Summary

Breakwave Dry Bulk Shipping ETF (NYSEARCA:BDRY) tracks an index of dry bulk freight futures contracts. It is to date the only freight futures fund that focuses exclusively on dry freight shipping. The funds futures holdings strategy is designed to profit from inefficiencies in the market. It does not invest in individual stocks like a more conventional ETF, but more like a commodities ETF that holds only futures contracts. We rate BDRY a Sell for the short term, but long term, we withhold judgement for now as we wait to see how the world turns.

Strategy

As per the fund prospectus:

The Fund holds freight futures with a weighted average of approximately three months to expiration, using a mix of one- to-six-month freight futures, based on the prevailing calendar schedule. The Fund intends to progressively increase its position to the next calendar quarter's three-month strip while existing positions are maintained and settled in cash. The initial freight futures allocation will be 50% Capesize contracts, 40% Panamax contracts, and 10% Supramax contracts, rebalancing annually, as needed, during the first two weeks of the month of December.”

Proprietary ETF Grades

- Offense/Defense: Offense

- Segment: Industries

- Sub-Segment: Shipping

- Risk (vs. S&P 500): Average

Proprietary Technical Ratings*

- Short-Term (next 3 months): D

- Long-Term (next 12 months): D

* Our assessment of reward potential vs. risk taken

(Rating Scale: A=Excellent, B=Good, C=Fair D=Weak, F=Poor)

Holding Analysis

BDRY holds no individual stocks or commodities. It holds 3 different types of futures contracts for dry bulk shipping: 50% Capesize contracts, 40% Panamax contracts, and 10% Supramax contracts.

For educational purposes, Capesize is a largest container vessel. They carry a weight of up to 200,000 dead weight tonnage (DWT). Typically, they are used in the transportation of coal, iron ore, and commodity raw materials. Panamax ships are medium-sized vessels with a carrying capacity of 65,000 and 80,000 DWT. Supramax vessels are medium-sized vessels with a carrying capacity between 48,000 and 60,000 DWT.

Strengths

The world moves on shipping. Despite all the technological advances over the last century, the cheapest and most efficient way to move goods long distances is still by boat. Shipping lanes are critical for commerce. Look at what happened last year when the Suez Canal was blocked by a single (though massive) container ship for six days. The estimated cost of lost revenue was $10 billion per day.

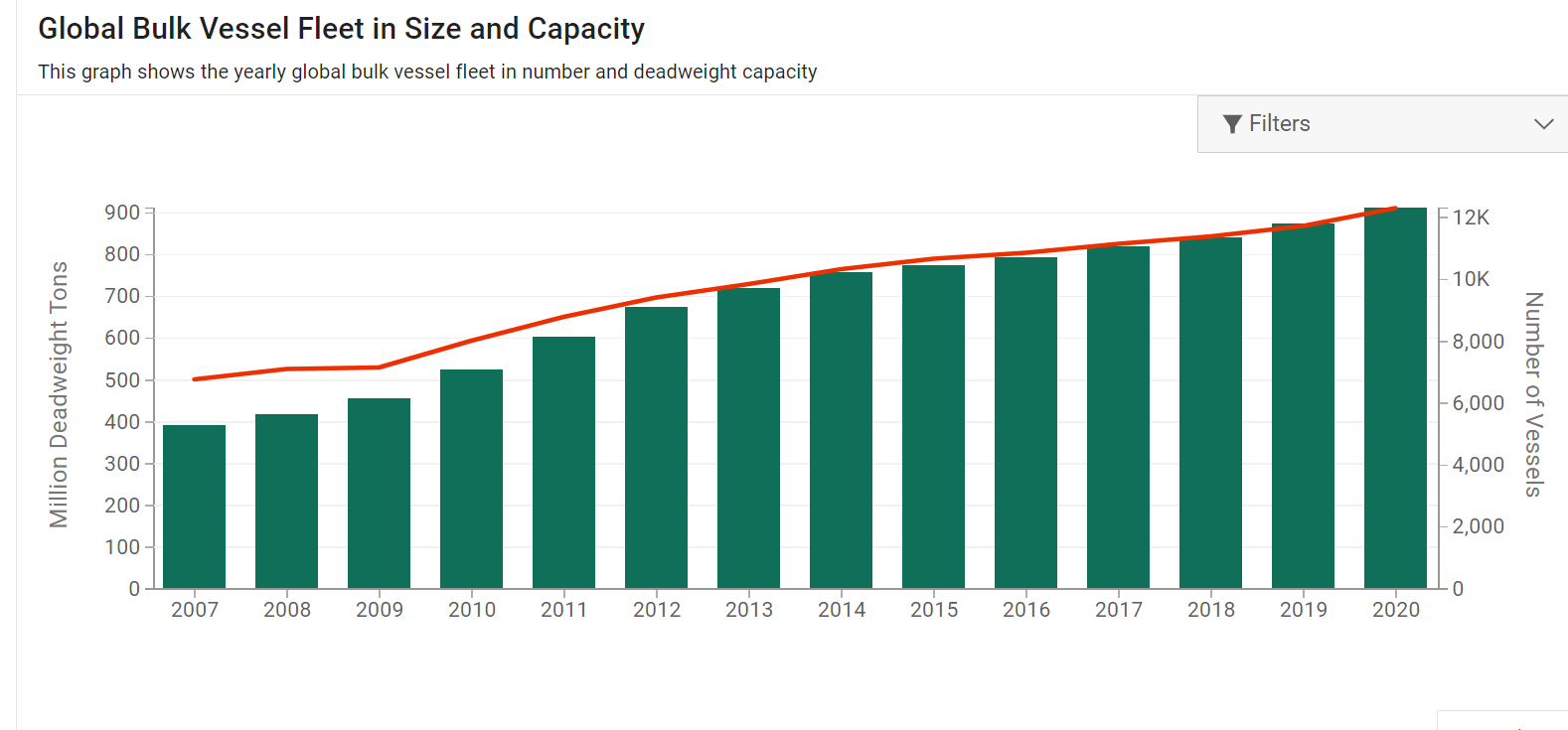

Globalization does not happen without a massive dry bulk shipping fleet. Not only does the total number of ships continue to grow, but the capacity grows, too. The size of the largest class of ships, Large Capesize vessel (200,000+ dwt) and Very Large ore carrier (Vloc) (200, 000+ dwt) is mind-boggling. The ships can carry as many as 24,000 twenty-foot containers or the equivalent of a 44-mile-long train. As an aside, the ports have the capacity to offload about 800 containers per hour. The logistics are incredible.

The global shipping fleet is massive and continuing to grow (USDA.gov)

The market is also expected to almost triple in size over the next 5 years as global demand for goods increases.

The Global Dry Goods shipping sector is expected to triple in the next five years (Valuates Reports)

Weaknesses

As mentioned above, a single container ship caused $60 billion in lost trade. The company was fined $900 million because the wind blew a ship sideways. An operation of this scale is highly susceptible to even minor delays.

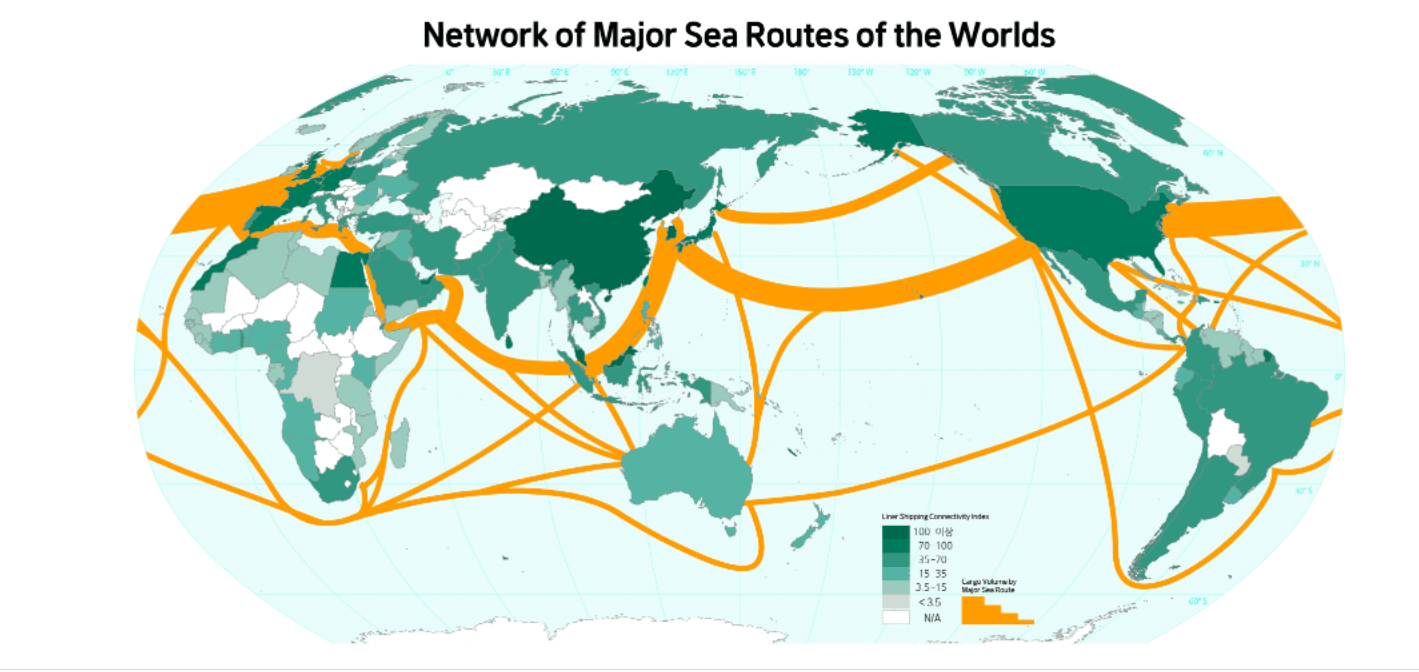

Futures contracts that lock in a price, even if just for three months, cannot take into consideration events like a blocked shipping route, or war games over the South China Sea that would prevent goods from crossing the Pacific or getting to the Suez Canal. Even a storm in the Atlantic could make crossing difficult.

The world's largest shipping lanes (cello-square.com)

Opportunities

The world needs shipping, and it needs shipping lanes to be stable and secure. Every country, enemy or friend, has a vested interest in making sure that commerce is uninterrupted. Even countries at war still take the time to ensure commerce proceeds. In July 2022, the Russians and Ukrainians reached an agreement to resume shipments of grain through the Black Sea.

The world does not mess with commerce. During the height of the COVID pandemic, global supply chains were severely disrupted, and to this day, we are still recovering from the effects of it.

BDRY focuses on a sector that everyone can agree is vital to global stability. After all, it's not just Amazon goods on those ships, it's medical supplies, microchips, food stuffs, coal… basically everything you see in your house at one time or another was on a ship.

Threats

Bad actors recognize both the fragility and the value of the global supply chain and can disrupt it in the short term. In the long run, this is not a major problem, but for a fund that holds three-month future contracts, this can be devastating. BDRY is really susceptible to even minor disruptions, and since the entire network is integrated, a hurricane in the Caribbean does, in fact, affect the price of tea in China.

Conclusions

ETF Quality Opinion

Like any futures ETF, BDRY has a limited capacity to control what will happen in the time the contracts are locked in. If all goes well, then the price holds and everyone is happy. However, a butterfly flaps its wings in Africa and suddenly the ports in Long Beach are shut down and the cost of shipping skyrockets as ships seek alternative ports to offload, lest they lose their shipments. With non-perishable shipments, it's just an inconvenience, but with perishables, it's a whole different story.

ETF Investment Opinion

Because of the extreme fragility of the sector and the unpredictability, it is hard to really get behind this fund. Today's blue seas could be tomorrow's stormy weather. There are simply too many variables to recommend this fund. As a result, we rate BDRY a Sell for the short term and remain vigilant for the longer term.