The growth/value debate is likely to continue raging through year-end, particularly if economic growth shows signs of topping and if Treasury yields remain volatile. However, some market observers believe one area to avoid is overly defensive sectors.

Source: Original Postress-this.php?">Avoid Defensive Sectors, Grab Growth with ‘GINN’

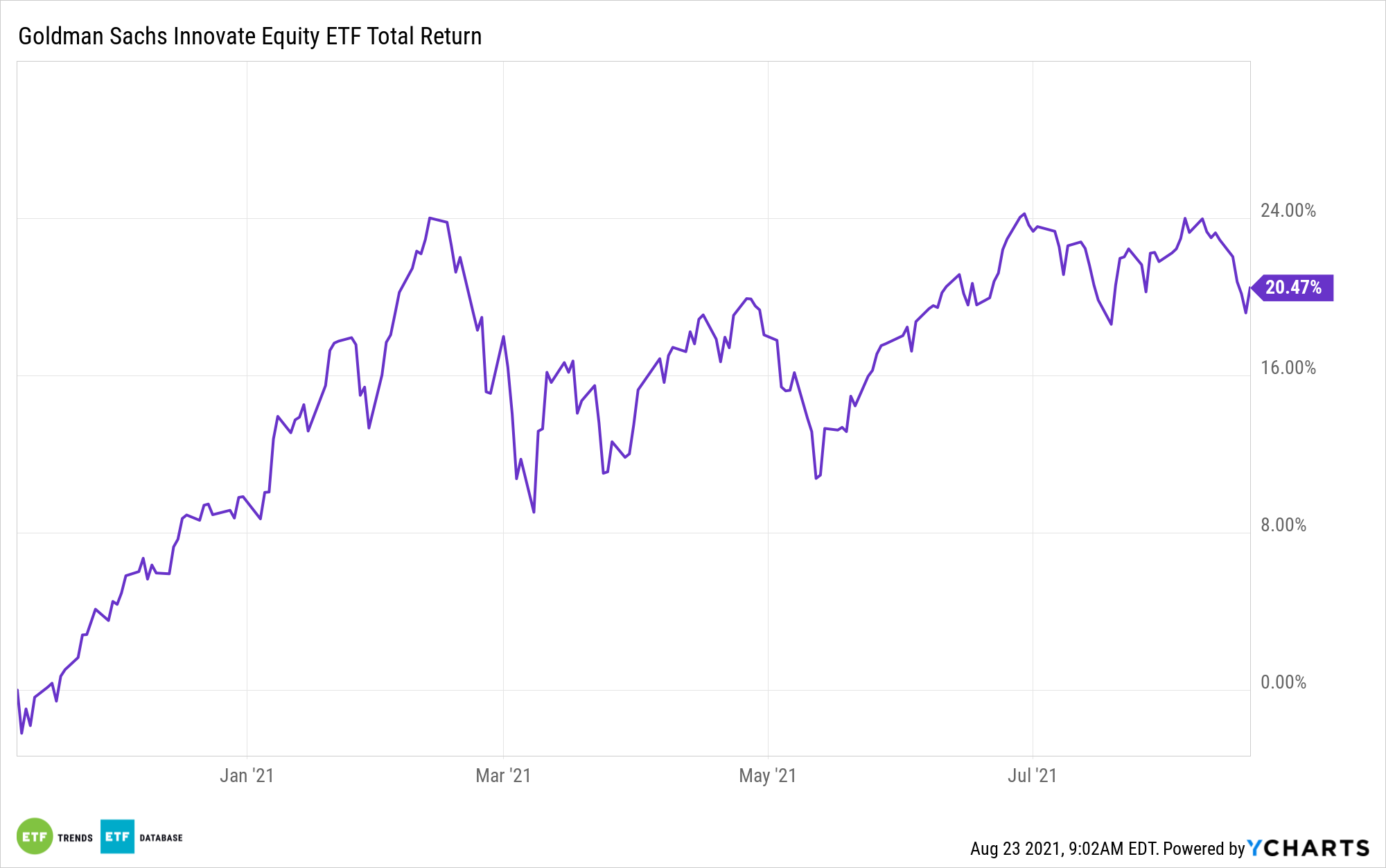

Should eschewing defensive stocks prove prudent, the growth-heavy Goldman Sachs Innovate Equity ETF (GINN) is among the exchange traded funds that could benefit. GINN, which tracks the Solactive Innovative Global Equity Index, focuses on disruptive growth companies – an ideal place to be if Treasury yields steady (or decline) and GDP growth slows.

GINN is also ideally positioned for a “there is no other asset” climate. Even if bond yields remain low and growth slows, investors may be disappointed if they’re too exposed to defensive sectors. Historically, and perhaps surprisingly, a top in economic growth doesn’t mean defensives become leaders. It’s also worth noting that growth sectors have become sturdier in down markets in recent years, potentially diminishing the allure of defensives.

“As we have seen in recent years, Information Technology, Consumer Discretionary, and Communication Services have done well throughout the bull markets, but they also tended to hold up even in weaker markets,” says David Kastner of Charles Schwab.

In order, tech, consumer discretionary and communication services stocks combine for almost 63% of GINN’s roster.

“There are likely to be opportunities for growth sectors to outperform and we see numerous compelling positive factors for some of the cyclical-value sectors, like Energy and Financials,” adds Kastner.

Said another way, growth or value or perhaps both could deliver for investors into the end of 2021. Defensives could continue lagging.

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

Traditional defensive sectors include consumer staples, healthcare, real estate, and utilities.

Year-to-date, real estate is the best-performing group in the S&P 500 while consumer staples and utilities are up, though lagging the broader market. In the case of healthcare, a positive is that the sector isn’t as defensive as it used to be. It’s actually taking more growth and innovative traits, and those trends aren’t likely to abate anytime soon.

“Health Care, on the other hand, has stronger long-term fundamental attributes, such as balance-sheet strength, new prescription drugs in the pipeline, demographic trends, and attractive valuations,” according to Kastner. “Despite some risks associated with potential prescription-drug price controls, this sector has greater potential to outperform in an environment where the economic growth rate moderates and overall market gains are less pronounced, in our opinion.”

Healthcare is GINN’s second-largest sector allocation at 19.7%.

For more news and information, visit the Future ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.