Summary

- The oil macro in 2023 will likely be heavily influenced by headlines related to Russian supply and Chinese demand as the country reopens.

- US production growth is expected to be modest, as companies practice capital discipline and grapple with service cost inflation.

- Traditional energy companies have been using cash flows from oil and gas to invest in clean energy opportunities.

Last week at Exchange: An ETF Experience, VettaFi’s Stacey Morris, Head of Energy Research, hosted a discussion of the global energy environment with Samuel Rines, Managing Director at Corbu, LLC. Morris and Rines discussed major themes in oil markets, the outlook for US production, and considerations for investing in energy stocks. This note provides a recap of last week’s session.

Russia and China dominate the oil narrative.

Several factors stand to impact global oil markets this year, including US production growth, OPEC+ supply, the strength of the US economy, China’s reopening, Russian production and exports, and the US dollar. That said, China’s reopening and Russia’s production and exports are likely to be the two most impactful factors for global oil markets. After a rare decline in 2022, China’s oil demand is expected to rebound this year given the end of its longstanding Zero-Covid policy. While an initial wave of cases muted oil demand so far in 1Q23, China’s demand is expected to be up approximately 0.8 million barrels per day (MMBpd) by the end of 2023.

Meanwhile, Russia to this point has been largely effective in re-routing its oil exports to China, India, and other parts of Asia. However, over time, Russian production is likely to decline due to the absence of expertise from Western oilfield service companies. Rines highlighted the service-intensive nature of Russian production and its steep decline curves. In short, it is more difficult and expensive to maintain production there. By his estimates, Russian barrels will probably come off the market at a significant clip this year of approximately 1-2 MMBpd and approaching 3 MMBpd in 2024. Interestingly, subsequent to the discussion, Russia announced on Friday a voluntary production cut of 0.5 MMBpd in protest of Western sanctions and the Group of Seven price cap. Whether the cut is fully voluntary or partially a function of production challenges in the field, the potential for production declines suggests a tightening market. That will increase reliance on Saudi Arabia and other OPEC+ members to fill a supply gap, particularly as US production growth has moderated.

US production is expected to increase modestly as energy companies have reigned in growth capital spending.

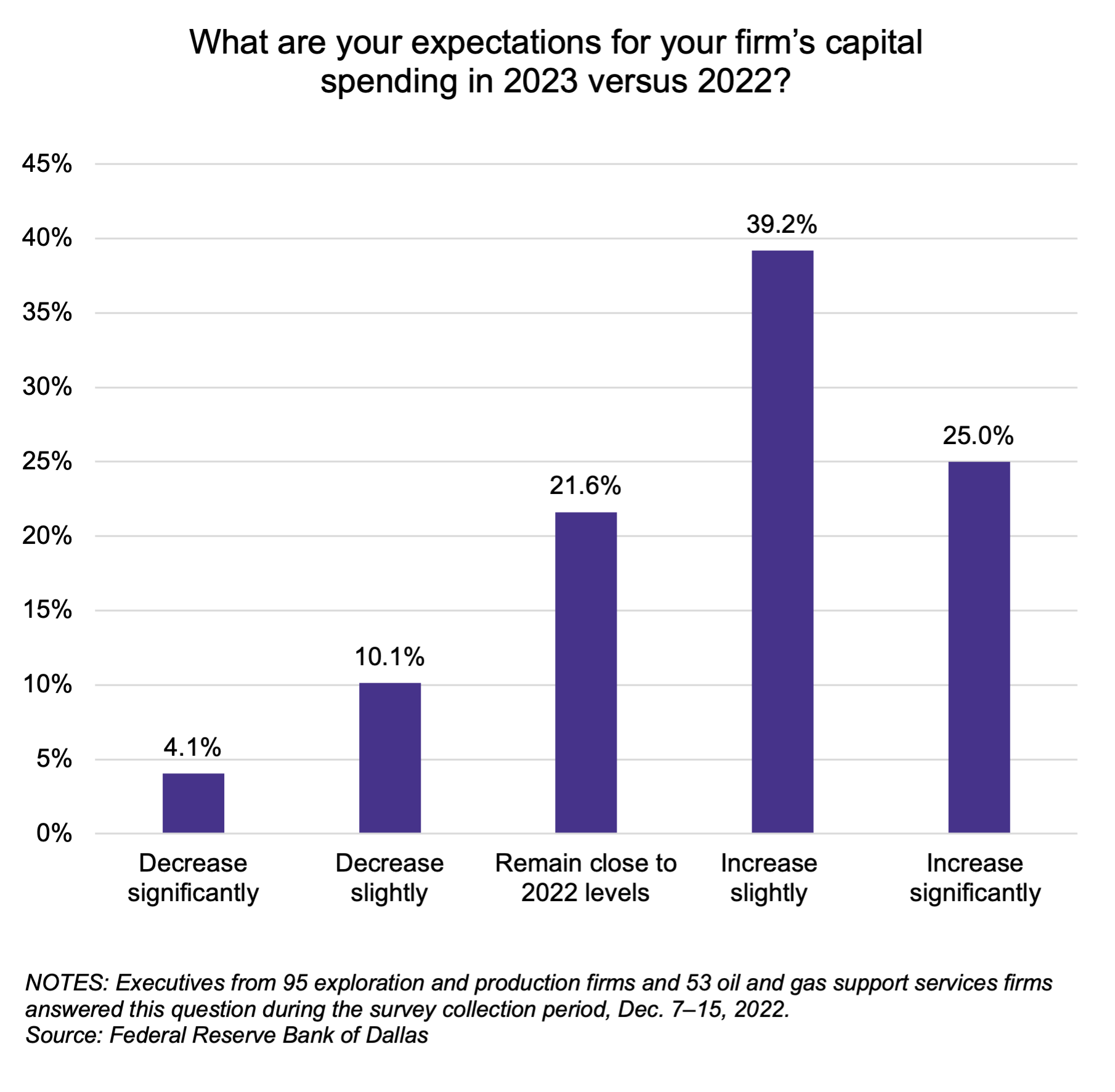

Prior to 2022, when oil prices increased, US producers could be relied upon to help fill any supply void, but those days are behind us. At investors’ urging, companies have prioritized capital discipline and are focused on returning cash to shareholders instead of growing production (read more). Rines pointed to a recent Federal Reserve Bank of Dallas survey of US oil and gas executives, which shows that most respondents do not see capital spending increasing significantly this year (see chart below). Notably, with oilfield service cost inflation estimated at 20-25% this year, producers would have to increase spending noticeably just to maintain last year’s activity levels.

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

For overall US production, Rines expects growth of 3-5% this year, more likely closer to 3%. The Energy Information Administration is currently forecasting growth of 0.6 MMBpd for 2023 on average, which equates to 5.0% growth relative to 2022. US production growth is likely to be driven largely by the Permian as has been the case in recent years. On their 4Q22 earnings call last week, Plains All American (PAA/PAGP) estimated that Permian oil production would grow by approximately 0.5 MMBpd on an exit-to-exit basis in 2023, relative to an estimated 2022 exit production rate of 5.65 MMBpd. If Chinese demand rebounds and Russian supplies decline, the world will likely need any and all growth from the US, but volumes may disappoint.

Yes, energy can align with ESG considerations.

Traditional energy companies that have been generating solid returns have not ignored the changes taking place in the energy landscape and the push to decarbonize our energy sources. Rines pointed out that companies are using the cash flow generated from oil and gas to meaningfully diversify their businesses. For example, bp (BP) recently announced it will invest $55-$65 billion in energy transition growth opportunities between 2023 and 2030. The company also acquired renewable natural gas producer Archaea Energy last year for $4.1 billion. In a similar vein, Chevron (CVX) acquired renewable fuel producer Renewable Energy Group in 2022 for $3.15 billion.

The world is going to need hydrocarbons for quite some time as the energy landscape evolves. Investing in companies that are producing (or handling) hydrocarbons while also being mindful of the future and taking steps towards a cleaner energy future can arguably be consistent with ESG investing. Many midstream companies have initiatives around carbon capture, hydrogen, and renewable fuels that represent positive progress on this front (read more). While companies advance clean energy opportunities, investors can enjoy the benefits of a reformed energy sector – namely, free cash flow generation stemming from capital discipline – and the buybacks and dividends that come with it.