As investors attempt to navigate through the many risks in today’s global economy, we want to again stress the value of having a dynamic and well-defined process. Multiple Scenario Analysis (MSA) is one of the tenets of our investment process, and it helps us develop an understanding of the future while also recognizing the shortcomings of trying to concretely predict it. Flexibility is achieved through MSA as we define bull, bear, and base case scenarios, and assign probabilities to each case that shift over time. Working with probabilities instead of absolutes give us an adaptable process that allows us to better manage risk in real time. As conditions inevitably change, so do our inputs, and we can act accordingly to address risk or opportunity.

Overall, we are optimistic about the U.S. economy during 2022 and suggest using equity market volatility as an opportunity to add to equities. Other global regions face more acute challenges, though we are still finding prospects outside of domestic markets.

As we have previously discussed, the U.S. economy is one of the most independent economies in the world. No other major world economy depends less on trade as a percentage of its overall GDP than the U.S. As a result, most of the global risks and events have little realized impact on U.S. economic fundamentals. Therefore, our U.S. economic outlook is based primarily on domestic issues.

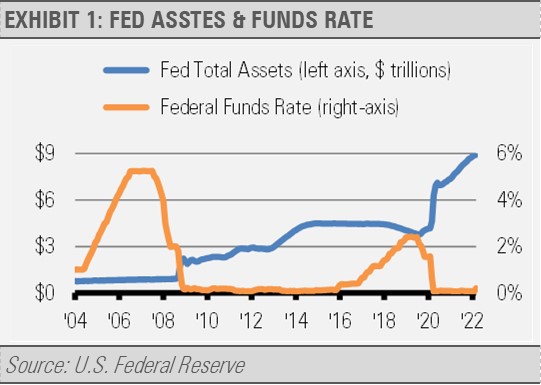

The biggest risk to our outlook is the impact of U.S. Federal Reserve (Fed) policy. While we expect to see the Fed focus more on inflation by raising short-term rates and reducing the size of their balance sheet through Quantitative Tightening (QT), our work suggests that the U.S. economy has plenty of momentum to continue to grow despite geopolitical challenges, COVID related headwinds, and the tightening of Fed policy. Even with the recent moves by the Fed to tighten monetary policy, we think that the Fed is behind the curve, so their overall policy stance is still loose compared to what their neutral level of policy would likely be.

For instance, the Fed is only now eliminating the emergency facilities that were put in place during the height of the pandemic related economic and liquidity shock.

Short-term interest rates remain below what we consider to be a neutral level while the Fed’s balance sheet, at nearly $9 trillion, is roughly double its size prior to the pandemic response (exhibit 1).

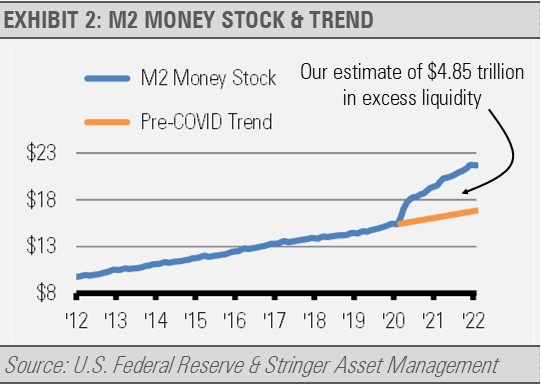

We can see the impact of their loose policy in the still elevated level of money growth in the economy relative to what it otherwise would have been (exhibit 2) as measured by M2, which includes currency in circulation along with savings, money market funds, and other liquid deposits.

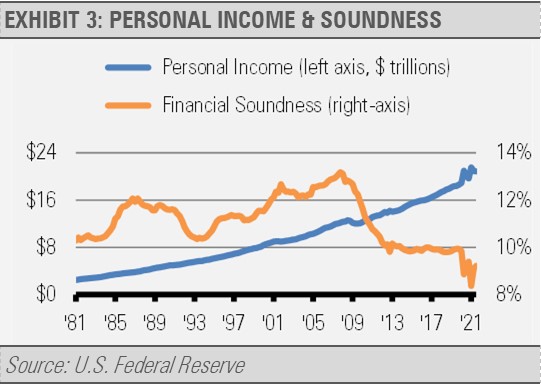

Meanwhile, personal income continues to climb while household financial soundness remains strong (exhibit 3). Financial soundness measures debt service and principal payments as a percent of disposable income, where lower is better. In fact, overall household finances are in better shape than they were during the heady days of the 1980s and 1990s.

Furthermore, we have seen a jobs recovery of epic proportions. One of the best leading indicators of jobs market health is the number of layoffs as measured by initial unemployment (i.e., jobless) insurance claims. During the week ending April 2nd, layoffs sank to roughly 166,000. This is the lowest level of layoffs as measured by unemployment insurance claims since 1966 when the U.S. labor force was only about half the size it is today.

In addition, the number of open jobs in the U.S. is now double the number of unemployed Americans looking for full-time work (exhibit 4). With layoffs near historic lows and jobs plentiful, we might be witnessing the strongest and tightest labor market in generations. This was certainly not the case during the stagflation years of the 1970s.

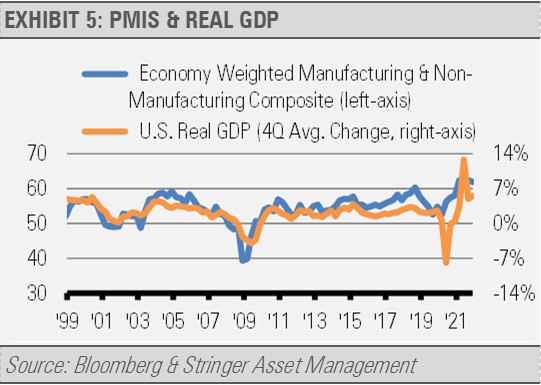

Other leading economic indicators that we track, such as Purchasing Manager Indices (PMIs), continue to look strong (exhibit 5) with the service sector PMI reading just off its all-time high.

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

Additionally, the prices of industrial metals continue an uptrend. This would not likely be the case if the global economy was on the verge of a downturn as a drop in demand would push these prices down, not up. These indicators suggest that U.S. economic growth will continue.

Finally, when looking at our broad set of recessionary risk indicators, none are showing significant signs of risk. These recessionary datapoints cover a wide range of economic series, such as interest rates, liquidity growth, and the previously mentioned layoffs and trends in the prices of industrial metals. This collection of tools has proved to be a reliable foundation for forecasting economic expansion and contraction.

INVESTMENT IMPLICATIONS

Based on these factors and more, our MSA indicates a high probability of continued U.S. economic growth. As the economy advances, businesses adapt to changing conditions, and that economic growth contributes to increases in revenue and earnings. Our experience suggests that unless there is a recession on the horizon, which we are not seeing, volatility is a buying opportunity.

Other global regions and countries face more significant headwinds, but the U.S. continues to stand head and shoulders above the rest. As a result, our equity allocations emphasize the U.S. over foreign equity markets. That said, we are finding some compelling opportunities overseas including high quality dividend payers, defensive sectors, and global natural resource companies.

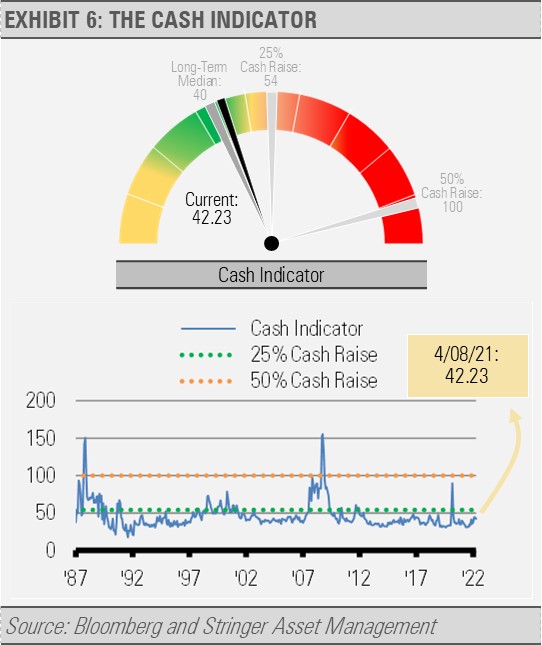

THE CASH INDICATOR

After a period of reflecting market complacency last year, the Cash Indicator (CI) recently elevated above its historical average. However, the CI has not reached and maintained a level suggesting that we hold more cash.

As we stated previously, we expect market volatility to pose an opportunity and not a threat. We remain fully invested and are seeing tactical opportunities to both manage risk and take advantage of potential gains.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.