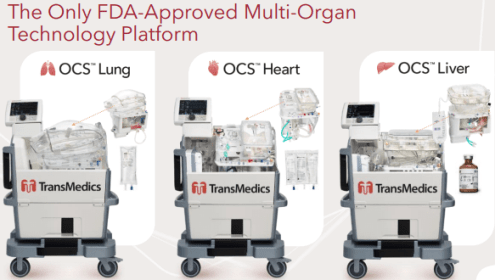

TransMedics Group, Inc., a pioneering medical technology company, specializes in organ transplant therapy. Their Organ Care System (OCS) is a leading solution for prolonging organ vitality and minimizing post-transplant complications. With a focus on liver, lung, and heart transplants, the company has significantly increased transplant numbers and aims for continued growth, making it an attractive investment opportunity.