As U.S. markets tumbled again on signs of inflationary pressures, investors worried about continued volatility can consider a targeted ETF strategy. Investors are refocused on the recent spike in inflation and whether or not rising consumer prices will stick around.

Source: As US Markets Stumble, Consider a Low-Volatility ETF

Many are worried that the prolonged period of faster growth in prices could push the Federal Reserve to hike interest rates or curb its accommodative monetary policy sooner than expected, which has weighed on stocks and other assets that have benefited from the low-rate environment.

“We see this as transitory, but you never know: there is stuff in here that could take a bit longer,” Lars Skovgaard Andersen, investment strategist at Danske Bank Wealth Management, told the Wall Street Journal. “There will be some volatility in markets still.”

Fed officials, though, argue that it is too soon to be concerned. Federal Reserve Bank of Atlanta President Raphael Bostic said he wasn’t ready to dial back support for the economy. Bostic also downplayed fears over rising prices and contended that it could take months to see a rising inflation trend.

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

“The conversation around inflation is really the focus of the market and everyone’s trying to get a picture on whether the Fed is right in saying if this is all temporary or is this something they need to take more seriously,” Greg Swenson, founding partner of Brigg Macadam, told Reuters.

“You’ll continue to see rotation (out of technology stocks) not only because of the outperformance of tech in the last year versus cyclicals, but the only way you can stay long equities and hedge against inflation is own more cyclicals – bank, energy,” he added.

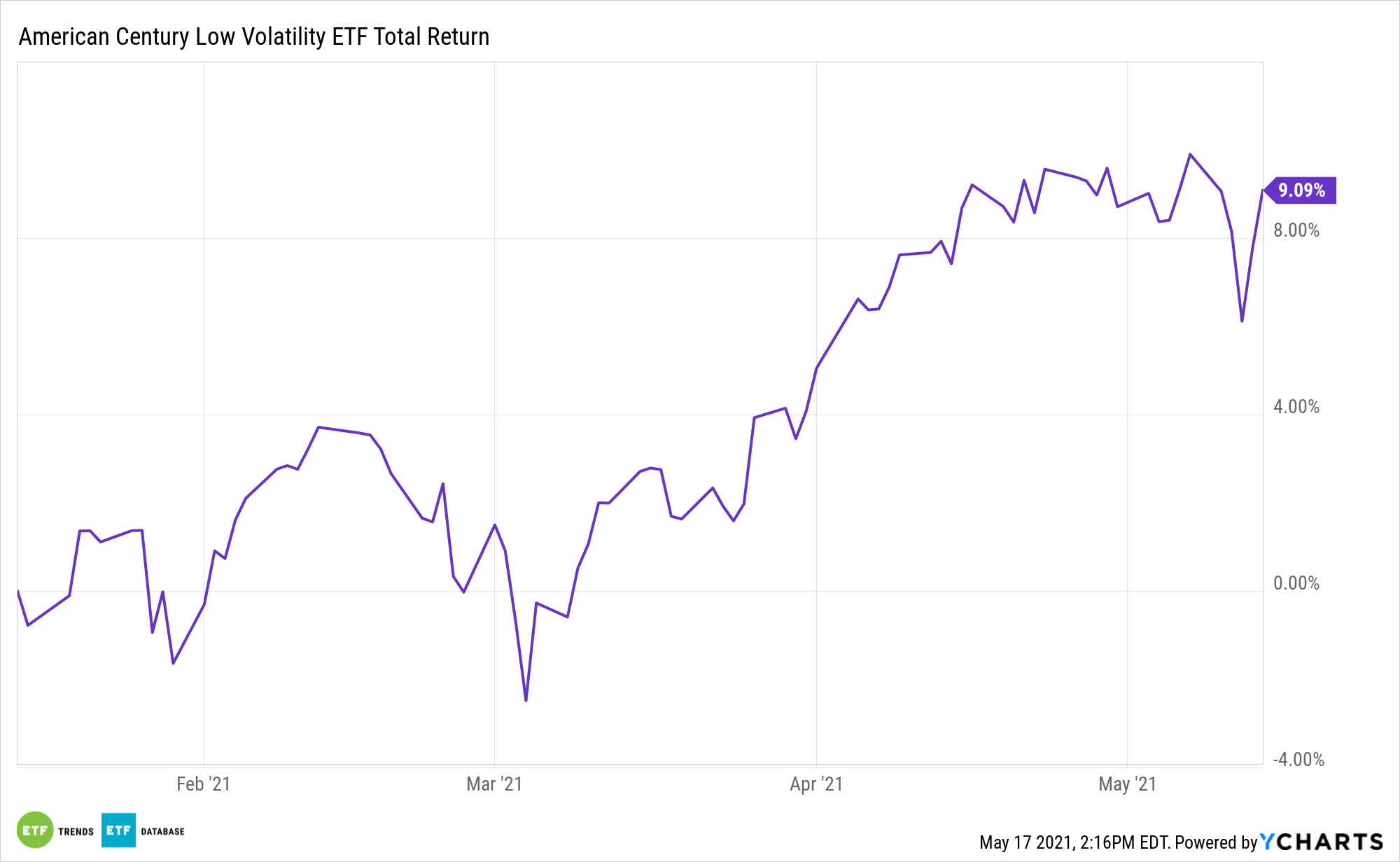

Investors who are worried about further market swings can take a look at a low-volatility ETF strategy to limit downside risks. For example, the American Century Low-Volatility ETF (LVOL) is designed for investors to temper volatility using American Century’s proprietary active methodology. American Century Low Volatility ETF’s managers use quantitative models to select securities with attractive fundamentals that they expect will provide returns that will reasonably track the market over the long-term while seeking less volatility.

For more news, information, and strategy, visit the Core Strategies Channel.