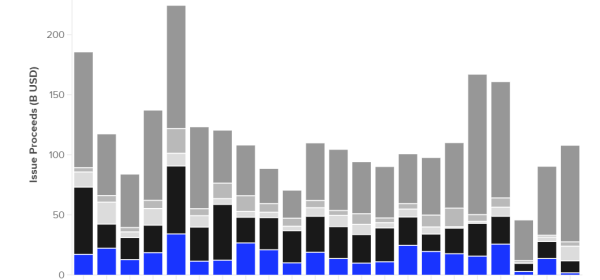

The Yield Curve, with the 10yr minus 3mo Treasury rate, is rising rapidly as investors anticipate more persistent inflation. Portfolio managers expect a significant rate decline, but recent industrial earnings reports and guidance suggest a shift towards industrials. This signals a turning point away from the sole focus on high tech investments to broader options.