Bonds and treasuries currently don't yield enough to provide a real return after inflation and taxes. Stocks are affected by significant uncertainty, and most of them still trade at relatively high valuations. Real assets, and REITs specifically, currently offer far better value.

My Portfolio Strategy For 2023

Right now, it appears that there are lots of different opinions on what you should be buying next.

Some think that now is a good time to buy bonds since interest rates are up

Others are buying the dips in stocks, thinking that they will rapidly recover.

The more aggressive investors are favoring tech stocks and cryptocurrencies like Bitcoin (Original Post>

The most conservative people are accumulating cash, preparing for an even steeper crash in the coming year.

What's the best portfolio strategy for 2023?

I don't think that it is any of the above. Let me explain why, and at the end, I will explain what I am doing with my capital.

Bonds and treasuries

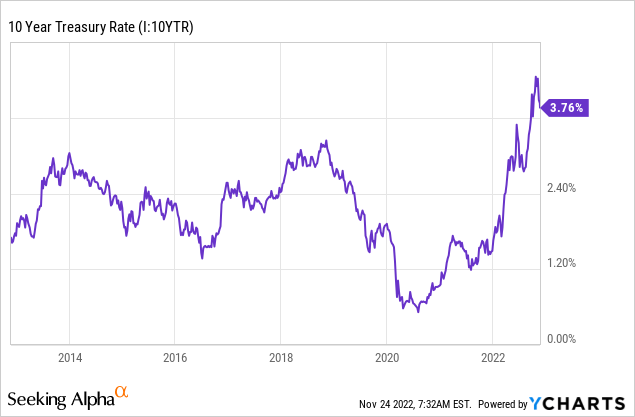

Today, interest rates are a lot higher than they were just one year ago, and it has lured a lot of investors into bonds and treasuries.

The 10-year Treasury yields 3.7%, and if you are willing to accept some credit risk, you could earn closer to 5-6% with investment-grade-rated bonds.

Lots of investors think that this is a great deal, but I think that they are biased by the fact that they got used to much lower interest rates in recent years. Without this bias, I doubt that so many of them would be buying these bonds right now, because even at these higher interest rates, the real rates remain negative after inflation.

Yes, it is nice to get a 6% yield, and that's a clear improvement from last year. However, after you remove taxes and inflation, you are left with a negative real return.

That's simply not sustainable.

You cannot ignore inflation when investing in bonds because your principal isn't protected. If you lend $100 today, you will still only get $100 back in 10 years if you invest in Treasuries. Sure, you get some interest, but will it be enough to cover the inflation and get a decent return on top of it?

I am not so sure.

Stocks

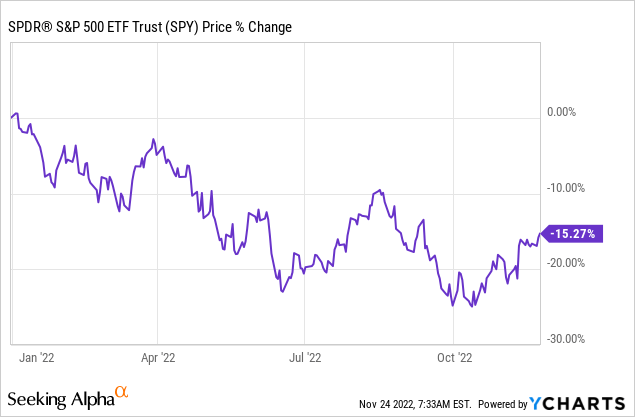

Stocks already seem to be a better option, especially after their 15% sell-off in 2022. I have bought some myself, and so I can definitely see the appeal in some of them:

But here's why I think that most stocks of big companies like those that are part of the S&P500 are still potentially overpriced:

- Interest rates are up significantly and leverage is relatively high.

- Lots of businesses were addicted to the low rates and high equity multiples to raise capital and grow.

- The war in Ukraine and the pandemic are forcing many global companies to bring back larger portions of their supply chains to the U.S., increasing costs and lowering their profitability.

- Lots of companies aren't able to pass on inflation to their clients and will see their margins decline.

- We have not even entered a proper recession yet, which will likely lower margins even further.

- Valuation multiples were historically high and not sustainable in many cases.

So, while I am buying some stocks, I don't think that this is where you will find the best opportunities, either. I would say that most stocks are fairly valued after the 15% drop given the headwinds that they are facing.

Tech stocks

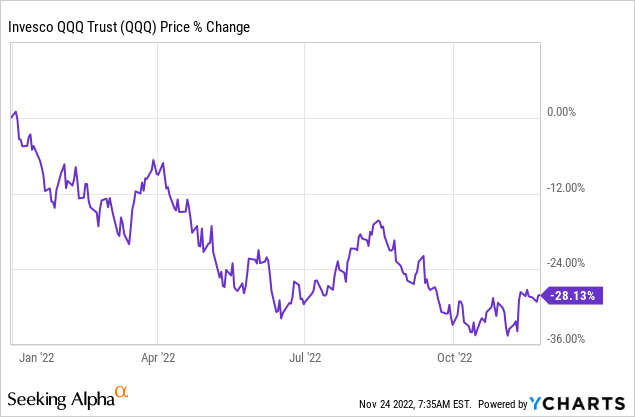

Tech stocks are down much more heavily than regular stocks:

Again, I have bought some tech stocks, so I am not completely against the idea of buying the dips here. However, in most cases, I think that the drop is well justified when you consider that many of these businesses were not just slightly unprofitable, but literally burning cash to grow. This was only possible in an environment of 0% interest rates and high equity multiples to raise additional capital.

Now that's gone, and all these businesses need to adapt to a new world. Some will succeed, but many won't. I suspect that many of these tech companies will have to change their leadership because the skills that are needed to grow a profitable company are very different from those of a typical start-up that tries to grow at all costs, regardless of suffering major losses in the near term.

We are already seeing major tech companies including Amazon (AMZN), Alphabet (GOOG, GOOGL), Meta Platforms (META), Stripe (STRIP), Tesla (TSLA), and Shopify (SHOP) announce major layoffs. They can probably adapt because they are well-established and have major competitive advantages, but what about the emerging tech companies that were so hot in 2020/2021?

It remains to be seen. Valuations are down, but unless they can become profitable, things could become a lot worse for them as the market realizes that these businesses cannot ever hope to turn a profit.

Cryptocurrencies

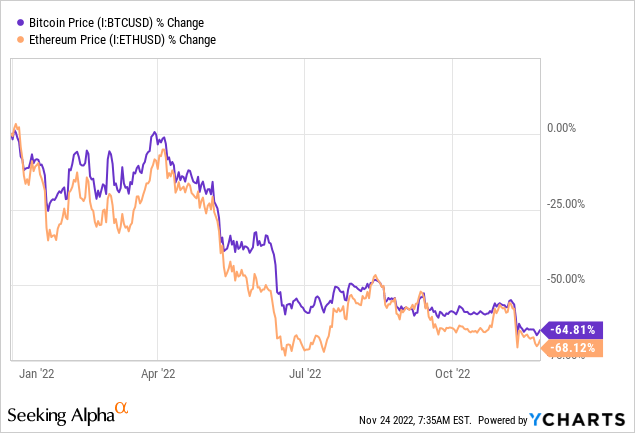

I will keep this one short, since I am far from being an expert in these investments (can you even call them investments?). I would simply note that cryptocurrencies, like tech stocks, were so popular in large part because interest rates were zero and inflation was non-existent.

It pushed a lot of investors up the risk curve, as free money encourages more speculation. NFTs would be an extreme example of that.

But that has now changed, and it makes the future extremely uncertain for cryptocurrencies like Bitcoin, Ethereum (ETH-USD), and even more so for the smaller coins.

Add to that the recent FTX scandal and confidence could be broken for years to come. FTX was the second biggest exchange, and it was apparently even worse than Enron. What does that tell you about the smaller exchanges?

I suspect that there will be many more exchanges in the coming years.

Cash

Cash only makes sense if you can time the market, but as has been proven time and time again, it is not possible to predict what the market will do in the short run. Therefore, holding a significant amount of cash is a bad idea, and especially so when inflation is so high.

So if bonds, stocks, cryptos, and cash aren't what makes up the bulk of my portfolio, what is it then?

More on that below:

My portfolio strategy for 2023

In a recent article, I highlighted Michael Burry's current portfolio strategy.

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

Burry is one of the best investors of all time. He has made money across many different asset classes on the long, as well as the short, side.

Some of his most notorious calls include shorting the housing market leading up to the great financial crisis, buying farmland shortly after, shorting the ARK Innovation ETF (ARKK) near its peak, and buying GameStop Corp. (GME) before it became a meme stock.

Lately, he has been pouring money into real assets and real asset stocks.

Real assets can be anything that's real and tangible. Typically, they are essential infrastructure that our society needs to prosper.

Good examples that Burry is buying include private prisons, healthcare facilities, communication infrastructure, and farmland.

He is investing heavily in these assets, and so am I.

My real asset mix is different, of course. As an example, I am not so keen on prison stocks like The GEO Group (GEO) or CoreCivic, Inc. (CXW). I prefer to invest more heavily in more traditional real assets like apartment communities in rapidly growing sunbelt markets.

But overall, the portfolio strategy is the same.

I invest over 50% of my portfolio into defensive real assets which are essential to our society, and I also get most of my exposure through publicly listed real asset stocks that are today discounted.

Here are 5 reasons why I think that investors may want to follow Burry's lead:

Reason #1: Real asset stocks are heavily discounted

The value of real assets has not changed materially in 2022. Some have experienced slight declines in value (apartment communities), but others have gained significant value (farmland). Overall, values are more or less the same in the private market.

However, the value of real asset stocks like real estate investment trusts (“REITs”) (VNQ) or MLPs (AMLP) has been very volatile this year, and that has caused many to become deeply undervalued. REITs, as a whole, are down 25% year-to-date, and many are down closer to 50%, but the value of their underlying assets has not changed. As a result, they now trade at large discounts relative to the value of the assets they own. To give you an example: apartment REIT Camden Property Trust (CPT) is currently priced at an estimated 30% discount to net asset value.

This means that you have the opportunity to buy these assets at 65 cents on the dollar through the public market and get the additional benefits of liquidity, diversification, and professional management.

Reason #2: Real assets generate lots of cash flow

With stocks, you are often fully reliant on appreciation to earn returns.

But real assets generate a lot of cash flow and real asset stocks pay large dividends while you wait.

To give you an example, the medical office firm Global Medical REIT Inc. (GMRE) pays an 8% dividend yield and has enough left over to invest in growth.

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

As such, you only need a little growth to get to double-digit total returns, and you get most of your returns in cold hard cash.

Reason #3: Real assets are inflation-resistant

Today, rents are growing at the fastest pace in many years, largely because the high inflation and higher interest rates have grown the pool of renters – all while delaying or canceling new development projects.

The replacement cost of existing properties is rising, and it also gives them greater pricing power with their tenants. You simply cannot inflate essential real assets away, but investors also profit, as their mortgages are being gradually inflated in real terms.

Reason #4: Real assets are recession-resistant

Most real assets remain in high demand even through recessions. There are exceptions, of course, like office buildings or hotels. However, for the most part, cell towers, data centers, farmland, apartment communities, manufactured housing, prisons, hospitals, roads, bridges, etc., remain in high demand regardless of the economy.

Reason #5: Discounted real asset stocks offer high yield, growth, and upside with limited risk relative to other assets in 2023

In the end, it comes down to the fact that discounted real asset stocks offer the best overall risk-to-reward out of all asset classes in today's environment.

- They are heavily discounted

- They generate lots of cash flow

- They may protect investors from inflation.

That's why we continue to invest heavily in real asset stocks at High Yield Landlord.