Having accurate and comprehensive data is critical to tracking the evolving European ETF universe. CFRA’s ETF dataset has included reference data for all global ETFs for several years. Today, CFRA announced we were expanding our data set to include constituent holdings coverage for all Europe-based ETFs.

Source: Diving into the Diverse European ETF Market

With this expansion, CFRA now has holdings and classifications data for over 85% of the global universe by assets. CFRA’s expanded ETF analytics is aligned with its commitment to providing independent, differentiated, and actionable investment research and insight. With more than four times the total number of listings and ten times the number of exchanges, the complexity of the European ETF marketplace outpaces that of what we see in the U.S., making it even more important investors have powerful research tools to help them cut through the noise and better understand their options.

Almost 10% of ETF assets in Europe are ESG (environmental, social, and governance) themed, clearly highlighting the region’s early leadership position on this issue. While in the U.S., ESG ETFs such as iShares ESG Aware MSCI USA ETF (ESGU) and Vanguard ESG Stock ETF (ESGV) have skyrocketed in popularity in the U.S. in recent years, ESG ETFs still account for less than 2% of aggregate ETF assets in that region. Many of the ESG ETFs in Europe were launched very early in the development of the industry, with one having an inception date of 2003.

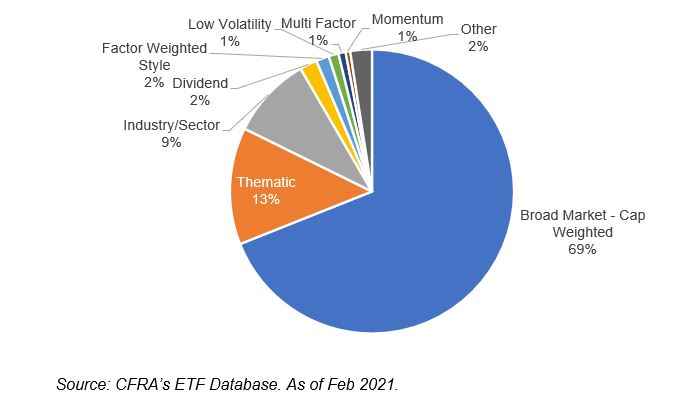

In the equity ETF space, broad, market-cap weighted equity ETFs still dominate in Europe, representing approximately 70% of ETF assets. However, a wide range of thematic and sector funds are popular. Thematic ETFs (13% of equity ETF assets), including those tied to Clean Energy, or slightly broader ESG index-based strategies as well as industry sector funds (9.3%), focused on technology or real estate were an alternative to traditional beta. Much of the remainder were other slices of the smart-beta arena, including dividend (2.0%), factor-weighted growth or value (1.5%), and low volatility (1.1%). Actively managed equity ETFs were a modest 0.05% of the category’s assets. The remainder of the equity ETF assets were split between momentum, multi-factor, and other alternatively weighted index approaches.

Figure 1: Asset Breakdown of European Equity ETF Market

| Preview | Product | Price | |

|---|---|---|---|

|

Galway Bay Long Sleeve Golf Rain Jacket - Three Layer Long Sleeve Golf Jackets for Men, Lightweight... |

$200.00 |

Buy on Amazon |

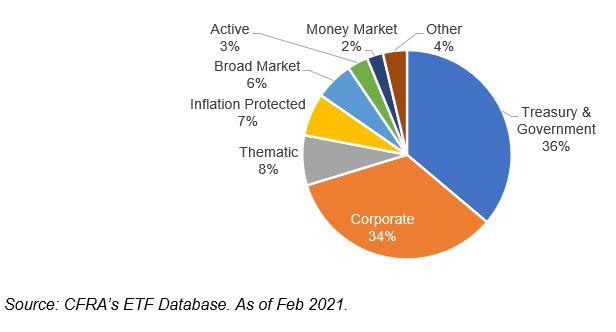

In the bond ETF space, corporate and government bond ETFs overshadow broad market ones in Europe. In the U.S., ETFs providing exposure to both investment-grade corporate bonds and government securities, such as those tracking the Bloomberg Barclays Aggregate Bond Index like the iShares Core U.S. Aggregate Bond ETF (AGG), represent more than one-third of all fixed income ETF assets. Yet, in Europe, the sub-category is just 5.9% of the assets, with Treasury & Government (36%) and Corporate Bonds (34%) dominating. Like the U.S., investors had begun to use actively managed fixed income ETFs from DWS, JPMorgan, and others, but in Europe active was a more modest 3.2% slice of the category dominated by index-tracking strategies.

Figure 2: Asset Breakdown of European Fixed Income ETF Market

- 🌴 Material: Chiffon, 100%Polyester ; Lightweight, soft and comfoy material

- 🌴 Features: Long sleeve chiffon lace mini dress for women spring, summer and fall, crew neck, long lantern sleeve, zipper closure, elastic waist, a-line and slim fit style, elegant ruffle design, this cute fall mini dress will make you more beautiful and lovely!

- 🌴 Occasions: Fall casual short dress suitable for you to party, holiday, school, date, cocktail, coming home, and daily life. Believe you will love it and get lots of compliment!

- 🌴 Garment care: Hand wash in cold water recommend, hang dry, low temperature ironing if necessary

- 🌴 Size Note: 0-2, 4-6, 8-10, please refer to our sizing information in the picture description to choose your size. Thanks for your understanding

With $1.4 trillion in ETF assets, Europe is the second-largest region for ETFs globally. Although significantly smaller than the approximately $6 trillion U.S. market, Europe is growing in importance as investors across the continent adopt the ETF product structure. We think European investors are eager to understand the market dynamics and looking for as much insight as possible. To learn more about CFRA’s ETF research and data visit www.cfraresearch.com

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.