We previously analyzed that International Business Machines Corporation's (NYSE:IBM) AI development predominantly revolved around the Software segment, representing 84.2% of AI projects. However, despite a diverse patent portfolio, AI has not notably boosted revenue growth as seen with the company's poor 5-year average growth (-4.4%). Although disclosed Intellectual Property and Custom Development Income increased by 8.4% to $664 mln in 2022, it fell short of the company's 10-year 17% average growth. Despite building a huge AI patent portfolio, we believe that the company has not fully capitalized on its portfolio, with IP income as a percentage of revenue growing modestly from 0.8% to 1.1%.

In this analysis, we delve into IBM's strategic initiatives to evaluate their effectiveness. Our analysis begins with an exploration of IBM's transition from its former Product Development strategy to its present AI for Enterprise Strategy, with a particular focus on its watsonx initiatives. Subsequently, we scrutinize IBM's pivot towards a software-centric approach, emphasizing hybrid cloud solutions. This shift is assessed by analyzing the trend of the share of its Software segment revenue of its total revenue, contrasting with its previous emphasis on Segment Diversification and M&A. Finally, we assess IBM's cross-selling strategy, evaluating its potential to generate synergies for the company.

AI for Enterprise strategy

Previous strategy: Product Innovation & Internal Product Development

In our previous analysis, we highlighted IBM's product innovation strategy with its pioneering contributions to computing. IBM initially dominated the tech sector with a 62% market share in 1962 attributed to its IBM 5100 portable computer. However, we identified that the company could not develop a competitive advantage compared to other new competitors with cheaper products and new product innovations. Thus, its share was substantially taken away by Compaq, Apple (AAPL), and Packard Bell after 1994.

Since then, the company has focused on internal product development as a strategy to regain its position in the market. We highlighted in our previous analysis that IBM has a broad portfolio of patents focusing on “high-impact advancements in the specific areas of hybrid cloud, data and A.I., automation, security, semiconductors, and quantum computing”.

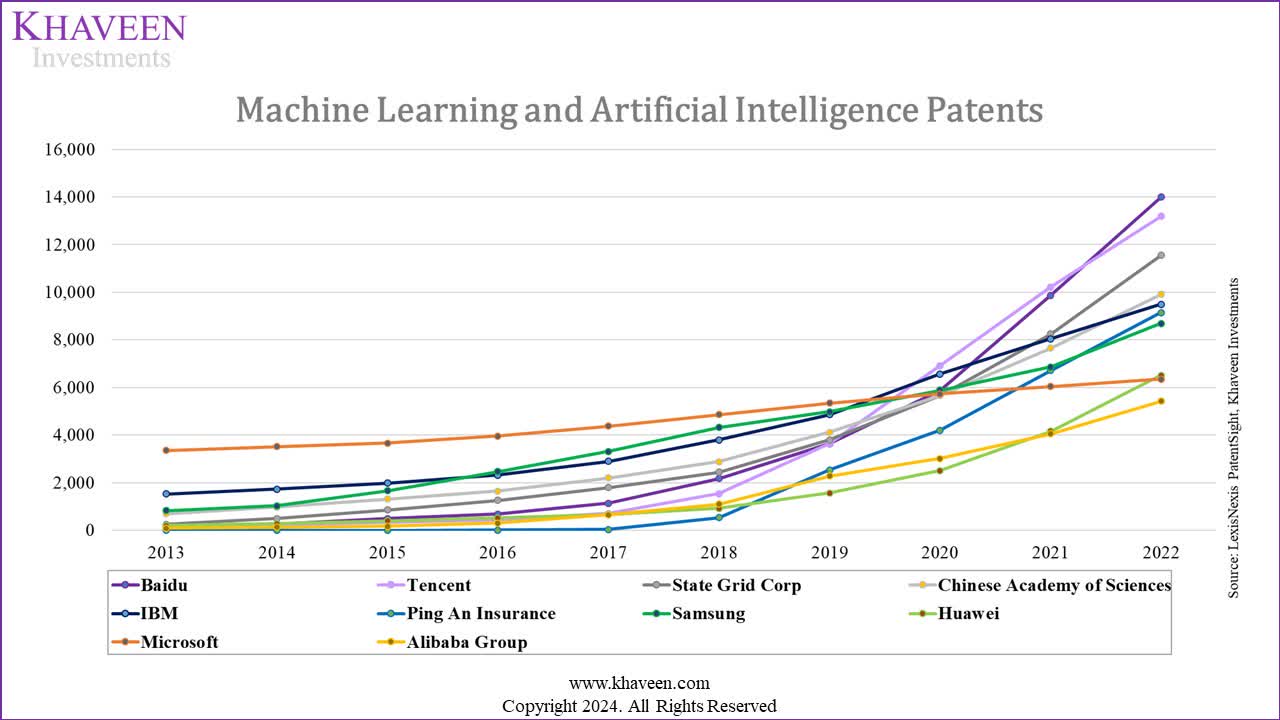

LexisNexis, PatentSight, Khaveen Investments

From the chart, IBM has seen a substantial surge in machine learning and AI patents, growing from 1,528 to 9,497 between 2013 and 2022 which is an increase of over 520%, equivalent to a CAGR of approximately 23%. This notable growth has elevated IBM to the top position among US companies in AI patents, surpassing Microsoft (MSFT).

However, we believe that the company, despite its large scale of patent portfolios and pioneering products, has not been able to significantly benefit IBM and is not indicative of IBM's competitive strength as we previously summarized below.

…we believe that the company does not have a positive track record of patent utilization as the company did not significantly benefit from licensing and selling its patents as it accounted for 1.1% of revenue with an average growth of -12.8%. Moreover, we believe the patents did not significantly benefit the companies that IBM had licensed its patents, given the lack of sustained partnerships. Additionally, the company's total revenue growth was also negative at -4.4% despite the company's patent leadership over the years. – Khaveen Investments

Current Strategy: AI for Enterprise Strategy

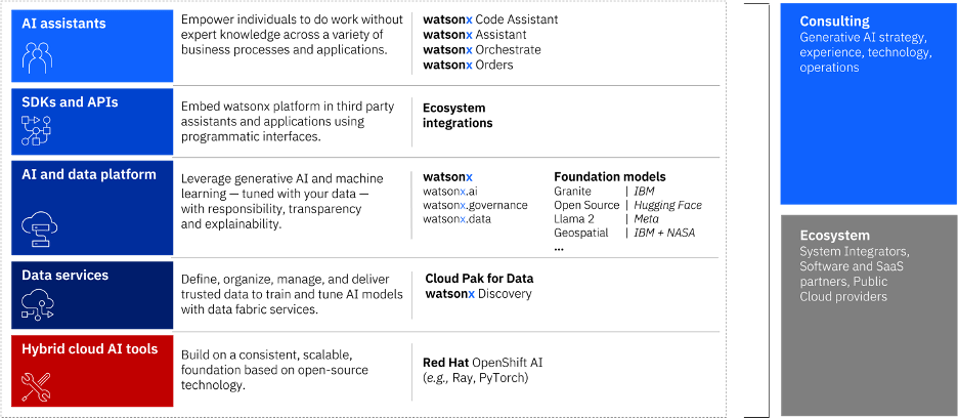

In 2020, IBM announced the split into 2 companies (IBM & Kyndryl) with IBM focusing more on AI applications. We examined whether IBM could execute on its AI strategy as highlighted by management. We identified 5 product offerings under its AI strategy, particularly targeting Consulting and Software segments, as seen in the picture below.

Forbes, IBM

watsonx AI Platform for Enterprise

One of the company's recent initiatives for its AI strategy was the launch of watsonx AI platform for Enterprises in 2023 to offer trained foundation models and open-source models for customers with access to the “toolset, technology, infrastructure, and consulting expertise to build their own – or fine-tune and adapt available AI models – on their own data and deploy them at scale in a more trustworthy and open environment to drive business success.”

In addition, watsonx platform consists of three product sets:

- IBM watsonx.ai: Offers AI builders an enterprise studio for training, testing, and deploying both traditional and generative AI models.

- IBM watsonx.data: Features an open lake house architecture data store optimized for governed data and AI workloads, reducing data warehouse costs by around 50%.

- IBM watsonx.governance: Provides an AI governance toolkit for trusted AI workflows.

IBM highlighted the platform could support enterprises in 5 key areas, including “interacting and conversing with customers and employees; automating business workflows and internal processes; automating IT processes; protecting against threats; and tackling sustainability goals”.

| watsonx products | Number of customer partnerships |

| watsonx | 6 |

| IBM watsonx.ai | 20 |

| watsonx.data | 16 |

| watsonx.governance | 4 |

| Total | 46 |

Source: IBM, Khaveen Investments

We identified that IBM has 46 partnerships, including Samsung (OTCPK:SSNLF), Intel (INTC), and Deloitte across its product sets. Moreover, SAP (SAP) also collaborated with IBM to integrate the platform with its solutions. In addition, we identified 22 Technology partners between IBM and tech companies to either integrate watsonx with their solutions or provide their open models to IBM's enterprise customers.

| Rank | LLM | Organization | Year Launched | Parameter count | MMLU Benchmark Comparison |

| 1 | GPT-4 | OpenAI | 2023 | ~1,800 bln parameters | 86.4 |

| 2 | Switch | 2022 | 1,600 bln parameters | N/A | |

| 3 | PaLM | 2022 | 540 bln parameters | ||

| 4 | Megatron-Tuning | NVIDIA (NVDA) | 2022 | 530 bln parameters | N/A |

| 5 | PaLM2 | 2023 | 340 bln parameters | 78.3 | |

| 6 | ERNIE 3.0 TITAN | Baidu (BIDU) | 2021 | 260 bln parameters | N/A |

| 7 | Falcon | Technology Innovation Institute | 2023 | 180 bln parameters | 70.6 |

| 8 | OPT | Meta AI (META) | 2022 | 175 bln parameters | N/A |

| 9 | GPT-3 | OpenAI | 2020 | 175 bln parameters | 43.9 |

| 10 | LaMDA | Google (GOOG) | 2020 | 137 bln parameters | N/A |

| 11 | Claude 2 | Anthropic | 2023 | 130 bln parameters | 78.5 |

| 12 | GLM | Tsinghua University | 2022 | 130 bln parameters | 44.8 |

| 13 | Galactica | Meta AI | 2022 | 120 bln parameters | 52.6 |

| 14 | Chinchilla | Google DeepMind | 2022 | 70 bln parameters | 67.5 |

| 15 | LLaMA | Meta AI | 2023 | 70 bln parameters | 68.9 |

| 16 | UL2 | 2022 | 20 bln parameters | N/A | |

| 17 | GPT-NeoX | EleutherAI | 2022 | 20 bln parameters | 35.95 |

| 18 | Granite | IBM | 2023 | 13 bln parameters | 40.06 |

| 19 | Flan-T5 | 2022 | 11 bln parameters | 55.1 | |

| 20 | H3 | Stanford University | 2022 | 2.7 bln parameters | N/A |

Source: Company Data, Khaveen Investments

In our previous analysis of Microsoft, we compared the LLM/Foundation models released in the market. We have updated our table for the top 20 models and highlighted that OpenAI's GPT-4 remained the best LLM model due to its tremendous parameter count of approximately 1.8 tln parameters. In addition, IBM's LLM model called Granite has a parameter count of 13 bln, ranked #18 in the table. IBM mentioned that its watsonx AI leverages this model, but the company also integrates third-party foundation models from other companies such as Google (Flan-T5), Meta (LLaMA), and Hugging Face models to cater to different needs of customers. We believe this could be due to its customers' demand for flexibility in choosing the models that are suitable for their use cases, as also highlighted by management below.

Clients are asking for choice and flexibility to deploy models that best suit their unique use cases and business requirements. – Kareem Yusuf, Product Management & Growth, IBM Software

However, the Granite model only costs $0.0006/1,000 tokens, while Meta's Llama model with 70 bln parameter costs triple that amount. Hence, we believe this is the company's move to offer more cost-effective models for its watsonx platform.

Outlook

We highlighted IBM's previous strategies focused on internal product innovation and development but faced challenges maintaining market dominance due to the company's lack of competitive advantages. Moreover, despite having a large patent portfolio catering to different segments including AI, IBM was unable to capitalize on it, resulting in a negative average growth over the years. However, the recent launch of watsonx AI platform with different product sets has helped the company to secure a substantial number of partnerships with enterprises. However, it is worth noting that the capability of its LLM model (Granite) lags behind several other models, with a parameter count of only 13 bln. Based on its AI roadmap below, IBM is planning to expand its enterprise applications by using more advanced transformers. Therefore, we expect that AI for enterprise products such as watsonx platform will continue to drive the company's AI strategy in the near future. However, it remains to be seen how effective IBM will be in monetizing these product developments given they have a less-than-stellar track record in leveraging their innovations.

IBM

Software-focused Strategy

Previous Strategy: Segment Diversification Strategy & M&A Strategy

In our previous analysis, we highlighted IBM's segment diversification strategy as it shifted its focus from the Hardware segment to high-margin segments, including the Software and Consulting segments. The revenue contribution of the Hardware segment dropped from 84% in 1986 to 23.6% in 2023. We believe the company achieved this by pursuing M&A across various business segments including software and IT consulting. We previously analyzed the company's track record of M&A activities including 69 acquisitions in the past 10 years until 2022.

While not significant, we determined that its inorganic revenue growth contributed more to its total revenue growth vs organic growth as it was higher at an average of 3.5% per year compared to the company's average growth rate (-5.6% on average). We attribute this to higher growth in the Software segment.

Current Strategy: Software-Focused Strategy

As the company has already become more diversified, we believe the company will continue making an active effort to focus its alignment on the software segment.

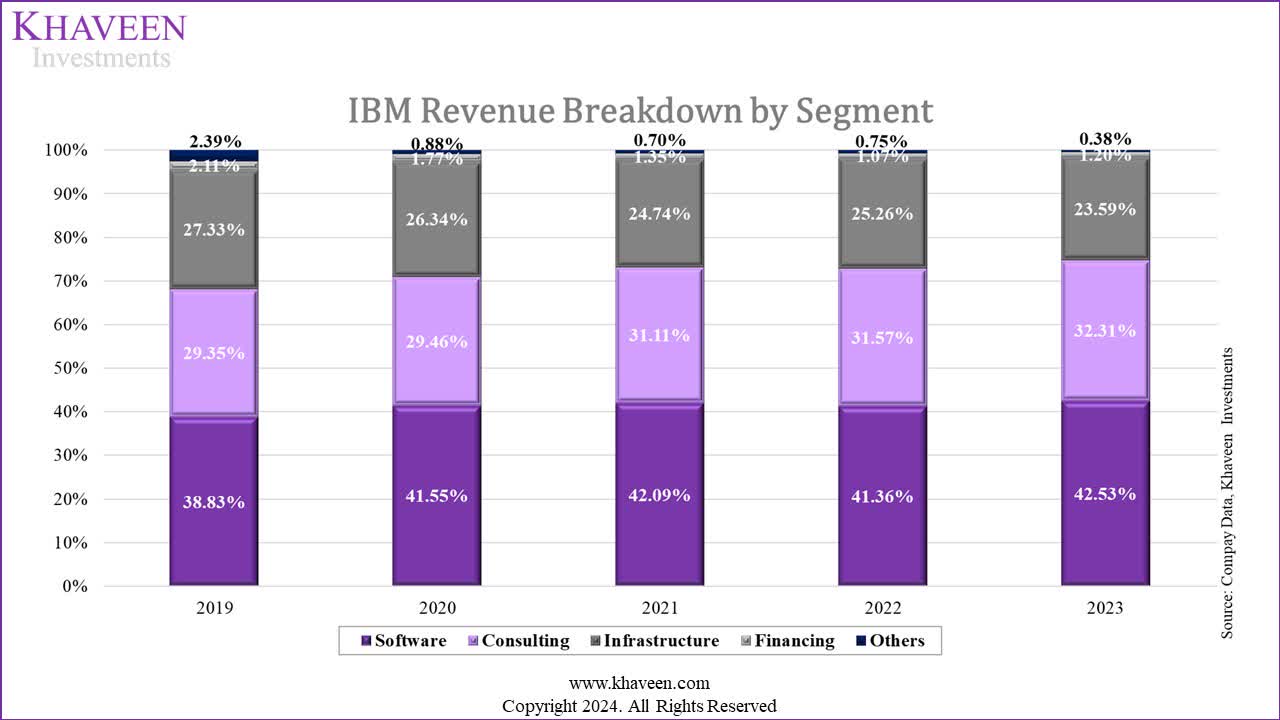

Company Data, Khaveen Investments

As seen in the chart above, IBM's software and consulting segment share of revenue has been increasing since 2019. However, the Software segment's share of revenue improved by 3.51% over the last 5 years, which is the highest growth among all segments, whereas Infrastructure and Financing segments had their share of revenues decline over the same period.

| IBM's Acquisitions | 2019 | 2020 | 2021 | 2022 | 2023 | Average |

| Software-related acquisitions | 1 | 4 | 8 | 4 | 7 | 5 |

| Total Acquisitions | 1 | 7 | 15 | 8 | 9 | 8 |

| Share of Software-related acquisition (%) | 100% | 57% | 53% | 50% | 78% | 68% |

Source: Company Data, Khaveen Investments

In addition, the table of IBM acquisitions over the same period revealed that software-related acquisitions accounted for 68% of total acquisitions on average. Therefore, we believe this indicates the company's shift towards a software-focused strategy.

Hybrid Cloud and Red Hat OpenShift

As company management highlighted the focus on the hybrid cloud, we believe that the hybrid cloud is IBM's biggest growth driver in the software segment. We examined the growth in this subsegment and determined whether it could drive the company's growth.

In 2021, IBM spun off its Kyndryl public cloud and instead focused on its hybrid cloud solutions business. This is as the company was outcompeted by larger competitors with the likes of AWS (AMZN), Microsoft, and Google Cloud gaining rapid share in the cloud market. Following the spinoff, IBM's hybrid cloud customers increased by 280% to 3,800 with clients such as “Bharti Airtel, Charles Schwab (SCHW), Samsung Electronics (OTCPK:SSNLF), and the U.S. Department of Education”.

Based on the company's annual report, the company highlighted its hybrid cloud strategy featuring Red Hat OpenShift highlighted as “the leading open-source hybrid cloud platform and enables clients to build, secure, operate and manage any application, anywhere, from on-premises environments to multiple clouds and the edge” catering to various enterprise clients including Fortune Global 500 companies.

- Sturdy and Durable: This OROPY wall mounted...

- Sleek Industrial Design: With its simple...

- Optimized Space Utilization: Expand your storage...

- Convenience at Your Fingertips: Hang your daily...

- Versatile Functionality: This multi-functional...

- 【Industrial Clothing Rack】 The clothing racks...

- 【Sturdy & Durable】 Our clothes racks are made...

- 【Height Adjustable】 The height of the lower...

- 【Multifunction Closet Rack】 Wall clothes rack...

- 【Multi-Scene Use】 Dimension: 115” W x87.5”...

- 【Safer Size/Style】: Whole sconces are UL...

- 【Outstanding Details】: Our high-quality black...

- 【NOTE】: Our bar lighting wall sconce include...

- 【Wide Application】: Vintage wall light...

- 【Tips】: As the tube bulb is a bit special, it...

IBM

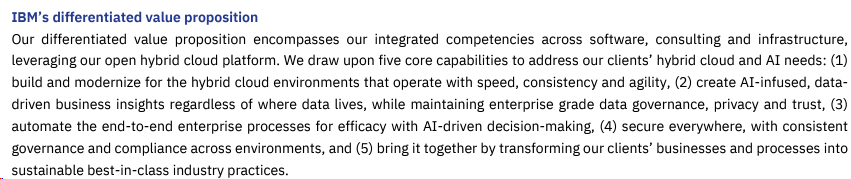

The company has also highlighted several benefits of its hybrid cloud offering better value than the public in terms of “scale, security, ease of use, flexibility, seamless experiences, and faster innovation cycles”. In relation, the company highlighted its differentiation through its value proposition, delivering a fast and agile hybrid cloud.

IBM

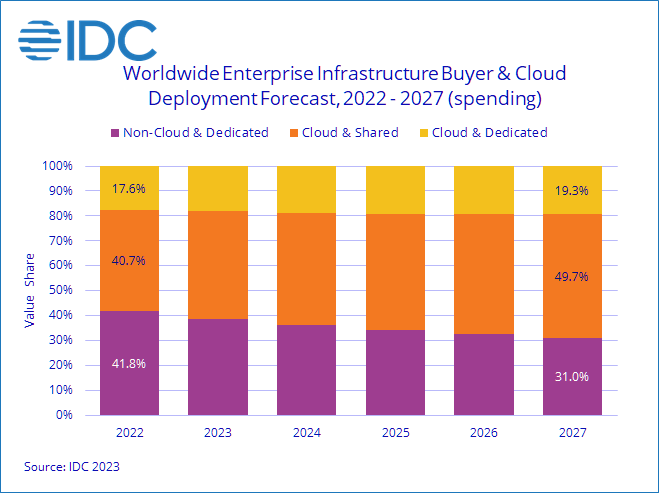

IDC

Based on the chart by IDC, in 2022, the deployment of Non-cloud & Dedicated (Private) infrastructure is the highest at 41.8% and is forecasted to decrease to 31% by 2027. Cloud & Shared (Public cloud services) is expected to rise the most from 40.7% to 49.7% by 2027 whereas Cloud & Dedicated (Hybrid Cloud) is projected to grow to 19.3%. This underscores the expected rapid rise of public cloud overtaking traditional non-cloud deployments, as well as being 2.5x larger than dedicated cloud deployments. We believe one of the factors for the higher growth in public cloud is the advantages it has over hybrid cloud in terms of cost and scalability, as hybrid cloud has a higher total cost of ownership (TCO) as well as compatibility issues despite its greater security benefits.

Outlook

| Hybrid Cloud Revenue ($ bln) | 2020 | 2021 | 2022 | 2023 | 3Y Average |

| IBM Software Segment Revenue | 22.9 | 24.1 | 25.0 | 26.3 | |

| Growth % | 5.3% | 3.7% | 5.1% | 4.7% | |

| IBM Hybrid Cloud Revenue (Software) | 6.9 | 8.7 | 9.32 | 10.17 | |

| Growth % | 26% | 7.1% | 9.1% | 14.1% | |

| Share of Software Revenue (%) | 30.1% | 36.0% | 37.2% | 38.7% | 35.5% |

Source: Company Data, Khaveen Investments

Based on the table above, IBM's hybrid cloud average revenue growth under the Software segment (4.7%) is triple the average revenue growth of the Software segment (14.1%), indicating a good management initiative to focus on hybrid cloud. In addition, its share of software revenue has increased over time from 30.1% to 38.7% in 2023. According to MarketsandMarkets, the hybrid cloud market is expected to grow at a CAGR of 17%, which also aligns with the average growth rate of IBM Hybrid Cloud Revenue (Software) of 14.1%. Therefore, we believe IBM's hybrid cloud revenue could continue to rise reflected by strong demand for hybrid cloud deployment.

Cross-selling Strategy

Previous Strategy: Integration Strategy

We highlighted IBM's Integration Strategy in our previous analysis that the company provided mainframe software (Software segment) which was integrated with its server system (Hardware/Infrastructure segment). However, this is the company's only product integration, and we believe its declining revenue in the Hardware segment and sluggish growth in other segments indicated IBM's inability to successfully synergize the segments.

Current Strategy: Cross-selling Strategy

After the Integration Strategy, We believe that IBM has shifted its strategy toward strategic partnerships rather than the integration of products. For example, the IBM Partner Ecosystem, by integrating the mainframe (IBM Z) into the hybrid cloud, enables the partners to leverage IBM products for their solutions. Not only that, the IBM Partner Plus program allows the customers to utilize the company's Hybrid Cloud to “automate, secure and modernize their businesses”. IBM also created a new tier within its partner program for 8 key industry leaders like AWS, Microsoft, and SAP as its strategic partners. With the combined strengths of each company, we expect IBM to create more attractive and powerful solutions for its customers. IBM also highlighted its specialization in Build, Sales, Services, and Marketing solutions which could leverage the platform and offer its partners high-value solutions.

In addition, IBM highlighted the importance of the partners in its growth and introduced a new Service track to assist partners in “Consultancies, Advisory Firms, Systems Integrators, and Managed Service Providers”. Management also expected that “every dollar of hybrid cloud platform revenue has a multiplier effect of 6 – 8 dollars in services revenue”.

| Revenue Breakdown by Segments ($ mln) | 2020 | 2021 | 2022 | 2023 | Average |

| Hybrid Cloud Revenue (Software) | 6,905 | 8,700 | 9,321 | 10,169 | |

| Hybrid Cloud Revenue (Consulting) | 5,896 | 7,900 | 9,019 | NA | |

| Consulting Revenue | 16,257 | 17,844 | 19,107 | 19,985 | |

| Consulting Revenue to Hybrid Cloud (Software) Revenue Ratio | 2.35 | 2.05 | 2.05 | 1.97 | 2.11 |

| Consulting Revenue to Hybrid Cloud (Consulting) Revenue Ratio | 2.76 | 2.26 | 2.12 | NA | 2.38 |

Source: Company Data, Khaveen Investments

From the table above, we examined the correlations between the revenue of IBM's Hybrid Cloud and Consulting segments. We analyzed that every dollar of hybrid cloud software revenue generates only 2.11x dollars in services revenue, and every dollar of hybrid cloud consulting software generates around 2.38x dollars on average. Furthermore, we observed a downward trend in these correlations and believe this could be due to the higher growth of the hybrid cloud market compared to the consulting market.

Outlook

Despite a lower multiplier effect compared to what management said in the article, we believe that the hybrid cloud could help increase IBM's consulting revenue due to its anticipated strong growth highlighted in the previous point. Moreover, we expect the strategic partnerships in advancing IBM's technologies and hybrid cloud offerings would help the company increase its service revenue.

IBM Partner Plus results from the company's journey to put partners at the center of IBM's go-to-market strategy and act as a growth engine to help capture the $1 trillion hybrid cloud and AI market opportunities. – IBM.

Risk: AWS Launches Generative AI Competency Program for Enterprise

AWS has recently introduced the Generative AI Competency to facilitate the adoption of generative AI among AWS enterprise customers and partners by offering specialized services, tools, and infrastructure in areas such as security, applications and integration. In addition, its customers could also utilize a wide range of its AI products, including “Amazon Bedrock, Amazon SageMaker JumpStart, AWS Trainium, AWS Inferentia”, and Amazon EC2. We believe this could be a threat to IBM and its watsonx AI platform due to the dominance of AWS in the cloud provider market.

Verdict

| IBM Revenue Projection ($ mln) | 2023 | 2024F | 2025F | 2026F |

| Internet Services & Infrastructure | 10,169 | 11,898 | 13,921 | 16,218 |

| Growth % | 9.1% | 17% | 17% | 17% |

| Software | 16,139 | 17,244 | 18,425 | 19,687 |

| Growth % | 2.7% | 6.8% | 6.8% | 6.8% |

| IT Consulting & Other Services | 19,985 | 20,928 | 21,916 | 22,841 |

| Growth % | 4.6% | 4.7% | 4.72% | 4.22% |

| Technology Hardware, Storage & Peripherals | 14,593 | 14,336 | 14,084 | 13,837 |

| Growth % | -4.5% | -1.8% | -1.8% | -1.8% |

| Others | 974 | 974 | 974 | 974 |

| Total Company Revenue | 61,860 | 65,381 | 69,320 | 73,556 |

| Growth % | 2.2% | 5.7% | 6.0% | 6.1% |

Source: Company Data, Khaveen Investments

We updated our forecast of IBM's revenue growth with its 2023 full-year results. For Software, we based the forecast on its 5-year average growth rate of 4.7%. In addition, we forecasted its Technology Hardware, Storage & Peripherals revenue growth based on its 4-year average of -1.8%. In total, we derived a 5-year forward revenue growth forecast of 5.7%.

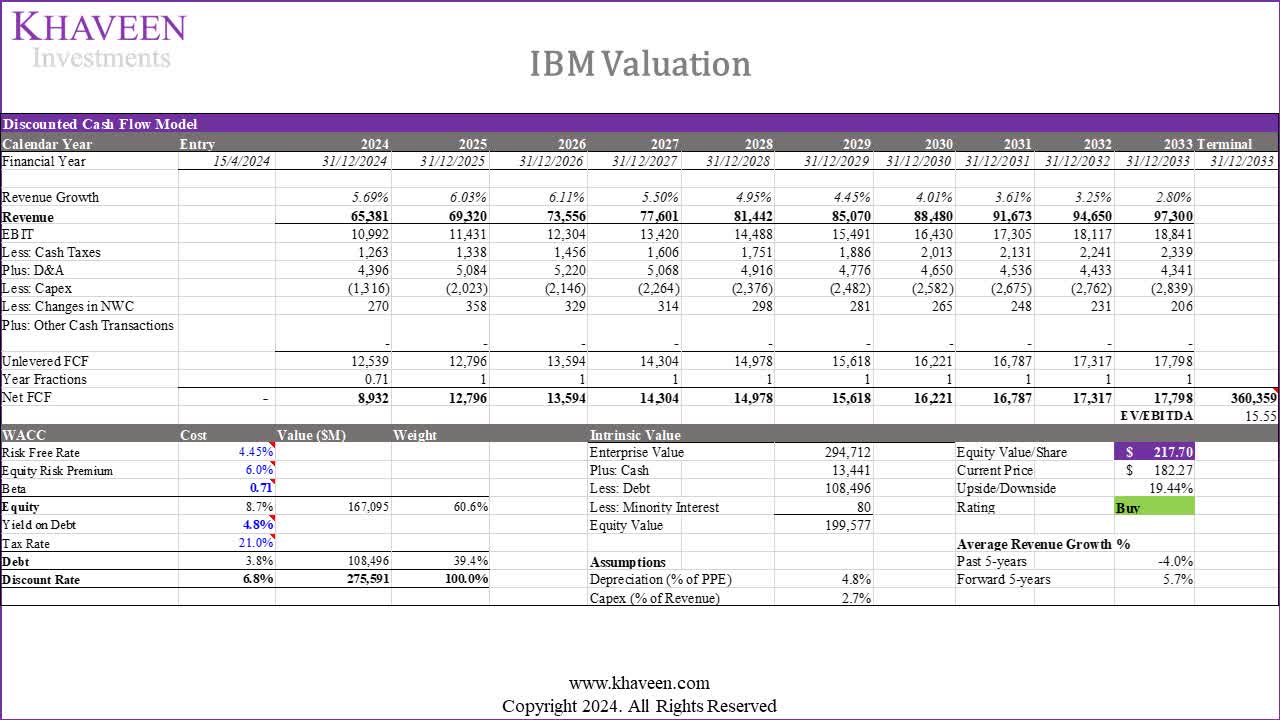

Khaveen Investments

Based on a discount rate of 6.8% (company's WACC), and terminal value based on its 5-year average EV/EBITDA of 15.55x, our model shows an upside of 19.44% for IBM. The updated forward 5-year growth rate is higher than our previous forecast by 0.5% due to the higher growth rate in Software (excluding Hybrid cloud) and Infrastructure segments. In addition, our updated model shows a higher upside due to an increase in the company's EV/EBITDA ratio.

In our analysis, we observed IBM's adoption of its most recent strategies, which include AI Innovation for Enterprise, Software-focused Growth, and Cross-selling strategies. Regarding the AI Innovation for Enterprise strategy, we noticed how the company has leveraged its diverse product offerings, particularly with the launch of its watsonX AI solutions, leading to numerous partnerships with top firms. As for the Software-focused Growth strategy, we anticipate hybrid cloud to serve as the primary growth driver, given the projected 17% CAGR of the hybrid cloud market, as enterprises transition from traditional on-premises solutions. Notably, IBM's Software segment has exhibited robust growth, averaging a rate of 4.1%. Lastly, in terms of the cross-selling strategy between hybrid cloud and consulting services, our analysis suggests a multiplier effect, with IBM's hybrid cloud revenue influencing its consulting segment revenue by approximately 2x. We anticipate that as hybrid cloud revenue continues to rise, IBM's consulting revenue growth will also see improvement.

Based on our updated DCF, we obtained a price target of $217.70 and rated the company as a Buy with a higher price target compared to our previous analysis of $140.52 due to slightly higher forward average revenue growth (5.7% vs 5.2%) and an increase in the company's 5-year average EV/EBITDA (15.55x vs 11.32x).