Investment thesis

Although we prefer to pick individual stocks for our portfolio we are well aware that this does not suit everyone. The majority of people have neither the time nor the inclination to spend the necessary time to do the necessary work.

Since we started coverage of Blackrock's iShares MSCI China A ETF (BATS:CNYA) in October of 2021, we initially gave it a Hold stance, and only changed the stance to a Buy in May of 2022.

TIH author rating history on CNYA (SA)

The share price is now down 21.6% since our first call. As a reference, the S&P 500 is down 14% in that same period.

Our more bullish stance was based on China starting to emerge from the fallout caused by severe restrictions on the movement of people that they have had for the last 3 years. As we experienced in other parts of the world, once society got back to normal traveling and living, the pent-up demand should create a big boost to the economy.

As Jing Liu, the chief economist for Greater China at HSBC recently said, there were expectations of “strong pent-up demand for activities and consumption, which previously faced restrictions”.

Better days for many companies in CNYA's portfolio

13 out of the top 20 holdings in CNYA's portfolio could produce better results in 2023, as 7 of them are financials, 5 are consumer staples and 1 is in the consumer discretionary category.

The financials will benefit from more fees on credit cards and activities in general. Consumer staples, including the largest position which is Kweichow Moutai, will also benefit as there will be more entertainment outside.

The one consumer discretionary company is China Tourism Group Duty-Free Corporation which surely will see better days.

Risks to the thesis

There are always risks associated with any investment thesis. Our job is to try to ascertain the likelihood and the severity of these risks and put it into context with the total risk and reward involved.

Some are short-term risks and others are more long-term risks.

Let us start with the short-term risks.

-

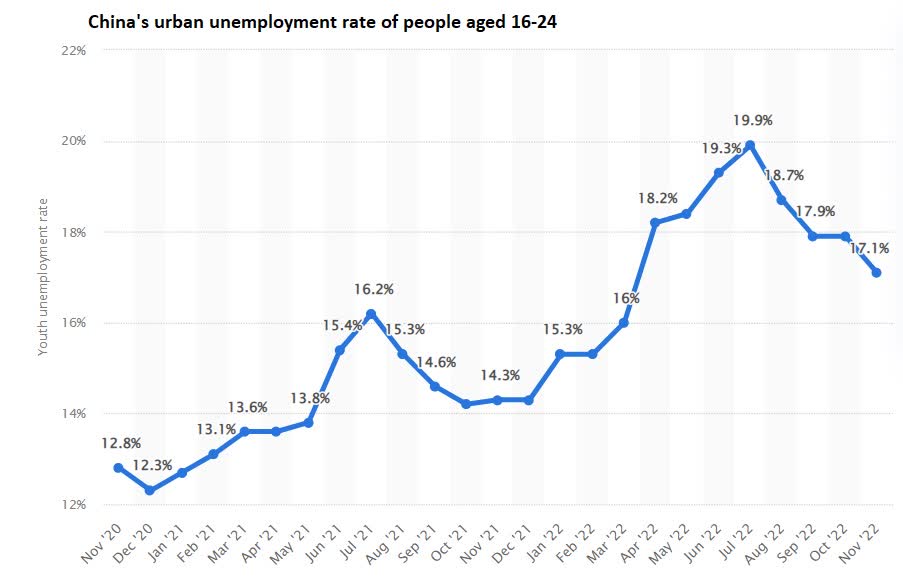

China's youth unemployment

In earlier articles, we raised concerns about the high unemployment among the young in China. Here is what we said in our initial coverage of Alibaba (BABA)

China does have a gargantuan task of creating jobs for the young entering the job market. According to the South China Morning Post, Chinese colleges and universities pumped out about 9 million fresh graduated into the job market in 2021 and another 10 million will graduate this summer, putting huge employment pressure on the world's second-largest economy.”

The latest figure up to November of 2022 did see some improvements in the employment of the young.

China's youth unemployment rate (Statista)

However, we fear that it could become a higher number in the coming months.

Over the last three years, millions of people, many of them young people, have been employed by working at Covid-19 testing sites.

According to China National Health Commission guidelines during these three years when testing was in place, cities in China had to have at least one PCR testing site for every 2,000 to 3,000 people. Each site had to have four to five booths staffed by 8 to 10 testers with medical credentials, plus 4 to 5 assistants to run the sites. I have not done the math but it does not surprise that millions were employed doing this work.

These are no longer needed in such large numbers.

The positive effect of opening up the economy, we should see businesses gradually start to hire a large number of workers.

-

China's latest PMI readings do not bode well.

Much data that we work with is obviously backward-looking. It tells us what has happened and not what will happen. The PMI is one good economic barometer for assessing businesspeople's view of where we stand in a cycle and how confident they are about the future.

| Preview | Product | Price | |

|---|---|---|---|

|

Galway Bay Long Sleeve Golf Rain Jacket - Three Layer Long Sleeve Golf Jackets for Men, Lightweight... |

$200.00 |

Buy on Amazon |

Last update on 2024-04-19 / Affiliate links / Images from Amazon Product Advertising API

China's latest PMI (China National Bureau of Statistics/SCMP)

We believe that once data is coming in for January we will see a reversal in the PMI. That is especially the case for the non-manufacturing part which has lately seen a low reading of just 42.

Anything below 50 is a negative sentiment.

The real estate market is important for all economies, and especially so for China as it has been the cornerstone for many people's wealth creation.

As Ray Dalio recently wrote in his recent piece titled “China's dangerous storm coming“, real estate accounts for about 25% of the economy and 70% of its wealth. That is why what happens to the real estate market is so important to China. Dalio concludes, as do we, that they will be able to work through this downturn. Some will lose a lot of money but lessons will be learned.

As the old adage goes “that too, shall pass”.

More long terms risks are:

Countries with a large percentage of young people generally speaking have favorable demographics because they can expect many taxpayers and consumers that need to spend on building things around their families. The opposite can be said for those that have many older people. They tend to spend less and pay fewer taxes and they cost society more in terms of pensions and healthcare.

China does not have favorable demographics.

According to data from the World Bank, as of 2021, the population of people over the age of 65 years old in China was 13%, which works out to 183 million people. Governments are generally left with few options, except to increase taxes, which brings us to the next long-term risk.

-

China's common prosperity

China's supreme leader Xi Jinping has clearly set out China's goals for the future. One theme is described as “achieving common prosperity”.

This is not necessarily a bad thing. The rich, and especially the 1% of the 1% of wealthy people should contribute more. What we see here is not isolated to China. It is happening in Europe and the U.S. too.

However, there is a real threat to China's economy if it becomes less attractive for companies to be based in China. Some companies, like those in the technology sector, can relocate their head office if the tax burden becomes too large.

Conclusion

- 🌴 Material: Chiffon, 100%Polyester ; Lightweight, soft and comfoy material

- 🌴 Features: Long sleeve chiffon lace mini dress for women spring, summer and fall, crew neck, long lantern sleeve, zipper closure, elastic waist, a-line and slim fit style, elegant ruffle design, this cute fall mini dress will make you more beautiful and lovely!

- 🌴 Occasions: Fall casual short dress suitable for you to party, holiday, school, date, cocktail, coming home, and daily life. Believe you will love it and get lots of compliment!

- 🌴 Garment care: Hand wash in cold water recommend, hang dry, low temperature ironing if necessary

- 🌴 Size Note: 0-2, 4-6, 8-10, please refer to our sizing information in the picture description to choose your size. Thanks for your understanding

Last update on 2024-04-19 / Affiliate links / Images from Amazon Product Advertising API

All in all, we still think that China will continue to grow with a larger middle class and fewer in the lower income level.

Many Chinese companies will become large multinational corporations too. One interesting development is the automobile industry. Here we see big steps forward in China.

The short-term risks in China will pass in our opinion. But we do need to take into account the long-term risks mentioned.

We keep our stance on CNYA as that of a Buy for the moment.