Fundamentals

The discussions within the BRICS bloc about creating an alternative payment system signify a significant geopolitical shift with far-reaching economic implications. Led by Russia, this move underscores a growing desire among emerging economies to reduce dependence on the United States and the dollar-dominated financial infrastructure.

The BRICS bloc, now expanded to include additional nations like Saudi Arabia, Egypt, the UAE, Iran, and Ethiopia, represents a formidable economic force. With a combined population of over 3.5 billion people and economies valued at more than $28.5 trillion, these countries collectively wield considerable influence in global trade and finance. Furthermore, their substantial share of global crude oil output further solidifies their importance in the international economic landscape.

At the core of this initiative lies the desire to lessen reliance on systems such as the Society for Worldwide Interbank Financial Telecommunication (SWIFT), which has traditionally been controlled by the United States. SWIFT's dominance has allowed the U.S. to exert significant influence over global financial transactions, leveraging its control over the dollar as the world's reserve currency. This control has been evident in instances where the U.S. has used SWIFT as a tool for imposing sanctions on countries deemed non-compliant with its foreign policy objectives, such as Russia following the Ukraine conflict.

Russia's development of its own payment system, the System for Transmitting Financial Messages (SPFS), serves as a model for potential alternatives within the BRICS bloc. Other member countries, such as China with its Cross-Border Interbank Payments System (CIPS), also possess similar infrastructures. The integration of these systems across BRICS nations could provide a viable alternative to SWIFT, reducing vulnerability to U.S. sanctions and increasing autonomy in international financial transactions.

Moreover, the discussion around establishing an alternative payment system highlights the potential role of gold in the international monetary system. As BRICS countries collectively hold significant gold reserves, the integration of gold-backed mechanisms could provide stability and confidence in the face of currency volatility.

However, the pursuit of an alternative payment system poses a direct challenge to U.S. dollar dominance. Given the dollar's pivotal role in global finance, any significant shift away from it could have profound economic ramifications for the United States. This includes the potential devaluation of the dollar, higher borrowing costs, and inflationary pressures, all of which could impact the stability of the U.S. economy.

Despite these challenges, the momentum towards de-dollarization appears to be accelerating, driven by the desire for greater financial sovereignty among emerging economies. As such, diversification into alternative assets like gold may become increasingly attractive for countries seeking to mitigate the risks associated with over-reliance on the dollar-dominated financial system.

De-dollarization, the gradual reduction of reliance on the U.S. dollar in international trade and finance, presents a multifaceted challenge for the U.S. economy with potentially far-reaching consequences. As the world's primary reserve currency for decades, the dollar's dominance has provided the United States with significant economic and geopolitical advantages. However, as countries seek to diversify their currency holdings and reduce exposure to U.S. economic influence, the implications for the American economy are profound and complex.

One of the most immediate effects of de-dollarization is the potential devaluation of the dollar itself. As countries shift away from using the dollar for international transactions, the demand for the currency decreases. This reduced demand could lead to a depreciation of the dollar relative to other currencies, making imports more expensive for American consumers and contributing to inflationary pressures domestically. Moreover, a weaker dollar could erode the purchasing power of American households and undermine confidence in the currency's stability.

Additionally, de-dollarization may result in higher borrowing costs for the U.S. government. Historically, the widespread use of the dollar has allowed the U.S. to borrow money at relatively low interest rates. However, if countries begin to favor alternative currencies or assets for their reserves, the U.S. government may find it more expensive to finance its budget deficits through the issuance of Treasury bonds and other securities. This could lead to higher interest payments on the national debt, exacerbating fiscal challenges and potentially crowding out other government spending priorities.

Furthermore, the diminishing role of the dollar as the world's primary reserve currency could undermine America's economic influence on the global stage. The U.S. has leveraged the dominance of the dollar to impose economic sanctions on countries deemed non-compliant with its policies, thereby exerting significant diplomatic leverage. However, as countries reduce their dependence on the dollar, the effectiveness of such sanctions may diminish, limiting the U.S.'s ability to shape international events and advance its foreign policy objectives.

Moreover, de-dollarization has the potential to disrupt global trade patterns and financial markets. A shift away from the dollar as the preferred medium of exchange could introduce uncertainty and transactional costs into international commerce, affecting U.S. exporters and businesses with global supply chains. Increased currency volatility and fluctuations in interest rates and asset prices could also unsettle financial markets, posing challenges for investors and potentially impacting economic growth and stability.

In summary, while the full extent of the effects of de-dollarization on the U.S. economy remains uncertain, it is clear that such a shift would present significant challenges and adjustments for policymakers, businesses, and consumers alike. Adapting to a world with reduced dollar dominance will require careful navigation and strategic planning to mitigate risks and capitalize on emerging opportunities in the evolving global economic landscape.

- INTERCHANGEABLE GRILL and GRIDDLE PLATES: From...

- 500°F MAX HEAT: Reach temperatures of up to...

- EDGE TO EDGE COOKING: No hot spots. No cold spots....

- SMOKELESS GRILL: The perforated mesh lid...

- FAMILY SIZED CAPACITY: The 14’’ grill and...

- Spacious 7 quart manual slow cooker serves 9 plus...

- Set cooking time to high and get a hot meal in no...

- Keep food at an ideal serving temperature for as...

- One pot cooking means there are less dishes to...

- All Crock Pot Slow Cooker removable stone inserts...

Let's examine next week's standard deviation report and see what short-term trading opportunities we can identify

GOLD: Weekly Standard Deviation Report

Apr. 07, 2024 5:34 PM ET

Summary

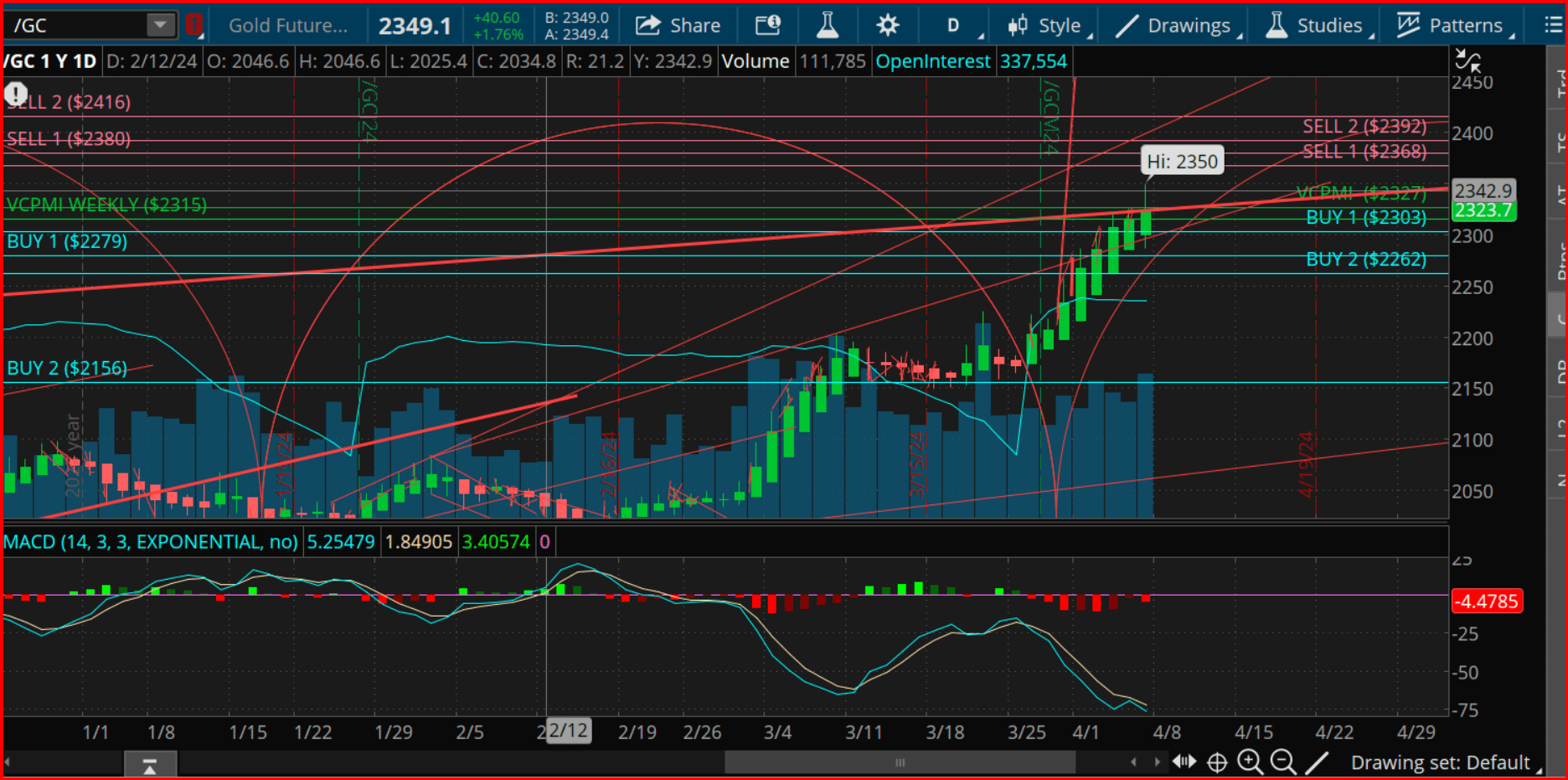

- Closing above the 9-day SMA indicates a bullish trend, attracting more buyers and potentially fueling upward momentum.

- The VC Weekly Price Momentum Indicator confirms bullish price momentum, strengthening the conviction in the bullish trend.

- Specific price levels are provided for managing positions, allowing traders to navigate market fluctuations while staying aligned with the broader trend direction.

weekly gold (TOS)

Weekly Trend Momentum Analysis: The use of the 9-day Simple Moving Average (SMA) as a trend indicator is a common practice in technical analysis. Closing above the 9-day SMA at, 2160 suggests that the recent average price is trending higher, indicating bullish sentiment among traders. This bullish confirmation may attract more buyers into the market, potentially fueling further upward momentum. Conversely, a close below the 9 SMA could signal a weakening of the bullish trend, potentially prompting profit-taking or short-selling strategies.

Weekly Price Momentum Analysis: The VC Weekly Price Momentum Indicator at 2315 provides additional insight into the strength of price momentum. Closing above this indicator confirms that price momentum is bullish, corroborating the bullish signal from the SMA. This confirmation strengthens the conviction in the bullish trend and may encourage traders to enter or maintain long positions. Falling below the VC PMI would suggest a loss of upward momentum, potentially leading to a reassessment of the bullish bias.

Weekly Price Indicator Analysis: The strategy provides specific price levels for managing positions, offering clear entry and exit points. Taking profits during corrections at the specified price range (2279–2214) for short positions acknowledges the potential for market retracements within the context of an overall bullish trend. Using the 2214 level as a stop-loss order for long positions helps to protect profits and manage risk in case of adverse price movements. By incorporating these price levels into the strategy, traders can navigate market fluctuations while staying aligned with the broader trend direction.

Cycle Analysis: Identifying cycle due dates, such as the one mentioned for 4.15.24, adds a temporal dimension to the analysis. Traders may interpret cycle dates as potential turning points in the market, where trends could reverse or accelerate. This awareness of cyclical patterns allows traders to anticipate market behavior and adjust their strategies accordingly, enhancing their ability to capitalize on emerging opportunities or mitigate risks.

- 【Easier to Move】You can use these appliances...

- 【Save Space and Protect Countertops】The small...

- 【Strong Adhesive】The counter slider for...

- 【Easy to Use】28pcs 22mm/0.87in kitchen...

- 【Wide Application】The coffee slider for...

- ✔Update Dishwasher: This dishwasher cover in...

- ✔Size: This Magnet Sticker Dishwasher Covers...

- ✔Material: This dishwasher cover is made of Our...

- ✔Easy to Install and Remove: Dishwasher Magnet...

- ✔Widely applicable: This magnets are easy to...

Strategy Analysis: The strategy's emphasis on profit-taking at specific price levels (2380–2415) for long positions reflects a disciplined approach to managing trades. Taking profits within this range aligns with the expectation of price movement based on technical analysis or other market factors. By adhering to the predefined profit-taking levels, traders can realize gains while minimizing the impact of market volatility or unexpected reversals.

Overall, the analysis highlights the systematic approach employed in the trading strategy, leveraging technical indicators, price levels, and cyclical patterns to make informed trading decisions. Continuous monitoring and adaptation of the strategy in response to evolving market conditions are essential for its effectiveness and long-term success.