damircudic/E+ via Getty Images

The iShares National Muni Bond ETF (NYSEARCA:MUB) provides diversified exposure to investment-grade U.S. municipal bonds, a tax-exempt segment of fixed-income. Similarly, MUB shareholders receive tax-free dividends through a monthly distribution as an important consideration for some investors.

Despite the traditionally conservative or low-risk profile of Munis, the group faced a historically volatile 2022 amid rising interest rates and the broader bond-market selloff. Fast forward, several developments in recent months have helped add to the attraction of fixed income with higher yields on offer. MUB yields over 3% and we'll note that the monthly payout is climbing in line with the underlying portfolio interest income. Overall, we like MUB and expect positive returns going forward.

What is the MUB ETF

MUB is recognized as the largest exchange-traded fund in the municipal bond category with over $32 billion in assets under management. The strategy technically tracks the “ICE AMT-Free US National Municipal Index”, with the (AMT) acronym referring to income tax exception.

Importantly, the underlying portfolio includes more than 2,000 bonds highlighting the breadth of the exposure with a wide range of issuers. Typically, munis are bonds issued by local or state municipalities to cover general obligations or fund a specific project.

Examples include the construction or maintenance of a highway in transportation or the new public University building in education for example. Some of the current top holdings that stand out include bonds from the State of California, the New Jersey Transportation Fund Authority, the University System of Michigan, and the Texas Water Development Board.

source: iShares

Given the size of the portfolio across several muni sectors and coast-to-coast states, the contribution from a particular issuance or risk of default is limited. The performance of the fund will end up capturing high-level market themes, which is the attraction of the fund.

The other important metric is the credit profile of the fund with more than 86% of the bonds rated (AA) or higher on the equivalent scale by a major credit rating agency. While munis are not “risk-free” like U.S. Treasuries, the data shows that the cumulative default rate over any 10-year period since 1970 is under 0.1%. In this regard, the ratings are simply a reference point for considering the yield spreads as a measure of relative valuation.

source: iShares

On the other hand, what is a bigger risk to consider in muni is the interest-rate sensitivity, particularly at the long end of the curve. The weighted-average maturity of the MUB ETF is listed at 6 years which is considered average for the bond market in general with an “intermediate” maturity profile.

This is also reflected in an effective duration of 6.4 years, which is a measure to interpret the fund's interest rate risk. All-else-equal, a 1% rise or decline in market interest rates should translate into a 6.4% decline or increase in the fund's value. In other words, the series of Fed rate hikes since early 2022, worked to move interest rates across the entire curve higher, forcing a repricing of all bonds, munis included.

The 5-Year Treasury rate currently around 3.7% is up from under 2% last year, although pulling back from a cycle high in late October near 4.5%. The trend helps explains the recent volatility in munis and the latest recovery.

source: CNBC

For context, MUB is currently down about -3.1% on a total return basis over the past year, although this considers the rally in recent months from lows in October. At its lows coinciding with the peak rates in the period, the fund was off more than -10% from its highs, which both highlights the potential risk in what was an extreme scenario, while the more recent momentum.

The chart below notes that MUB outperformed the broader bond market through the iShares Core U.S. Aggregate Bond ETF (AGG), which is down by -8.5% over the past year, along with long-bond treasuries and the iShares 20+ Year Treasury Bond ETF (TLT). Again, the profile of MUB makes it relatively low risk compared to other segments of fixed income.

No products found.

Data by YCharts

What's Next For MUB?

The way we're looking at the bond market and munis is that rates have sort of reached this new higher plateau. The scenario where interest rates least stabilize from here, and remain below the 2022 highs can be positive for the market.

The good news is that signs are inflationary pressures, which forced the Fed to hike rates, have eased and indications are that the end of the tightening cycle is on the horizon. That was the takeaway from the latest Fed meeting where Chairman Powell suggested encouraging signs the disinflationary process has started.

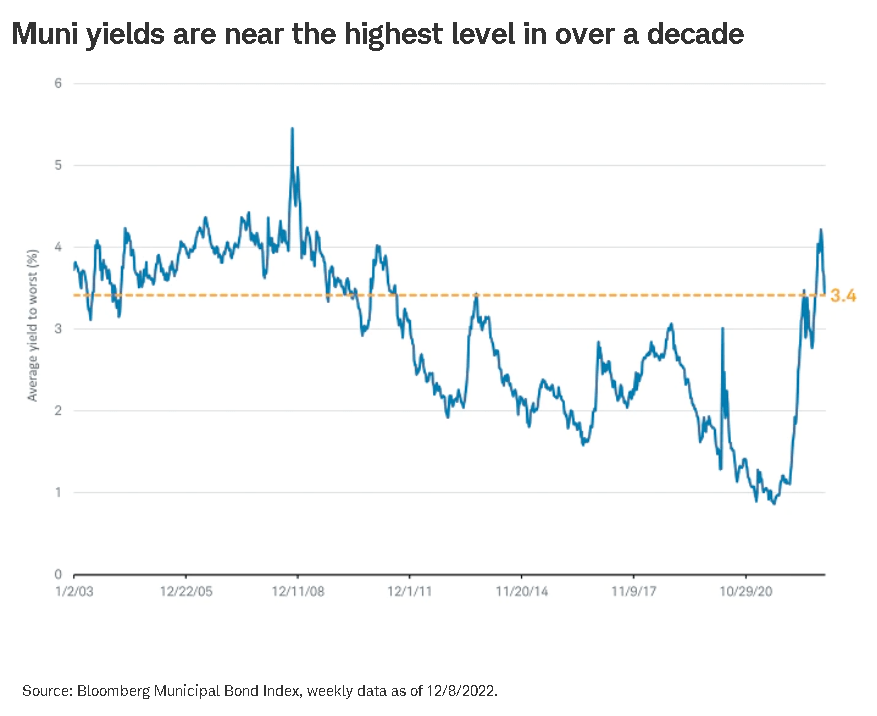

From there, the repricing over the past year in the bond market has driven available yields to more compelling levels. The trend is evident as muni yields are at the highest levels of the past decade.

source: Schwab

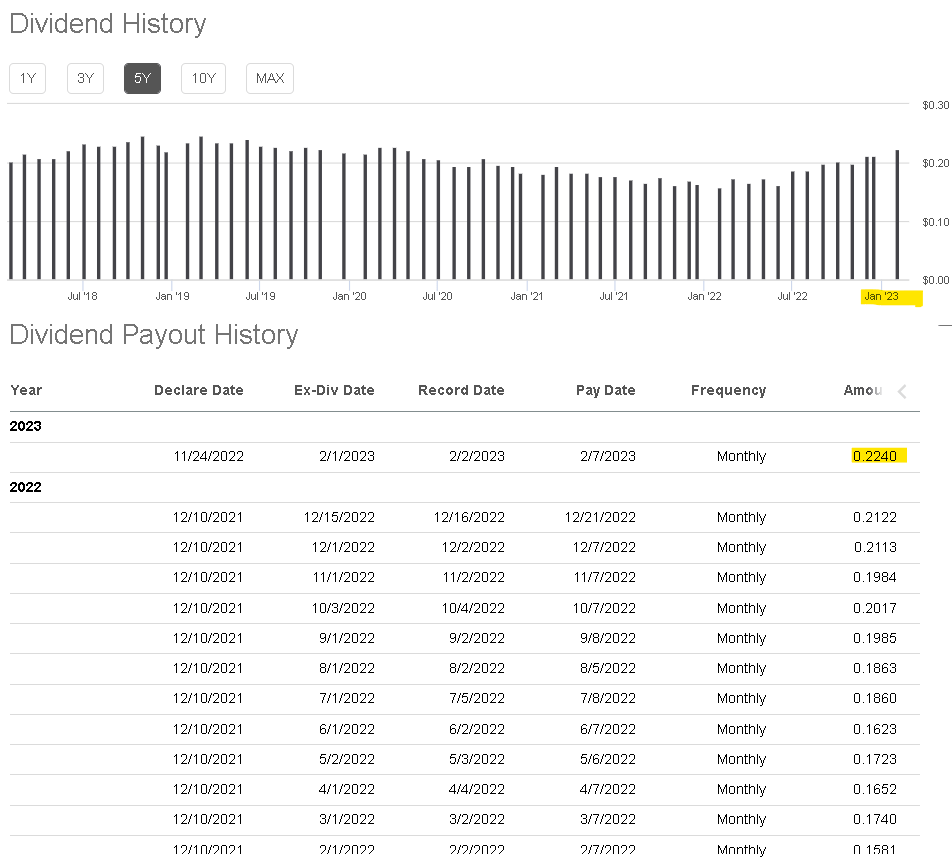

We can also see the shift in the rising yield and growing monthly dividends from MUB as the portfolio gradually captures climbing interest income from the underlying bonds. Based on the latest $0.224 per share payout for February, the annualized forward yield for MUB is 2.5%.

That said, the understanding is that the monthly rate will continue to climb higher based on the regular portfolio turnover with new bonds being added offering higher coupons as existing positions mature. The reported “SEC 30-day yield” on the fund reported by iShares is 3.2%, while we estimate that would settle towards 3.5% over the next several months.

Seeking Alpha

In terms of specific themes for munis, JPMorgan Chase Asset Management notes that municipal issuers overall have strong fundamentals that can be resilient to any ongoing macro uncertainty. Strong state-level reserves, prudent budgeting practices by municipalities along with a tailwind from Federal pandemic relief aid provide flexibility that is positive for credit metrics.

No products found.

There is also a thought that as it becomes clear the Fed rate hiking cycle is ending, fund flows into fixed-income should improve as driving an incremental source of positive return.

To the upside, a scenario where interest rates decline sharply lower would add to the fund's upside potential. This could be driven by Fed rate cuts over the next few years or a deterioration of the economic environment and sharper economic contraction for any number of reasons. By this measure, MUB can provide some safety or hedge next to riskier assets.

Final Thoughts

While 2022 was difficult for fixed-income investors, the setup now is into an improved risk-reward backdrop under the assumption that the trend in interest rates will not repeat its climb from last year. At the same time, the main risk to consider would be an environment where inflation re-accelerates higher, forcing the Fed to turn more aggressive with further rate hikes, and opening the door for renewed volatility in bonds.

Overall, MUB is a high-quality fund and a good option to gain exposure to this important market segment. The fund can work in the context of a broader portfolio as a long-term holding by adding a layer of diversification and a component of tax-free income.