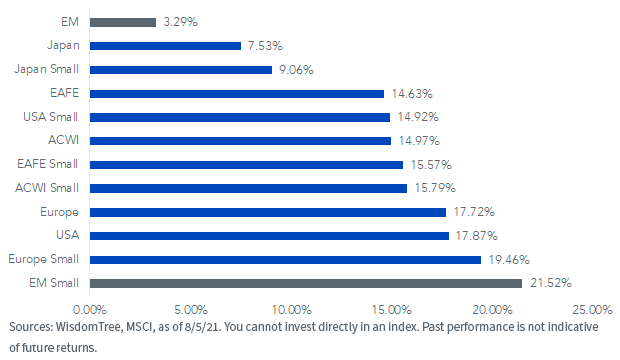

Earlier this year there were expectations that a global economic recovery would be a boon for the export-reliant and commodity-sensitive emerging markets (EM). Fast-forward to August, and the MSCI Emerging Market Index (measured in local currency) is the worst-performing broad index we track—up just over 3% compared to the nearly 15% gain of the MSCI ACWI .

Source: Original Postress-this.php?">Emerging Markets Both Leader and Laggard

The best performing? The EM small-cap index.

Our Global Head of Research, Jeremy Schwartz, wrote about the rally in EM small caps in a recent blog post.

Year-to-Date MSCI Index Returns (in Local Currency)

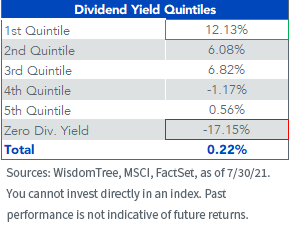

Another area of the EM market that has similarly shined amid headline risk in China tech stocks is high dividend payers.

The highest dividend quintile within the MSCI EM Index has outperformed the bottom dividend quintile by over 1,000 basis points (bps) and outperformed non-dividend payers by nearly 3,000 bps.

MSCI Emerging Markets Index: Year-to-Date

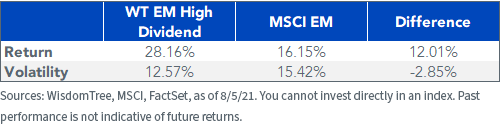

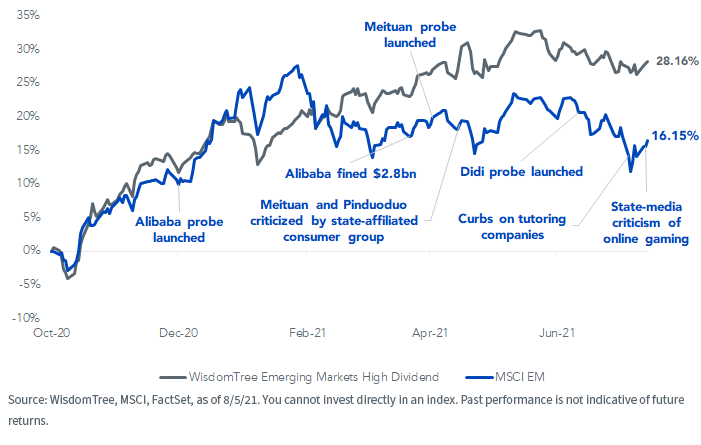

At the fall 2020 annual rebalance of the WisdomTree Emerging Markets High Dividend Index (WTEMHY), we implemented several risk screens to mitigate exposure to the riskiest dividend payers in the EM universe.

As a by-product of this screen—and a result of natural under-weights to China’s tech sector—the Index has experienced significantly lower volatility than the broad MSCI EM Index while handily outperforming it.

Index Performance since 10/22/20

While we are still constructive on the long-term growth potential of many of these Chinese tech companies, the near-term uncertainty of a more heavy-handed regulatory environment in China has weighed on the benchmark index’s recent returns. China makes up nearly 35% of the index’s weight.

Index Performance since 10/22/20

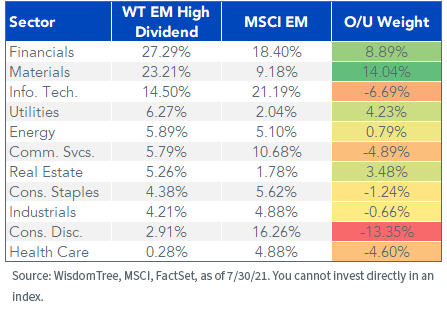

WisdomTree’s high dividend Index has under-weight allocations to the companies—mostly in the Information Technology, Communication Services and Consumer Discretionary sectors—that have been the main targets of China’s regulatory crackdown.

The Index has also been over-weight in the value sectors like Financials and Materials that have been beneficiaries of an improving global economy and a rally in commodity prices.

Index Sector Weights

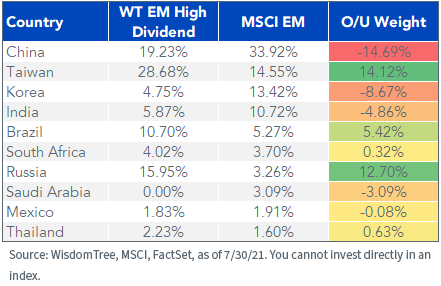

From a country perspective, the WisdomTree high dividend Index has a much smaller allocation to China than the broad MSCI EM Index, at less than 20%. That under-weight allocation to China is offset by heavier allocations to Taiwan and Russia.

| Preview | Product | Price | |

|---|---|---|---|

|

Galway Bay Long Sleeve Golf Rain Jacket - Three Layer Long Sleeve Golf Jackets for Men, Lightweight... |

$200.00 |

Buy on Amazon |

Last update on 2024-04-20 / Affiliate links / Images from Amazon Product Advertising API

Top Country Weights

A Higher Active Share EM Solution

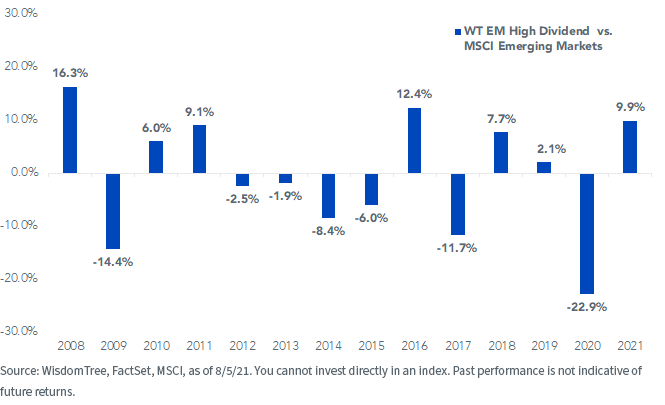

Since its inception in 2007, the WTEMHY has outperformed the MSCI EM Index by 84 bps annualized.

The outperformance was achieved with less risk over the full period, albeit with similar volatility to the benchmark in more recent years.

We think this approach to targeting quality dividend payers can provide a solution for investors interested in enhancing potential income for portfolios, as an active management solution, and/or to tap into a higher inflation thesis, given its tilts to the Materials, Financials and Real Estate sectors.

While its absolute volatility levels are similar to, or below, that of the MSCI EM Index, the WisdomTree high dividend Index has an active share of 88%, resulting in a high tracking error.

- 🌴 Material: Chiffon, 100%Polyester ; Lightweight, soft and comfoy material

- 🌴 Features: Long sleeve chiffon lace mini dress for women spring, summer and fall, crew neck, long lantern sleeve, zipper closure, elastic waist, a-line and slim fit style, elegant ruffle design, this cute fall mini dress will make you more beautiful and lovely!

- 🌴 Occasions: Fall casual short dress suitable for you to party, holiday, school, date, cocktail, coming home, and daily life. Believe you will love it and get lots of compliment!

- 🌴 Garment care: Hand wash in cold water recommend, hang dry, low temperature ironing if necessary

- 🌴 Size Note: 0-2, 4-6, 8-10, please refer to our sizing information in the picture description to choose your size. Thanks for your understanding

Last update on 2024-04-20 / Affiliate links / Images from Amazon Product Advertising API

In a challenging year for the headline EM index, some investors may prefer a diversifying allocation with lower correlation to EM beta.

Index Calendar Year Relative Returns

Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.