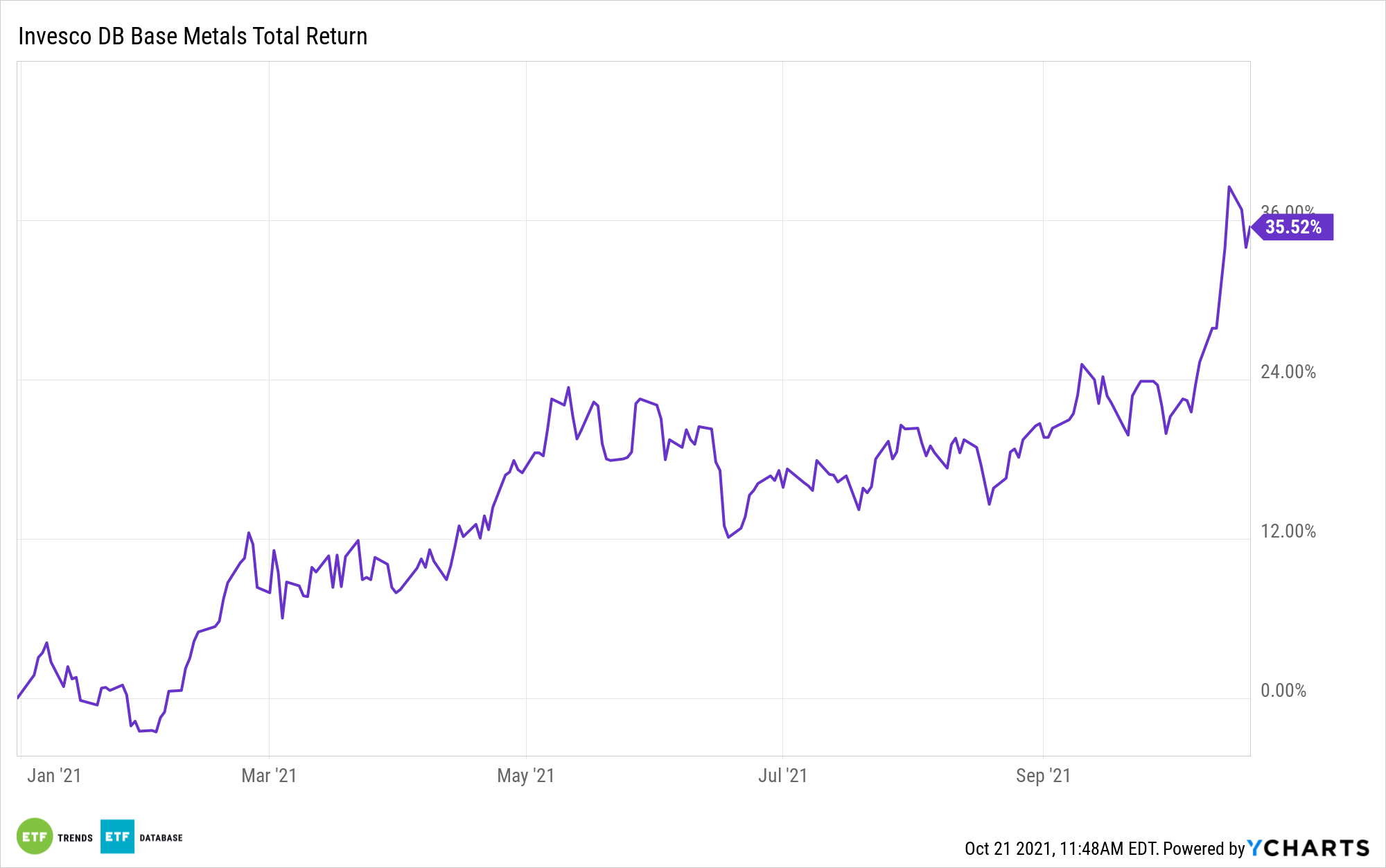

Transitory to long-term inflation forecasts and an energy crisis could provide an economic backdrop for base metals and the Invesco DB Base Metals Fund (DBB) to thrive. Rising oil prices are causing consumers pain at the pump, while the macroeconomic environment is seeing high prices across the board for commodities.

Source: Original Postress-this.php?">Inflation and Energy Crisis Can Help Boost This Base Metals ETF

This is all well and good if you’re looking to invest in base metals.

“Fears of inflation could increase demand for metals as there is a perception that they are a hedge against inflation, which is especially true for copper,” an FX Street article noted. “In the meantime, a retreat in US real rates, along with the broad trade-weighted dollar index over the last couple of days, is also driving momentum.”

“The recent stronger renminbi has accentuated the broader demand expectations for commodities from China and has led to the open of import arbitrage in some metals,” the article added. “The broad trade-weighted renminbi is up nearly 6%.”

Hedge Inflation With Base Metals

Inflation can be a thorn in the side for fixed income investors, especially with its ability to erode income. That said, rising prices in base metals like aluminum and copper (which comprise 80% of DBB’s holdings in futures) can offer an ideal hedge.

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

“The energy crisis has added fuel to the inflation debate in Europe, and rising energy costs will certainly push headline inflation higher for some time,” the FX Street article said further. “Meanwhile, our US economist has pointed out that there are cracks in the Federal Reserve’s ‘transitory’ narrative in terms of inflation.”

DBB seeks to track changes, whether positive or negative, in the level of the DBIQ Optimum Yield Industrial Metals Index Excess Return™ (DBIQ Opt Yield Industrial Metals Index ER) plus the interest income from the fund’s holdings of primarily U.S. Treasury securities and money market income, less the fund’s expenses.

The fund is designed for investors who want a cost-effective and convenient way to invest in commodity futures. The index is a rules-based index composed of futures contracts on some of the most liquid and widely used base metals — aluminum, zinc, and copper (grade A).

For more news, information, and strategy, visit the Innovative ETFs Channel.