Domestic value stocks are garnering plenty of attention this year, and the returns for the asset class in the first half of the year were worthy of adulation. While some of that momentum ebbed, value equities still have some catalysts, including precedent for performing well during inflationary climates, the possibility that Treasury yields will rise anew, and the fact that the current value rally is still young by historical standards.

Source: Original Postress-this.php?">Emerging Markets Value Could Be Long-Term Winner

.

Domestic value stocks may look attractive today, and some are, but investors shouldn’t ignore international equivalents, including emerging markets fare. On that note, the ALPS Emerging Sector Dogs ETF (NYSEArca: EDOG) is an exchange traded fund to consider. In fact, inflation is a big reason to consider emerging markets value.

“So, value looks priced to give us about a 4% real return above inflation, still kind of anemic. Emerging markets are priced to give you about 5%, and emerging-markets value–value stocks within emerging markets, avoiding the highfliers in the emerging markets–are priced to give you about a 9.5% real return, well, add in inflation and that’s probably a 12% return per annum for 10 years,” says Research Affiliates Chairman and founder Rob Arnott.

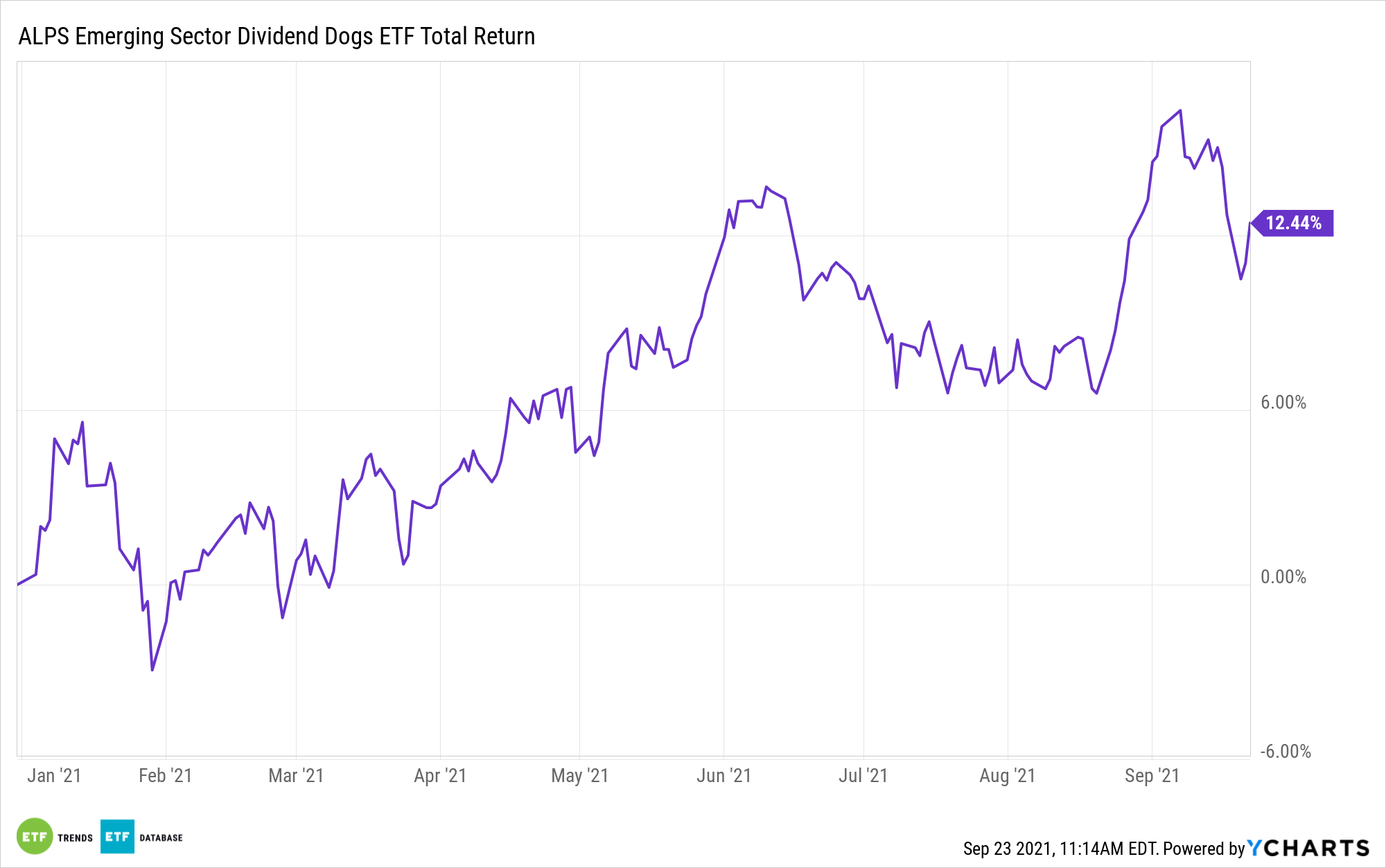

While Arnott is careful to note that it’s not clear that this scenario will play out over the next 12 months, it is clear that EDOG is up over 10% year-to-date while the MSCI Emerging Markets Index is lower by 1.32%. Add to that, Arnott sees “extraordinary opportunities” in emerging markets value.

Unlike traditional value ETFs, both foreign and domestic, EDOG isn’t excessively weighted to one or two sectors because the fund’s sector exposure are equally weighted. Currently, EDOG’s sector allocations range from 9.21% to 10.52%.

| Preview | Product | Price | |

|---|---|---|---|

|

Galway Bay Long Sleeve Golf Rain Jacket - Three Layer Long Sleeve Golf Jackets for Men, Lightweight... |

$200.00 |

Buy on Amazon |

Last update on 2024-04-19 / Affiliate links / Images from Amazon Product Advertising API

Additionally, EDOG’s geographic methodology is a perk at a time when Chinese stocks are roiling the broader emerging markets complex, perhaps distracting investors from solid performances in other regions. As just two examples, EDOG is overweighting Mexican and Russian equities relative to the MSCI Emerging Markets Index, and stocks in both of those countries are sharply higher this year.

EDOG delivers those benefits with a dividend yield of 2.96%, which is well in excess of the yields on both the MSCI Emerging Markets Index and the S&P 500 Value Index.

Other emerging markets dividend ETFs include the ProShares MSCI Emerging Markets Dividend Growers ETF (CBOE: EMDV), the iShares Emerging Markets Dividend ETF (DVYE), and the WisdomTree Emerging Markets Equity Income Fund (NYSEArca: DEM).

- 🌴 Material: Chiffon, 100%Polyester ; Lightweight, soft and comfoy material

- 🌴 Features: Long sleeve chiffon lace mini dress for women spring, summer and fall, crew neck, long lantern sleeve, zipper closure, elastic waist, a-line and slim fit style, elegant ruffle design, this cute fall mini dress will make you more beautiful and lovely!

- 🌴 Occasions: Fall casual short dress suitable for you to party, holiday, school, date, cocktail, coming home, and daily life. Believe you will love it and get lots of compliment!

- 🌴 Garment care: Hand wash in cold water recommend, hang dry, low temperature ironing if necessary

- 🌴 Size Note: 0-2, 4-6, 8-10, please refer to our sizing information in the picture description to choose your size. Thanks for your understanding

Last update on 2024-04-19 / Affiliate links / Images from Amazon Product Advertising API

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.