Thesis

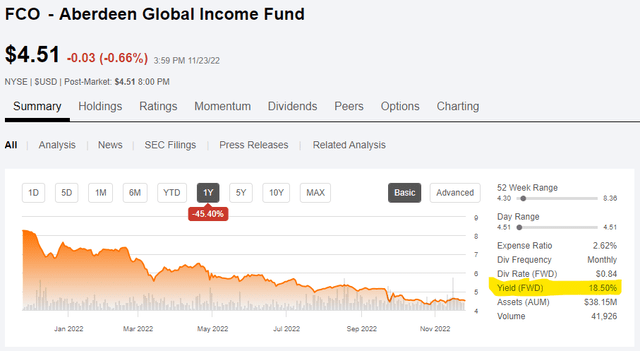

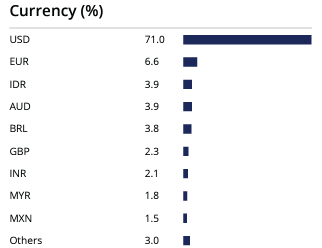

Aberdeen Global Income Fund (NYSE:FCO) is a closed end fund focused on the global fixed income universe. The fund tends to invest in dollar debt from sovereign issuers and corporates. As of the latest fact sheet, the fund held debentures denominated in USD for over 71% of the portfolio, while sovereign and quasi-sovereign holdings accounted for over 48% of the collateral pool. The fund is very small, with only $60 million in assets under management. The vehicle piqued our interest via its large dividend yield:

Yields are the main focus in the CEF world, many investors assuming that they represent true distributions for the funds, similarly to what people are used to from the equities and bonds space. Not so fast in the CEF-land. The vehicle has an eyepopping yield of 18%, but it is not supported. In reality, the fund is now yielding somewhere close to 6%, after the carnage in fixed income this year.

How is it possible to have such a massive yield then if the underlying assets only yield 6%? The answer is return of capital (aka “ROC”). The closed end fund structure allows for this structural feature, which entails returning shareholders their own capital. In effect, going to an extreme, a CEF that holds all its funds in cash with 0% returns, can still generate a call it 10% dividend yield via ROC. Ultimately the utilization of ROC deeply cuts the AUM of the fund every year, and it is just a marketing gimmick and a destructive and non-sustainable way to run a business.

Why is ROC destructive when utilized in the fashion FCO does? Because it is a marketing gimmick only, and the only purpose it serves is to keep the fund alive. ROC is constructive when utilized for short period of times to make up short-falls in the underlying asset class’s returns. For example, this year, many equity based CEFs do not have the capital gains to use in order to distribute their dividends fully. What these CEFs are doing is utilizing ROC partly, until there are gains in the equities space again that can be monetized to pay dividends. ROC in this case represents a temporary utilization of the fund’s assets to cover dividend shortfalls that are going to be generated in the future. Not in FCO’s case. The underlying pool of fixed income securities will never generate more than 6% to 7% yields. Thus the high ROC utilization is just an artificial way to keep investor interest in the vehicle.

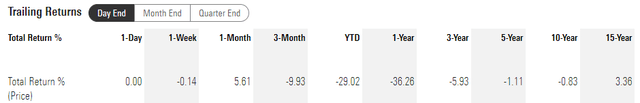

The unfortunate piece of news for the holders is that these types of funds with high ROC end up having dreadful long-term performances because their asset base keeps shrinking and the fund management is always pressed for cash, thus not always making optimal choices regarding the collateral. The story is no different for FCO:

The fund has a negative annualized total return when measured on a 10-year basis, which is rare to find ! Just holding your cash in a T-bill fund would have generated risk-free returns in excess of what FCO did for investors.

Holdings

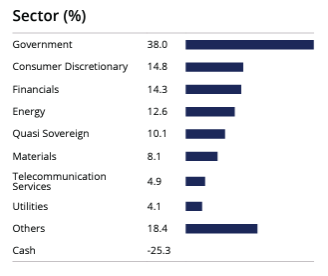

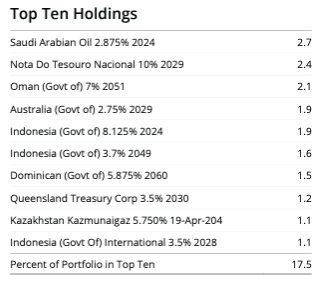

The fund focuses on dollar sovereign issuances:

We can see that the government and quasi-sovereign sleeves account for over 48% of the fund. The majority of the collateral is dollar denominated:

- Amazon Prime Video (Video on Demand)

- Jim Parsons, Rihanna, Steve Martin (Actors)

- Tim Johnson (Director) - Tom J. Astle (Writer) -...

- English (Playback Language)

- English (Subtitle)

- ✨【Night Lights Plug into Wall】: 0.5 watts,...

- 💕【Dusk to Dawn Sensor Night Light】:...

- 🐋【Personalized Night Light】:Takes the space...

- 🌃【Widely Used】: This plug in night light...

- 💡【Satisfied Service】If you’re ready to...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

The fund does not have any single issuer concentration issues:

We can see from the top holdings list that no single issuer accounts for over 3% of the collateral pool.

Distributions

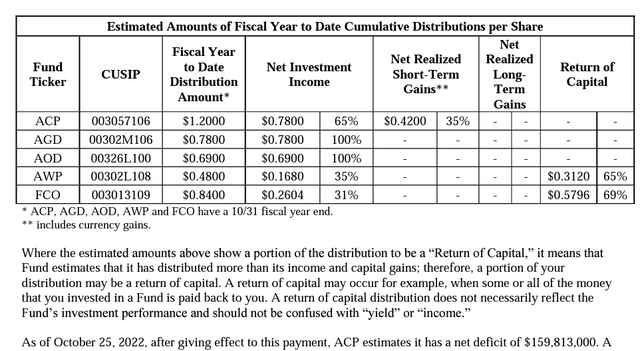

The fund is a heavy utilizer of ROC:

We can see from the above table, extracted from the fund's Section 19a notice, that in the current fiscal year FCO used ROC for over 69% of its distribution. That is a shockingly high amount for a fixed income fund. If a fixed income CEF ever exposes consistent ROC utilization of over 40% then it should raise a massive red flag in an investor's mind.

Conclusion

- AIRTIGHT LIDS & 3 GRATER ATTACHMENTS The airtight...

- NON-SLIP SILICONE BOTTOMS The rubber on the bottom...

- NESTING BOWLS & DISHWASHER SAFE These kitchen...

- 6 SIZES BOWLS & EXTRA KITCHEN TOOLS SET The range...

- DURABLE STAINLESS STEEL The stainless steel...

- ✅FOOD GRADE SILICONE -- Made of food-grade...

- ✅NO BEND & NO BREAK & HEALTHY FOR COOKWARE --...

- ✅HIGH TEMPERATURE WITHSTAND:The Silicone Cooking...

- ✅33 DURABLE WOODEN HANDEL KITCHEN UTENSILS SET -...

- ✅BEST KITCHEN TOOLS :One- piece stainless steel...

Last update on 2024-04-11 / Affiliate links / Images from Amazon Product Advertising API

FCO is a closed end fund from the Aberdeen family. The vehicle focuses on dollar denominated global debt, with a large sovereign and quasi-sovereign sleeve. Its collateral pool yields around 6%, yet the fund distributes an 18% dividend yield. The differential is composed of return of capital. FCO is a book example of a destructive and gimmicky use of ROC. The CEF structure has many benefits, but certain fund managers use it to create artificial, unsupported yields. These CEFs usually have very poor long-term returns, FCO being a point in case, with a negative annualized total return when looking back over 10 years. New money looking to enter the space after the 2022 fixed income carnage should not only steer away from FCO, but actually run. Holders in the fund, despite our poor opinion of the vehicle, would do well to divest at the end of 2023 when they would have recouped some of the duration induced losses from 2022.