The article discusses a potential demand cycle for tech hardware due to the replacement of COVID-era PC and smartphone purchases. It highlights a growing trend in smartphones and PCs, with a surge in rush orders for tech hardware and semiconductors. The article also emphasizes the impact of AI and advanced packaging, offering insights for investors in the tech industry.

Category: Investment

Silver and Gold: The Winning Bet

In his analysis, Michael Ballanger discusses the gold and silver market’s current state, recalling an anecdote about a client’s misguided investment in silver. He emphasizes the historical relationship between gold and silver, emphasizing the unpredictability of silver’s performance. Despite losses, the client ultimately shifted to bonds and utility stocks.

Think You Know REITs? Here’s the Real Story

The real estate and REITs sector has been making frequent negative headlines, but the outlook for REITs is more positive than suggested. Data centers and AI are driving growth in the sector, with record investment in renewable energy creating a favorable environment for further data center construction. This trend may appeal to investors seeking diversification.

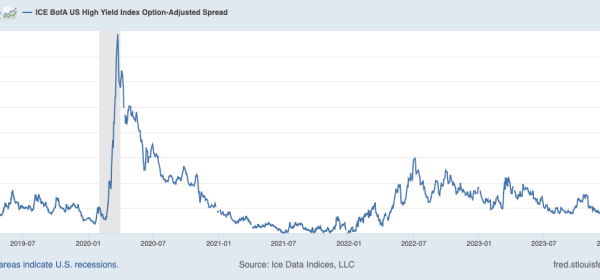

Short HYG: High-Yield Spreads Are Likely To Widen

The article proposes a trade idea: short junk bonds with put options and a hedging strategy to reduce costs. The trade is based on narrowing high-yield spreads and cheap put options on HYG. The author anticipates spreading widening and suggests potential hedges in Treasury notes, puts, or housing-related stocks. They also highlight the risks and reasons for credit spread widening.

MBIA: More Value Can Come From The Insurance Subsidiaries

MBIA Inc. experienced a significant cash release and one-time dividend following insurance regulations approval. The company’s National subsidiary displays strong financial standing, hinting at potential future liquidity releases. Despite risks, further payouts are anticipated, offering a 10% to 60% share upside. The recent $500 million dividend signals positive prospects amid ongoing de-risking efforts.

eXp World Holdings: Trough Earnings, But Expensive

eXp World Holdings (NASDAQ:EXPI) is a cloud-based real estate brokerage challenging the traditional brick-and-mortar model. Despite its appealing business model and potential for a housing market recovery, concerns about market weakness and high valuation prompt a bearish outlook. Anticipated interest rate declines may boost market activity, but EXPI’s high valuation remains a risk, leading to a SELL rating.

Paramount Global’s Sale Will Not Be Easy, Cheap, Or Fast

Paramount Global (NASDAQ:PARA) faces complex asset transfer, likely involving contentious negotiations. Non-voting shareholders may fight for better terms. Despite decreased share price, the assets retain value, prompting a shift from negative to neutral/hold rating. Expect increased share price volatility. Market uncertainties and debt burden complicate potential sale. The outcome remains uncertain. (Words: 50)

Adding Perdoceo Education To My Value Portfolio

The article discusses the addition of Perdoceo Education (NASDAQ: PRDO) to the author’s portfolio, acknowledging regulatory risks but highlighting the company’s focus on technology, mature student demographic, and potential for growth through corporate partnerships. The author rates PRDO as a “Strong Buy” and has taken a medium-sized position due to regulatory risks despite the company’s initiatives to address them.

Playing Demographic Divergence Now

The working-age population is shrinking in developed markets but growing in emerging markets. This demographic trend is driving sector and company dispersion. Developed markets face slower growth and higher inflation due to an aging population, while emerging markets like India and Mexico could benefit from a growing working-age population. Sectors and firms need to adapt to capitalize on these shifts.

NetEase: Strong Gaming Business, Regulatory Risk Lingers

NetEase, a diverse technology company, derives nearly 80% of its revenue from gaming. Q4 revenue rose 7% to $3.8 billion, driven by successful game launches. With a focus on mobile gaming and international expansion, NetEase has potential for growth. While regulatory concerns persist, its robust game portfolio provides stability but uncertainties remain.

BRICS Rebellion: Plotting The End Of Dollar Dominance And U.S. Economic Power

The BRICS bloc’s discussions on an alternative payment system signal a geopolitical shift, aiming to decrease reliance on the U.S. and the dollar-centric financial system. This poses challenges for the U.S., including potential dollar devaluation, higher borrowing costs, and reduced economic influence. Globally, de-dollarization’s effects are uncertain, requiring strategic adaptation.

Fed Rate Cuts Could Be Just What Doctor Ordered for EM ETFs

Emerging markets equities and ETFs are influenced by Fed’s interest rate decisions. With the potential for rate cuts, these assets show promise. The KraneShares Dynamic Emerging Markets Strategy ETF (KEM) could benefit from lower U.S. interest rates due to its composition. JPMorgan Asset Management highlights the positive correlation between emerging markets and the end of U.S. rate hike cycles.

China’s Long Game

The article discusses the challenges facing China’s economy and the potential shift towards high-tech manufacturing and clean energy. With a focus on the risks and opportunities, it highlights the need for a vibrant consumer sector and the geopolitical challenges. While the potential for growth exists, the risks currently outweigh the upside.

Resurging Corporate Profits Show Inflationary Pressures Are Reheating After Lull: Corporate Profits By Major Industry

Corporate pre-tax profits in non-financial domestic industries (excluding banks and financial companies) surged by 5.6% in Q4 from Q3, and by 10.7% year-over-year, reaching a record $2.69 trillion. The inflation surge led to increased profits, especially in durable-goods manufacturing and retail trade, reflecting companies’ ability to raise prices without losing customers.