LQD focuses on investment-grade bonds. The fund's holdings have low credit risk, but high interest rate risk. Dividends are low, with the fund yielding 3.3%.Dividends are quite low.

LQD: Investment-Grade Bond ETF, Excessive Interest Rate Risk, Subpar 3.3% Yield

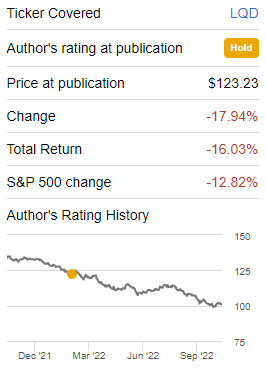

I last covered the iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSEARCA:LQD), a broad-based investment-grade corporate bond index ETF, in early 2022. In that article, I claimed that LQD's low dividend yield and excessive interest rate risk made the fund a subpar investment, and one which would significantly underperform if rates were to rise. Since then, rates have risen, and the fund has significantly underperformed, as expected.

Although conditions have materially changed these past few months, LQD remains a subpar investment opportunity, for several reasons.

The fund's interest rate risk remains excessive, and is particularly concerning as inflation remains elevated, and interest rates continue to increase.

The fund focuses on long-term bonds, which yield almost as much as short-term bonds, at significantly greater risk.

The fund's investment-grade bonds generally yield less than riskier non-investment grade bonds, but spreads are much wider than average.

LQD remains a subpar investment opportunity, so I would not be investing in the fund at the present time.

LQD – Basics

- Investment Manager: BlackRock

- Underlying Index: Original Postdf/MKT-iBoxx-USD-Liquid-Investment-Grade-Index-factsheet.pdf">Markit iBoxx USD Liquid Investment Grade Index

- Expense Ratio: 0.14%

- Dividend Yield: 3.26%

- Total Returns CAGR 10Y: 1.3%

LQD – Overview and Benefits

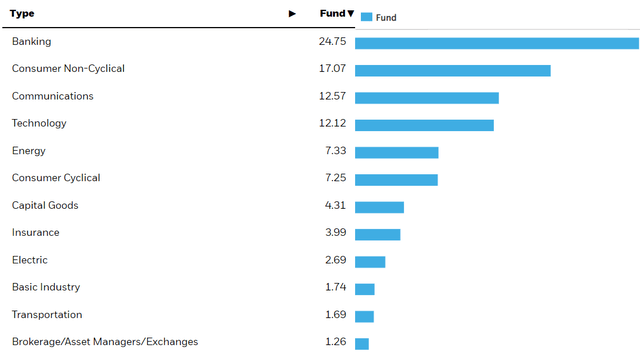

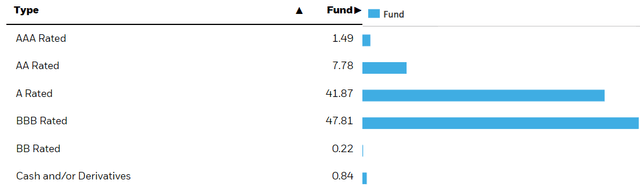

LQD is an investment-grade corporate bond ETF. It is the largest such fund in the market and the industry benchmark. LQD tracks the Markit iBoxx USD Liquid Investment Grade Index, an index of these same securities. Said index includes all dollar-denominated corporate bonds from developed country issuers with investment grade credit ratings (BBB or higher). Applicable securities must also meet a basic set of liquidity, size, and trading criteria. It is a market-cap weighted index, with a 3% issuer cap.

LQD provides broad-based exposure to investment-grade bonds, with investments in over 2,500 of these, from all relevant industry segments.

LQD focuses on relatively safe securities, with strong credit ratings, average of A / BBB, and low credit risk and default rates.

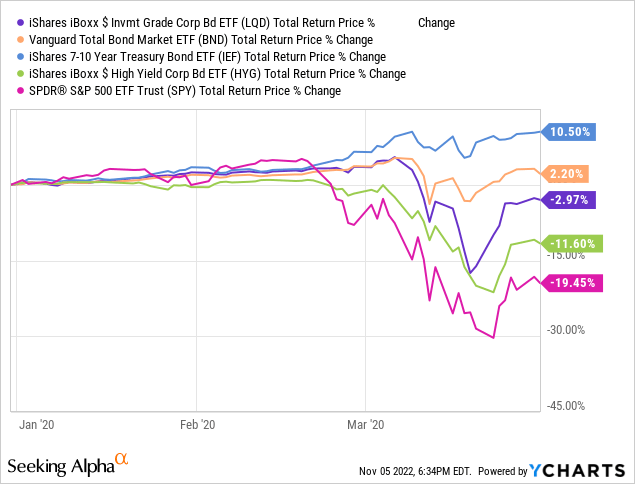

LQD's safe, diversified holdings decrease risk, volatility, and potential losses during downturns and recessions. Expect relatively low losses during the latter, as was the case during 1Q2020, the onset of the coronavirus pandemic. On the other hand, the fund does underperform relative to treasuries during these, due to a lack of flight-to-quality effect.

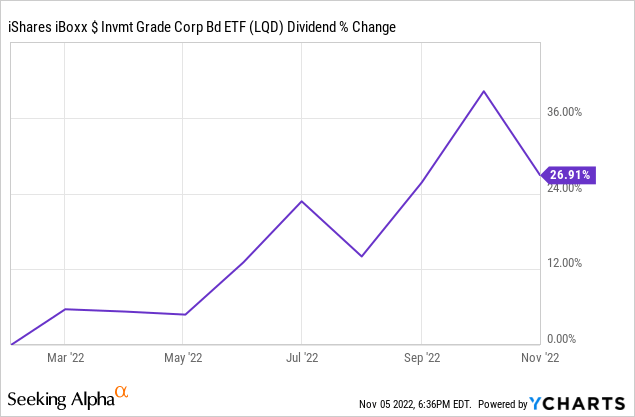

LQD currently yields 3.3%, a relatively small amount. Although fund dividends are low right now, dividends will almost certainly see strong growth in the coming months, due to higher interest rates from the Federal Reserve. LQD currently sports an SEC yield, a standardized measure of short-term generation of income of 5.9%. As such, fund dividends should grow to around 5.9% in the coming months and years, at least assuming that interest rates remain elevated. LQD's dividends are already seeing strong growth, increasing by over 27% YTD, equivalent to a 0.7% increase in yields.

LQD offers investors a rapidly growing 3.3% yield, at a low level of credit risk. Although this is a reasonably compelling value proposition, it is more than outweighed by the fund's risks and drawbacks. Let's have a look at these.

LQD – Risks and Drawbacks

Excessive Interest Rate Risk

LQD focuses on investment-grade corporate bonds. These securities carry very long maturities, as corporate issuers issued a lot of long-term debt from 2020 to 2021, when interest rates were at rock-bottom levels. Conditions have materially changed since, but the debt load remains, for several more years at least.

- Amazon Prime Video (Video on Demand)

- Jim Parsons, Rihanna, Steve Martin (Actors)

- Tim Johnson (Director) - Tom J. Astle (Writer) -...

- English (Playback Language)

- English (Subtitle)

- ✨【Night Lights Plug into Wall】: 0.5 watts,...

- 💕【Dusk to Dawn Sensor Night Light】:...

- 🐋【Personalized Night Light】:Takes the space...

- 🌃【Widely Used】: This plug in night light...

- 💡【Satisfied Service】If you’re ready to...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

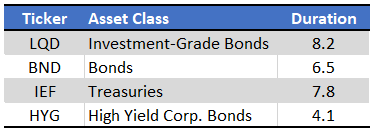

Due to the above, LQD focuses on securities with relatively long maturities and interest rate risk, with an average duration of 8.1 years. Investors should expect capital losses of around 8.1% for every 1.0% increase in interest rates, a very large amount, and a bit higher than its peers.

LQD's duration, high duration means the fund should underperform when interest rates rise, as has been the case YTD. Fund performance has been somewhat worse than expected, as duration was even higher earlier in the year.

LQD's excessive interest rate risk led to significant losses and underperformance in the past, and could lead to further losses if interest rates continue to increase / increase more than expected. This is a distinct possibility, as inflation remains elevated, and as the Federal Reserve remains committed to further interest rate hikes. These are mostly priced-in already, but could occur if inflation persists for longer than expected, necessitating higher interest rates for a longer period of time. Inflation has persisted for longer than expected, so this is a very real risk.

LQD's high interest rate risk is a significant negative for the fund and its shareholders. In my opinion, it is a deal-breaker under current economic and market conditions, and will remain so until inflation normalizes, and the probability of higher interest rate decreases.

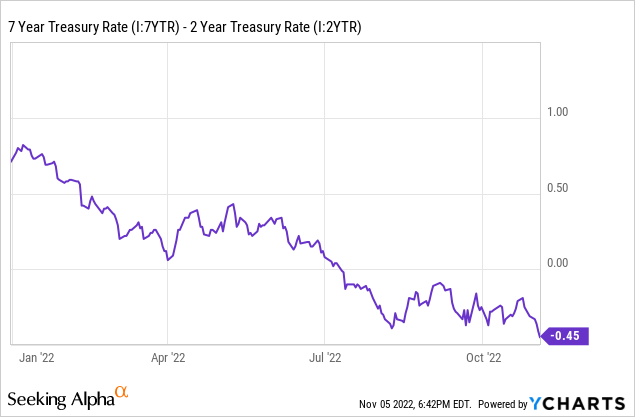

Term Premia Are Low

Long-term bonds have higher interest rate risk. As compensation, long-term bonds tend to offer investors higher interest rate, and hence dividends. Although this is generally the case, there are exceptions, and we are currently in the midst of one.

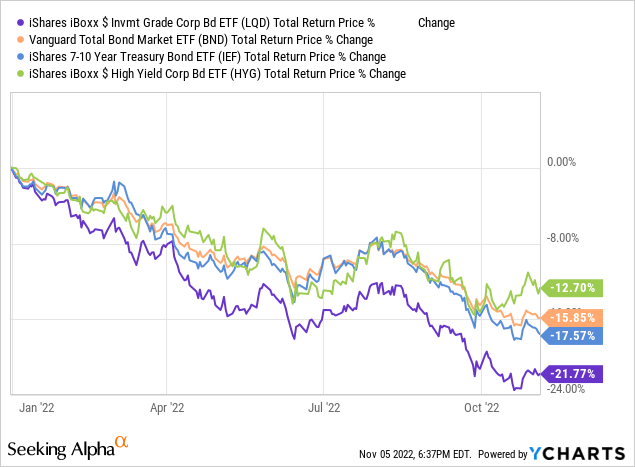

Skyrocketing inflation has led to higher interest rates across the board, but some interest rates have risen more than others. Short-term interest rates have risen a lot, as investors expect significant, aggressive Federal Reserve hikes in the short-term. Long-term interest rates, on the other hand, have risen by more modest amounts, as investors expect these hikes to be transitory, and for interest rates to normalize in the coming years. Due to this, long-term rates are about equal to short-term rates, sometimes lower. As an example, 7-year treasury rates, which are closest to LQD's average maturity, are 0.45% lower than 2-year treasury rates. Spreads are significantly lower than their historical average, and lowest in more than a decade.

Long-term bonds have higher interest rate risk than short-term bonds, and yield less to boot. Under these conditions, long-term bonds are plainly inferior to short-term bonds, in my opinion at least. LQD focuses on long-term bonds, and so shares the same issues and short-comings as said asset class.

Credit Spreads are Wide

- AIRTIGHT LIDS & 3 GRATER ATTACHMENTS The airtight...

- NON-SLIP SILICONE BOTTOMS The rubber on the bottom...

- NESTING BOWLS & DISHWASHER SAFE These kitchen...

- 6 SIZES BOWLS & EXTRA KITCHEN TOOLS SET The range...

- DURABLE STAINLESS STEEL The stainless steel...

- ✅FOOD GRADE SILICONE -- Made of food-grade...

- ✅NO BEND & NO BREAK & HEALTHY FOR COOKWARE --...

- ✅HIGH TEMPERATURE WITHSTAND:The Silicone Cooking...

- ✅33 DURABLE WOODEN HANDEL KITCHEN UTENSILS SET -...

- ✅BEST KITCHEN TOOLS :One- piece stainless steel...

Last update on 2024-04-11 / Affiliate links / Images from Amazon Product Advertising API

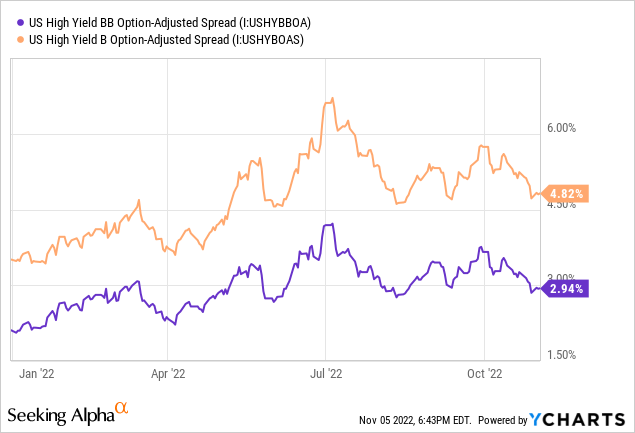

LQD focuses on investment-grade bonds. As these securities have strong credit ratings and default rates, interest rates and yields are low. High yield bonds are the opposite, with weak credit ratings, high default rates, but strong interest rates and yields. Although high yield bonds (almost) always yield more than investment-grade bonds of comparable maturities, spreads have widened these past few months, and are at historically above-average levels.

Widening credit spreads means high yield bonds offer comparatively strong yields, making them much more compelling investment opportunities. Risks are higher too, but potential rewards are even higher, and higher than they have been in the past. Under these conditions, I would pick high yield corporate bonds over comparable investment-grade bonds. The SPDR Portfolio High Yield Bond ETF (SPHY) is a particularly simple, strong high yield corporate bond index ETF, yields 6.3%, and is an overall better investment than LQD, in my opinion at least.

Conclusion

LQD is a simple investment-grade bond index ETF. LQD has excessive interest rate risk, and yields comparatively little. As such, I would not be investing in the fund at the present time.