The iShares National Muni Bond ETF (NYSEARCA:MUB) is an exchange-traded fund, or ETF, covers a portfolio of municipal bonds in the U.S., more or less debt value basis across the states, so primarily for New York and for California. We think that there is actually a discount on MUB, consistent with the discount that's been seen on munis across the asset class. This is because there are risks, like the debt ceiling, inflation, interest rates, and high yield chaos that are still hitting these markets. Primary demand is definitively down, but maybe renewables will be a backstop. On balance, it comes down to credit rating, and we think that even with some downward revisions in state credit ratings, MUB YTMs are disproportionately high. Probably a decent buy, although fixed income is in the basin of all the swirling economic factors and requires caution in general.

MUB Breakdown

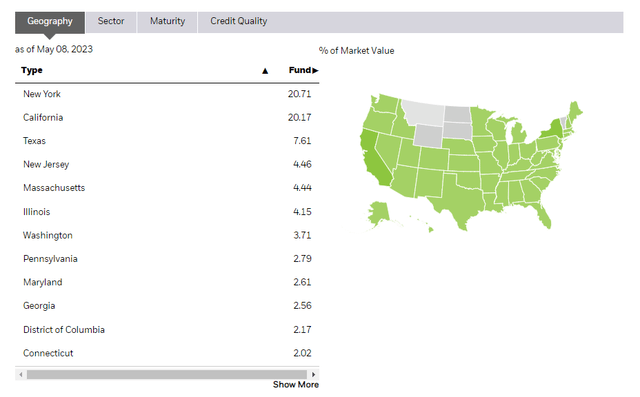

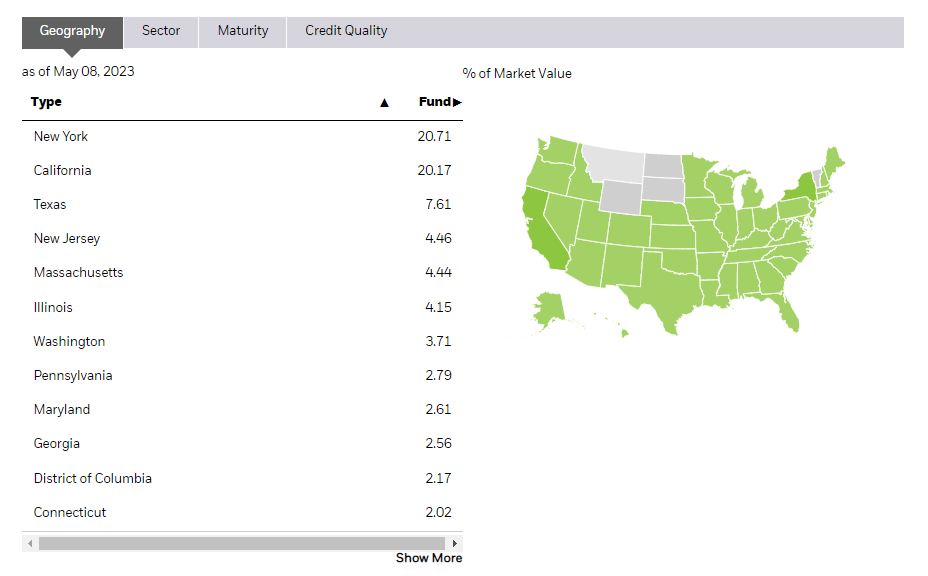

The helpful breakdown here is by Geography. The distribution is more or less consistent with the size of these state-level economies on a value basis, with New York, California, Texas, and New Jersey being the first 50% of the allocations.

Geography (iShares.com)

Other key data is the duration, which is at 6.43 years. That's a fair bit, and it means MUB ends up being sensitive to any expectations revisions for the prevailing interest rate. The YTM is 5.42% on a tax equivalent basis – this is the figure you use because munis are tax-free, so headline figures will of course be lower.

Problems with MUB

There are several things that investors considering MUB may want to think about:

- The debt ceiling impasse can matter a lot for prevailing rates. If political divisions become a speculative factor in assessing the credit situation of the U.S., since we're in a time of greater political division, the rates could go a lot higher on credit concerns. The dollar could probably also go a lot lower. Really bad for high-duration fixed income securities like MUB.

- In addition to having high duration that can interact negatively with issues like the debt ceiling, MUB also has negative convexity. This is because while the yield is tax-free on munis, the gain till maturity is not. When rates rise, prices of munis fall further, accounting not only for the duration effect but also the fact that the next buyer needs to be compensated with extra capital gain to offset the fact that gains are taxed with munis.

- Primary markets for muni bonds are not doing well, and this is because of the chaos caused by changing interest rates and hits to the high-yield market, where some parts of the muni market are high yield. This is not a good sign for demand in the asset class and raises financing costs for municipalities.

- Exposure to California and New York are subject to risks beyond macroeconomic ones – namely greater sensitivity to real estate tax, especially with offices in New York, as well as sensitivity to more pro-cycle jobs like finance and in this case tech, which may not ordinarily be as pro-cycle but is definitely one of the major markets to see layoffs in labor. Not good for state coffers.

- Political risks apply, since the incentive to create renewable developments, a more secular type of infrastructure spending, may be impacted substantially by a change in administration in 2024, if that were to occur.

Bottom Line

No products found.

There are risks for iShares National Muni Bond ETF if rates keep going up and if the economy continues to spend and inflate stubbornly despite credit troubles and higher rates hitting household wealth. Duration and negative convexity would see MUB get hit badly by further Fed rate hikes. Moreover, prevailing rates could rise as the debt ceiling issue becomes a greater concern. It's not a safe time for fixed income, and iShares National Muni Bond ETF happens to be riskier than average.

However, looking purely at credit ratings, the equivalent YTM is at a full 2% premium in rates compared to Treasuries with the same duration. That's a lot, and is not consistent with credit ratings between AA and AAA – there shouldn't be a big risk premium. On that basis, as well as on the fact that despite economic troubles renewables are likely to keep getting subsidized, iShares National Muni Bond ETF could be a good buy on balance, with demonstrable value consistent with the rest of the asset class. However, there are risks, and the MUB proposition is actually quite speculative.

No products found.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.