Dividend ETFs started the year outperforming the S&P 500 during the first five months, only to see sentiment shift back to mega-cap growth and tech. Large-caps have taken the spotlight of late and left most other strategies behind.

Source: Original Postress-this.php?">In Chaotic Times, Seek Out Quality Dividends

If you look at the long-term track record for dividend stocks, though, dividends tend to drive a huge portion of total return for investors. Dundas Global Investments Partner Neil Sutherland said in an interview with Trustnet, “Where the dividends go, the share prices follow. Dividend growth has really been the unsung hero of long-term total returns.”

No matter what your investment goals are, dividends are likely to have a place in your portfolio. They are the Swiss Army knives of investments. If you need to hedge against inflation, dividends can do that. If you need income, dividends can do that.

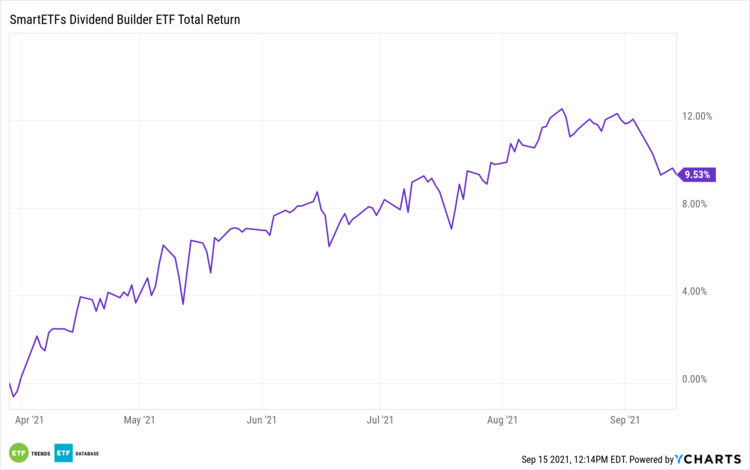

Older investors will need high-yields to generate income, while younger investors will generally look more toward dividend growth. The SmartETFs Dividend Builder ETF (DIVS) has had an impressive track record since its inception in 2012. It seeks a moderate level of income paired with constant dividend growth aimed at outpacing inflation — which is especially important in times of increased market volatility and prevalent inflation risk.

Go With Quality

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

The fund has a focus on quality, which does mean that it sacrifices some yield in exchange for more stability. Quality companies have healthy balance sheets, lower volatility, and solid track records that make them reliable income generators even during uncertain times. With growing concerns about the Delta variant, disappointing job reports, inflation possibilities, and COVID-19 hospitalizations cresting their 2020 levels, uncertainty abounds.

DIVS is also an actively managed fund, which allows for nimble reaction from the management team. If opportunities arise or something rocky appears on the horizon, actively managed funds are more likely to rapidly adjust and react.

This is precisely the kind of moment at which most investors will want to have reliable dividend income streams.

For more news, information, and strategy, visit the Dividend Channel.