There are always two sides to every story, and the first quarter of 2023 is no exception for emerging markets (EM) debt. On one hand, the asset class suffered from an increase in risk aversion led by concerns about the health of the U.S. banking sector. On the other hand, we believe those concerns should drive the end of the monetary tightening cycle and improve the global macro backdrop, supporting EM debt fundamentals.

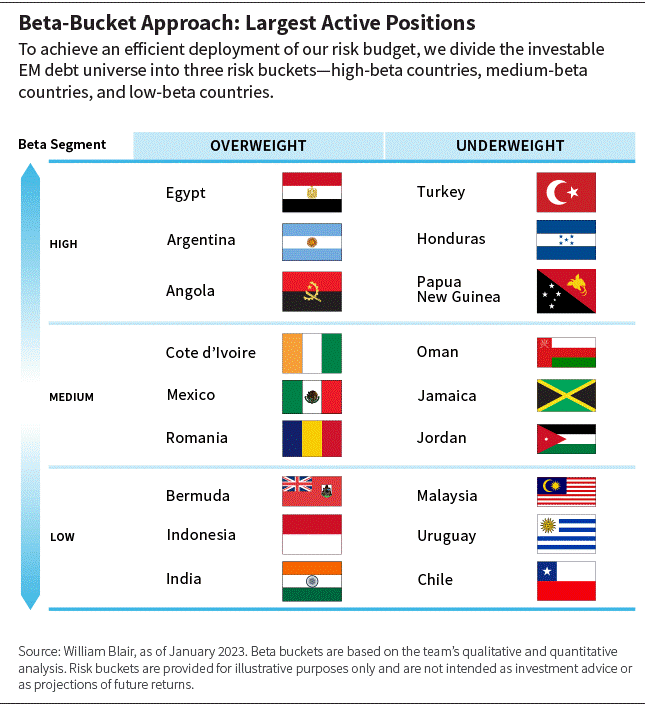

A View of the Opportunities: Overweight/Underweight

There’s a lot to like about EM debt as we make our way through the second quarter.

The distressed debt market may present opportunities if default probabilities are overestimated and recovery values are underestimated, as we believe they are. We see value in high-beta, high-yield credit, and are positioned for high-yield/investment-grade spread compression.

We also see select opportunities in EM local currency debt, where currency valuations and term premiums for local rates appear attractive; and corporate credit, where there are differentiated fundamental drivers, favorable supply technical conditions, and attractive absolute valuations.

Moreover, we have recently added diversified exposure to our financials positions as U.S. financial contagion seems muted.

That said, we see considerable scope for fundamental differentiation, and prefer countries with easier access to multilateral and bilateral funding and issuers with low refinancing needs and robust balance sheets.

In Latin America, our positions are diversified across oil and gas; technology, media, and telecommunications (TMT); utilities; and industrials and financials. We are focused on Brazil, Colombia, and Central America.

In Central and Eastern Europe, the Middle East, and Africa (CEEMEA), our positions are diversified across financials; oil and gas; TMT; utilities; metals and mining; and real estate. We are focused on the United Arab Emirates (UAE), Eastern Europe, and Africa.

In Asia, our positions are diversified across oil and gas; financials; industrials; metals and mining; technology, utilities; and real estate. We are focused on China, India, and Indonesia.

Our highest-conviction overweight and underweight positions are shown in the table below.

High-Beta Bucket

In the high-beta bucket, our largest overweight positions are in Egypt, Argentina, and Angola, and our largest underweight positions are in Nigeria, Honduras, and Bolivia.

Egypt (overweight): We believe Egypt’s external financing needs will be met with support from the International Monetary Fund (IMF) and the country’s partners in the Middle East, and recent currency adjustments will reduce imbalances and support increased financial inflows.

Argentina (overweight): We see the possibility of a positive regime change following elections in the second half of 2023, but we are concerned about the country’s international reserve position. Our exposure is primarily in what we believe are more defensive securities and higher-quality provincial paper, which we believe should pay down prior to a new government taking office next year.

Angola (overweight): Angola’s policies are prudent, and the exchange rate flexibility it demonstrated last quarter cements our positive view.

Nigeria (underweight): Nigeria has low revenue-mobilization capacity, which, in combination with expansive fiscal policies (particularly fuel subsidies), is contributing to a rise in public debt levels (albeit from a low base). Most fiscal gains achieved from high oil prices in 2022 have already been absorbed by low oil output and the costly gasoline subsidy. This could further strain already low government revenues.

Bolivia (underweight): We do not have a position because we are concerned about macroeconomic fundamentals. Bolivia has had an unsustainable policy mix of high fiscal deficits and an inflexible exchange regime. There are currently severe shortages of foreign exchange, and Bolivia faces an uncertain future.

Honduras (underweight): We do not have a position because we believe Honduras is on a declining trajectory and we are not properly compensated for the risks. In particular, we are concerned about the direction of policy. President Xiomara Castro has undone many of the previous administrations’ positive reforms and has distanced herself from the IMF.

Medium-Beta Bucket

In the medium-beta bucket, our largest overweight positions are in Mexico, Cote d’Ivoire, and the Dominican Republic, and our largest underweight positions are in Oman, Jamaica, and Bahrain.

Mexico (overweight): Recently, President Andrés Manuel López Obrador (AMLO) attempted to change how elections were governed to benefit his party, but the country’s supreme court suspended the implementation of the proposed changes. Elections are scheduled to take place in July 2024. Our overweight is largely due to our position in the state-owned oil company whose spreads (among the widest over the sovereign in the EM debt universe) appear attractive.

Cote d’Ivoire (overweight): We believe fundamentals remain relatively supportive on the back of attractive valuations in long-dated euro-denominated bonds.

Dominican Republic (overweight): The Dominican Republic remains one of the brightest fundamental stories in Latin America, in our opinion. We have a small overweight in sovereign bonds, but have rotated exposure into the belly of the curve as we think relative value is attractive and there is scope for spread compression.

Oman (underweight): Our underweight is predominantly due to tight valuations and heavy investor positioning. Oman has been a strong reform story over the past couple of years, but we believe its success is fairly priced into its bonds. Moreover, the country is still highly dependent on oil, where prices are vulnerable to slowing global growth.

Jamaica (underweight): We currently do not have a position, largely due to valuations. Since the government undertook an IMF program many years ago, Jamaica’s finances have been solid. However, Jamaican credit spreads are close to all-time tights, so we see little value left.

Bahrain (underweight): Our underweight is predominantly due to valuation concerns. Bahrain’s sensitivity to lower oil prices is high, and while there has been some successful fiscal reform, debt metrics do not support the tighter spreads, and the potential for supply to come to the bond market is high.

Low-Beta Bucket

In the low-beta bucket, our largest overweight positions are in Bermuda, Saudi Arabia, and Guatemala and our largest underweight positions are in the UAE, Malaysia, and Chile.

Bermuda (overweight): We believe Bermuda is on a strong fundamental trajectory and is in a much stronger position institutionally than other Latin American low-beta credits, such as Chile and Peru.

Saudi Arabia (overweight): We believe Saudi Arabia is the strongest credit in the region given its positive reform story, which diversifies the economy away from dependence on oil. Recent rating upgrades support this trend, and we are comfortable with relative valuations.

Guatemala (overweight): Guatemala has solid macro fundamentals but suffers from limited governability due to its small size. We are basically neutral to the benchmark via sovereign debt; our overweight is largely due to corporate exposure.

UAE (underweight): We have reduced positions in Sharjah and Dubai, where spreads have rallied, because we believe there are better uses of cash in the lower-beta region. Our positioning in the UAE is now largely concentrated in the stronger Abu Dhabi credit.

Malaysia (underweight): We see valuations as unappealing, especially in longer-duration sovereign and quasi-sovereign bonds.

Chile (underweight): Valuations are tight and the country’s political trajectory is uncertain. After the failed approval of a new constitution, we think institutional uncertainty lingers and there are more attractive markets in which to invest.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Asset Allocation: The Power of Traditional Thinking