Rising interest rates have led to higher yields for cash-replacement funds. MINT is one such fund, sporting a good 5.4% yield to maturity / forward yield. An overview of the fund follows.

MINT: Simple Cash-Replacement ETF, 5.4% Yield To Maturity

I last covered the PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (NYSEARCA:MINT), a very short-term, investment-grade bond ETF, in early 2022. In that article, I argued that MINT's meager 0.44% dividend yield did not adequately compensate investors for MINT's risks. Risks were very low, but rewards were extremely low, so the overall risk-return profile was not compelling, especially in comparison to CDs and similar investments.

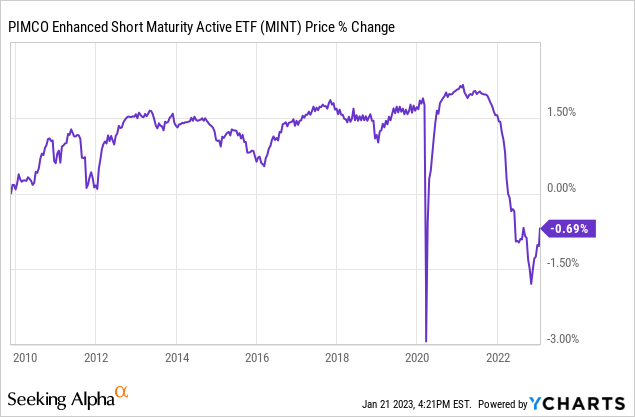

Since then, the fund's share price is down 2.0%, with total returns of -0.2%. Losses have been extremely low on an absolute basis, but high compared to the fund's yield and risk profile, broadly consistent with my previous analysis.

Rising interest rates have increased the expected dividends and returns of the fund, with MINT boasting a yield to maturity / long-term expected returns of 5.4%. This is a much stronger figure than before, and one which adequately compensates investors for MINT's risks.

MINT's diversified holdings, low credit and interest rate risk, and good 5.4% yield to maturity, make the fund a buy.

MINT – Basics

- Investment Manager: PIMCO

- TTM Dividend Yield: 1.89%

- Yield to Maturity: 5.28%

- Expense Ratio: 0.35%

MINT – Overview

MINT is an actively-managed ETF, investing in short-term, investment-grade bonds. MINT is administered by PIMCO, one of the most successful fixed income investment managers in the world. PIMCO's bond funds tend to offer above-average yields and strong, industry-beating returns, and MINT is no exception.

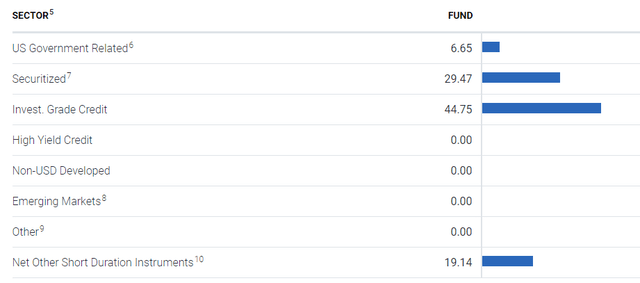

MINT focuses on investment-grade corporate bonds, with sizable allocations to mortgage-backed securities, and smaller allocations to treasuries. These are the main asset classes in the fund's niche, barring ultra short-term securities like CDs or money market funds.

MINT's portfolio is not particularly concentrated, with the fund investing in over 600 securities, and with the top ten of these accounting for around 20% of its value. Concentration is somewhat higher than that of most bond index funds, but not excessively so.

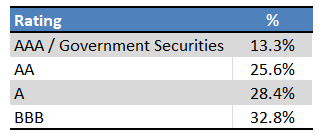

MINT's underlying holdings are all reasonably safe, low-risk securities with strong credit ratings. These sport a median rating of A, indicative of issuers with solid financials, balance sheets, and the capacity to fulfill their financial obligations during almost all economic and industry scenarios.

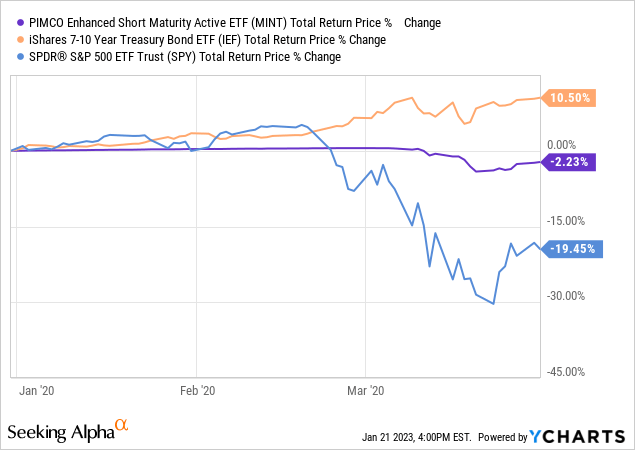

Due to the above, MINT's underlying holdings have very low default rates, even during downturns and recessions. Expect the fund to outperform during these, as was the case during 1Q2020, the onset of the coronavirus pandemic. MINT suffered losses of around 2% at the time, significantly outperforming relative to equities, but underperforming relative to treasuries.

MINT's low credit risk and outperformance during downturns is a significant benefit for the fund and its shareholders, although the fund does pale in comparison to treasuries in this regard.

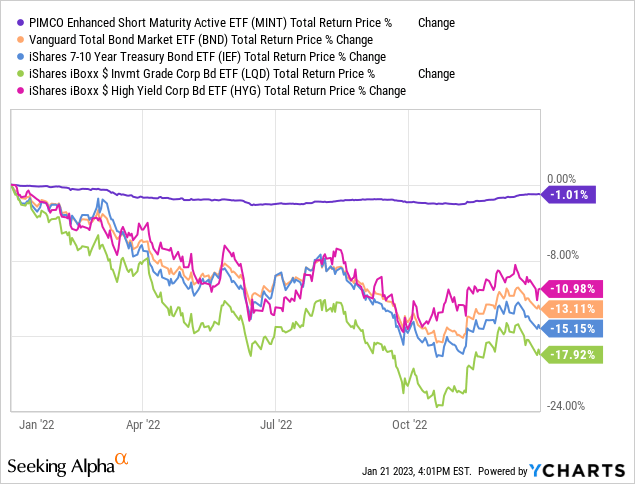

MINT exclusively invests in short-term bonds, with an average maturity of 053 years, and an average duration of 0.45 years. Both figures are low, lower than those of most bond indexes, and indicative of a fund with low interest rate risk. Expect very low, below-average, capital losses when interest rates increase, as was the case in 2020.

- Amazon Prime Video (Video on Demand)

- Jim Parsons, Rihanna, Steve Martin (Actors)

- Tim Johnson (Director) - Tom J. Astle (Writer) -...

- English (Playback Language)

- English (Subtitle)

- ✨【Night Lights Plug into Wall】: 0.5 watts,...

- 💕【Dusk to Dawn Sensor Night Light】:...

- 🐋【Personalized Night Light】:Takes the space...

- 🌃【Widely Used】: This plug in night light...

- 💡【Satisfied Service】If you’re ready to...

MINT has very low credit and interest rate risk, which ensures a strong degree of capital / share price stability. MINT's share price has fluctuated between $98 – $102 per share since inception, a reasonably tight range.

MINT's underlying holdings mature relatively quickly, allowing the fund to rapidly cycle through its portfolio to take advantage of rising rates. It takes the fund between six and seven months to replace its portfolio, so it takes between six and seven months for the fund to fully benefit from an increase in rates. The process is much slower for most bond funds, usually taking several years.

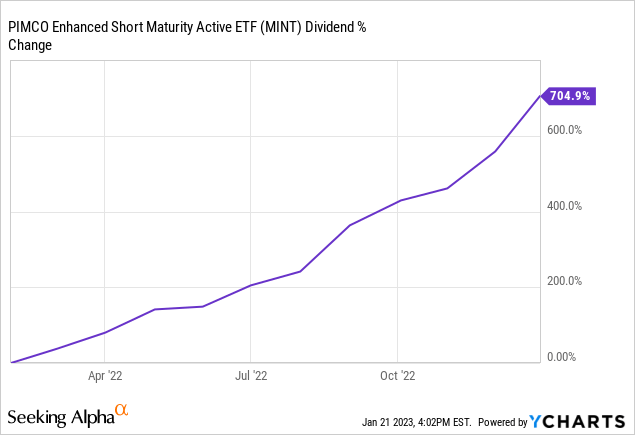

Due to the above, the fund's dividends should see very healthy, above-average growth when the Federal Reserve hikes rates. As an example, MINT's dividends went up 7x times in 2022, equivalent to a 3.5 percentage points increase in dividend yields (by annualizing the fund's last monthly dividend payment).

MINT's dividends should continue to see strong growth moving forward, as the impact from past Fed hikes is felt across asset markets, and as the Fed is likely to hike rates a few more times this year. MINT's yield should grow until it reaches around 5.3%, equivalent to the fund's yield to maturity. Said metric measures the long-term expected returns of a bond fund. Bonds are income vehicles, so their returns will generally / mostly consist of income, so one would expect yields to (roughly) match a fund's yield to maturity, in the long-term, at least. Dividend growth is somewhat dependent on future Fed policy, and so growth might stall if the Fed pivots into rate cuts in the next few months.

MINT's yield to maturity is reasonably good, better than the yield offered by most comparable alternatives, but much lower than the one offered by high-yield corporate bond ETFs.

As a final point, MINT currently sports a trailing twelve-month yield of 1.9%. Said yield figure is the standard yield metric, but its backwards-looking, and not indicative of the dividends investors should expect moving forward. MINT's yield has skyrocketed these past few months, and will almost certainly continue to see growth in the future, so these older, backwards-looking figures are not necessarily

Quick Peer Comparison

- AIRTIGHT LIDS & 3 GRATER ATTACHMENTS The airtight...

- NON-SLIP SILICONE BOTTOMS The rubber on the bottom...

- NESTING BOWLS & DISHWASHER SAFE These kitchen...

- 6 SIZES BOWLS & EXTRA KITCHEN TOOLS SET The range...

- DURABLE STAINLESS STEEL The stainless steel...

- ✅FOOD GRADE SILICONE -- Made of food-grade...

- ✅NO BEND & NO BREAK & HEALTHY FOR COOKWARE --...

- ✅HIGH TEMPERATURE WITHSTAND:The Silicone Cooking...

- ✅33 DURABLE WOODEN HANDEL KITCHEN UTENSILS SET -...

- ✅BEST KITCHEN TOOLS :One- piece stainless steel...

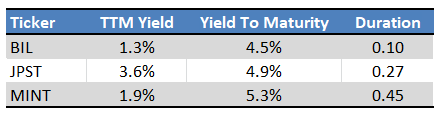

Finally, a quick comparison between MINT and other cash-replacement ETFs.

MINT is on the riskier, higher-yielding side of its niche, with several cash-replacements ETFs focusing on safer, shorter-term securities. MINT's yield is quite a bit higher as well.

Conclusion

MINT's diversified holdings, low credit and interest rate risk, and good 5.4% yield to maturity, make the fund a buy.