Investment thesis

Europe's energy crisis has had a far less dramatic effect on the economy than thought, thanks to a milder-than-average winter as well as about $800 billion spent on mitigating effects. The better-than-feared economic outcome, at least thus far, has led to renewed investment optimism for European assets. This is reflected in a rebound in the Vanguard FTSE Europe ETF (NYSEARCA:VGK) from recent lows experienced in the fall of 2022 when Europe's energy security prospects were in serious doubt. It is up about 25% since then.

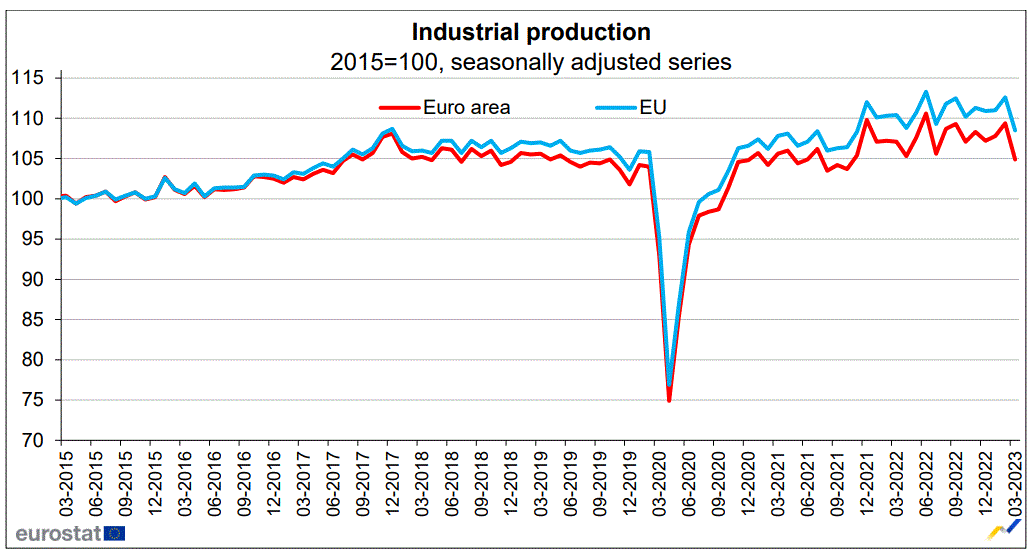

Some EU metrics do paint a picture of economic resiliency in the face of what can only be described as perhaps the most dire economic situation since WW2 in Europe. For instance, its manufacturing activity has been holding up surprisingly well, at least until very recently, even as the EU currently uses about 13% less natural gas than it did before the Ukraine war started. There are other metrics, however, such as cratering consumer demand, which has been on a steady decline path for over a year now. Coupled with close to no economic growth in the past year, the overall picture is one of stagflation, even as risks ranging from geopolitical to higher rates going forward continue to mount. VGK might become a good investment choice, perhaps once most of these negative factors will play out and be reflected in its share price, but right now, the negative factors are nowhere near being fully priced in.

The VGK fund offers diverse, broad exposure to the European economy.

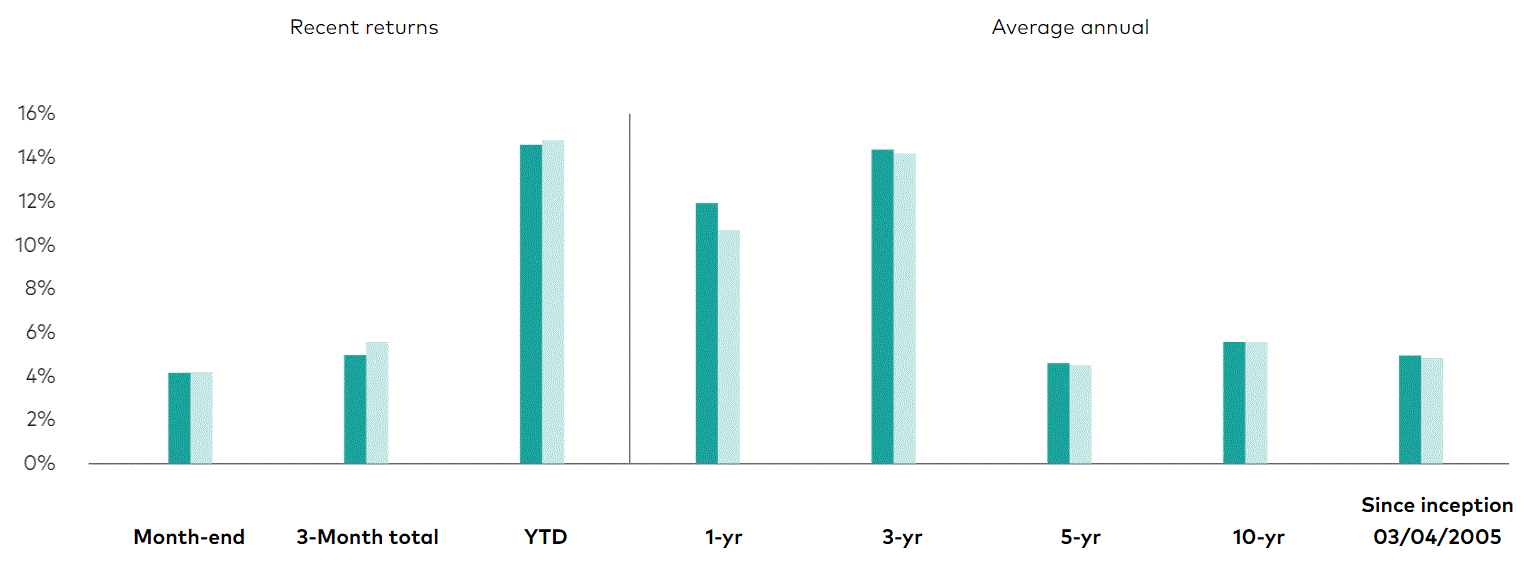

Contrary to the overall broader European economy, where the EU GDP/capita, as well as net average wages, are now about half compared to the same American metrics, the VGK ETF has performed relatively well, recently, as well as going back through the years.

Vanguard

One of the fundamental reasons why the fund has been performing arguably much better than the European economy itself is that many of the companies represented in the fund are heavily dependent on international operations and sales.

There are a total of 1328 stocks currently represented in the fund. The largest holding is Nestle S.A. (OTCPK:NSRGY), making up just under 3% of the total fund. The second-largest is ASML (ASML), with 2.4%. ASML sells semiconductor manufacturing machines, with its UV lithography machines being a crucial component in the advanced semiconductors manufacturing process. As such, its machines are more likely to be sold to Taiwan, S. Korea than they are to be sold in Europe. As one goes down the list, it becomes clear that there is not a clear positive correlation between the European economy and the VGK fund. There is some partial correlation, with many companies like Mercedes (OTCPK:MBGAF) which makes up only about .5% of the fund's weight still highly dependent on European production and sales. Overall, I see this fund as being half dependent on the European market and operations, with roughly half dependent on the global market.

The expense ratio is just .11%, meaning that it can be well-suited to a longer-term investment strategy. Its P/E ratio of 13.5 is currently significantly better compared with the S&P, which is currently at almost 24. It does pay a dividend of close to 3% based on the past 12-month average, but the distributions tend to be volatile, with the lowest quarterly payout per share being the last one which was just $.21/share, while the highest one was a year ago at $1.04/share.

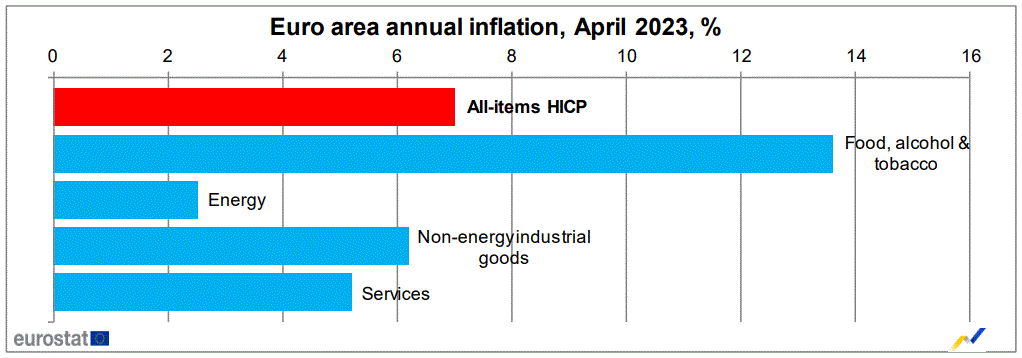

Latest euro area inflation numbers suggest ECB rate hikes will continue for a prolonged period, which could hit European stocks particularly hard.

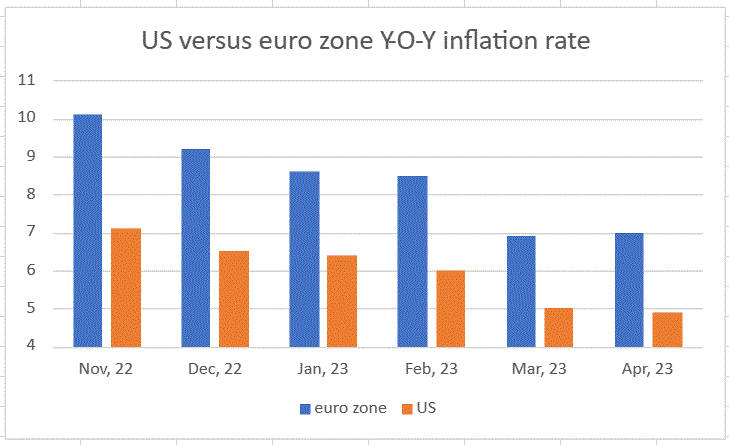

The latest eurozone inflation numbers show a break in the trend of declining year-over-year inflation. It came in at 7%, versus 6.9% in the previous month which is far higher than here in the US.

Data source (Eurostat, Trading Economics)

Not only is inflation significantly higher in the eurozone, but it is also seemingly headed in the wrong direction again, even as here in the US the declining trend continues.

The likely response of the ECB will be to go higher in terms of interest rates, for longer. This comes within the context where some of the metrics such as consumer spending are already pointing to a struggling EU economy.

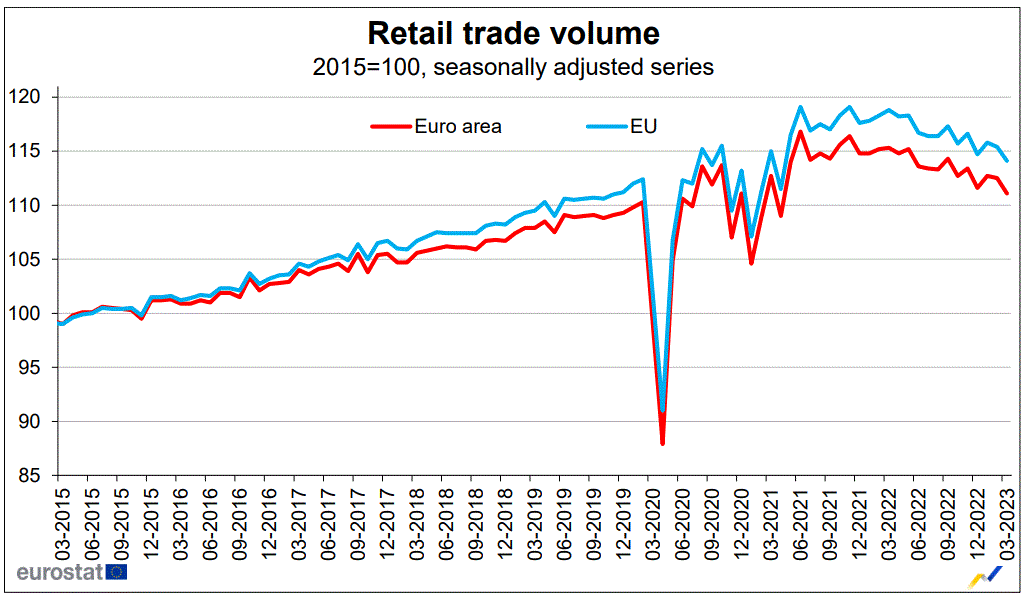

Eurostat

While consumer demand is still higher compared with pre-COVID crisis levels, it is quickly converging back down to those levels, based on most indications. European consumers seem to be squeezed particularly hard by rising food prices, which risks a collapse in demand for most other goods & services.

Eurostat

Between stubbornly high food inflation, which reduces disposable incomes available for consumers, and rising interest rates that make it more expensive and less attractive for consumers to purchase items on credit, many companies represented in the VGK ETF that have significant sales exposure to the European market can see a massive negative impact in revenues and profits going forward.

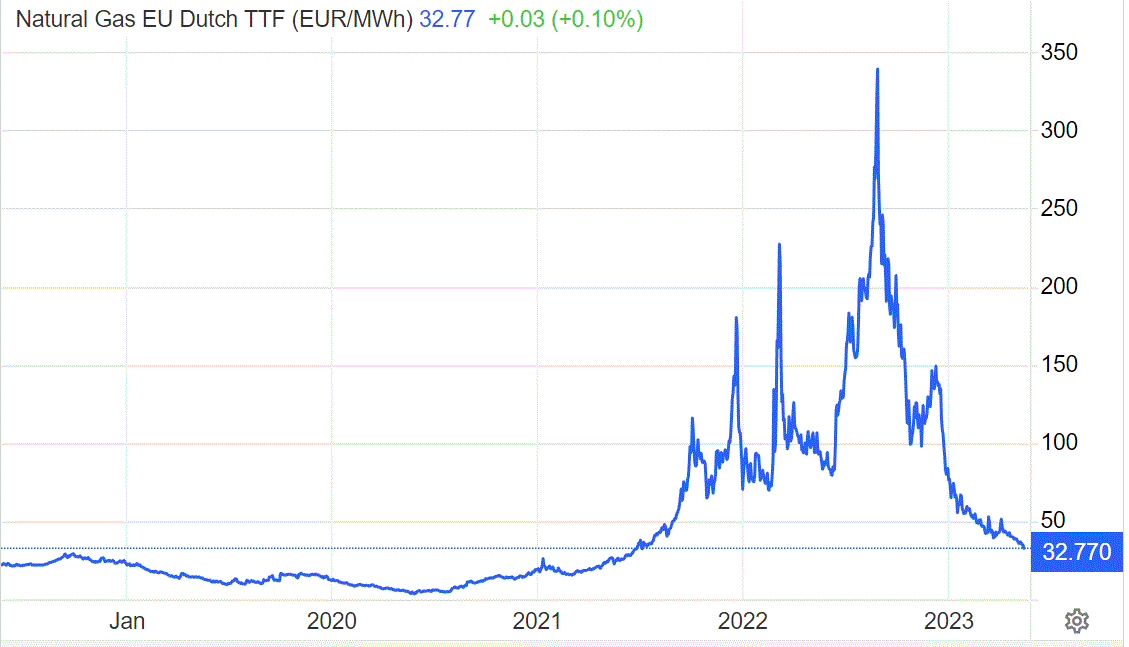

In addition to the above-mentioned issues, the new reality facing the EU economy in regard to energy security is that we will always be one prolonged period of unfavorable weather away from a severe energy crisis gripping the continent. This reality became evident in 2021 already, when a massive shortfall in wind energy production in places like Germany led to a severe spike in natural gas prices in Europe in the fall of that year. With the war in Ukraine and associated energy-related issues in Europe overwhelming public discourse, we tend to forget that this occurred at all, but if we look at European natural gas spot price trends, we can see that it all started months before the war.

Trading Economics

| Preview | Product | Price | |

|---|---|---|---|

|

Galway Bay Long Sleeve Golf Rain Jacket - Three Layer Long Sleeve Golf Jackets for Men, Lightweight... |

$200.00 |

Buy on Amazon |

Last update on 2024-04-19 / Affiliate links / Images from Amazon Product Advertising API

The hard truth about the overall European energy security situation is that it has been severely weakened over the past two decades or so, as more and more of its electricity supply now comes from intermittent sources of generation. Any sustained regional or continent-wide shortfall in wind, solar, or hydropower output like we saw in 2021, will lead to spikes in natural gas and coal demand that can last for potentially many months.

Colder than average winters can also exacerbate the situation, as we saw during the 2017-2018 winter season, where, by spring, storage resources were depleted, and intervention by Russia's Gazprom was the saving grace that kept the EU economy from shutting down in the face of a late cold spell. In a nightmare scenario, Europe could potentially experience a year of renewable energy generation shortfalls, followed by a colder-than-average winter at any point going forward. It could happen this year, or next, or any year thereafter, and this time around, there is the added risk associated with the severing of trade ties with what was up until recently the only potential provider of immediate natural gas, coal as well as crude and refined products supply relief, in the event that an unforeseen weather-related shortfall emerges. This is a potential risk factor that has the potential to hit the VGK fund with devastating effects, even though its overall exposure to the European economy is somewhat limited by the international business diversification of the component companies represented in the fund.

EU industrial production which held up surprisingly well last year, is showing early signs of succumbing to the overall negative trends.

A very mild winter, coupled with very generous government support programs for industry in the face of high energy prices helped Europe's industry weather the past year better than I expected in the face of the energy decoupling from what was by far its largest supplier of energy before 2022, namely Russia.

Eurostat

Despite all the efforts to shield the economy, a 3.6% decline Y-O-Y in industrial production output arguably signals a significant fundamental problem. That is the case, especially when coupled with the severe decline of 3.8% Y-O-Y in consumer demand. The two data points, when put together suggest that we may be on the verge of a dramatic economic slowdown in the EU, even as inflation continues to pose a challenge for the ECB, which increasingly has a stagflationary environment on its hands. In other words, a continued effort to cool the economy in order to bring inflation under control no longer seems to work, and yet it has to continue raising rates in order to prevent an even more aggressive inflationary cycle from taking root.

Investment implications

Even though many of the companies that make up the VGK fund are mostly global, rather than regional in terms of sales and operations, there is still a very significant exposure to the ailing European economy. From the time I last covered this ETF, its share price increased slightly by about 3.5%, even as the overall picture of the European economy has deteriorated, and the outlook going forward seems to have far more downside risk than upside potential.

In addition to the troubling energy security situation as well as other factors that continue to weigh down the European economy, we may be on the verge of yet another geopolitically driven negative economic event that has the potential to not only impact Europe's trade but also the foreign operations of many companies included in the VGK fund. The ongoing debate in the EU in regard to how to treat relations with China involves trade worth $2.5 billion/day.

The China relationship, which could be on the verge of turning sour, goes beyond trade, with most major EU industrial entities having significant operations in China, with the Chinese market being a significant market for many European companies. For instance, of just over 2 million Mercedes vehicles sold in 2022 worldwide, over 750k were sold in China, with many of those vehicles assembled in China, meaning that it does not show up in trade data. That is twice as many Mercedes cars than were sold in North America, and more than Mercedes sales in Europe, which came in at just under 640k units sold. The trade data alone does not fully reflect the economic co-dependence that this relationship entails. Furthermore, while cutting off China's access to the EU market would be a heavy blow to the Chinese economy, given the EU's already severe inflationary pressures, the loss of Chinese intermediary goods as well as finished goods would probably exacerbate things to the point where inflation would become uncontrollable.

VGK is currently overpriced, even though it trades at a much lower P/E compared with the S&P. The EU economy still has a long way to go before the inflation-fighting phase of the current economic slowdown can end, even as the US economy seems to be nearing that point a lot sooner. In terms of GDP growth, the year-over-year growth rate in the EU is currently .1%, while in the US growth was recorded at 1.1%.

Risks are also more pronounced, arguably in the EU than in the US, if one is to assume that the US debt ceiling issue will be resolved. Keeping all this in mind, exposure to Europe overall continues to remain risky, as long as the energy situation, the geopolitical situation as well as internal problems that arguably hamper growth remain unresolved. Once these issues are either resolved or become better reflected in the market pricing of this ETF, it would be a great way to gain broad investment exposure to the EU.

- 🌴 Material: Chiffon, 100%Polyester ; Lightweight, soft and comfoy material

- 🌴 Features: Long sleeve chiffon lace mini dress for women spring, summer and fall, crew neck, long lantern sleeve, zipper closure, elastic waist, a-line and slim fit style, elegant ruffle design, this cute fall mini dress will make you more beautiful and lovely!

- 🌴 Occasions: Fall casual short dress suitable for you to party, holiday, school, date, cocktail, coming home, and daily life. Believe you will love it and get lots of compliment!

- 🌴 Garment care: Hand wash in cold water recommend, hang dry, low temperature ironing if necessary

- 🌴 Size Note: 0-2, 4-6, 8-10, please refer to our sizing information in the picture description to choose your size. Thanks for your understanding

Last update on 2024-04-19 / Affiliate links / Images from Amazon Product Advertising API

The market seems to be disagreeing with me in the short term since the fund is up significantly from recent lows. More often than not, shorter-term market moves are not in any way a reflection of fundamental realities, but rather immediate reactions to news or to popular narratives that become predominant, such as the false one in regard to Europe's energy security status being solid, even though it is mostly a reflection of favorable weather conditions which as we know, can turn unfavorable very fast. I for one choose to remain skeptical of an investment opportunity that will change with weather patterns. At the very least, it will be worth waiting for the next negative weather event that will batter it, before getting in, keeping in mind the prime investment goal of buying low and selling high, rather than going the other way around.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

SparkChange cross-lists physical carbon ETC in Germany and Italy