Investing in funds that own sustainable bonds has grown increasingly popular. Assets in sustainable and impact bond funds have grown 11 times over the past decade, reaching $516 billion at the end of 2022, according to Morningstar research. These funds own green, social, sustainability, and sustainability-linked bonds, all commonly referred to as GSS+ bonds.

Even though net inflows into sustainable bond funds slowed in the challenging market environment of 2022, they remained positive. By contrast, traditional bond funds experienced massive outflows during the same period.

A Guide to Green Bonds and Other Sustainable Bonds

- Green bonds account for roughly two thirds of the overall GSS+ universe. They finance projects that aim to achieve positive environmental impact, such as renewable energy development or energy efficiency improvements.

- Social bonds are typically tied to projects aimed at achieving positive social outcomes, such as improving access to affordable housing, increasing food security, or helping individuals with disabilities.

- Sustainability bonds, meanwhile, finance a mix of green and social projects.

- Sustainability-linked bonds, or SLBs, use a different structure. They account for less than 10% of overall GSS+ assets. SLBs finance day-to-day issuer activities rather than specific “green” or “social” projects. Specific features of the bonds (usually a bond’s coupon) can be adjusted depending on whether the issuer meets its sustainability objectives. While initially touted as the “next big thing” in impact investing, SLBs have not achieved widespread use by impact bond fund managers.

- Transition bonds represented less than 1% of GSS+ issuance volume in the first half of 2022, according to Climate Bonds Initiative data. Transition bonds are similar to green and social bonds in that their proceeds are earmarked for specific projects. They are in sectors that are structurally difficult to decarbonize, such as steel, chemicals, aviation, and some utilities. In layman’s terms, transition bonds usually finance projects that can’t be inherently “green” but are trying to become less carbon-intensive. No internationally established norms and definitions exist around transition finance yet, which has limited the scale of such offerings for now.

Most Green-Bond Funds Are in Europe, With a Handful in the U.S.

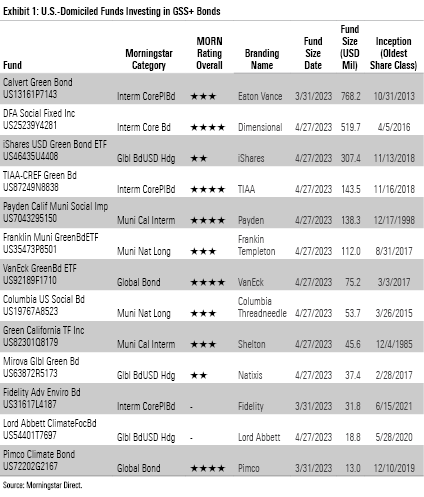

Most of the growth in GSS+ bond offerings has been driven by investor interest in Europe. Of the 113 funds we’ve identified in Morningstar’s database as investing in GSS+ bonds, 92 are domiciled in Europe. A handful of options are available for U.S. investors as well, including reasonably priced passive options such as the iShares USD Green Bond ETF BGRN and VanEck Green Bond ETF GRNB. Some 23% of sustainable bond fund assets are in passive strategies.

Green-Bond Performance Has Been Mixed

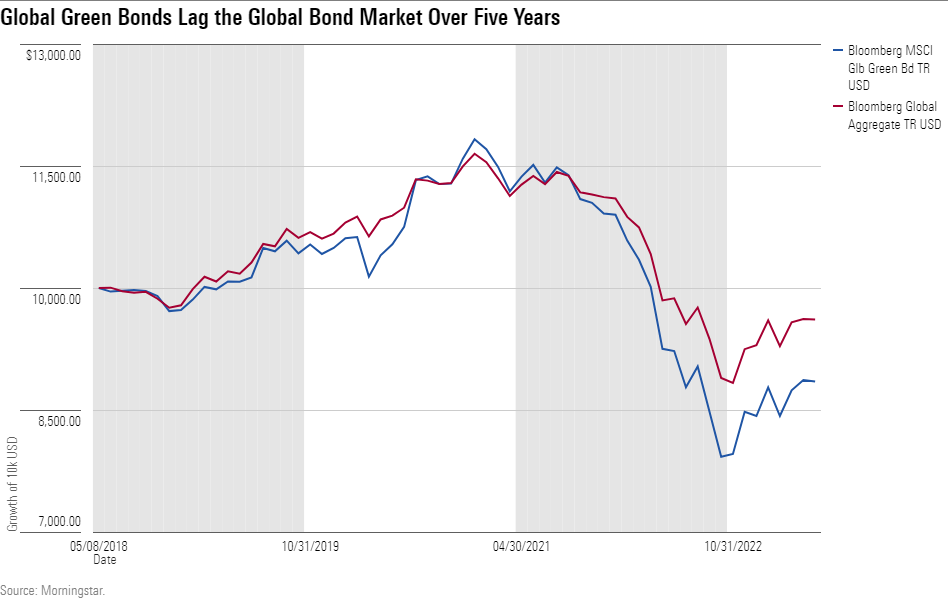

Performance for green-bond funds has been mixed. After a five-year period of positive returns and low volatility compared with conventional bond products, the global green-bond market as a whole significantly underperformed in 2022.The story behind that reversal of fortune is largely one of duration. Before 2022, green-bond issuances tended to have longer maturities than their nongreen counterparts, particularly those issued by sovereign and supranational issuers that sought to lock in low-cost financing for long-term projects while interest rates were low. That allowed green bonds to benefit more from central banks’ easing measures before 2022 but made them vulnerable once central banks began hiking rates last year.

At the same time, green bonds within the corporate-bond space were more vulnerable than their nongreen peers because of their specific industry mix. Corporate green-bond issuance tends to be tilted toward the real estate sector, which is relatively sensitive to interest-rate increases. Meanwhile, green bonds are underrepresented within the energy and basic-materials sectors. That structural underweight detracted from performance in 2022, as rising energy and commodities prices provided some ballast against rising borrowing costs, leading especially the energy sector to outperform.

In the U.S., Look for Municipal Green-Bond Funds

- Amazon Prime Video (Video on Demand)

- Jim Parsons, Rihanna, Steve Martin (Actors)

- Tim Johnson (Director) - Tom J. Astle (Writer) -...

- English (Playback Language)

- English (Subtitle)

- ✨【Night Lights Plug into Wall】: 0.5 watts,...

- 💕【Dusk to Dawn Sensor Night Light】:...

- 🐋【Personalized Night Light】:Takes the space...

- 🌃【Widely Used】: This plug in night light...

- 💡【Satisfied Service】If you’re ready to...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

Many U.S. municipalities have been offering debt that supports socially and environmentally responsible projects for decades, making the U.S. municipal-bond market seem like a natural fit for GSS+ bonds. As of March 2023, Morningstar data showed 17 U.S.-domiciled strategies focused on the GSS+ muni market. One of them is the Franklin Municipal Green Bond ETF FLMB, which has a limited track record as it only switched to a green-bond mandate in 2022, and it remains small with roughly $110 million in assets as of April 2023. Similarly, Green California Tax-Free Income CFNTX was launched in December 1985 but changed its mandate in 2019. The strategy is even smaller with just $45 million in assets; and while it seeks to be a green-bond fund according to its prospectus, it can invest in any issues it judges as meeting its proprietary environmental, social, and governance screens.

- AIRTIGHT LIDS & 3 GRATER ATTACHMENTS The airtight...

- NON-SLIP SILICONE BOTTOMS The rubber on the bottom...

- NESTING BOWLS & DISHWASHER SAFE These kitchen...

- 6 SIZES BOWLS & EXTRA KITCHEN TOOLS SET The range...

- DURABLE STAINLESS STEEL The stainless steel...

- ✅FOOD GRADE SILICONE -- Made of food-grade...

- ✅NO BEND & NO BREAK & HEALTHY FOR COOKWARE --...

- ✅HIGH TEMPERATURE WITHSTAND:The Silicone Cooking...

- ✅33 DURABLE WOODEN HANDEL KITCHEN UTENSILS SET -...

- ✅BEST KITCHEN TOOLS :One- piece stainless steel...

Last update on 2024-04-11 / Affiliate links / Images from Amazon Product Advertising API