By Sweta Shah

The Invesco S&P 100 Equal Weight ETF (NYSEARCA:EQWL) uses an equal-weight approach to reduce the impact of any single stock within the portfolio, and to diversify risk across a broader set of companies. This offers a way to capture the potential upside of the largest U.S. companies, while potentially mitigating some of the risks associated with traditional market-cap-weighted approaches.

EQWL invests in the 100 largest publicly traded companies in the U.S., with each stock given an equal weighting in the portfolio. That can be helpful when the market is rewarding stocks more evenly, but it can produce underperformance to capitalization-weighted indexes during mega-cap-led periods, which can last for years.

I rate EQWL a hold. I believe that equal-weighted ETFs likely have an advantage over cap-weighting investing, simply given the dramatic outperformance of the latter for so many years. In addition, weaker markets tend to favor equal weighting, since that ETF format spreads the risk out more evenly.

Strategy

EQWL is an exchange-traded fund that seeks to track the performance of the S&P 100 Equal Weight Index. EQWL aims to give investors exposure to 100 of the biggest U.S. publicly traded firms in a range of industries, but each index company is given the same weighting regardless of market capitalization.

ETF Grades

- Offense/Defense: Offense

- Segment: Investment Segment

- Sub-Segment: U.S. Large Cap

Technical Ratings

- Short-Term (next 3 months): D

- Long-Term (next 12 months): D

Rating scale: A = Excellent, B = Good, C = Fair, D = Weak, F = Poor. For a detailed description of MII's proprietary technical rating system, see disclosures at the bottom of this article.

Holding Analysis

EQWL is not sector-based, so regardless of how many of the 100 largest stocks reside in any of the 11 S&P 500 sectors, they will be included in EQWL. Among EQWL's 100 stock holdings, Financials currently have the highest sector weighting (19% of assets). Technology and Healthcare each occupy about 14% of the ETFs' allocation. This ETF's lowest weightings are in Energy, Real Estate, and Basic Materials, similar to the cap-weighted S&P 100 Index.

Strengths

EQWL provides a level of diversification in the large-cap space that many ETFs lack. That's because the S&P 500, and especially the S&P 100 subset of that larger index, is heavily tilted toward a relatively small number of very large stocks. Specifically, 28% of the S&P 100 Index – which is available in ETF form via the iShares S&P 100 ETF (OEF) – is in just four mega-cap stocks. EQWL, as an equal-weighted ETF, will not own much more than a total of 4%-6% across any four stocks. That's a huge difference, especially if the long run of leadership from that small group of very large companies fades. That has already started, based on 2022's stock market decline.

In addition, OEF's equal-weighting removes some of the Nasdaq 100 influence that is a more significant part of the cap-weighted S&P 100 Index. The top eight stocks in the more commonly found, cap-weighted S&P 100 Index occupy 35% of that index currently. Only one of those stocks is not part of the Nasdaq 100's bigger holdings. So, by opting for an equal-weighted ETF like EQWL, investors derisk themselves a bit from continued problems in that former leadership group within the broader stock market.

EQWL still provides focused exposure to some of the largest and most established U.S. companies across a range of sectors, which can be attractive to investors seeking exposure to blue-chip stocks. It is simply structured to remove the top-heavy nature of the more popular version of the S&P 100.

Weaknesses

The strengths mentioned above can just as easily be weaknesses when mega-cap stocks roar, as they did for about a decade prior to 2022 and continued to do so during the past year's bear market rallies. The other related point here is that by spreading the risk away from the largest stocks, EQWL takes on a relatively lower-cap approach. So, when mid-cap and small-cap stocks lead the market down, EQWL can end up being caught in that selling storm.

Opportunities

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

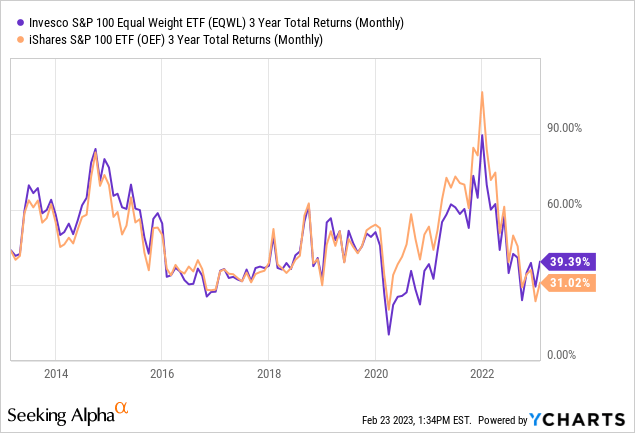

Perhaps the best way to explain how EQWL's aforementioned strengths can be opportunities for investors in 2023, and the next few years, is to visualize the trend change I'm starting to see. That is, a change toward stronger performance in equal-weighted large cap ETFs vs. cap-weighted funds. Below is a chart of EQWL vs. OEF. Toward the right side of the chart, you can see what is essentially like a “crossover” in technical analysis terms, except I have applied it to the relative performance of these two ETFs.

Data by YCharts

On a three-year rolling total return basis, EQWL recently outperformed OEF for only the second time since 2016. The other incidence of this was very briefly in late 2018/early 2019, following the S&P 500's nearly 20% drop during that period. While I'd stop short of saying EQWL is a “risk-off” version of the S&P 100, it does tend to perform better in sharp selloffs.

Threats

Despite some intermittent short-term rallies, I still believe that the stock market is a firmly in a bear cycle. As such, any broad-based equity ETF is loaded with potential downside risk. That along with the possibility of relative underperformance by another long-term wave of mega-cap outperformance are the main threats here.

Conclusions

ETF Quality Opinion

I am a fan of equal-weighted ETFs, though I prefer a smaller group of holdings to the 100 included here. However, 100 is not as overdiversified as many ETFs that own many hundreds or even thousands of individual stocks. So I'll continue to keep it on my watchlist.

ETF Investment Opinion

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

EQWL gets a hold rating from me. Equal weighting appears poised to perform well on a relative basis to cap-weighted ETFs, but the overall market trend for stocks is still a strong headwind.

Modern Income Investor's proprietary technical rating system was created by the firm's founder, Rob Isbitts, a chartist for more than 40 years. The ratings emphasize risk-management, and the belief that while any investment can appreciate in price at any time, each investment carries a different level of potential for major loss. The balance of reward and risk is calculated each night for thousands of securities, using a formula that analyzes price trend, strength of that trend and key price levels. It analyzes data over multiple time frames to produce a short-term rating (looking 3 months out) and a long-term rating (looking 12 months out).