Michael Burry is one of the most influential investors of our time.

He became famous after he correctly predicted the housing crash of 2008-2009 and made a fortune by shorting it. By the time he closed his hedge fund in 2008, he had earned almost 150x the returns of the S&P 500 (SPY) over the same time period.

But what many of you may ignore is that Michael Burry was already a very successful investor prior to that. He also profited from the dot-com crash and more recently, he also successfully shorted Tesla (TSLA) and the ARK Innovation ETF (ARKK) when they were near their peak valuations. He also invested in GameStop (GME) shortly before it became a meme stock!

So needless to say that he is something worth following. His company's holdings and latest transactions are public and besides, he also tweets a lot and is heavily mediatized.

Lately, he has made a lot of headlines because he sold nearly all of his positions. Among the stocks that he sold are Meta (META), Bristol Myers (BMY) and Cigna (CI), and many others.

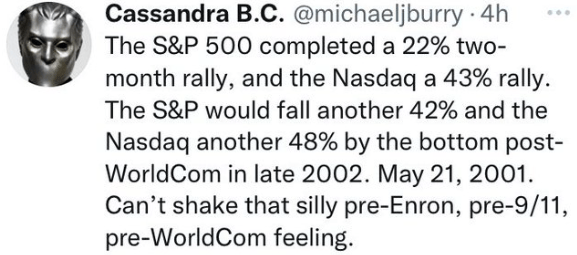

This comes after he has repeatedly warned us on Twitter (TWTR) that the latest bull run isn't sustainable and that it will be likely followed by another crash:

If you scroll through his Twitter feed, you will find that he worries about many things:

- Inflation

- Valuation multiples

- The broader economy

- The surging energy prices

- The pandemic

- The political landscape

- The increasing socioeconomic tensions

- China's potential invasion of Taiwan

- And the devastation caused by Russia's invasion of Ukraine

Ultimately, it appears that he came to the conclusion that the market cannot keep rising with all these issues lingering around, and decided to sell everything.

Or “almost” everything should I say!

Because equally interesting is that he decided to buy one real asset stock called GEO Group (GEO).

GEO is a former real estate investment trust (REIT) that specializes in private prisons and mental health facilities. Last year, it converted into a C-corp in order to maximize its value by retaining its cash flow to deleverage, buy back stock, and diversify its business, but essentially, this is still a REIT-like real estate stock.

This means that Michael Burry's hedge fund is now 100% invested in real assets and then holding a lot of cash. What we can take away from this is that he is very bearish on the broader market, but secondly also that he sees some opportunities in specialty real assets.

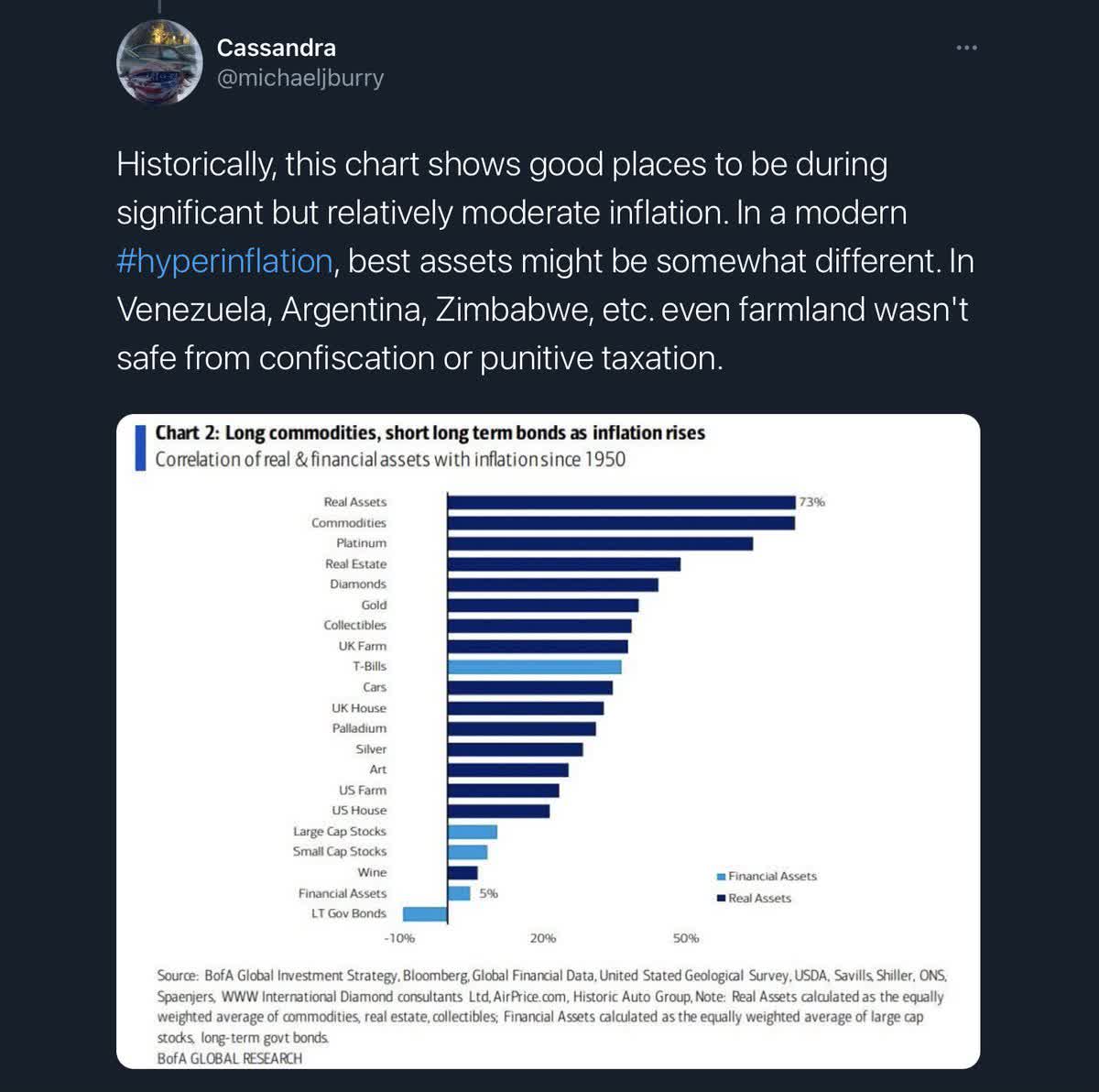

This makes sense since his primary worry appears to be inflation and real assets are notoriously resilient to it. Moreover, many REITs and other REIT-like entities are currently priced at historically low valuations as we explain in a recent market update that you can read by clicking here.

And most investors appear to forget an important thing: Michael Burry's wealth is not entirely in his hedge fund. He has amassed a lot of private wealth over the years, and he has given us a lot of clues that he is heavily investing in not just prisons, but also other real assets.

Michael Burry's Bet On Real Assets, Water, and Farmland Specifically

Burry became famous in 2015 when theaters worldwide aired “The Big Short” movie. The storyline focused mainly on how he successfully shorted the housing market, but at the very end of the movie, we also got to know how he was redeploying his gains. The very last statement of the movie read:

The small investing he still does is all focused on one commodity: water.

There are many ways to invest in water, but the most popular approach is to invest in farmland and this appears to have been Burry's strategy. In a later interview, he explains that:

What became clear to me is that food is the way to invest in water. That is, grow food in water-rich areas and transport it for sale in water-poor areas. This is the method for redistributing water that is least contentious, and ultimately it can be profitable, which will ensure that this redistribution is sustainable.

He added that:

Agriculture land with water on site will be very valuable in the future, and I have put a good amount of money into that.

When asked how much of his portfolio is in farmland, he replies:

Oh I don't want to disclose that, but it is a significant amount at this point.

This interview is old of course.

But farmland is an illiquid asset class that investors typically buy and hold over many generations. Therefore, a decade actually isn't a long time frame for farmland.

Also, more recently, Michael Burry has tweeted about farmland's inflation resilience, so I think that it is safe to say that he still owns a lot of farmland, in addition to his position in the GEO Group.

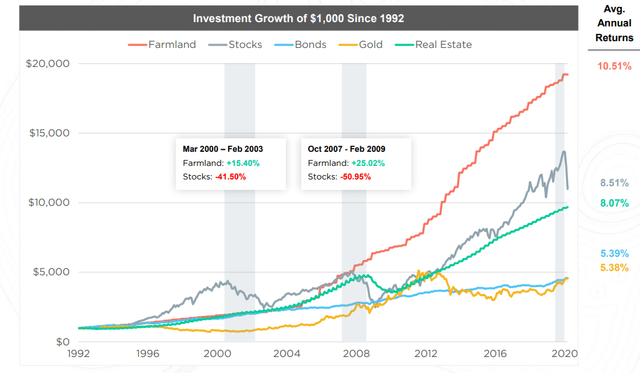

It would also make sense since he is mainly worried about two things: inflation and a market crash. Real assets and farmland specifically have historically been highly resilient to inflation, and also to market crashes.

From the below chart, you can see that farmland values even kept on rising in 2008-2009:

If he was mainly focused on farmland investing in 2015, and he has only become more concerned about inflation since then, I think it is safe to assume that he is still heavily invested in farmland and other real assets.

So all the headlines that say that Burry has sold “everything” likely aren't accurate. If Burry was out there trying to sell all his farmland, we would probably know about it since it is a significant portion of his personal net worth.

A more accurate headline would be: Burry is heavily investing in real assets and holding cash to protect himself against a market crash.

So before you rush to sell your stocks, perhaps you may want to consider investing in real asset allocation instead.

That's what I have done.

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

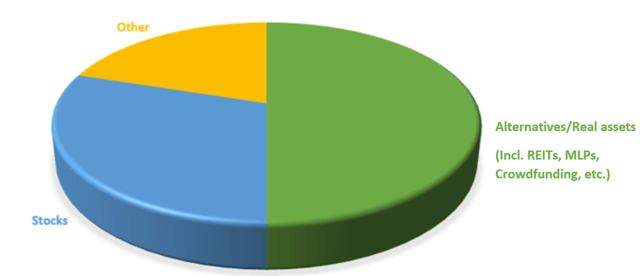

I have always been heavily invested in real assets, but I have bumped my allocation even further in 2022, and it is now surpassing 50% of my portfolio:

I get most of my real asset exposure through listed vehicles like REITs (VNQ) and MLPs (AMLP), and I also use crowdfunding to get additional exposure to some specialty real assets that aren't traded on the public market.

Below, I highlight some examples:

Private prisons

I don't own the GEO Group (GEO), but I actually own a position in its closest peer CoreCivic (CXW) to get exposure to private prisons. I am bullish on this sector for the same reasons as Michael Burry. The public facilities are at overcapacity and therefore, the private facilities hold a lot of value as they are absolutely necessary to our society. Yet, they are priced at a huge discount to replacement costs due to political fears. We think that even if private prisons were eventually banned, it would lead to a positive outcome for shareholders because these prisons are still needed, you are buying them at a very low price, and CXW has a strong balance sheet. Currently, CXW is priced at ~5x cash flow and just around a third of the replacement costs of its properties. The company is deleveraging and buying back shares to create value for shareholders.

Farmland

I invest in farmland in two ways. I hold a position in the publicly listed farmland REIT: Farmland Partners (FPI) and I also invest in the crowdfunding platform: FarmTogether.

I am bullish on FPI because it trades at a slight discount to NAV and I expect its new asset management business to result in significant growth.

I also use FarmTogether because it gives me better diversification benefits (protected from the public market volatility) and much greater income as many of their deals yield over 8% per year.

Apartment communities

Everybody needs a roof over their head, whether the economy is booming or collapsing. I focus mainly on affordable housing in rapidly growing cities like Austin, which are enjoying rapid rent growth and near 100% occupancy rates.

You would expect the REITs that own such properties to trade at high valuations, but against all odds, a few of them are actually deeply discounted.

Warehouses, billboards, cell towers, hospitals, foreign real estate,…

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

There are over 200 REITs in the US alone, and there are REITs in over 30 countries. I could discuss a lot of different types of opportunities but that's beside the point of this article. You should know however that it is easier than ever before to invest in real assets and you don't need to be a wealthy investor like Burry to get exposure to these investments.

Bottom Line

Burry is not just holding cash.

The many headlines that claim that he is fully out of the market are almost certainly wrong.

Yes, his hedge fund holds only one position, but his personal wealth is still heavily invested in real assets as far as we know.

So before you make the mistake of going into cash, remember that Burry is protected from inflation through his real asset investments.

You may want to consider investing more heavily in real assets as well.