VOO is a simple S&P 500 index ETF, with strong realized and potential capital gains, and an outstanding performance track-record.

VOO Vs. JEPI: Which ETF Is The Better Dividend Investment

JEPI is a popular equity income ETF, with a strong dividend yield, and an outstanding performance track-record.

A comparison of these two funds follows.

The Vanguard S&P 500 ETF (NYSEARCA:VOO) is one of the most popular ETFs in the market, tracking the benchmark U.S. equity index.

The JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) is smaller, but is rapidly gaining ground in dividend and retirement investment communities, due to its strong 11.0% dividend yield.

Due to reader and editorial interest, I thought to do an article comparing these two funds, their strategies, holdings, dividends and performance. Both funds are buys, but specific investors might find the value proposition of one or the other more compelling.

JEPI's strong 10.0% dividend yield make it the best ETF for dividend investors, in my opinion at least. JEPI's low volatility holdings could also reduce capital losses during future downturns, which might be beneficial for conservative investors and retirees.

VOO's stronger potential capital gains, and slightly stronger long-term total return track-record, make it the best ETF for long-term investors for whom dividends are not an important consideration, in my opinion at least.

Strategy And Holdings Comparison

VOO – Simple S&P 500 Index Fund

VOO tracks the S&P 500 index, the benchmark U.S. equity index.

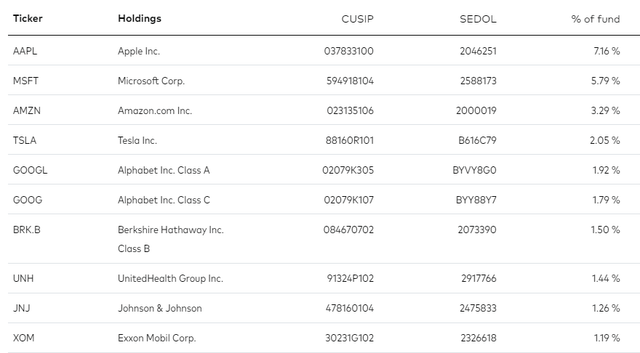

VOO's underlying index is quite simple, including the 500 largest U.S. equities subject to a basic set of inclusion criteria. It is a market-cap weighted index, so larger constituents have greater weights. Currently, this mostly means mega-cap tech stocks, including Apple (AAPL), Microsoft (MSFT), and Google (GOOG). Concentration is about average for an equity index fund, with the fund's top ten holdings accounting for 27% of its value. VOO's largest holdings are as follows.

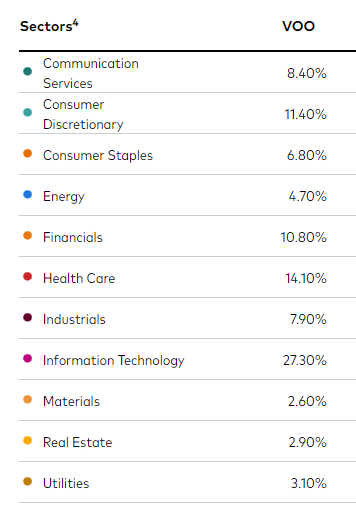

VOO invests in all relevant equity industries, although there is the aforementioned overweight tech position.

VOO's holdings cover 75% of the U.S. equity market, by market-cap. The fund provides investors with broad, diversified exposure to said market. Only notable exclusion is mid-caps and small-caps, which account for the remaining 25% of U.S.S equity market-cap.

VOO is a simple S&P 500 index fund, and could easily be a core portfolio holding. It is also one of the best long-term investors can make, in my opinion, and in the opinion of some of the greatest investors of all time, including Warren Buffett.

JEPI – Complicated Low Volatility Equity + Covered Call Fund

JEPI is somewhat more complicated than VOO.

JEPI invests around 80% – 90% of its assets in lower risk, lower volatility U.S. equities. The fund is actively-managed, so security selection and weights are a discretionary investment decision, ultimately up to fund managers. JEPI uses a proprietary investment model to attempt to select stocks with strong fundamentals and attractive risk-return profiles.

JEPI's returns are partly dependent on the effectiveness of said model, as well as other investment decisions taken by the fund's management team. This differs from VOO, a simpler index fund, whose returns simply track those of an index. Actively-managed funds are generally riskier than index funds, as investment strategies can always fail or underperform. This is the case for JEPI as well, but only slightly so, as the fund's strategy seems adequate, and not particularly risky or aggressive. In my opinion at least.

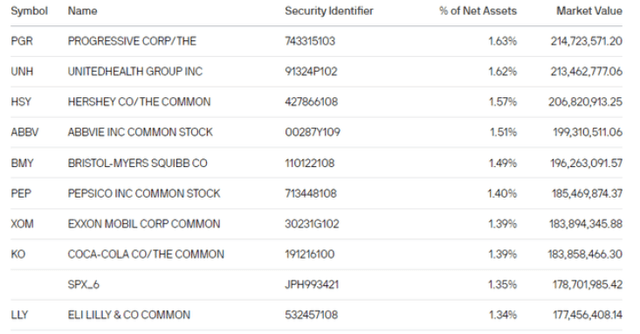

JEPI generally invests in over 100 U.S. equities, currently 122. The fund is generally overweight older, stodgier, blue-chip U.S. large-caps, as is currently the case. JEPI's larger holdings include dividend investor favorites like AbbVie (ABBV), PepsiCo (PEP), and Coca-Cola (KO). JEPI focusing on these and other similar holdings serves to reduce risk, volatility, and potential losses during downturns. These are important benefits for all investors, and particularly important for retirees and other more risk-averse investors.

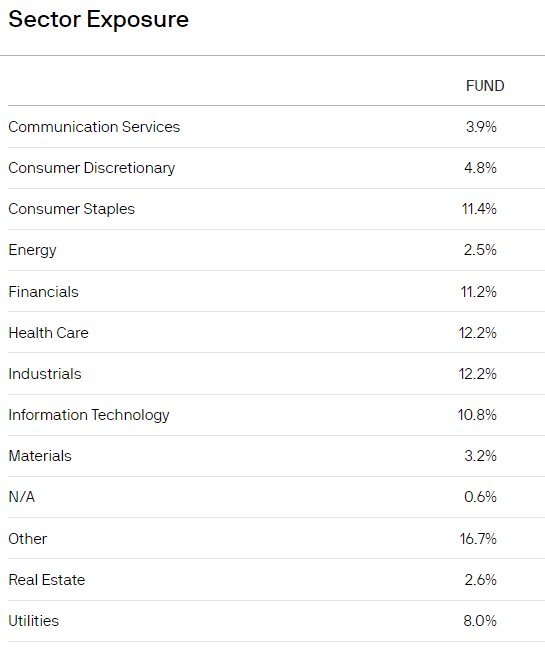

JEPI provides investors with diversified exposure to all relevant equity industry subsegments. Unlike VOO, the fund is not overweight technology.

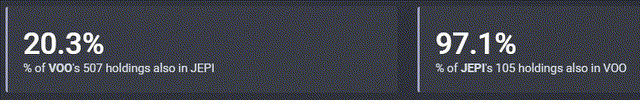

JEPI is a materially less diversified fund than VOO, with a much lower number of holdings. In general terms, every JEPI holding is also included in VOO, but the opposite is not true.

JEPI's lower diversification increases portfolio risk, volatility, and the possibility of underperformance. VOO closely tracks the U.S. equity market, so the fund should see gains if U.S. equities are up, with very few exceptions. JEPI does not track U.S. equity markets as closely, so the fund might not benefit from rising equity prices under certain scenarios. JEPI might, for instance, focus on underperforming equities and industries, and so it can post losses even as U.S. equity markets rise. JEPI is diversified enough that this is not a significant risk, but it remains a possibility.

In my opinion, VOO is the most appropriate investment for investors looking for as much diversification as possible, and those who wish to receive market average returns, yields, and the like. JEPI is sufficiently diversified, and focusing on low volatility stocks helps, but VOO remains the more broadly diversified choice.

JEPI invests around 80%-90% of its assets in the aforementioned U.S. equities. The other 10%-20% is invested in leveraged equity-linked notes. These are relatively complicated securities, but are structured as to combine the economic characteristics of investing in the S&P 500, and selling covered calls on the same index. This is the exact same strategy followed by the Global X S&P 500 Covered Call ETF (XYLD), for those who know about the fund.

JEPI's equity-linked notes are structured in such a way as to reduce potential share price appreciation, while increasing income and yields. These securities make JEPI a very different investment proposition relative to VOO in several key ways. Let's have a look at some of these.

Income Comparison – JEPI Clear Winner

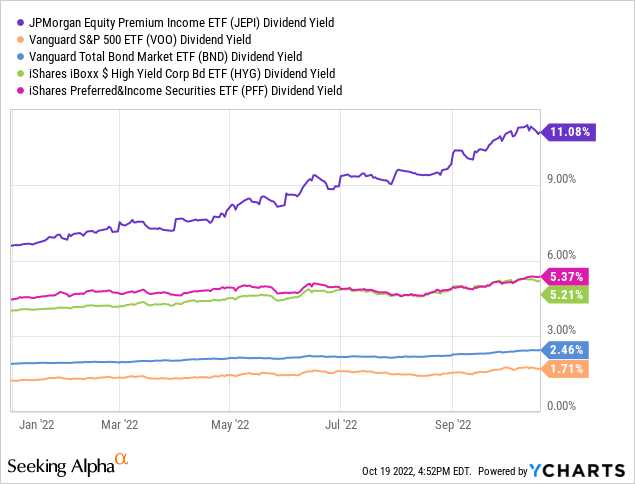

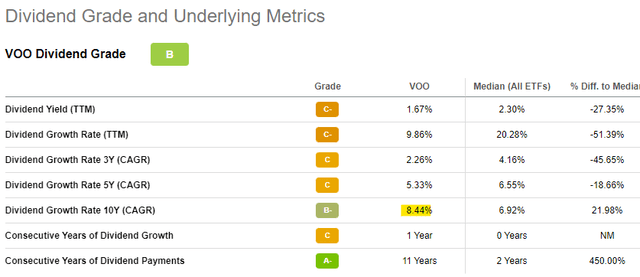

VOO's equity holdings generate modest dividends, with the fund currently yielding 1.7%. It is a normal yield for an equity index fund, but quite low on an absolute level, and much lower than the yields offered by dividend-focused equity funds, and other types of income funds.

JEPI's equity holdings also generate modest dividends but, most importantly, its equity-linked notes generate a lot of income, through option premiums. The premiums generated by these notes are distributed to shareholders, boosting the fund's yield to 11%. JEPI's dividend yield is incredibly strong on an absolute level, significantly higher than VOO's yield, and quite a bit higher than that of most asset classes.

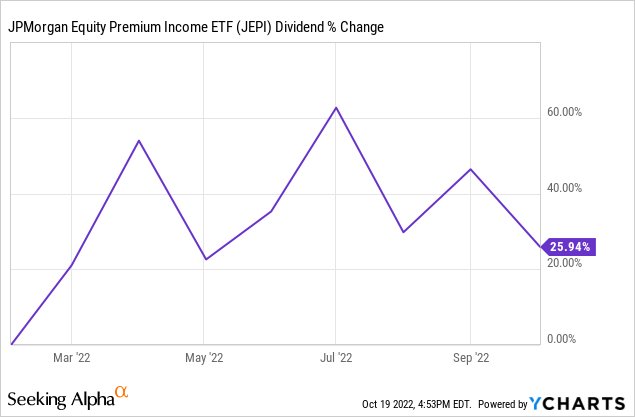

JEPI's dividends are covered by underlying generation of income/option premiums. As evidence, the fund currently sports an SEC yield, a standardized measure of short-term generation of income, of 12.5%. JEPI currently generates 12.5% in income, which more than covers the fund's 11.0% yield. As the fund generates more in income than it distributes to shareholders, dividend growth is a distinct possibility. JEPI's dividends have seen solid growth all year, as one would expect.

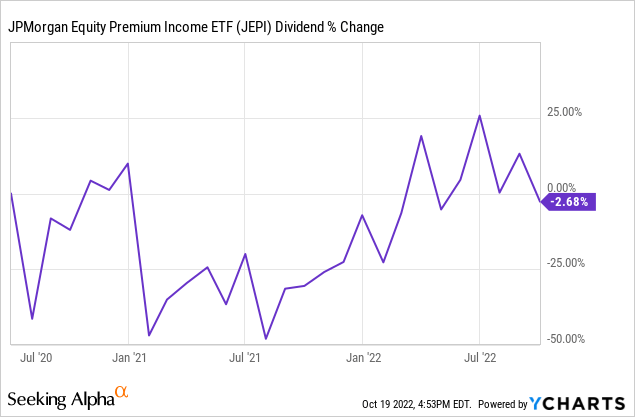

JEPI does not have a long dividend growth track-record, as the fund was only created in mid-2020. The fund's dividends have slightly decreased since inception. Although this is something of a negative, I don't find it to be a material one: the decrease is very small, and the fund's track-record is very short.

JEPI's long-term dividend growth will likely prove to be positive, due to dividend growth from the fund's underlying equity holdings. On the other hand, fund dividends are strongly dependent on option premiums, so it could see significant movements and reductions from changes in these. I have no reason to believe that option premiums will decrease long-term, but can't rule out the possibility.

VOO's dividend growth track-record is reasonably strong. Dividends tend to grow year after year, and have grown at an 8.4% CAGR for the past decade or so. Although growth is strong, the starting yield is very low, so it would take decades until the fund's dividends grow into reasonable income/yield on cost.

VOO's long-term dividend growth will very likely prove to be positive, due to dividend growth from the fund's underlying equity holdings. VOO's dividends are not dependent on option premiums or similars, so dividend growth should prove to be less volatile, and much more certain, relative to JEPI.

JEPI's strong 11% dividend yield is a significant benefit for the fund, and a key advantage relative to VOO. In my opinion, JEPI's strong dividend yield makes it the best choice for dividend investors.

Capital Gains / Share Price Appreciation Comparison – VOO Clear Winner

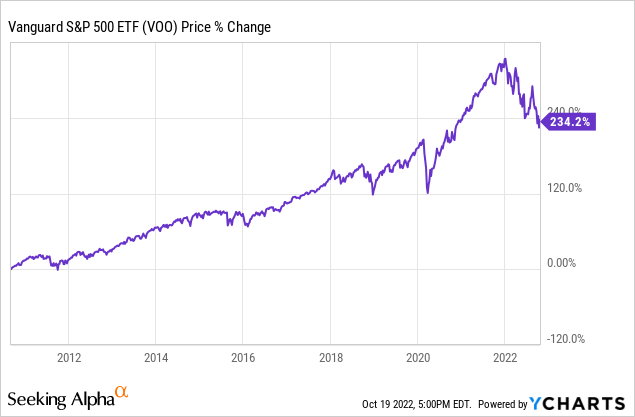

VOO focuses on U.S. equities, one of the strongest, best-performing asset classes in the world. Returns tend to be strong, and mostly consist of capital gains or share price appreciation. VOO's share prices has more than tripled since the fund's inception, almost twelve years ago.

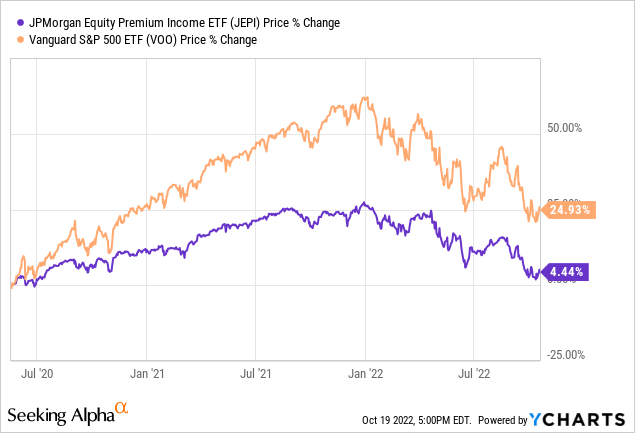

JEPI's equity holdings tend to see strong capital gains as well, but the fund's equity-linked notes do not. Due to the structure and leveraged nature of these notes, the result is a fund with significantly decreased realized and potential capital gains and share price appreciation. JEPI's share price has risen since inception, but by little, and by much less than VOO.

VOO's stronger realized and potential capital gains are a significant benefit for the fund, and key advantage relative to JEPI.

Total Return Comparison – VOO Slight Winner

- A masculine fragrance with a fusion of sandalwood,...

- FRESHEN YOUR LIFE: Fiber Can is LITTLE TREES...

- MORE THAN JUST A CAR AIR FRESHENER: Freshen up at...

- LONG-LASTING FRAGRANCE EXPERIENCE: Specialized...

- SLIDE LEVER TO ADJUST STRENGTH: Slide the lever on...

- UV SHIELDING - Provide your baby with protection...

- SIMPLE UNIVERSAL INSTALLATION - Experience...

- THIS SET INCLUDES- 2 transparent car window...

- DURABLE MESH MATERIAL & STURDY WIRE- Rely on...

- GIVE THE BEST BABY GIFT- Need a baby shower gift...

- SAFETY ESSENTIAL CAR ACCESSORIES: If your car is...

- PRACTICAL AND PERFECT CHRISTMAS GIFT: A surprise...

- SAFE AND DURABLE TOOL KIT: This bag is made of...

- EVERYTHING YOU NEED FOR CAR SAFETY IN ONE BAG:...

- SUITABLE FOR MOST EMERGENCIES: This roadside...

- ✔ADJUSTABLE STRAP & COLLAPSIBLE SHAPE – The...

- ✔MAGNETIC SNAPS: There are 4 metallic magnetic...

- ✔HARD-WEARING LEAKPROOF INNER LINING – This...

- ✔MULTIPURPOSE – This car garbage bin can be...

- ✔GREAT COMPATIBILITY – An effective solution...

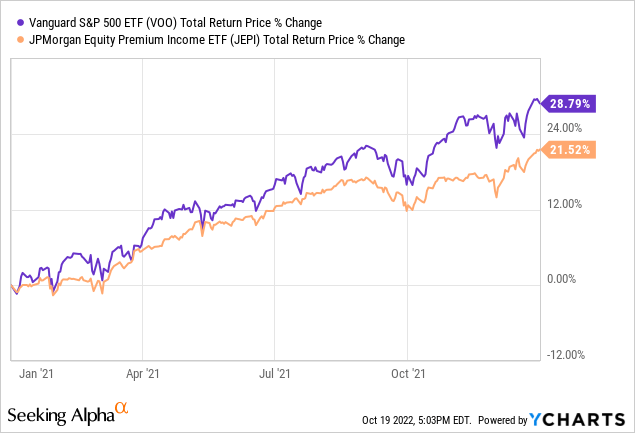

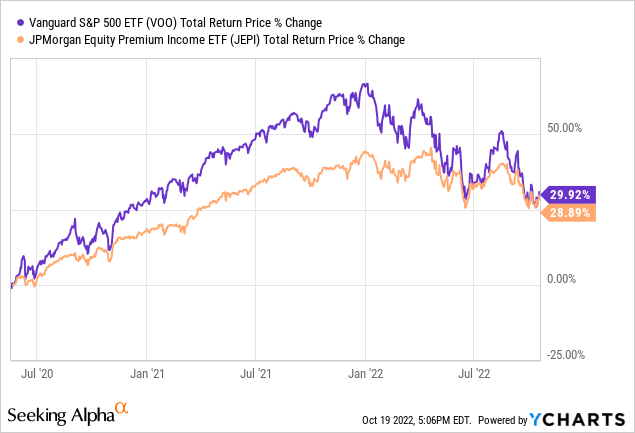

VOO tends to experience stronger share price appreciation than JEPI, but has a much lower yield. The net effect tends to be positive for VOO during bull markets and recoveries, as equity prices tend to skyrocket during these. Expect VOO to outperform during said market conditions, as was the case during 2021, in which the S&P 500 rallied by almost 30%.

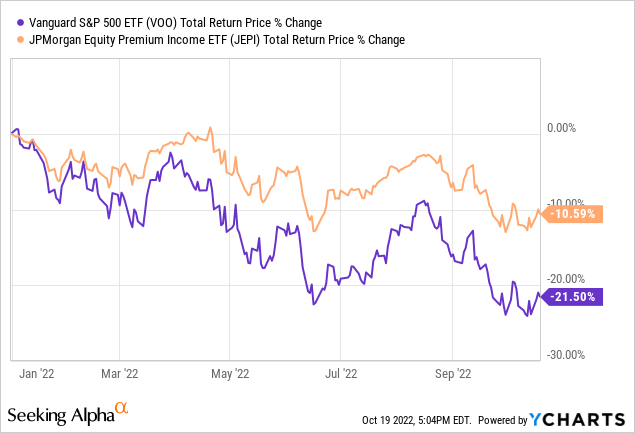

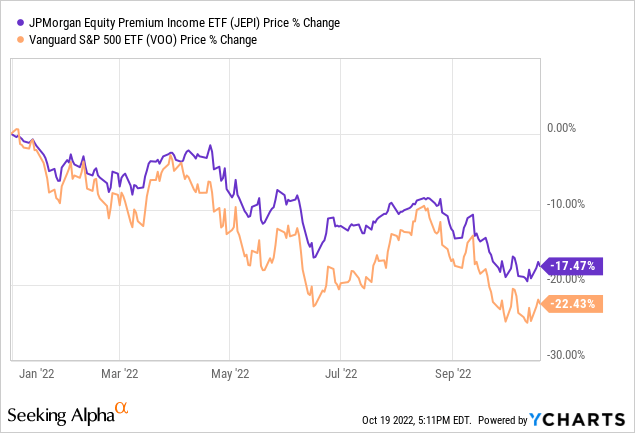

JEPI has a stronger dividend yield than VOO, but experiences lower share price appreciation. The net effect tends to be positive for JEPI when markets are flat or drift downwards, as share price appreciation is non-existent during these, so total returns will consist entirely of dividends. Expect JEPI to outperform during said market conditions, as has been the case YTD, during which the S&P 500 is down more than 20%.

VOO outperforms on a total return basis during bull markets, JEPI when markets are flat or drift downwards. Bull markets are the most common market scenario, stocks mostly go up, so VOO should outperform on a total return basis long-term, as has been the case since inception.

On the other hand, JEPI could conceivably outperform long-term under certain conditions, especially if markets remain flat for a sufficiently long amount of time. I don't think this is too likely, stocks mostly go up, but it is definitely possible, and an important fact for investors to consider.

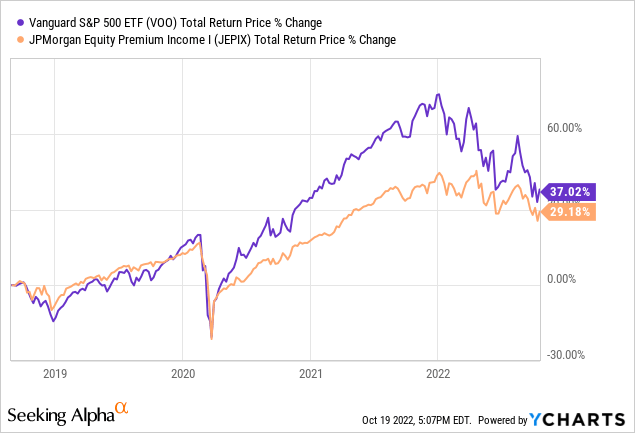

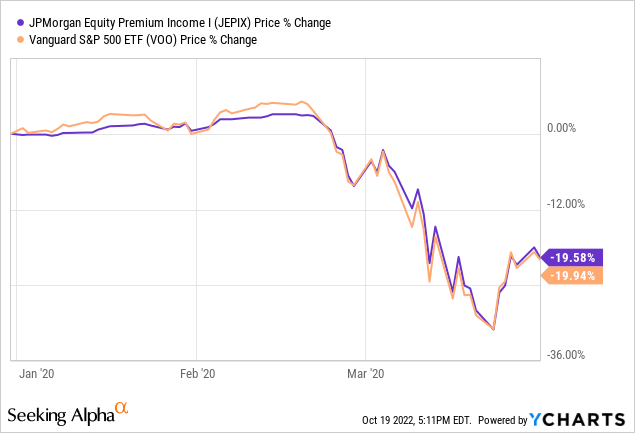

JEPI's performance track-record is quite short, so the above might not necessarily reflect the fund's expected long-term performance. J.P. Morgan has a similar, older fund following the exact same strategy as JEPI, but structured as a mutual fund: the JPMorgan Equity Premium Income Fund Class I Inst (JEPIX). Comparing VOO to JEPIX might prove instructive. VOO has also outperformed relative to JEPIX since inception, as expected.

VOO's stronger capital gains means the fund is likely to outperform on a total return basis moving forward, a benefit for the fund, and advantage relative to JEPI. VOO's outperformance is likelier than not, but is not a given, as JEPI does perform quite well under certain conditions.

Although VOO's total return track-record is overall stronger, JEPI's returns might be more appropriate, better suited for some dividend investors and retirees. JEPI has fared much better YTD, in which asset prices have declined across the board, than VOO. Reduced capital losses when times are tough are important for retirees, many of which might not have the financial ability, or stomach, to hold volatile equities during down markets. JEPI does underperform during bull markets, but returns tend to be quite high during these regardless, and might be more than sufficient for some retirees.

As an aside, I want to emphasis the fact that JEPI will almost certainly underperform on a total return basis during market recoveries, as capital gains/equity price appreciation tend to be quite high during these. The S&P 500 is down almost 20% YTD. It will almost certainly bounce back sometime in the future, as has been the case for all previous downturns and bear markets. When it does, JEPI will see below-average capital gains, and will almost certainly underperform on a total return basis.

Expenses Comparison – VOO Clear Winner

VOO is an incredibly cheap fund, with a 0.03% expense ratio.

JEPI is a comparatively more expensive fund, with a 0.35% expense ratio. JEPI's expenses are reasonable, in-line with the expenses of most niche index funds, and lower than average for a covered call ETF. XYLD, the fund's closest peer, has an expense ratio of 0.60%, for example.

Lower expense ratios increase yields and returns, and are always a benefit for a fund and its shareholders. VOO's capital gains might fail to materialize if markets are flat. JEPI's dividends might get cut, due to the vagaries of option/equity-linked note prices and premiums. VOO's lower expense ratio, on the other hand, will always increase (reduce by less) returns, while the opposite is true for JEPI.

VOO's lower expense ratio is a benefit for the fund, and advantage relative to JEPI. As JEPI's expenses are within normal parameters, these are not deal-breakers, nor do they significantly detract from the fund's overall value proposition or investment thesis. In my opinion, at least.

Risk Comparison – VOO Slight Winner

JEPI focuses on low volatility stocks, which tend to be less risky, and to suffer below-average losses during downturns and recessions. Focusing on these stocks should lead to lower than average capital losses during downturns and recessions, as has been the case in the past. JEPI has seen lower capital losses than VOO YTD.

JEPIX, JEPI's mutual fund version, saw comparable capital losses to VOO during 1Q2020, the onset of the coronavirus pandemic.

JEPI's low volatility holdings seem to reduce capital losses during downturns and recessions, but not significantly or consistently so. Still, the effect should be positive, and that does seem to be the case.

On a more negative note, JEPI's equity-linked notes are incredibly leveraged, complicated, and opaque holdings.

Leverage increases risks, for pretty self-explanatory reasons.

Complexity also increases risks, insofar as it exposes shareholders to the possibility of losses and underperformance for unforeseen, hard-to-understand reasons. ELN performance is dependent on many factors, including their structure, characteristics, industry conditions, and the vagaries of derivatives pricing. Changes in any one of these could lead to losses or underperformance, and these issues are very hard to analyze or forecast.

These securities are also relatively opaque, in part due to their complexity. Although JEPI does provide relevant information concerning these securities, something seems to be lacking, at least in accessible, easy to understand form. As an example, XYLD explicitly tells us that the fund aims to sell covered calls on the entirety of its holdings. JEPI does not explicitly mention this, at least not to my understanding.

Although JEPI's ELNs are relatively risky investments, the fund does seek to minimize said risks. JEPI's ELNs account for only 10% – 20% of the value of the fund, which significantly limits exposure, risks, and potential losses. I would not feel comfortable if the fund only invested in ELNs, but feel much more comfortable with a smaller position in the same. JEPI further focuses on low-volatility stocks, which tend to be less risky, reducing risks further. These two strategies have successfully limited risks, volatility, and losses during downturns in the past.

In my opinion, JEPI's ELNs make it a slightly riskier investment relative to VOO, but risks are manageable, and have not been an issue in the past.

Conclusion – JEPI Best Dividend Fund

JEPI's strong 11.0% dividend yield make it the better dividend investment relative to VOO, in my opinion.

VOO's stronger potential capital gains, and slightly stronger long-term total return track-record, make it the best ETF for long-term investors for whom dividends are not an important consideration, in my opinion.