By Sebastian Dooley, CFA, Senior Fund Manager; Casey Miller, Managing Director, Portfolio Management; & Ben Wobschall, Managing Director, Portfolio Management

Demand, supply, and the top data center markets

Demand for data center capacity has been rising exponentially for well over a decade. COVID-19 caused a significant acceleration in that growth, at the same time as it upended global supply chains. Add increasingly scarce land, and power and demand began to outstrip supply in many top markets. Vacancy rates plummeted (see Exhibit 1) and timelines for new data center development ballooned, in some cases by as many as six years.1

Stories about top markets being ‘out of power' have made headlines, as have stories of hyperscalers building massive new facilities in far-flung locations. One could see these headlines as demonstration of movement away from primary markets into secondary markets, but that would be inaccurate.

The idea that a data center can be anywhere belies the reality that data centers cluster in certain locations – top markets – because those locations have the fundamentals that benefit end users (and therefore, developers). These fundamentals are factors like critical mass (the presence of other data centers), connectivity, occupancy cost, and the policy environment.

Fundamentals are why Northern Virginia remains the #1 U.S. market, even as power and land are increasingly hard to come by. They're also why – despite the fact that some hyperscalers are building huge data centers in far-flung locations for AI model training – there's no indication of a widespread trend set to unseat the top markets.

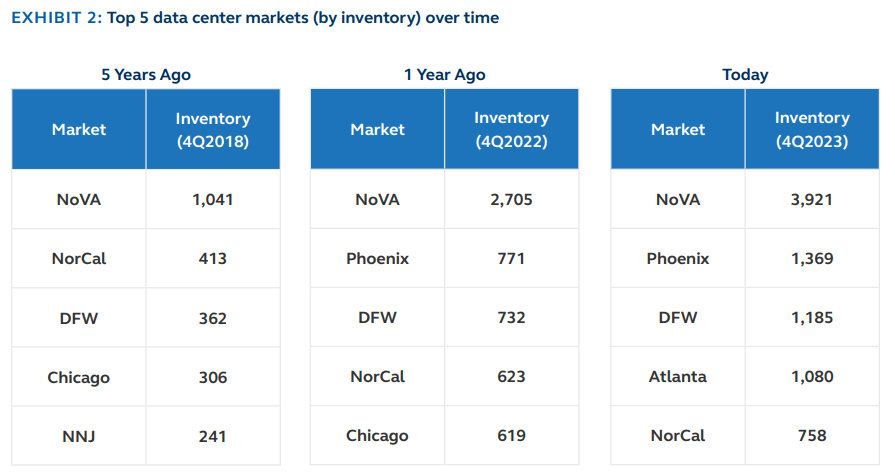

It is true, however, that the list of top data center markets is dynamic. As Exhibit 2 demonstrates, there is movement into and out of the top five as fundamentals in a particular area change and as clusters form in new markets. For example, in Northern California, power and real estate constraints along with high cost of doing business have caused that market to drop out of the top five. Meanwhile, power availability and favorable data center tax abatements in Atlanta have pulled it onto the list.

Source: datacenterHawk, 31 December 2023

A case study on core market evolution: Phoenix vs. Silicon valley

For many years, Northern California (Silicon Valley) was one of the top data center markets in the U.S. The area's origins as a top market were similar to Northern Virginia's: both were home to the first internet exchange points in the U.S. (MAE-East and MAE-West), established in the early 1990s.

Connectivity made Silicon Valley a data center hub and critical mass ensured its longevity. Most cloud providers have data centers in Silicon Valley as part of their regional deployment strategies. (A cloud region has one or more availability zones within it, and an availability zone has one or more data centers. Distributing cloud instances across multiple availability zones provides redundancy and failover.) And of course, Silicon Valley is home to several of the world's largest technology companies.

Over time, however, Silicon Valley has become less competitive on other fundamentals – power and land availability and cost of doing business. Today it can take 7-10 years to get new power, there is essentially no vacant land, and the cost of doing business is quite high relative to most other markets.

At the same time, connectivity and critical mass improved in other locations, like Phoenix, which has advantages on other fundamentals as well. For example, compared to Silicon Valley, power and land in Phoenix is more available, occupancy cost is relatively low, and policy is quite business friendly.

As a result, new data center capacity in Phoenix has grown quite rapidly, while in Silicon Valley it has slowed. Now, Phoenix is now a top five market by inventory, and Silicon Valley no longer is. (To be clear: The data center market in Silicon Valley remains strong, but new capacity development is very limited. It's not shrinking as a data center market, but others, like Phoenix, are growing much more.)

Data center market fundamentals

The fundamentals that make a market attractive to data center end users – and therefore, to developers – are largely the same as they've always been. Of course, how a particular market stacks up on the fundamentals can change over time (as happened in Silicon Valley and Phoenix, for example, with Silicon Valley weakening on power and land availability and Phoenix strengthening on critical mass). In addition, the weight end users ascribe to each factor change over time. (For example, as data centers grow ever larger, land and power availability become more important factors.)

The fundamentals that make a market attractive to data center end users

- Critical mass (data center clusters)

- Strong network connectivity

- Power availability

- Land availability

- Low risk of natural disaster

- Occupancy cost (including power, taxes, and labor)

- Access to technical talent

- Business friendly environment

- Proximity to end users (for latency, or simply for efficiency)

Why data centers cluster

Data centers tend to locate where there are many other data centers. The high cost of setting up a new cloud region or availability zone is one reason. Furthermore, connectivity is typically superior in established data center clusters. This is one of the reasons Northern

Virginia remains the #1 data center market, even though some of its fundamentals – especially land and power availability-are weakening.

Those weaknesses are offset by the significant benefits of the critical mass already in the region. (All of the major cloud providers have data centers in NoVA.)

Power, power, anywhere?

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

There has been a lot of talk lately about power availability (or lack thereof) in major data center markets, and some pundits have argued that power constraints will drive data centers out of core markets and into Tier 2 locations. That's the story often told about Northern Virginia, but in the past year that market has added more new capacity than the total inventory in any other U.S. market.

Of course, power is a constraint on the supply of new data center capacity in Northern Virginia and other markets. If it weren't, we'd see magnitudes more development in those markets than we're seeing today. But power constraints are a damper on supply development; they're not shutting it down completely.

European nuance: More growth in Tier 2

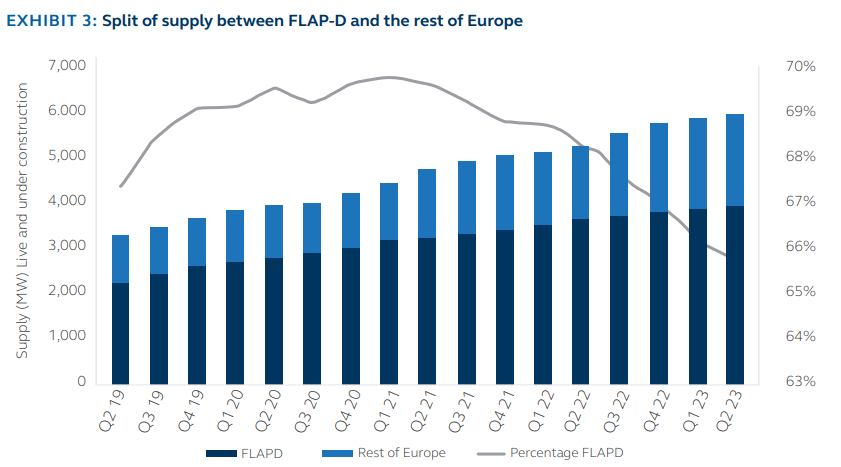

The story is a bit different in Europe, where Tier 2 markets are taking an increasingly large share of new capacity. In Europe, the core data center markets are Frankfurt, London, Amsterdam, Paris, and Dublin (known by the acronym FLAP-D). Since peaking in Q1 2021, the share of total European data center capacity in FLAP-D markets has fallen from a high of just under 70% to a low of about 66% (see Exhibit 3).

The shift is not demand moving out of FLAP-D markets, but rather other markets getting an increasing share of new capacity. For example, Madrid and Milan have become some of the larger, fastest growing markets in Europe. The move toward Tier 2 markets is happening in very specific, clustered regions; it's not a ‘go wherever' approach. And it's often driven by European particularities like data sovereignty regulations (which require data to be kept in the country where it is collected) that aren't applicable in the U.S.

Top data center markets for investors

End user demand based on fundamentals is one of the most important factors that determine whether a market is a great place to invest in data center capacity. But it's not the only factor. Also important are time horizon (long term vs. short term investment strategy), liquidity (whether other capital will invest in the market), and concentration (how much how much of the market you own).

Factors that make a market an opportune place to invest in data center capacity

- The fundamentals that make the market attractive to end users

- Time horizon (long term vs. short term investment strategy)

- Liquidity (Is there other capital that will invest in that market?)

- Concentration (How much how much of the market do you own?)

Overlaying time horizon, liquidity, and concentration on top of data center market fundamentals helps ensure the long-term viability of the investment. For example, an investment in a top five market a decade ago may still generate significant value; even though the market is not growing with significant new capacity it likely still has strong demand for existing capacity. Silicon Valley is a good example of such market.

Bottom line:

Most new data center capacity is still in primary markets

It's true that the list of top data center markets is not static. In the last five years alone, there have been several entrances and exits. But it's not true that there is a widespread move out of primary markets to Tier 2 markets (except in Europe, where the story is a bit different). Rather, new capacity is growing more in some new markets (e.g. Phoenix) than in some old markets (e.g. Silicon Valley). Other ‘old' markets, like Northern Virginia, are growing as fast as ever, even in spite of constraints on fundamentals like power and land.

Footnotes

1CBRE, High Demand, Power Availability Delays Lead to Record Data Center Construction, 14 September 2023.

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

2As of 3Q 2023, the top 10 U.S. markets were Northern Virginia, Phoenix, Dallas/Fort Worth, Atlanta, Chicago, Northern California, Portland, Northern New Jersey, Salt Lake City, and Los Angeles.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.