The auto industry is competitive with high inventory levels, presenting a buyer’s market. Tesla offers affordable leasing, but misses out on EV tax credits. Toyota’s Camry Hybrid leases for $439/mo with lower down payment, while the Tesla Model 3 lease costs $329/mo with higher down payment but potential resale value advantage.

Category: Investment

Tesla Is An AI Company That The Market Won’t Reward For Now

Tesla’s production ramps are moving in the right direction, and I expect the Cybertruck to contribute meaningfully to Tesla’s profits later this year, but in Q2, I expect Tesla’s Automotive margins to remain depressed

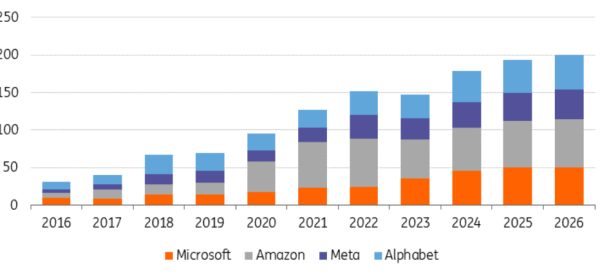

AI Frontrunners Will Benefit Most, With Microsoft In The Lead

The hyperscale data centre market is dominated by leading tech companies, positioning them to lead the AI revolution and gain substantial value. Major players like Microsoft are expected to provide actual AI services, with substantial investments in digital infrastructure. The emergence of AI-driven solutions presents opportunities in various sectors, driving growth in the cloud software market.

ASML Is Positioned For A Cyclical Upswing With EUV

ASML reported a cyclical downturn for q1’24, with an expected decline into eq2’24 before an upswing later in the year. The shift to EUV for advanced chip nodes is anticipated to boost demand, with significant investments expected from Intel and Taiwan Semiconductor. ASML shares are recommended as a BUY with a price target of $1,134/share at 32.49x EV/EBITDA.

Cloudflare: Too Much Optimism

Cloudflare’s share price surge may have outpaced its fundamentals, leading to overly optimistic near-term expectations. While the company’s fourth quarter results were strong, cautious customer technology investments and higher interest rates may affect spending. Cloudflare’s long-term promise is attractive, but current valuation and market conditions signal potential weakness ahead.

Amazon Web Services Expands Bedrock GenAI Service

The Generative AI landscape is diverse, with various vendors offering solutions. Cloud computing giants like Google and Amazon are unveiling GenAI-powered capabilities, enhancing their services for GenAI applications. Amazon’s Bedrock GenAI now supports customized models and offers tools for creating AI agents and evaluating models. These enhancements are crucial as organizations focus on near data deployment and multi-platform GenAI use.

IBM: Best Strategies For Success

IBM’s AI development has mainly focused on the Software segment, but has not significantly impacted revenue growth. The company transitioned to an AI for Enterprise Strategy, launching watsonx AI platform. With 46 partnerships and a shift to a software-centric approach, IBM aims to drive growth through hybrid cloud solutions. Despite challenges, the company’s strategic initiatives show promise.

AMD: Making A CUDA Killer

AMD is challenging Nvidia’s GPU dominance with new developments in their CUDA competitor and strong Q4 performance. By investing in open-source alternatives and fostering partnerships, AMD aims to disrupt Nvidia’s market share. With the AI sector projected to reach $400 billion by 2027, AMD’s strategy holds significant potential for capturing a substantial share of the future market.

Is the World Deglobalizing?

Neil Shearing, the economist at Capital Economics, discusses trouble and strength in emerging markets, India’s potential as a major economy, and the impact of geopolitical tensions on global markets. He explains the potential challenges of implementing new tax cuts in the US and the changing landscape of global trade, emphasizing a move towards fragmentation and national security concerns.

Five Key Charts to Watch in Global Commodity Markets This Week

Earnings season is underway, featuring Big Oil companies and heavy-machinery maker Caterpillar Inc. Five significant charts for the global commodity markets include insights on oil production growth, silver’s price surge, Brazilian corn harvest impact, peak LNG demand in Europe, and Caterpillar’s influence on mining and construction industries. These highlights provide valuable indicators for market trends.

Most New Data Center Capacity Is Still In Primary Markets

The demand for data center capacity has grown significantly due to COVID-19 and supply chain disruptions. Despite some movements to secondary markets, top markets remain crucial due to factors like critical mass, connectivity, and policy environment. Silicon Valley has lost ground to Phoenix due to improved fundamentals, but new capacity is still predominantly in primary markets.

Silver Demand Outstrips Supply For Third Straight Year

Silver demand exceeded supply for the third consecutive year in 2023, leading to a significant structural deficit of 184.3 million ounces, despite a 7% decline in total silver demand. Industrial demand, particularly in green applications, set a record, with expectations of further growth. Silver investment demand fell, but the Silver Institute projects a 2% demand increase in 2024.

Is a Commodities Super Cycle on the Way?

McAlinden Research Partners discusses the potential for a commodities supercycle. Despite stock market strength, commodities are varied, impacted by geopolitics and cycles. Factors include inflation, job market trends, US dollar strength, and 2024 election impact. While not at the supercycle’s beginning, it may be on the horizon. ETF options are limited, but some offer potential.

Buy 6 Ultra-Yield MLPs Now As Middle East War Could Explode

The major oil benchmarks have experienced significant fluctuations, with potential concerns over supply disruption due to Middle East conflict. Investors seeking energy exposure and income should consider Master Limited Partnerships (MLPs). Notable MLPs include Enterprise Products Partners, Energy Transfer, Hess Midstream, Mach Natural Resources, MPLX, and USA Compression Partners, offering high dividend yields and stable distributions.