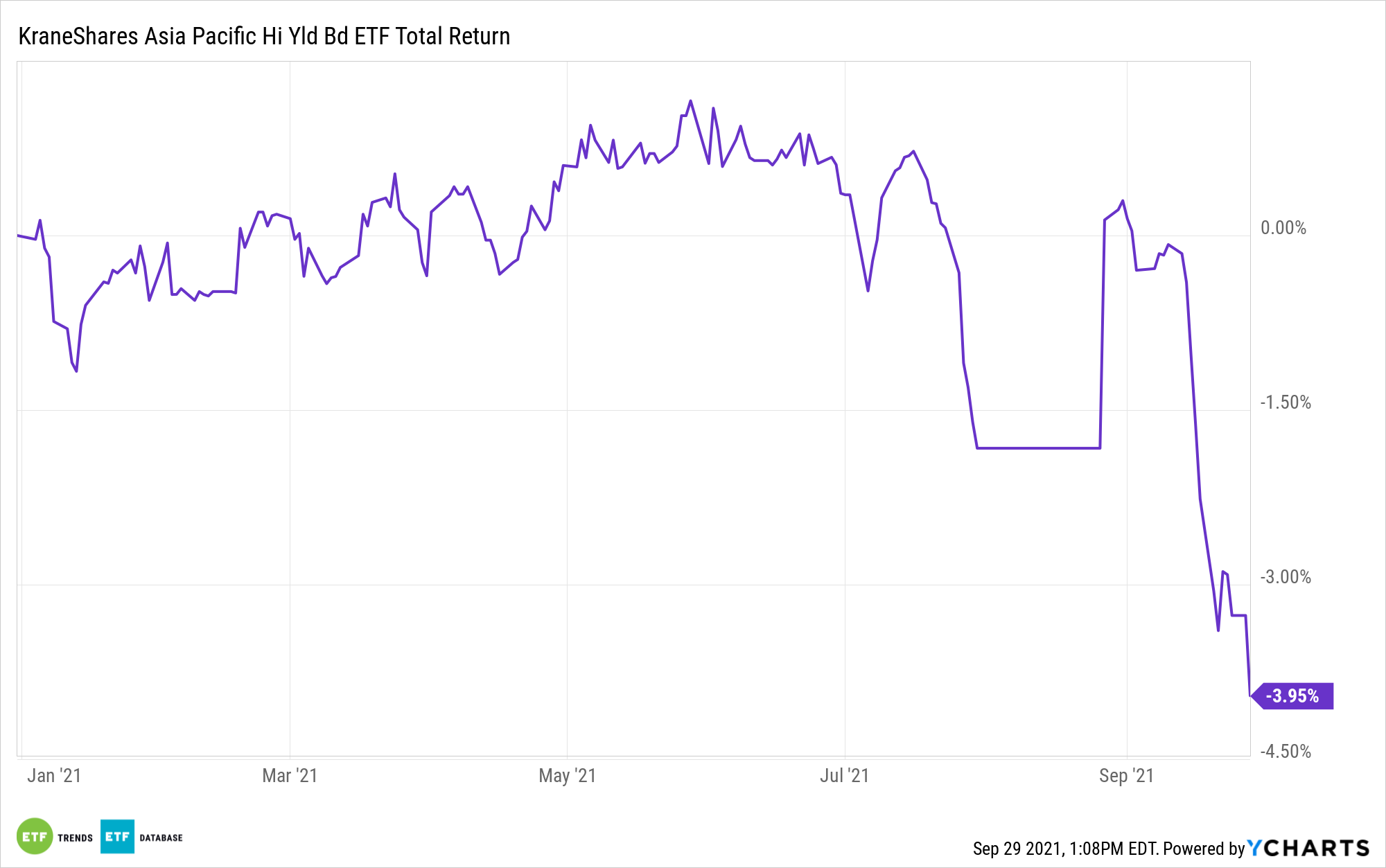

Nikko Asset Management’s Wai Hoong Leong, portfolio manager for the KraneShares Asia Pacific High Yield Bond ETF (KHYB) , recently held a webinar with Brendan Ahern, CIO of KraneShares, on their analysis of the Evergrande default and what it means going forward.

Source: Original Postress-this.php?">Asia’s Top Fixed Income Manager Gives Perspective on Evergrande

Evergrande is the second-largest property manager in China as of 2020 sales, but it has borrowed heavily to reach that position. Its current demise is a unique case, but it indicates potential issues in the real estate sector. While it just sold its stake in Shengjing Bank for RMB 10 billion/$1.55 billion to be able to pay off its debts, the overarching implications of its default and struggle most likely mean restructuring for the entire sector going forward.

Evergrande has been in a position of being highly leveraged with very weak liquidity for a long period of time, having leaned on Chinese financial institutions, suppliers, and the government for continued support. When those supporters and stakeholders lost confidence in Evergrande and began withdrawing their support, the company spiraled to its current position.

Nikko views the most likely outcome for Evergrande as a restructuring with some government intervention and facilitation. The Chinese government has to walk a fine line of dealing with a highly leveraged company while avoiding rewarding what Ahern called “poor corporate choices,” as this could encourage other businesses in the industry to follow the same path.

“We expect the government and Evergrande to focus on protecting the customer and supplier while ensuring an orderly restructuring for creditors who are likely to take the larger impact,” Leong said.

Evergrande’s exposures across credit markets include the equivalents of 1.1% of trust assets in trust firms, 0.1% of system loans carried by banks, 2% of JACI HY market value within USD bonds, and 0.18% of China’s onshore corporate bonds. While it has debt that carries through the credit markets, Nikko does not believe that it has the broad-reaching systemic impact that the Lehman collapse that sparked the financial crisis of 2008 did.

Source courtesy of KraneShares: Evergrande Briefing with Top Asia Fixed Income Manager

China’s mortgage market is structured differently, with mortgages remaining on banks’ balance sheets, and there have been strict restrictions and limitations on real estate policies in the last several years. China has conservative loan-to-value ratios (70% for first home buyers, 40–60% for second home buyers), as well as strict policies on buying homes in cities.

In the short term for the property sector, Leong anticipates slower sales growth “while margins will be lower as financing and regulatory measures remain tight,” he explained. “On the other hand, despite the tough market condition, the valuation of Chinese property companies in general have improved substantially.”

Source courtesy of KraneShares: Evergrande Briefing with Top Asia Fixed Income Manager

Property makes up about 15% of the Chinese economy, according to JPMorgan, and a 5% drop in real estate growth would only affect the national GDP by less than a percentage point for the year (0.6–0.7%).

| Preview | Product | Price | |

|---|---|---|---|

|

Galway Bay Long Sleeve Golf Rain Jacket - Three Layer Long Sleeve Golf Jackets for Men, Lightweight... |

$200.00 |

Buy on Amazon |

The restructuring process will be “a really complicated process” said Leong, due to the size of the debt and the fact that it spans many sectors, but it is necessary to prevent this kind of situation from happening again. Those debts are currently being consolidated under one court to streamline this process.

“Beyond this current down cycle, we believe that the long-term demands for these sectors remain sound, even China urbanization drive as well as home formation which the government is pushing,” Leong said.

KHYB: an Actively Managed ETF Within the High-Yield Asiatic Bond Market

The KraneShares Asia Pacific High Yield Bond ETF (KHYB) invests in USD-denominated high-yield debt securities from companies in Asia, excluding Japan.

Nikko Asset Management, a partner of ARK Investment and one of the largest asset managers in Asia, recently became the active manager of KHYB. One of its first moves as sub-advisor was to divest the fund of its position in Evergrande.

KHYB is benchmarked to the JP Morgan Asia Credit Index (JACI) Non-Investment Grade Corporate Index and invests in high-yield fixed income securities, or “junk bonds,” that are rated below the four highest categories (Ba1/BB+ or lower) by at least one credit rating agency, or, if unrated, are determined by the sub-advisor to be of similar quality.

Nikko, the sub-advisor, uses top-down macro research and bottom-up credit research to create the portfolio, as well as a proprietary process that is a combination of qualitative and quantitative factors used to value an issuer’s credit profile.

- 🌴 Material: Chiffon, 100%Polyester ; Lightweight, soft and comfoy material

- 🌴 Features: Long sleeve chiffon lace mini dress for women spring, summer and fall, crew neck, long lantern sleeve, zipper closure, elastic waist, a-line and slim fit style, elegant ruffle design, this cute fall mini dress will make you more beautiful and lovely!

- 🌴 Occasions: Fall casual short dress suitable for you to party, holiday, school, date, cocktail, coming home, and daily life. Believe you will love it and get lots of compliment!

- 🌴 Garment care: Hand wash in cold water recommend, hang dry, low temperature ironing if necessary

- 🌴 Size Note: 0-2, 4-6, 8-10, please refer to our sizing information in the picture description to choose your size. Thanks for your understanding

By moving the credit curve up, KHYB will be more defensive against the benchmark and have shorter duration bonds compared to the index. “This helps with minimizing the volatility,” Leong explained. When the bonds mature, Nikko can decide how and when it wants to redeploy and invest in new bonds, depending on market conditions.

KHYB carries an expense ratio of 0.69%.

For more news, information, and strategy, visit the China Insights Channel.