There was a high level of commodity and equity trading as well.

In this case, JP Morgan which is VFH's largest holding reported net profit of $9.4 billion, up 4% compared with last year boosted by a 30% increase in trading revenue and a decrease in the bank's provision for credit losses. As a sign of gradual improvement of credit, the bank set aside only $611 million in credit reserves during Q3-2020, down from $10.4 billion in the previous quarter.

This improvement coincided with positive job results but this may not be continually the case in the current uncertain economic environment where banks, especially smaller ones are so important for small businesses seeking loans.

Therefore, it becomes important to assess VFH’s strength.

VFH's strength

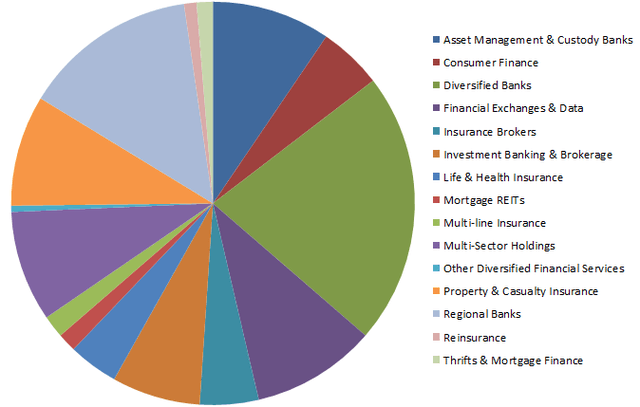

First, regional banks which constitute 15% of VFH’s portfolio played a vital role in providing more credit to smaller businesses under the Paycheck Protection Program (“PPP”) from April to August and are likely to perform the same role again in case there is any further economic deterioration.

More importantly, according to study by PWC on retail banking, some of the associated products like the home equity offerings may further be developed to address new realities thereby constituting growth opportunities.

Second, there are more profound transformations occurring for IB, an activity where all the major banks in VFH’s portfolio are involved.

In this case, according to a study by Ernst and Young, IB which was initially challenged by COVID is being reshaped both in terms of business and customer approaches through digital transformation. Also, going forward, EY expects to see investment banks opting for a more strategic focus on valuable products and geographies.

Looking inside VFH, the ETF has exposure to a number of high performing stocks including Berkshire Hathaway (BRK.B) whose share price has risen by 4.79%, overcoming March lows. The reason is that in addition to being an insurer, Berkshire has Apple (OTC:APPL) as part of holdings.

Also, there is BlackRock, the world's largest asset manager, with $7.4 trillion in assets under management (2019 figures) and S&P Global (SPGI), a provider of ratings and analytics to capital and commodity markets.

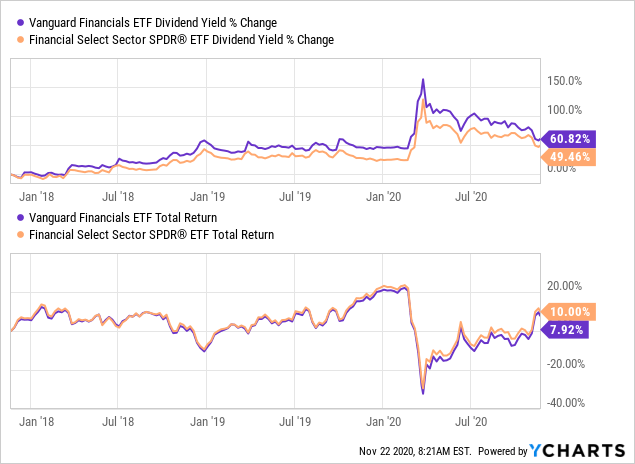

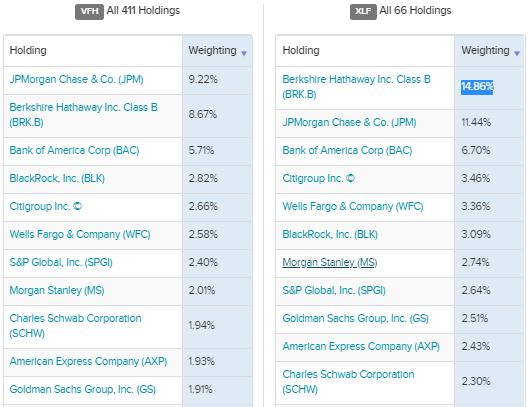

Comparing with the Financial Select Sector SPDR ETF (XLF), while the latter's total return has beaten VFH by 2%, the Vanguard ETF's dividend yields have outperformed by 13%.

As a matter of fact, VFH pays a 3% dividend yield compared to only 2% for XLF.

Here, it is important to make the distinction between total return which is capital appreciation obtained in case dividends are re-invested as opposed to when they are cashed out on a quarterly basis. Thus, VFH is more suitable for investors needing regular income.

Figure 3: Comparing dividend yield and total return of VFH and XLF.

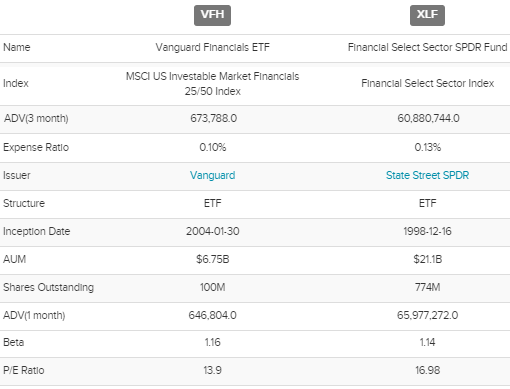

Furthermore, VFH has a smaller expense ratio or the fees paid to the fund manager at 0.10%. In contrast, it has a higher turnover ratio at 5% compared to only 4% for XLF.

Now, the turnover ratio measures the rate at which the ETF's underlying fund manager has bought and sold positions. The higher value for VFH suggests that the fund manager is relatively more active despite being paid a lower fee.

Figure 4: Comparing the key metrics of VFH an XLF.

Source: etfdb.com

Furthermore, VFH has 411 holdings which mean that it is more diversified and the fact that the top ten holdings constitute less than 50% of total assets signifies that the ETF is subject to lesser concentration risks.

Figure 5: Comparing holdings of VFH an XLF.

Source: etfdb.com

- A masculine fragrance with a fusion of sandalwood,...

- FRESHEN YOUR LIFE: Fiber Can is LITTLE TREES...

- MORE THAN JUST A CAR AIR FRESHENER: Freshen up at...

- LONG-LASTING FRAGRANCE EXPERIENCE: Specialized...

- SLIDE LEVER TO ADJUST STRENGTH: Slide the lever on...

- UV SHIELDING - Provide your baby with protection...

- SIMPLE UNIVERSAL INSTALLATION - Experience...

- THIS SET INCLUDES- 2 transparent car window...

- DURABLE MESH MATERIAL & STURDY WIRE- Rely on...

- GIVE THE BEST BABY GIFT- Need a baby shower gift...

- SAFETY ESSENTIAL CAR ACCESSORIES: If your car is...

- PRACTICAL AND PERFECT CHRISTMAS GIFT: A surprise...

- SAFE AND DURABLE TOOL KIT: This bag is made of...

- EVERYTHING YOU NEED FOR CAR SAFETY IN ONE BAG:...

- SUITABLE FOR MOST EMERGENCIES: This roadside...

- ✔ADJUSTABLE STRAP & COLLAPSIBLE SHAPE – The...

- ✔MAGNETIC SNAPS: There are 4 metallic magnetic...

- ✔HARD-WEARING LEAKPROOF INNER LINING – This...

- ✔MULTIPURPOSE – This car garbage bin can be...

- ✔GREAT COMPATIBILITY – An effective solution...

Still, despite some recent vaccine development, the light at the other end of the tunnel is yet to be seen.

In this respect, a prolonged period of low interest rates is generally viewed as detrimental to the profitability of banks and life insurers. Moreover, pension funds which are a sizeable chunk of Blackrock's (BLK) customer-base could be forced to take bigger risks.

Macro-economic risks

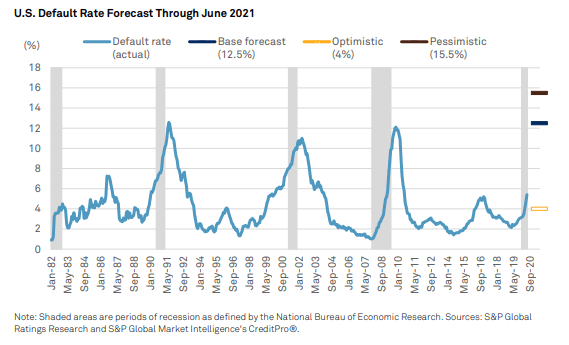

The most important concern remains default rates or outstanding loans being written off after several missed payments by corporations.

According to a report by ratings agency S&P Global at the beginning of October, the COVID-19 crisis will double company default rates across the U.S. and Europe over the next 9 months. The firm has an optimistic default rate of 4% and a pessimistic one at 15% in case more lock-downs are required.

Interestingly, the optimistic case assumes that a coronavirus vaccine will be widely available by the middle of next year.

Figure 6: Optimistic and pessimistic default rate.

Source: reuters.com

Pursing on a positive note, S&P Global also states that the record downgrade (by credit rating agencies) pace of recent months was now slowing.

Furthermore, financial markets exhibit intrinsic volatility, whereby a wide variety of news can cause short-lived fluctuations. In this case, asset prices suffered as a result of the market’s overreaction to news in the second week of November pertaining to the “tussle” between the Treasury Secretary and the FED Chairman over allocation of emergency funds to support small and medium sized businesses.

These funds amounting to $455 billion have been instrumental at building confidence measures by their very presence at the FED. Also, a much larger amount is currently the subject of negotiations between democrats and republicans as part of the second round of fiscal stimulus.

Valuations and key takeaways

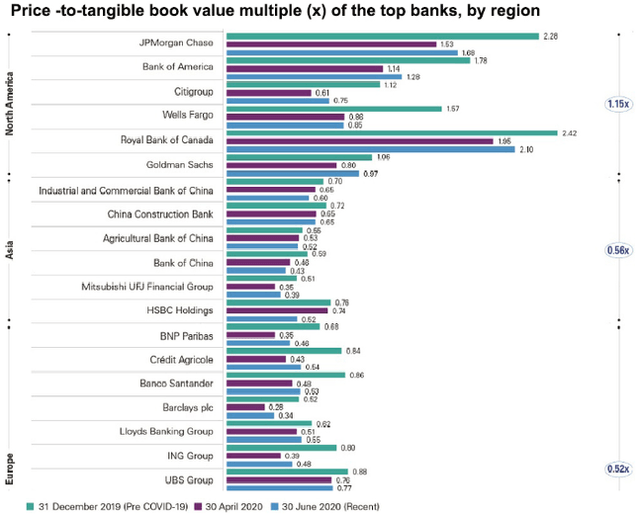

The financial sector continues to be vulnerable to subsequent shocks but the U.S. banking sector, while being impacted during COVID-19 in mid-March suffered less than its European counterpart as measured by the Euro STOXX Bank Index. According to the report by KPMG, European banks saw a massive decline of nearly 40% .

Figure 7: Comparing the valuations of North American and European banks before, during and after COVID-19 impact.

Source: home.kpmg

The reasons provided for the relatively higher valuations (as measured by the Price to NAV metric) of North American banks was “a strong correlation with profitability”, which in turn was mainly driven by the diversification of the business activity to include investment banking services.

Also, according to another report, this time by S&P Global, the ROE (Return on Equity) of the twelve largest U.S and European investment banks are expected to reach 12% in 2020. Five of these are U.S names forming part of VFH's top 11 holdings.

Now, the reasons for this high expectation are strong revenue growth and minor increase in capital combined with a fall in trading desk headcount, with all leading to higher operating margins.

Being more realistic in view of second and third waves concerns, even if those strong revenues do not materialize, newly adopted secular WFH trends should save on real estate expenses. Additionally, digital transformation of the business model bring cost-saving opportunities both for insurers and banks.

Figure 8: VFH diversified holdings.

Source: Chart built from data on Original Post>

Now, VFH's NAV is $67.21 with the current share price standing at $68.22. Thus, the ETF is trading at a premium to NAV. Still, when considering the Price to Earnings metric, VFH's smaller value of 13.9 suggests a lower valuation when compared with XLF at 16.98.

Hence, considering the NAV and earnings metrics, VFH is a buy in the $67-68 range with a possible 15% upside following nomination of Janet Yellen, an experienced economist for the post of Treasury Secretary. She is an advocate of federal spending from Congress to tackle the economic devastation caused by the virus.

The ETF with over 70% of assets constituted by large caps provides a predominately U.S exposure at 96%. Another of VFH's qualities is diversity, through its non-banking holdings.

Looking further down the road, the conduct of yet another round of stress tests on the largest U.S. banks by the FED to assess their ability to withstand a second coronavirus-related recession scenario could prolong dividend payments and share buybacks constraints.

Still, these measures are aimed at banks with $100 billion in total assets.

Therefore, with over 400 diversified financials, VFH's quarterly dividends are safe and should continue to be credited in shareholders’ savings accounts.