To dig deeper into this marketplace and explore some of its hidden risks and opportunities, we were introduced to James Pruskowski, Chief Investment Officer at 16Rock Asset Management – a NYC-based

To dig deeper into this marketplace and explore some of its hidden risks and opportunities, we were introduced to James Pruskowski, Chief Investment Officer at 16Rock Asset Management – a NYC-based

The iShares National Muni Bond ETF ( NYSEARCA: MUB ) is an exchange-traded fund, or ETF, covers a portfolio of municipal bonds in the U.S., more or less debt value basis across the states, so primarily for

Vanguard’s head of fixed income product Jeff Johnson told VettaFi that VTES was launched to accommodate investors looking to generate tax-exempt yield in their portfolios while minimizing interest rate sensitivity.

Compared to potentially higher-yielding corporate bonds, munis offer investors more peace of mind, especially in the current market environment where inflation and rising rates are top-of-mind concerns.

That should help muni-bond funds ride out the kind of recession that could hurt corporate bonds or other credit sensitive parts of the fixed-income market.” “That’s especially the case when factoring in the primary

The iShares National Muni Bond ETF ( NYSEARCA: MUB ) provides diversified exposure to investment-grade U.S. municipal bonds, a tax-exempt segment of fixed-income. Despite the traditionally conservative or

The Vanguard Tax-Exempt Bond ETF (VTEB) tracks the Standard & Poor’s National AMT-Free Municipal Bond Index, which measures the performance of the investment-grade segment of the U.S. municipal bond

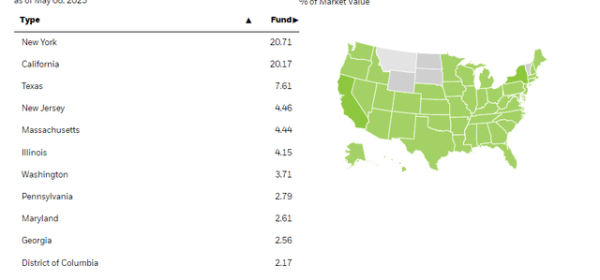

Fortunately for ITM investors, the ETF allocates more than 35% of its weight to munis issued by New York and California — two states with substantial tax bases. Still, the widely observed ICE AMT-Free US

Designed for investors who are seeking current income, the fund dynamically adjusts investment grade and high yield exposures based on prevailing market conditions. The municipal bond exchange traded fund

Helped by its short duration, SHYD is outpacing the Bloomberg US Aggregate Bond Index this year. With aggregate bond indexes flailing this year at the hands of rising interest rates, fixed income investors are

Municipal bonds have been dragged lower with the broader fixed income market this year thanks to the Federal Reserve’s scorched earth campaign of raising interest rates. MBNE currently sports a 30-day SEC

Schwab Asset Management has introduced the world’s most cheaply priced ETF targeting the US tax-exempt bond market. Schwab Asset Management has introduced the world’s lowest-cost municipal bond ETF.

Those wanting to increase municipal bond exposure to their investment portfolios may want to consider the Xtrackers Municipal Infrastructure Revenue Bond Fund ( RVNU A- ), which tracks an index of investment-

VCEB seeks to track the performance of the Bloomberg MSCI US Corporate SRI Select Index, which excludes bonds with maturities of one year or less and with less than $750 million outstanding, and it is