Many smart and well-informed analysts seem to think that this is a great opportunity to buy the dip in regional bank stocks. While I think that the SPDR S&P Regional Banking ETF will eventually recover, I believe that the risks are disproportionately high. I think that KRE ETF is a sell today, but my rating will likely change once the market provides enough clues of bullish support.

KRE: Regional Banks – It's All About Risks And Price Action (NYSEARCA:KRE)

A quick look at Seeking Alpha's main page for the SPDR S&P Regional Banking ETF (NYSEARCA:KRE) leaves little doubt: many smart and well-informed analysts seem to think that this is a great opportunity to buy the dip in regional bank stocks. Four of the five articles written after the SVB Financial (SIVB) collapse support a buy rating, while the other merely considers KRE a hold.

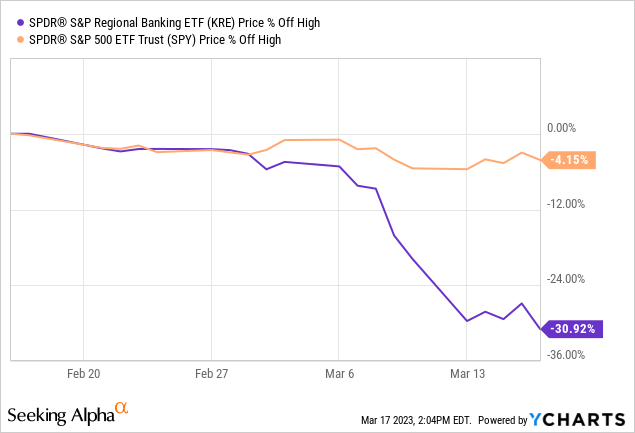

I can understand the rationale. While certain players in the financial sector appear to be in deep trouble, the global financial system at large still seems to be structurally sound. Then, why not just buy a diversified basket of bank stocks that has corrected 30% in the past few days alone, as is the case of KRE (see below), and patiently await the rebound?

To me, the reason is simple: even if the reward potential exists, and it probably does, the risks associated with it are disproportionately large. Investing in regional banks will eventually make a lot of sense, in my opinion, but the right time to do so might not be right now.

Short-term pain, long-term gain

Maybe I am just getting old and cranky, but there are certain behaviors in the market that bother me. One of them is the pursuit of potentially outsized future returns without proper regard for risks — as if one were not the mirror image of the other.

If all that mattered were gain opportunities, I would consider KRE (1) a tossup in the short term, albeit with a bearish bias, and (2) probably a good investment for the very long term.

As I argued in a few of my recent articles, “an economic slowdown is a near certainty [and] I don't think that a recession has been this obviously telegraphed in many decades.” Because regional bank stocks are heavily correlated with the broad equities market and economic cycles, I think that the current landscape does not bode well for the sub-sector. However, given enough time (think many years), the financial services space is likely to recover, as it has in previous crises, and regional bank stocks should move well past previous highs.

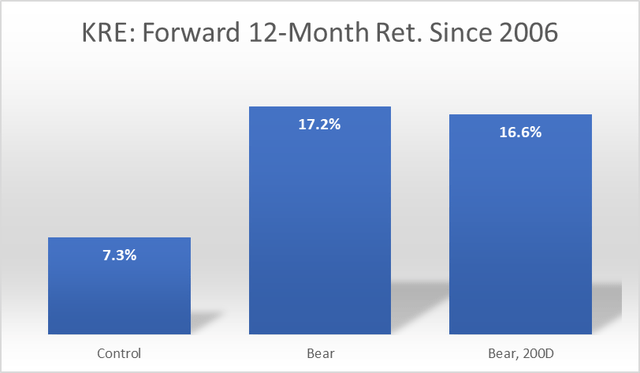

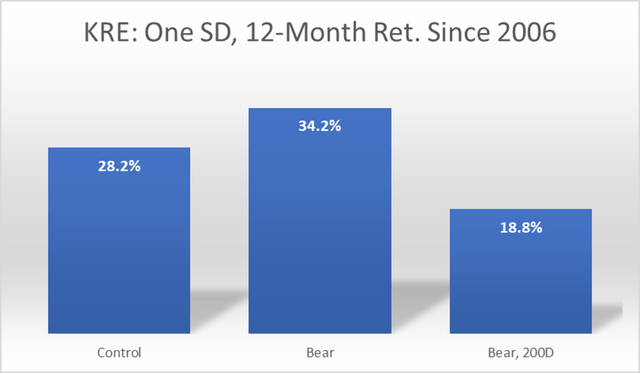

Regarding the long term, the following graph illustrates my point. Since its 2006 inception, KRE has returned an average of 7.3% over any 12-month period — the first bar labeled “control”. But if bought after a 20%-plus correction from peak levels, also known to some as a bear market, the average gains in KRE have been a much better 17.2% over the following year (the second bar below). Clearly, in this case, buying panics has paid off.

Think risks, not just rewards

Having said the above, I think that risks should be carefully considered before committing capital to the SPDR S&P Regional Banking ETF. This is where my current sell rating on this fund begins to take shape.

I could spend some time discussing the potential issues that the regional banking sub-sector could be facing, but the financial media has already been covering the subject extensively. I bet that few investors fail to understand the possible pitfalls posed by a weakening economy, rising interest rates, and a deeply inverted yield curve.

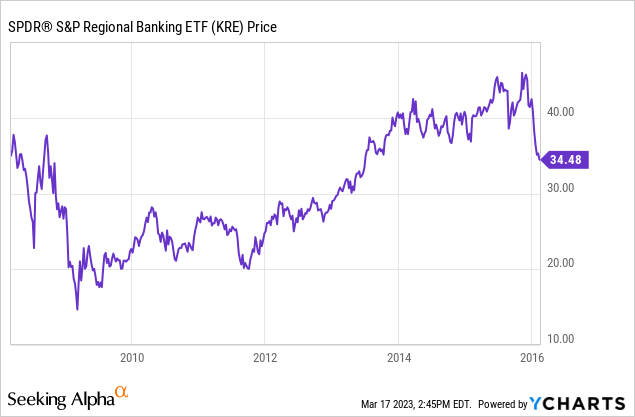

Instead, I focus on the analysis of historical data. While buying the dips in KRE has eventually proven to be a good idea in the past, as I discussed above, the risks have also been disproportionately high. For example, the worst 12-month return in KRE of -57% happened when shares were bought on March 11, 2008. On that day, the ETF had already corrected 33% from the peak reached in February 2007. Those who bought the dip back then suffered massive losses in the short term and were still under water nearly eight years later (see below).

Pay attention to price action

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

So, we seem to have hit a wall. Buying dips is a good thing, but the opportunity comes attached to meaningful risks of sizable losses. What is the best course of action then: to be fearful or to be greedy?

In my view, investors should wait for the storm to pass. Fundamentally speaking, this is easier said than done, especially because the market tends to react well ahead of any improvement in the macro landscape. However, the market itself may provide investors with the clues that they need to ride the recovery without exposing too much capital to the potential of large losses.

Instead of blindly buying KRE when the ETF is in a bear market, I added one layer to my backtest presented above: only do so if the fund ended the previous trading session above the 200-day moving average. Doing so ensures that dip-buyers are not riding the bear market all the way to the bottom while participating (even if not from the very beginning) in the rebound.

Purely from a return perspective, not surprisingly, being cautious during bear markets has not yielded better results. The forward 12-month gains, in this case, have been 16.6% on average since 2006, about 60 basis points lower than just blindly buying KRE during a bear correction. However, one standard deviation of the returns has been only 18.8%, nearly half the volatility levels of simply buying the dip (see the second and third bars below).

The reward-to-volatility ratio (think risk-adjusted returns) of buying KRE during a bear market has been 0.50, better than the 0.26 ratio of buying and holding the ETF regardless of market conditions. But much better has been the 0.88 ratio produced by buying KRE during bear markets only when the price has been showing signs of strength again.

In summary

I bet that the regional bank ETF will eventually recover, make new highs, and provide dip buyers with market-beating absolute returns. However, owning shares without clear signs of bullish support, as is the case today, could expose capital to sizable losses and possibly keep bulls underwater for years.

I would not buy KRE ETF today, but I am interested in following price action closely to know when it is safer to do so. Therefore, I issue a sell rating on this ETF at this moment, understanding that my rating will likely change once the market provides enough clues of bullish support.