International stocks offer investors cheap valuations, above-average yields, and the potential for market-beating returns. VYMI is a diversified international equity index ETF, focusing on stocks with above-average yields.

VYMI: International ETF With Double-Digit Dividend Growth

An overview of the fund follows.

The Vanguard International High Dividend Yield ETF (NASDAQ:VYMI) is a diversified index ETF, focusing on international stocks with above-average dividend yields. VYMI's diversified holdings, strong 5.3% yield, double-digit dividend growth track-record, and cheap valuation make the fund a buy.

VYMI – Basics

- Sponsor: Vanguard

- Underlying Index: FTSE All-World ex US High Dividend Yield Index

- Expense Ratio: 0.22%

- Dividend Yield: 5.25%

- Total Returns CAGR (Inception): 6.83%

VYMI – Overview and Investment Thesis

VYMI's investment thesis is quite strong, and rests on the fund's:

- Diversified holdings, with exposure to dozens of countries, all relevant industry segments, and over one thousand individual securities

- Strong 5.3% dividend yield, quite a bit higher than average, and fully-covered by underlying generation of income

- Double-digit dividend growth track-record, which directly benefits all investors, and is particularly beneficial for long-term dividend growth investors

- Cheap valuation, which could lead to capital gains and market-beating returns if valuations were to normalize

The above combine to create a strong fund and investment opportunity. Let's have a closer look at each of these four points.

Diversified Holdings

VYMI is an index ETF, tracking the FTSE All-World ex US High Dividend Yield Index. It is a relatively simple index, which includes relevant securities from all international markets with above-average dividend yields, subject to a basic set of inclusion criteria. Applicable stocks are ranked according to their forward dividend yield and included in the index until their cumulative market capitalization reaches 50% of the total market cap of applicable stocks. So, VYMI invests in the top 50% highest-yielding international securities, by market-cap.

VYMI's underlying index is quite broad, which results in a well-diversified fund. VYMI invests in over one thousand securities from all relevant industry segments, and from several dozen countries. Diversification is greater than that of most broad-based equity indexes, including the S&P 500 and the Nasdaq-100. VYMI is diversified enough that it could function as a core portfolio, or as the only international equity fund in an investor's portfolio, as it provides sufficient, diversified exposure to said industry niche. VYMI only lacks exposure to U.S. securities, which are more or less required for most investors and portfolios, which must be gained through investments in other funds.

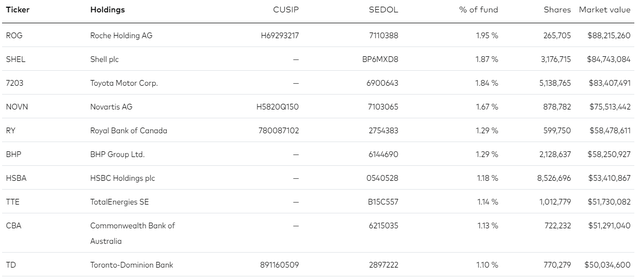

VYMI's largest holdings are mostly well-known international blue-chip stocks, including Roche (OTCQX:RHHBY), Novartis (NVS), and Royal Bank of Canada (RY). These are strong, comparatively safe holdings, with good dividend yields, dividend growth track-records, and performance, important benefits for the fund and its shareholders.

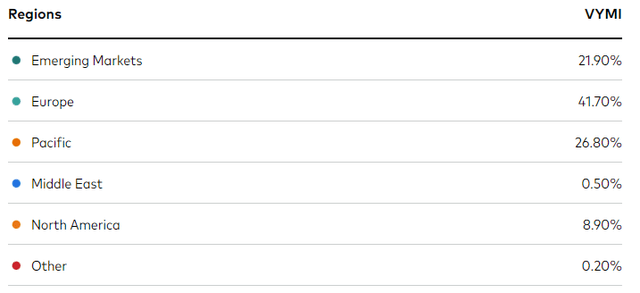

The fund is somewhat overweight Europe, due to the continent's large economy and public equity markets, but not significantly so.

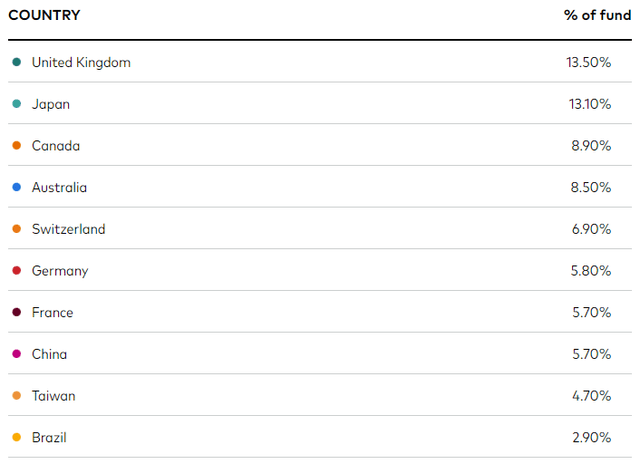

UK, Japan, Canada, and Australia are some of the fund's largest country exposures, for the same reasons.

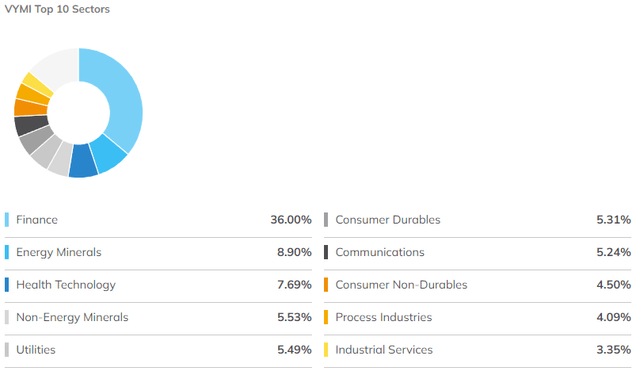

VYMI is generally significantly overweight financials, with a 36% industry allocation, as said industry tends to be a large player in international equity markets, and as financials tend to sport above-average dividend yields. Although most dividend-focused ETFs are overweight financials, VYMI is significantly more overweight than average.

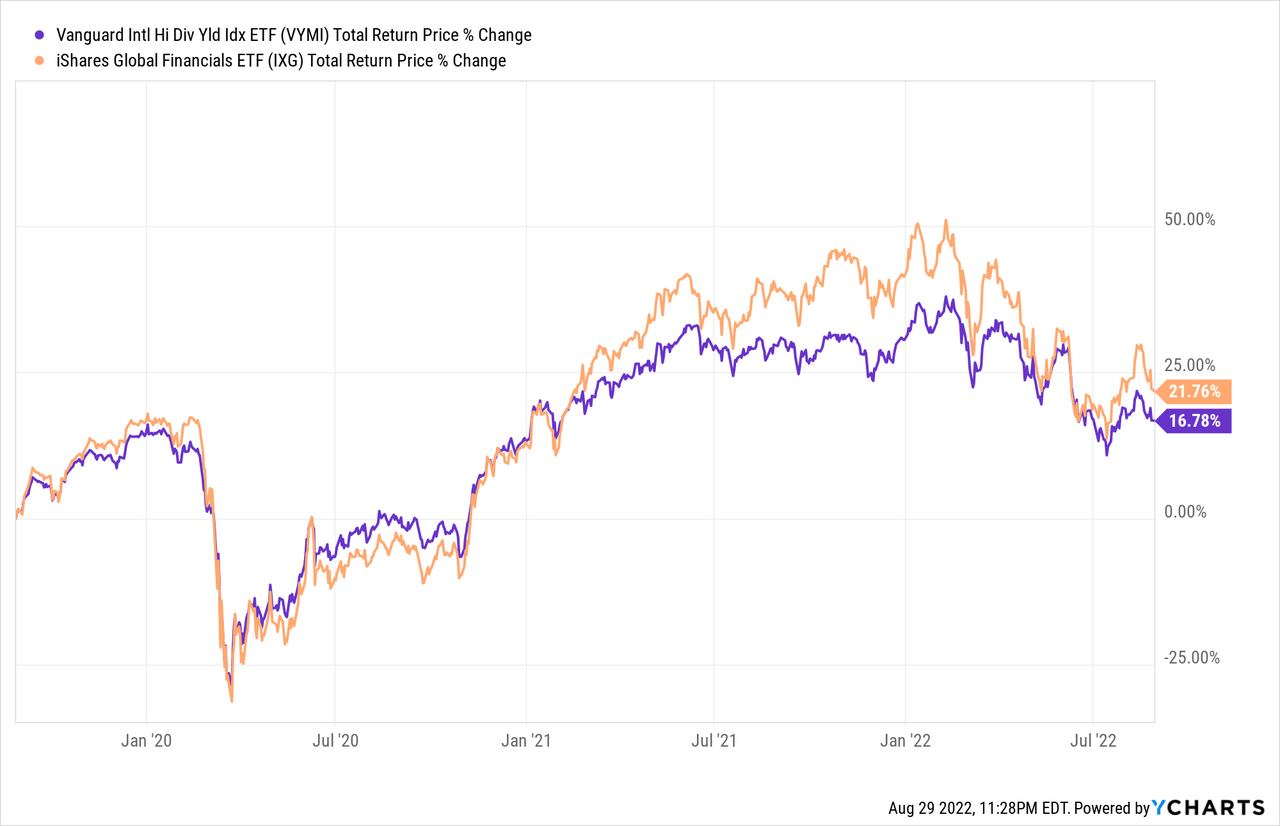

Due to the above, VYMI's performance is strongly dependent, and tends to track, the performance of international financial companies. I was unable to find an appropriate index for these securities, but there are several ETFs tracking the global financial industry, and VYMI's performance tends to be quite similar to these.

Although there is nothing inherently wrong with being overweight financials, said positioning is an important fact for investors to consider. This is particularly important for investors who focus on dividend ETFs, as most of these tend to be overweight financials. Consider greater exposure to other industries through other funds or investments.

Notwithstanding the above, VYMI is an incredibly well-diversified fund. Diversification reduces risk and volatility, and is a significant benefit for the fund and its shareholders.

Strong 5.3% Dividend Yield

International stocks tend to trade with lower share prices and cheaper valuations than comparable U.S. equities, due to their lower growth rates and higher level of (perceived) risk. U.S. equities are the best in the world, but also relatively expensive, and relatively low-yielding.

- A masculine fragrance with a fusion of sandalwood,...

- FRESHEN YOUR LIFE: Fiber Can is LITTLE TREES...

- MORE THAN JUST A CAR AIR FRESHENER: Freshen up at...

- LONG-LASTING FRAGRANCE EXPERIENCE: Specialized...

- SLIDE LEVER TO ADJUST STRENGTH: Slide the lever on...

- UV SHIELDING - Provide your baby with protection...

- SIMPLE UNIVERSAL INSTALLATION - Experience...

- THIS SET INCLUDES- 2 transparent car window...

- DURABLE MESH MATERIAL & STURDY WIRE- Rely on...

- GIVE THE BEST BABY GIFT- Need a baby shower gift...

- SAFETY ESSENTIAL CAR ACCESSORIES: If your car is...

- PRACTICAL AND PERFECT CHRISTMAS GIFT: A surprise...

- SAFE AND DURABLE TOOL KIT: This bag is made of...

- EVERYTHING YOU NEED FOR CAR SAFETY IN ONE BAG:...

- SUITABLE FOR MOST EMERGENCIES: This roadside...

- ✔ADJUSTABLE STRAP & COLLAPSIBLE SHAPE – The...

- ✔MAGNETIC SNAPS: There are 4 metallic magnetic...

- ✔HARD-WEARING LEAKPROOF INNER LINING – This...

- ✔MULTIPURPOSE – This car garbage bin can be...

- ✔GREAT COMPATIBILITY – An effective solution...

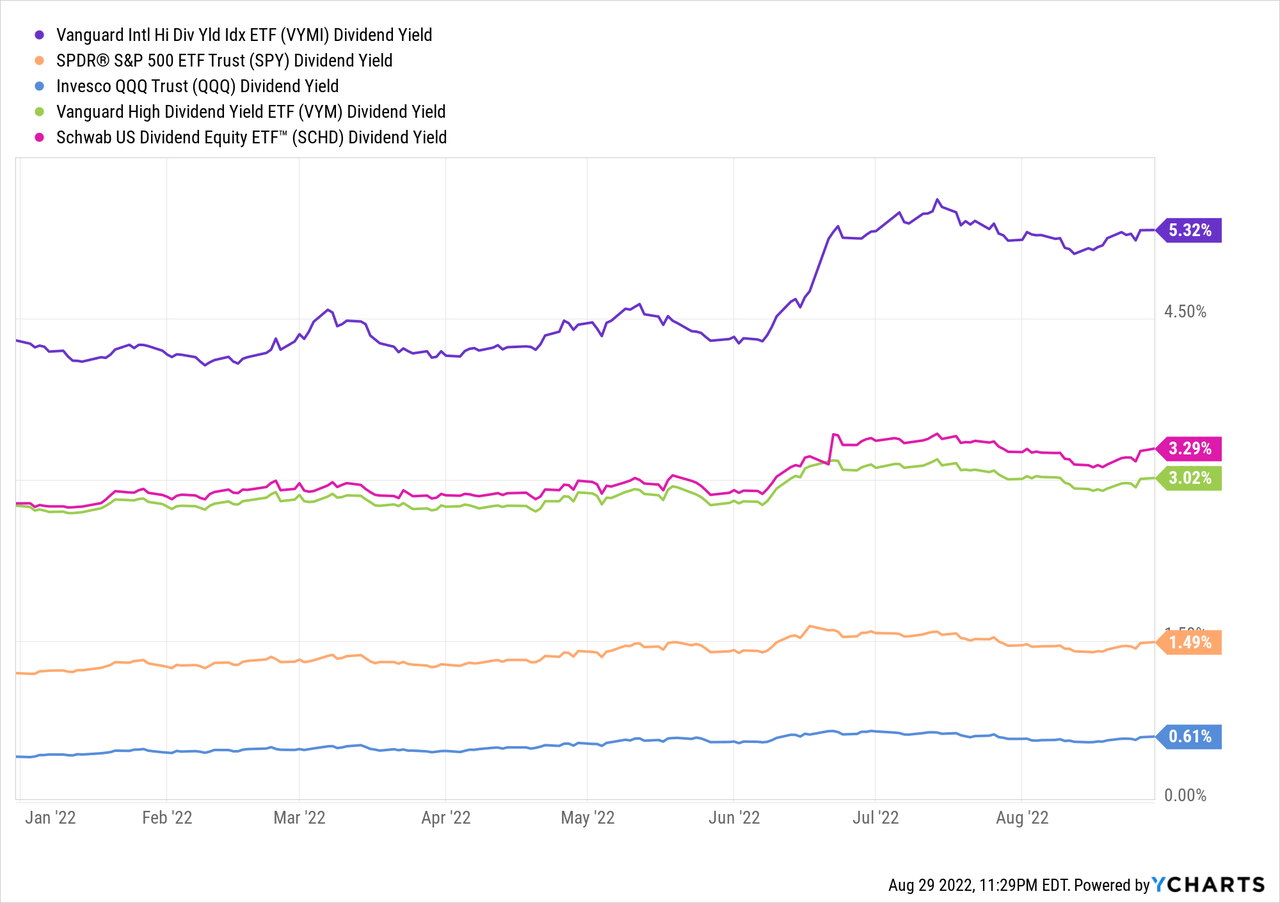

VYMI invests in international stocks, which tend to sport comparatively strong yields. VYMI further focuses on international stocks with above-average yields, which boosts the fund's yield further, to 5.3%. It is a reasonably strong yield on an absolute basis, and higher than the yields on most broad-based U.S. equity indexes, and U.S. dividend equity funds.

ETF dividends tend to be fully-covered by underlying generation of income, due to regulatory, operational, and legal reasons, and VYMI is no exception. The fund's 5.3% dividend yield is covered by the income generated by the fund / dividends received from its equity investments, meaning it is a reasonably safe, sustainable dividend.

Double-Digit Dividend Growth Track Record

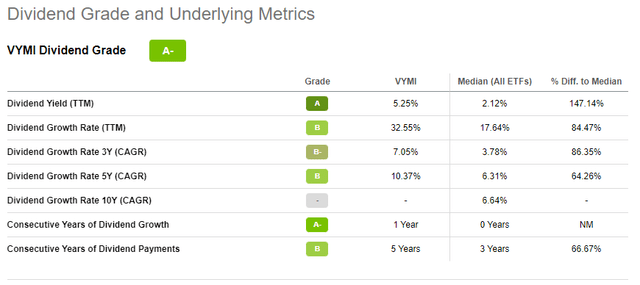

VYMI offers investors strong and fast-growing dividends, a solid combination. The fund's dividends tend to see healthy growth year after year, growing at a double-digit CAGR since inception. Growth has accelerated these past few months, reaching 32%, as most international stocks only fully recovered from the pandemic in 2021, which led to higher dividends in 2022. Although recent growth rates are unlikely to continue, growth should remain relatively healthy, as has been the case since inception.

On a more negative note, ETF dividends tend to be quite volatile, and VYMI is, again, no exception. VYMI's dividends tend to fluctuate every quarter, and the fluctuations can be quite large. First quarter dividends tend to be quite low, as comparatively few international equities pay dividends in said quarter. Dividends tend to pick up in the second quarter of the year, as dividends from the fund's holdings start trickling in.

Fluctuating, volatile dividends are obviously a negative for investors, and particularly harmful for income investors and retirees who depend on dividends for their monthly expenses. Fluctuating, volatile dividends also complicate the calculation and analysis of dividend growth metrics. It is sometimes unclear if dividends are growing, or if dividends simply had a temporary, volatility-induced increase. Still, from what I've seen, I'm confident that VYMI's dividends truly are growing, volatility notwithstanding.

Cheap Valuation

International stocks currently trade with comparatively cheap valuations, as the unprecedented 2009-2020 U.S. bull market leads to skyrocketing prices and valuations for U.S. equities.

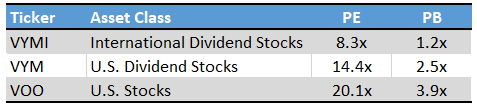

VYMI invests in international stocks, so the fund naturally trades with a competitive valuation. VYMI further focuses on international stocks with above-average yields, a common valuation metric, which cheapens valuations further. The fund currently trades with a PE ratio of 8.3x and a PB ratio of 1.2x, both relatively low figures on an absolute basis, and lower than the average U.S. equity or U.S. dividend equity index fund.

VYMI's cheap valuation could lead to capital gains and market-beating returns if investor sentiment were to improve, and valuations were to normalize. Although this has been the case for many undervalued asset classes and equity industry sub-segments in the recent past, it has not been the case for international stocks, most of which remain significantly undervalued relative to their U.S. peers.

In general terms, I see no catalyst for a valuation reset. The economic reopening of late 2020 / early 2021 was the catalyst for most undervalued asset classes in the past, but international dividend stocks refused to budge. I do expect valuations to normalize sometime in the future, but as there is no near-term catalyst, I think investors might have to wait years for VYMI's (potential) capital gains to materialize.

On a more positive note, VYMI does offer investors strong, growing dividends, and these are not dependent on investor sentiment, unlike capital gains. These dividends ensure a reasonable rate of return as investors wait for valuations to normalize, and for capital gains to materialize.

Conclusion

VYMI's diversified holdings, strong 5.3% yield, double-digit dividend growth track-record, and cheap valuation make the fund a buy.