What a difference a year makes. 2022 saw the “reopening” of markets from the COVID-19 pandemic evolve into a “recession.” Margaret Thatcher put it succinctly on February 27, 1981—“The lesson is clear. Inflation devalues us all.” Monetary policy has been on the most pronounced tightening campaign in decades as inflation progressed from being transitory to potentially permanent due to the energy crisis.

Politics Is Driving Economics, Not the Other Way Around

In the pre-war global economy, globalization was an important source of low inflation. A large amount of global savings had nowhere to be deployed, rendering interest rates lower on a global basis. However, post-war, global defense spending has risen to a level not seen in decades as national security consumes governments’ agendas. There will be vast opportunity costs tied to the increase in world military spending. We expect the rate of globalization to take a back seat as Europe would never want to be as dependent on Russian energy as it is today. In a similar vein, the U.S. does not want to fall for the same mistake Europe made and will aim to strengthen ties with Taiwan in order to ensure the smooth flow of chips.

National Security Is Inflationary

We are in the midst of a war in Europe, owing to the brutal battle being waged by Russia in Ukraine. While the war is centered in Ukraine, the reality is that we are all paying the price of this war by allowing it to continue. There is another war brewing in the background that we must not ignore: the United States’ deepening ties with Taiwan are aggravating China.

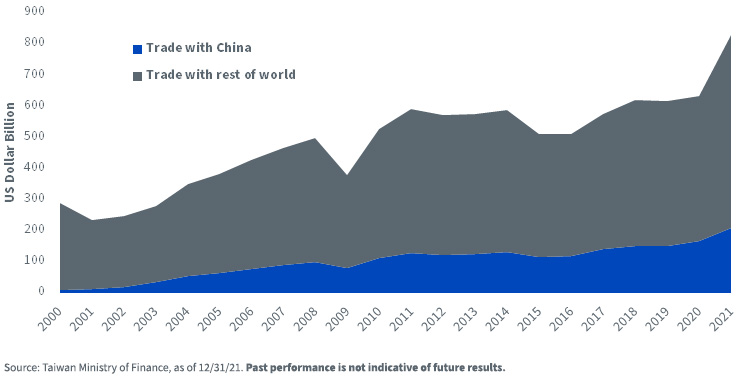

The Taiwan issue remains sticky. Taiwan’s role in the world economy largely existed below the radar until it came to prominence as the semiconductor supply chain was impacted by disruptions to Taiwanese chip manufacturing. Companies in Taiwan were responsible for more than 60% of the revenue generated by the world’s semiconductor contract manufacturers in 2020.1 Tension between Taiwan and China could have a big impact on global semiconductor supply chains. The United States’ dependence on Taiwanese chip firms heightens its motivation to defend Taiwan from a Chinese attack. The desire to control technologies, commodities and straits is paving the way for economic wars ahead.

Figure 1: China Makes Up the Largest Share of Taiwan’s Trade

China Needs to Get Its House in Order

The economic headwinds that China faces are multifaceted. Unfortunately, policy easing from China in Q1 2022 has been insufficient to arrest the extent of the slowdown. Of late, China’s State Council stepped up its economic stimulus further by announcing a 19-point stimulus package worth $146 billion (under 1% of GDP) to boost economic growth.2

The property markets continue to deteriorate. The problem stems from a lack of financing needed by many developers for the construction of their residential projects. All of this came about from the central government’s decision in 2020 to introduce the “three red lines” policy to rein in excessive borrowing in the real estate sector. Vulnerable property developers are struggling to secure capital to sustain their businesses. Alongside demand for housing has deteriorated due to intermittent COVID-19 lockdowns, a weakening economy and doubts over developers’ ability to deliver completed housing units.

However, the weakness in China’s economy extends beyond the property sector, with rising unemployment and energy shortages. Chinese earnings growth since Q3 2019 has lagged behind the rest of the world. China has also suffered significant capital outflows owing to its adherence to “COVID zero.” This has set back its rebalancing toward a consumption-driven economy, rendering China more addicted to export-led growth. However, export demand has begun to weaken as the rest of the world slows.

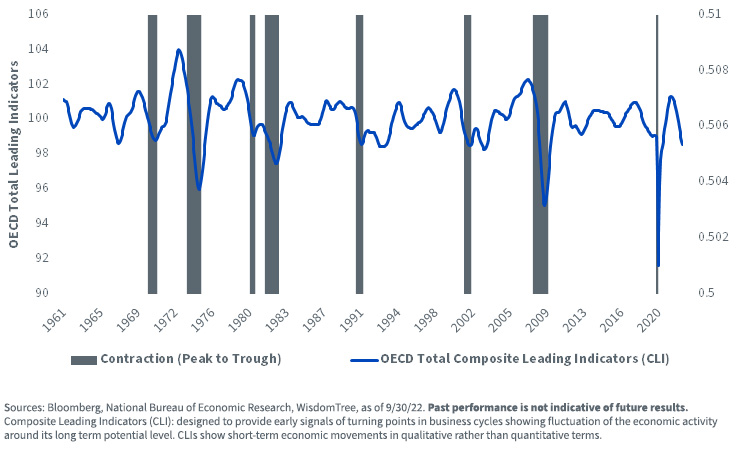

The U.S. Is in the Early Innings of a Recession

The U.S. economy appears a haven amidst the ongoing energy crisis, as it is less exposed to the vagaries of the Russian oil supply. It also recovered faster from the pandemic than the rest of the world. The labor market remains strong as jobs continue to be added, wages accelerate, consumption continues to grow—albeit more slowly—and unemployment remains at a five-decade low. Despite the recent upswing in GDP growth caused by noise in the foreign trade numbers and technicalities in inventory data, the big picture of a slowing economy in the face of aggressive monetary tightening remains intact. There are mounting signs of slowing, too, especially in the housing sector, owing to the rapid rise in mortgage rates.

Figure 2: The Decline of Leading Economic Indicators Reignites Recession Concerns

Earnings in 2022 have reflected the challenging environment being faced by U.S. corporations, with earnings growth for companies grinding down to 3.17%3. The more value-oriented sectors, such as Energy, Industrials and Materials, continue to outperform. Looking ahead, earnings revision breadth for the S& 500 Index is in deeply negative territory, suggesting the downside is coming from an earnings growth standpoint.

Core inflationary pressures remain concerning, especially housing rents and medical inflation—components that are typically much stickier than goods and transport inflation. The stickier high services inflation reflects strong labor market dynamics as services are labor intensive and housed domestically. The Federal Reserve (Fed) appears unwilling to declare victory in its war against inflation. As we look ahead, it’s clear that the Fed’s role in quelling inflation without tipping the economy into recession will take center stage.

Harsh Winter Ahead for Europe

Europe is heading for a recession in response to a strong external shock. Gas flows from Russia to Europe have declined substantially to 10% of their levels in 2021, causing gas prices to spike. The Russian war in Ukraine is showing no signs of abating, with Russia deciding on a partial mobilization after a rather successful Ukrainian counteroffensive. These higher energy prices are squeezing the real disposable income of consumers and raising costs higher for corporations, causing further curtailment of output. The energy-driven surge in headline inflation to 10.7% year over year4 has sent consumer confidence to a record low, leaving Europe in a bind.

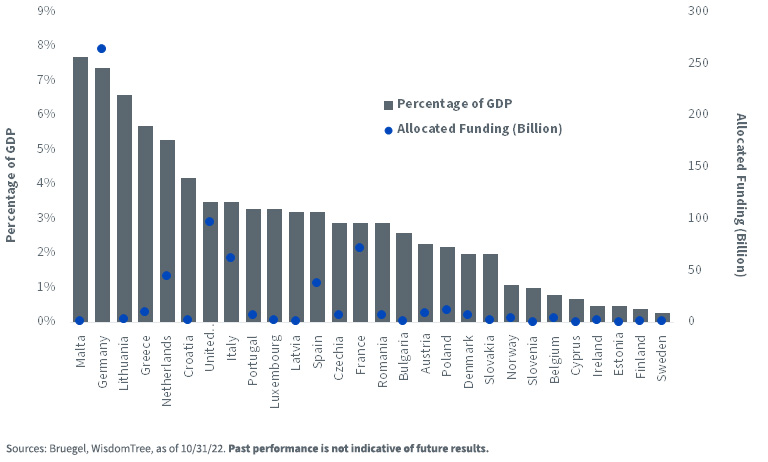

Fiscal Policy in Focus

The European Union (EU) aims to define the direction and speed of Europe’s energy policy restructuring through its REPowerEU strategy. However, crucial energy policy decisions have been taken by EU countries at the national level. In an effort to shield European consumers from rising energy costs, EU governments have earmarked 573 billion euros, of which 264 billion euros has been set aside by Germany alone. In most European countries, both energy regulation and levies are set at the national level. The chart below illustrates the funding allocated by select EU countries to shield households and firms from rising energy prices and their impact on the cost of living.

Figure 3: European Governments’ Earmarked and Allocated Funding

No Pivot Yet from the ECB

We experienced a decade of almost no inflation and quantitative easing in Europe. We have now entered a phase in which the European Central Bank (ECB) has gone ahead with its third major policy rate5 increase this year, thereby making substantial progress in withdrawing monetary policy accommodation. The ECB remains eager to have policy choices dominated by risks rather than the base case. Owing to this, more rate hikes are coming. If Eurozone inflation continues to surprise to the upside, the ECB will have to continue raising rates and determine when to activate the Transmission Protection Instrument (TPI) to support the periphery. We expect the ECB to take the deposit rate to 2.5% by March as it continues to see risks to inflation tilted to the upside in both the short and long term.

A tightening cycle into a slower-growth macro landscape has never been helpful for equities. European equities are faced with an extremely challenging backdrop, ranging from high energy prices and growing cost pressures to negative earnings revisions estimates and cooling growth. Amid the sell-off in equity markets in the first half of this year, European equities currently trade at a price-to-earnings ratio of 14.3x, marking the steepest discount versus its long-term average of 21x compared to other major markets. To a certain degree, the risk of a recession is being priced into European equity markets.

Figure 4: Global Equity Market Valuations

Conclusion

In our view, the global economy is projected to avoid a deep downturn. However, we expect to see a series of individual country recessions take shape at different points in time. As evident from recent data, the downturn in the U.S. is expected in the second half of 2023, while the Eurozone and United Kingdom will likely enter a recession by Q4 this year. Contrary to the rest of the world’s key central banks, China and Japan are expected to keep monetary policy accommodative, which should help buffer some of the slowdown. Given the highly uncertain environment, we believe that maintaining an equal weight position in U.S. and Chinese equities alongside an under-weight in European equities would be prudent. Across factors, we continue to tilt to value, dividend and quality, given the expectations for weak economic growth, higher rates and elevated inflation.

Aneeka Gupta is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.