Many diversified infrastructure exchange traded funds feature healthy allocations to the utilities sector, but investors looking to play a new round of massive infrastructure spending with utilities stocks may want to go straight to the source.

Source: Original Postress-this.php?">The Utilities Sector: Why Energy Investors Are Going Straight to the Source

Enter the Utilities Select Sector SPDR (NYSEArca: XLU). Although utilities is one of the smallest sector allocations in the S&P 500, its leverage to increased infrastructure spending is mighty. Morgan Stanley analysts acknowledged as much in a note out Monday.

“Utilities would doubly benefit from Biden’s infrastructure plan, analysts wrote. In absolute terms, additional funding for clean energy construction would directly boost bottom lines. And in relative terms, utilities’ greater ability to pass along any corporate tax hikes used to fund infrastructure could help their stocks overperform,” Business Insider reports, citing Morgan Stanley.

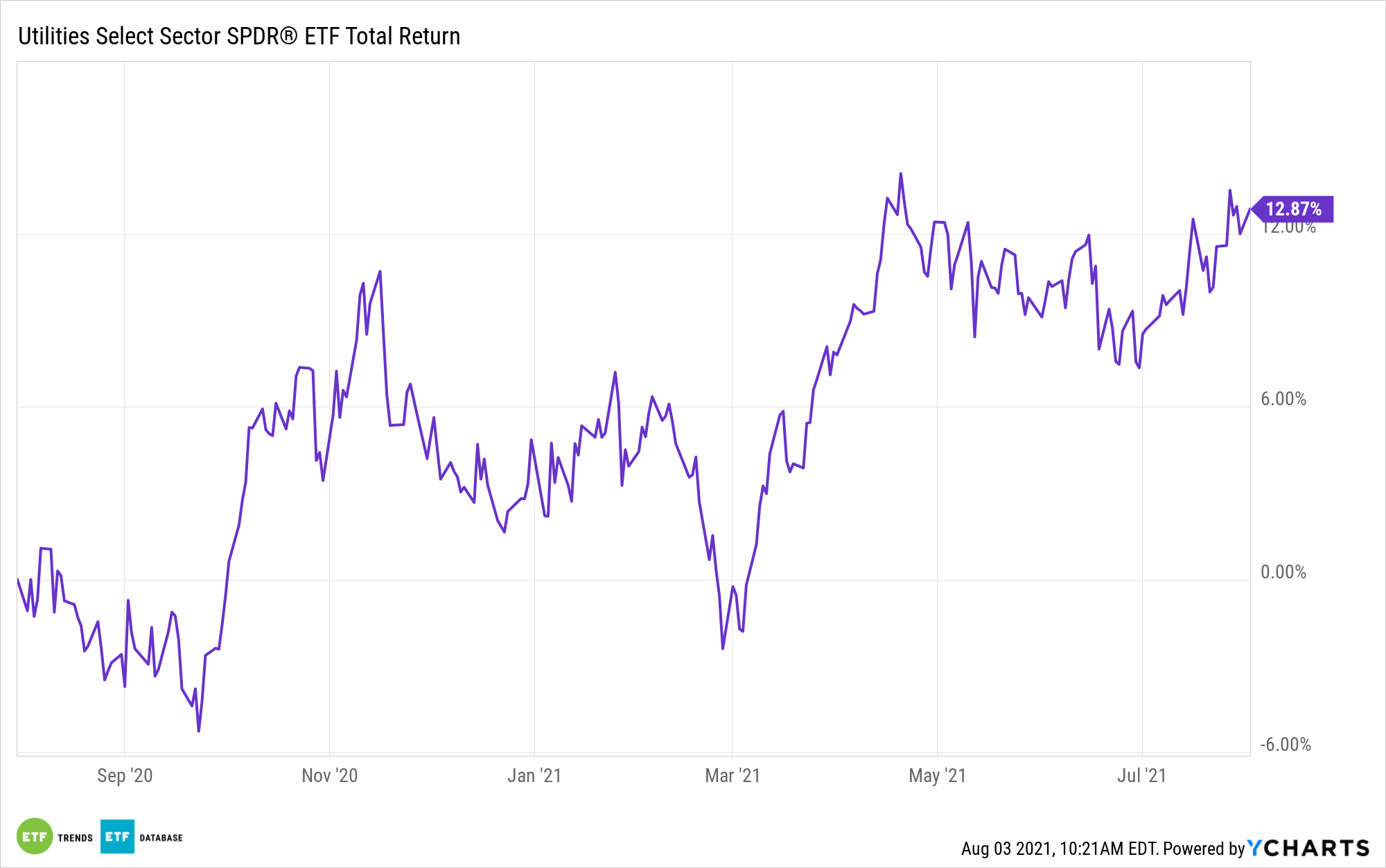

While utilities stocks are lagging the broader market on a year-to-date basis, XLU may be starting to price in infrastructure ebullience as highlighted by a gain of 4% over the past month.

Even Better than Energy?

Adding to the case for XLU and utilities as plays on infrastructure largesse is how the sector may even be better-positioned as an infrastructure idea than the previously hot energy sector.

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

“Utility stocks’ earnings have performed below the long-term average, indicating that normalization could drive share prices higher. A potential infrastructure bill could disrupt earnings normalization, but would benefit utilities disproportionately,” adds Business Insider.

Beyond infrastructure, other catalysts point to the utilities industry. For starters, XLU yields 3.10%. That’s more than twice the dividend yield on the S&P 500. Should 10-year Treasury yields remain stable or decline in the coming months, XLU’s income proposition looks all the more compelling.

Second, XLU is typically a decent performer at this time of the year, which isn’t surprising when considering that the August through October period is the worst three-month span of the year for equities. If that historical trend repeats this year and volatility jumps, it’s possible investors will flock to XLU, with infrastructure spending being icing on the sector’s defensive cake.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.