The WisdomTree Investment Philosophy

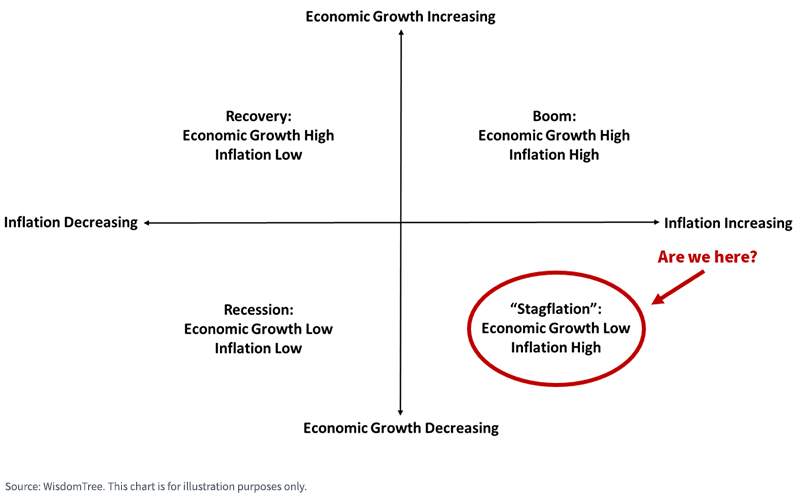

At any given time, the economy is either expanding or contracting, and inflation is either rising or falling, creating a four-quadrant “economic regime” framework for designing and managing investment portfolios:

The economy tends to rotate through these four quadrants (to varying degrees) over full market cycles (typically 6–8 years, although this time frame perhaps is truncated in today’s economic and policy landscape), and different investment strategies tend to perform better (i.e., either generate positive performance or help mitigate downside risk) depending on which economic regime quadrant we may be in at any given time.

The economy tends to rotate through these four quadrants (to varying degrees) over full market cycles (typically 6–8 years, although this time frame perhaps is truncated in today’s economic and policy landscape), and different investment strategies tend to perform better (i.e., either generate positive performance or help mitigate downside risk) depending on which economic regime quadrant we may be in at any given time.

This “economic regime” structure provides a logical framework for building full market cycle Model Portfolios. WisdomTree refers to this as building “all-weather” portfolios. The goal is to build portfolios that perform consistently regardless of where we are in the economic cycle.

Investment Philosophy, Point 1: Build portfolios that are diversified at both the asset class and risk factor levels to optimize the potential for more consistent performance throughout evolving economic regimes.

The WisdomTree Investment Process

Given that no single investment approach consistently performs at all times and under all market conditions, successful portfolio management depends on several factors:

- An investment philosophy that is logical, rational and quantitatively defensible;

- A track record of success over full market cycles; and

- Discipline to the approach over those full market cycles.

- Logical, Rational and Quantitatively Defensible: Within reason, we adhere to many accepted investment principles, including:

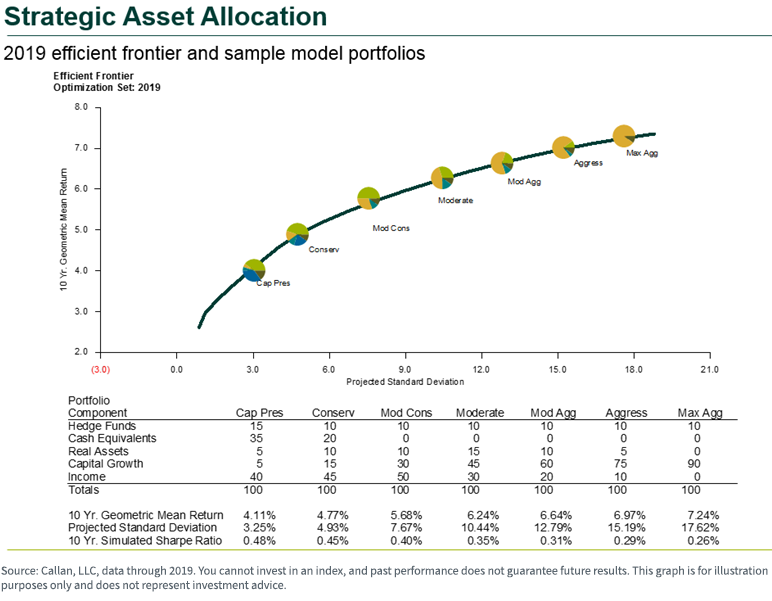

- Modern Portfolio Theory (MPT): The idea that there is a relationship between risk and return and that risk can be reduced through appropriate diversification;

- Capital Market Theory (CMT): The notion that markets are rational over time and there is an “efficient frontier” that represents a series of portfolios that optimize expected returns for various levels of risk; and

- The Power of Asset Class and Risk Factor Allocation: The belief that asset and risk factor allocation decisions, not individual security selection, are the primary determinants of portfolio performance over time.

- The implementation of these investment principles into actual portfolio construction requires:

- Capital Market Assumptions (CMAs): Forward-looking assumptions as to what levels of expected risk and return different asset classes and investment strategies may generate over a given period (typically 5–10 years), as well as the relationship (correlations) between the different asset classes—that is, how they move or change in value relative to one another. WisdomTree aggregates multiple third-party sources on a regular basis to help us develop appropriate CMAs; and

- Portfolio Construction Tools: More commonly known as “Mean-Variance Optimizers” (MVOs), these are algorithmic and analytical tools that take CMA inputs and generate efficient frontiers—the set of portfolios that, based on the assumed CMAs, optimize expected returns for any assumed level of risk. This then allows WisdomTree to create Model Portfolios that fit different “risk profiles,” from “conservative” (lower risk) to “aggressive” (higher risk).

A typical “efficient frontier” might look like this.

The theories of MPT, CMT and asset allocation are well-established and supported by academic work that resulted in Nobel Prizes for many thought leaders in the respective areas. That said, WisdomTree recognizes that these are all just theories based on assumptions and are not to be adhered to blindly.

The theories of MPT, CMT and asset allocation are well-established and supported by academic work that resulted in Nobel Prizes for many thought leaders in the respective areas. That said, WisdomTree recognizes that these are all just theories based on assumptions and are not to be adhered to blindly.

This is the primary role of the WisdomTree Asset Allocation and Model Portfolio Investment Committees—we start with and are informed by the quantitative output of the various assumptions and tools. We then apply our collective knowledge and practical experience to arrive at portfolios we believe are defensible quantitatively but which also reflect our understanding of client expectations, as well as when and where the theories may not always hold true.

Specifically, most of these theories are based on necessarily simplified assumptions. While they present a robust framework for conceptualizing portfolio construction over full market cycles, they are not necessarily predictive of market conditions at any given time.

We believe this combination of rigorous quantitative analytics and extensive practical experience helps us in creating robust portfolios that (a) investors are comfortable maintaining over their preferred time horizon and (b) have the best opportunity to succeed over full market cycles.

Investment Philosophy, Point 2: WisdomTree applies quantitative and qualitative analysis to both long-term forecasts and current market conditions to build strategic, longer-term portfolios.

WisdomTree Portfolio Construction

WisdomTree believes in taking a longer-term approach to building globally diversified portfolios based on the process described above.

We further believe that the two portfolio characteristics advisors have the most control over are fees and taxes.

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

As such, we are ETF-centric in our portfolio construction process, as we believe that the ETF is a superior investment structure versus mutual funds and their use helps optimize portfolio fees and taxes.

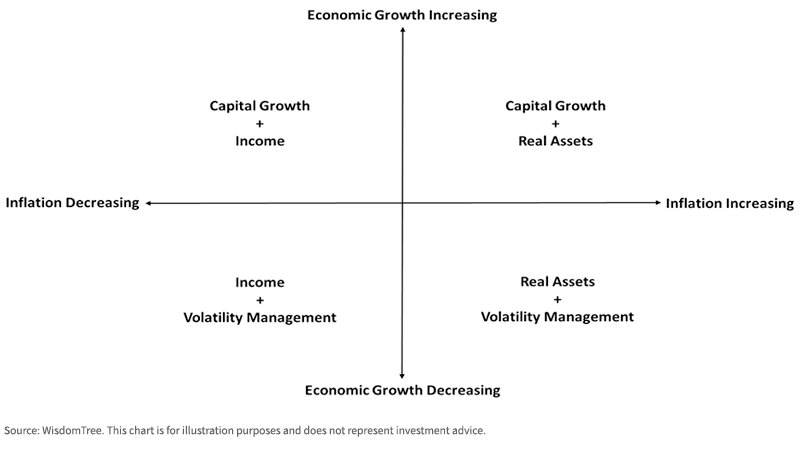

We use four “building block” strategy categories, the combination of which we believe has the potential to build multiple and diversified portfolios that can meet a variety of investment mandates and generate consistent performance under all economic regimes and in all market conditions:

- Global Equities, or “Capital Growth”: We access ETFs across all major geographies, asset classes and asset styles. These strategies include both passive “cap-weighted beta” strategies and (as is typical with WisdomTree products) “factor-tilted” strategies (i.e., screened for dividends, value, size, quality, etc.). Using both types of products allows us to build “core-satellite” portfolios using primarily ETFs.

- Fixed Income: We access a wide variety of ETFs, both U.S. and non-U.S., inclusive of most major fixed income sectors (rates, credit, high yield, securitized, both fixed and floating rate, preferreds, municipals, etc.).

- Alternatives, or “Volatility Management”: Strategies may include but are not limited to equity long/short, global macro, managed futures, event-driven, short-bias, inflation hedge and options based. In the portfolios where we include these strategies, they are designed to (a) provide additional diversification to portfolio equity, interest rate and inflation risk, (b) access a more diverse set of potential sources of return and (c) reduce the volatility of the overall portfolio over time.

- Real Assets: These types of strategies historically have proven to be sensitive to longer-term changes in inflation, and when we incorporate them, we are attempting to (a) provide still more diversification to the portfolio equity risk, (b) access additional sources of potential return and (c) provide purchasing power protection to the portfolio against rising inflation. These strategies may include but are not limited to gold, broad-basket commodities, real estate, energy Master Limited Partnerships (MLPs) and diversified inflation-sensitive products.

If we overlay these four product strategy categories onto our economic regime quadrants, in terms of when we might expect each “building block” to “help most” with respect to delivering consistent risk-adjusted returns over time, it might look like this:

We take a generally strategic approach to our portfolio construction and ongoing management—we do not try to “time the market” and rotate in and out of strategies based on the regime we believe we might be in.

We take a generally strategic approach to our portfolio construction and ongoing management—we do not try to “time the market” and rotate in and out of strategies based on the regime we believe we might be in.

Instead, depending on the underlying investment mandate, our models are diversified across all or most of the strategy building blocks in an attempt to deliver consistent performance regardless of which regime we may be in or evolving to. We may make marginal dynamic allocation or strategy decisions as changing market conditions warrant, but we build our portfolios with a longer-term time horizon in mind.

Investment Philosophy, Point 3: In building Model Portfolios, we are (1) ETF-centric in nature to optimize both fees and taxes, (2) global in nature and (3) “open architecture”—we use both WisdomTree and third-party models in all of our portfolios to help us deliver better asset class and risk factor diversification, as well as access “best in class” investment solutions, and (4) we take a “core-satellite” portfolio construction approach.

Summary and Conclusions

The WisdomTree Investment Philosophy and Portfolio Management approach is grounded in both academic research and practical experience. Over full market cycles and in varying economic and investment regimes, we strive to deliver consistent and positive risk-adjusted net-of-fee performance. By doing so, we attempt to help advisors and their end client investors meet their long-term investment goals and objectives.

Important Risks Related to this Article

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

Neither asset allocation nor diversification assures a profit or protects against loss in a given market environment. Investors should consider their investment time frame, risk tolerance level and investment goals.

For Retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from the information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For Financial Advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.