With bond yields at their best levels in years, a look at what some Morningstar Medalist funds have to offer investors.

12 Top-Performing Bond Funds With High Yields

A bright side to this year’s brutal selloff in the bond market is that thanks to rising yields, bond fund investors now have considerably more options when looking to add income and the potential for total return to fixed-income portfolios.

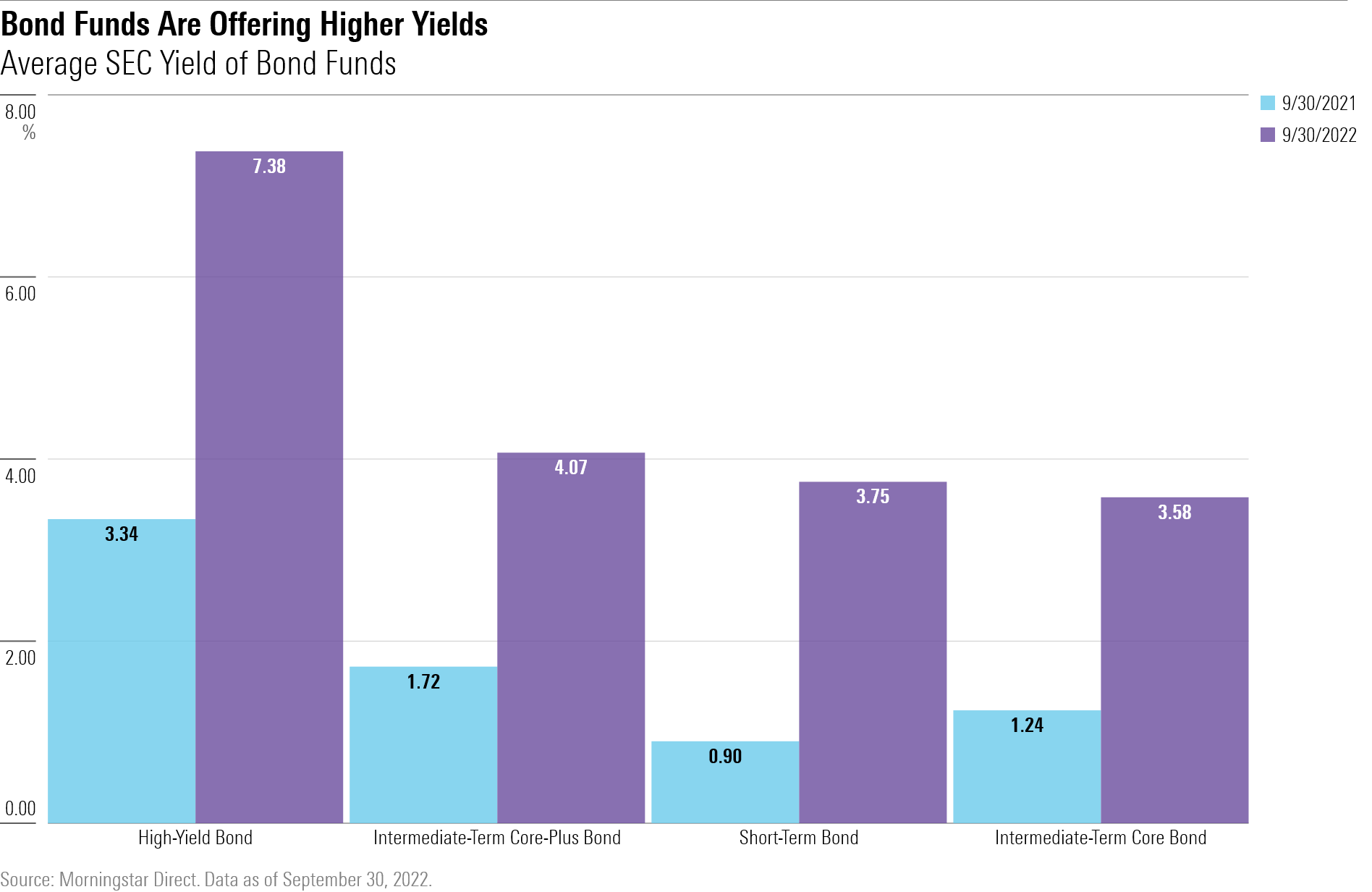

Consider that the average intermediate-term core bond fund is now yielding 3.58%, according to Morningstar Direct, up from just 1.24% at the end of September 2021.

Even as bonds have dealt a big blow to investor portfolios, failing to live up to their usual role as an offset to stock market declines, they still play an important part in a diversified portfolio and yield is one of their key advantages.

To find quality, high-yielding bond funds, we set out to screen from among the bond funds covered by Morningstar analysts with an Analyst Rating of Bronze, Silver, or Gold. Using each fund’s oldest share class, we looked for funds where the yields are above that of their category average, and where performance has also been above average for both year to date and over the last three years.

Comparing the statistic known as SEC yield is the easiest way to compare yields on bond funds, but the metric is not a guarantee of future income. The SEC yield calculation is based on a 30-day period ending on the last day of the previous month. It represents the hypothetical income an investor would earn from the fund over a 12-month period if the fund continued earning at the same rate as the 30-day calculation period.

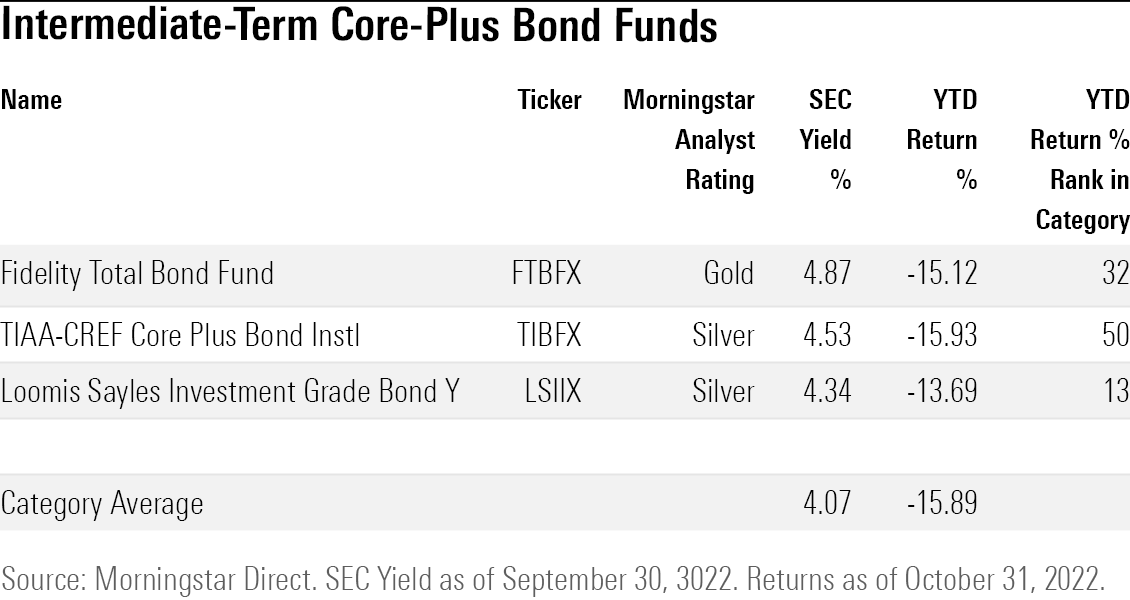

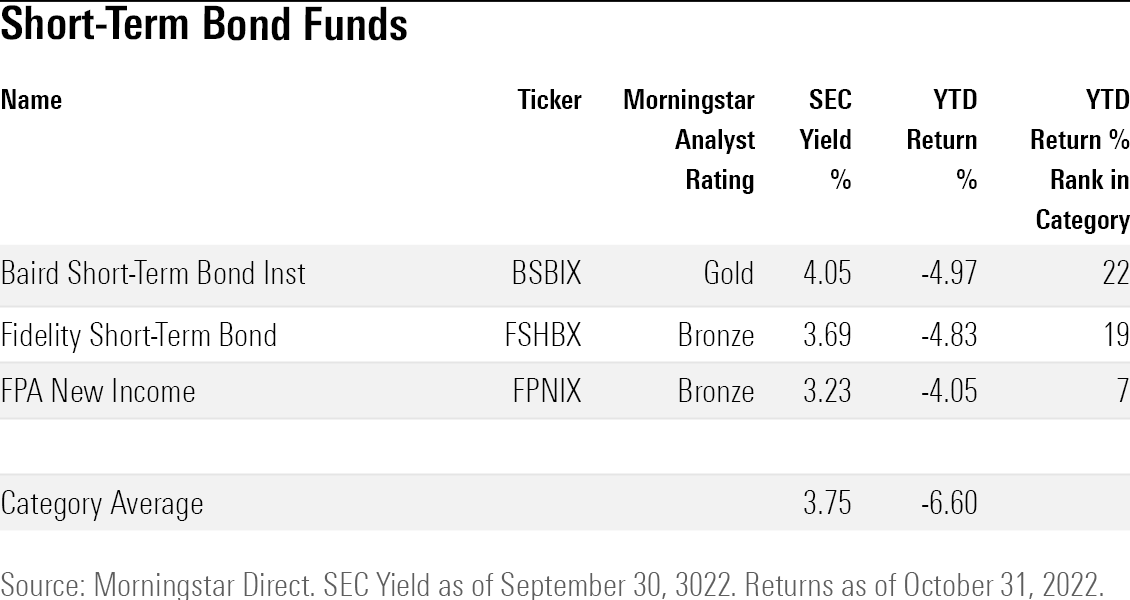

To keep the list manageable, we focused on the four largest Morningstar bond fund categories: Intermediate-Term Core Bond Funds, Intermediate-Term Core-Plus Bond Funds, Short-Term Bond Funds, and High-Yield Bond Funds.

Here are the funds that made it through the screen:

- Fidelity Investment Grade Bond FBNDX

- Fidelity Intermediate Bond FTHRX

- SPDR Portfolio Aggregate Bond ETF SPAB

- Fidelity Total Bond Fund FTBFX

- TIAA-CREF Core Plus Bond TIBFX

- Loomis Sayles Investment Grade Bond LSIIX

- Baird Short-Term Bond Inst BSBIX

- Fidelity Short-Term Bond FSHBX

- FPA New Income FPNIX

- BrandywineGLOBAL High Yield BGHSX

- Hotchkis & Wiley High Yield HWHIX

- PGIM Short Duration High Yield Income HYSZX

Does Higher Yield Mean Higher Risk?

It’s important for investors to remember that there also can be a trade-off with yield. While the income level on bond funds is higher than it was a year ago thanks to rising interest rates, some managers are boosting yields even more by adding riskier bonds into their portfolios, such as more bonds with lower credit quality than their peers and securitized credits. Those bonds could be backed by commercial or residential mortgages, auto loans or even credit card debt.

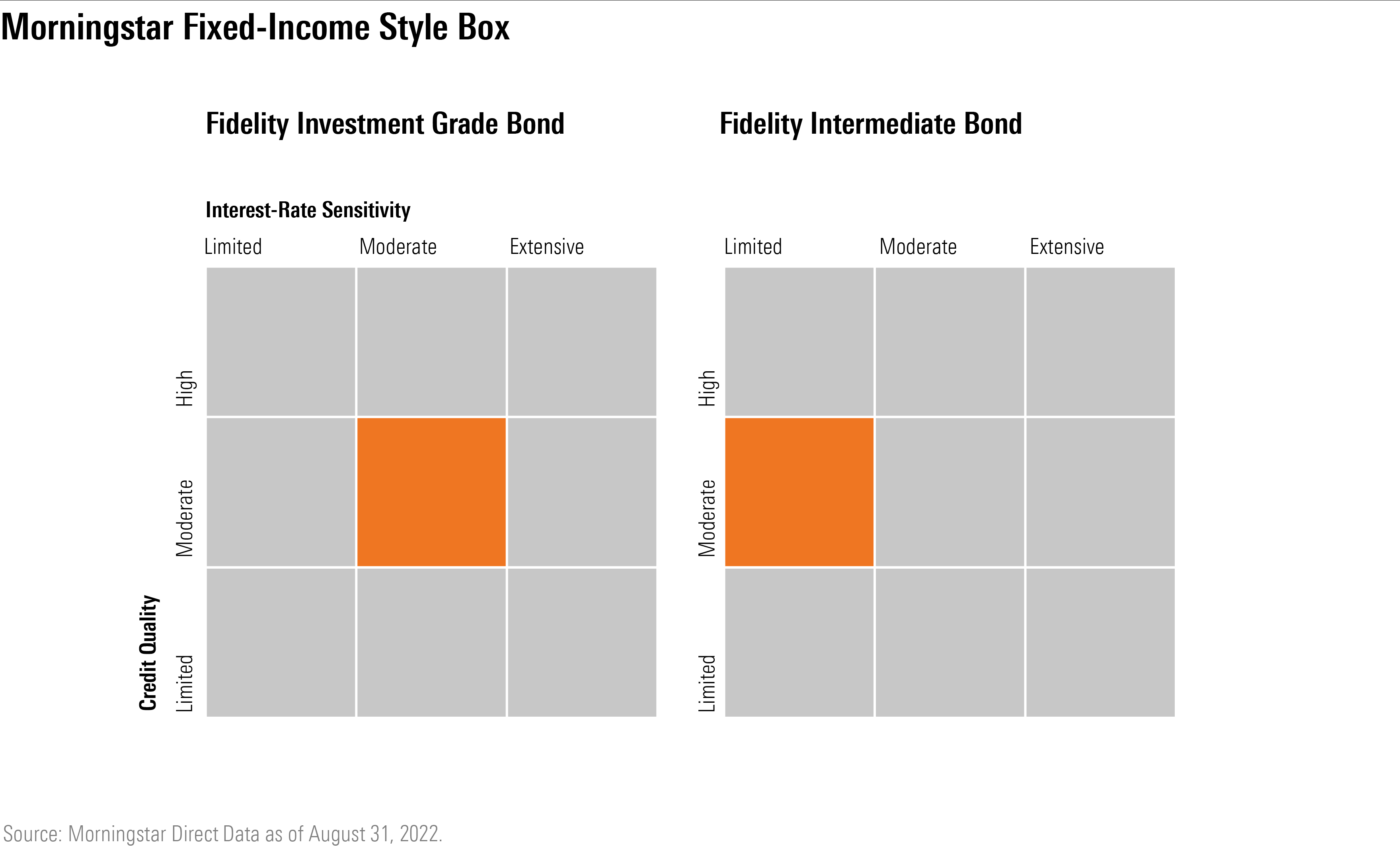

Investors can assess the credit quality of any bond fund by comparing it against other funds using the Morningstar Fixed-Income Style Box, which plots the credit quality and interest rate sensitivity of a fund.

Investing in riskier securities has brought mixed results lately. Recession fears have dampened high-yield corporate bond returns for most parts of the year, and the performance of securitized credit has taken a hit as higher interest rates jeopardizes the ability of borrowers to make interest payments.

“It matters where managers are taking their risk,” says Morningstar analyst Chiayi Tsui. Tsui adds that even if funds take on more credit risk, they can balance that by lowering the sensitivity of the fund to changes in interest rates—another major variable for bond funds.

Original Postgid=articleoffer/relocate=https://www.morningstar.com/newsletters/smart-investor">

NEWSLETTERS

Smart Investor

Markets editor, Tom Lauricella, delivers a weekly rundown of Morningstar’s latest on the big trends driving the markets and new investment opportunities.Subscribe Now

Here’s a closer look at the funds that made it through our screen.

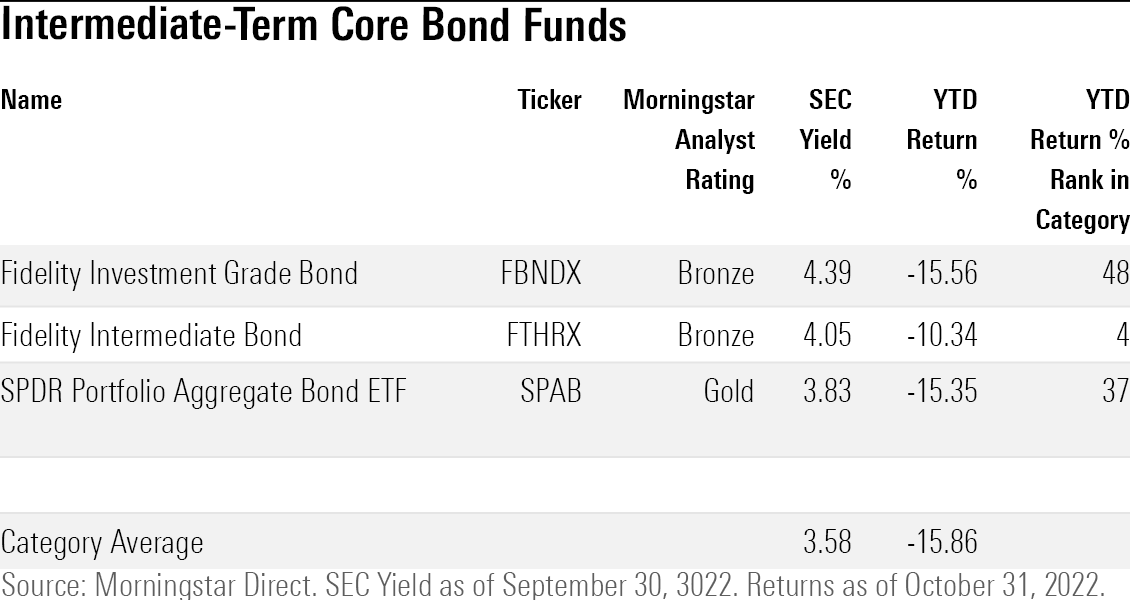

Highest-Yielding Intermediate-Term Core Bond Funds

Intermediate-term core bond funds make up a central position in most diversified portfolios. These are generally tame investment strategies, and though managers must stay in the confines of the category, investing mostly in investment-grade government and corporate debt, there are some higher yielding options.

- Amazon Prime Video (Video on Demand)

- Jim Parsons, Rihanna, Steve Martin (Actors)

- Tim Johnson (Director) - Tom J. Astle (Writer) -...

- English (Playback Language)

- English (Subtitle)

- ✨【Night Lights Plug into Wall】: 0.5 watts,...

- 💕【Dusk to Dawn Sensor Night Light】:...

- 🐋【Personalized Night Light】:Takes the space...

- 🌃【Widely Used】: This plug in night light...

- 💡【Satisfied Service】If you’re ready to...

While the average intermediate core bond had a 3.58% yield as of Sept. 30, Fidelity Investment Grade Bond posted a 4.39% SEC yield. “The fund has taken on more credit risk,” says Morningstar senior manager research analyst Mike Mulach.

Fidelity Intermediate Bond offers one of the highest yields in the category at 4.05%. Morningstar manager research analyst Saraja Samant says the fund has “more exposure to corporate bonds that generally yield higher than Treasury bonds.”

The Fidelity Intermediate Bond fund has outperformed most intermediate-term core bond funds this year. Intermediate Bond lost 10.34% through Oct. 31, compared to the average intermediate-term core bond fund’s 15.86% drop. Samant says, “the fund has a shorter duration in the category, meaning its sensitivity to interest rate changes is lower than most funds in the category.”

Intermediate-term core-plus bond funds have broader mandates than the bond funds Morningstar classifies as intermediate-core bond. Funds in this category can venture more into riskier corners of the bond market scooping up higher yields. The average intermediate-term core-plus bond fund yielded 4.07% as of Sept. 30.

TIAA CREF Core Plus Bond has been yielding higher than the average fund with a 4.53% SEC yield. Morningstar’s Tsui says “the fund’s yield has been a bit higher than its typical rival since early 2020.” The managers have been “sourcing a bit more for emerging markets,” she says. “That 10.2% stake in emerging-markets debt is almost 4 times the category peer median, though, and about half of it is rated below-investment-grade,” she wrote in a report published in February.

The managers have balanced riskier allocations with shorter interest rate bets. “These allocations represent increased credit risk, but the strategy’s yield (a proxy for risk) has hugged quite closely to the peer median in the past couple of years, indicating a reasonable level of risk-taking,” she wrote.

Short-Term Bond Funds

Short-term yields have risen the fastest over the past year. One year ago, the average short-term bond fund yielded only 0.90%, but as of Sept. 30, the average stood at 3.75%. That was slightly above what the average intermediate-term core bond fund offered.

- AIRTIGHT LIDS & 3 GRATER ATTACHMENTS The airtight...

- NON-SLIP SILICONE BOTTOMS The rubber on the bottom...

- NESTING BOWLS & DISHWASHER SAFE These kitchen...

- 6 SIZES BOWLS & EXTRA KITCHEN TOOLS SET The range...

- DURABLE STAINLESS STEEL The stainless steel...

- ✅FOOD GRADE SILICONE -- Made of food-grade...

- ✅NO BEND & NO BREAK & HEALTHY FOR COOKWARE --...

- ✅HIGH TEMPERATURE WITHSTAND:The Silicone Cooking...

- ✅33 DURABLE WOODEN HANDEL KITCHEN UTENSILS SET -...

- ✅BEST KITCHEN TOOLS :One- piece stainless steel...

Morningstar’s Samant says that’s not a surprise given the Fed’s increase in interest rates, which most directly affect shorter-term bonds. Samant says short-term yields should stay higher until the Federal Reserve pivots and starts decreasing rates, offering investors a rare opportunity to earn higher yields and still keep interest rate sensitivity in check. (While the Fed’s moves directly affect short-term bonds, longer-term bond prices have greater swings on changes in interest rates.)

Baird Short-Term Bond carried one of the highest yields in the category at 4.05% as of Sept. 30. “This team takes risk through credit rather than interest rates,’’ writes Morningstar senior analyst Gabriel Denis. “When the team wants to add credit risk, it prefers well-trafficked corporate bonds or high-quality securitized credit,” he writes. The Gold-rated fund has outperformed this year, losing only 4.97% compared with the average short-term bond fund’s decline of 6.60%.

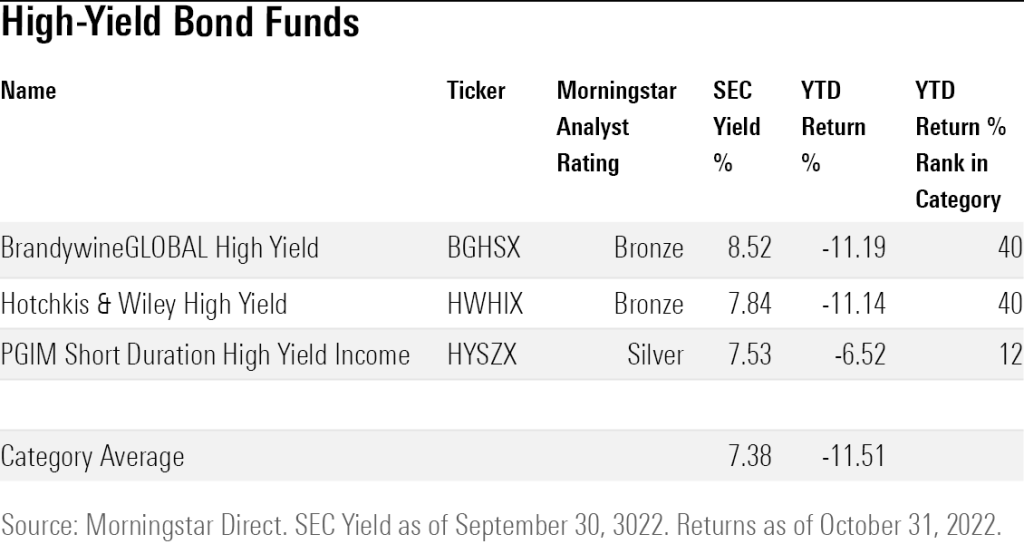

High-Yield Bond Funds

High-yield bond funds have been offering the most income from any category of bonds, and Brandywine Global High Yield is one of the highest. The fund reported an 8.52% SEC yield as of Sept. 30, well above the average high-yield fund’s 7.38%.

And in a dynamic similar to other funds that have outperformed this year, PGIM Short Duration High Yield Income has balanced higher yields with less interest rate sensitivity this year. The fund has lost only 6.52% this year, while the average high-yield fund is down 11.51%.