Transfer of Paramount Global (NASDAQ:PARA) assets in whole or part will likely be complicated, drawn out in time, and involve extremely contentious, convoluted, and lawsuit-dense negotiations.

Class B non-voting common shareholders may ultimately have to fight for a higher price.

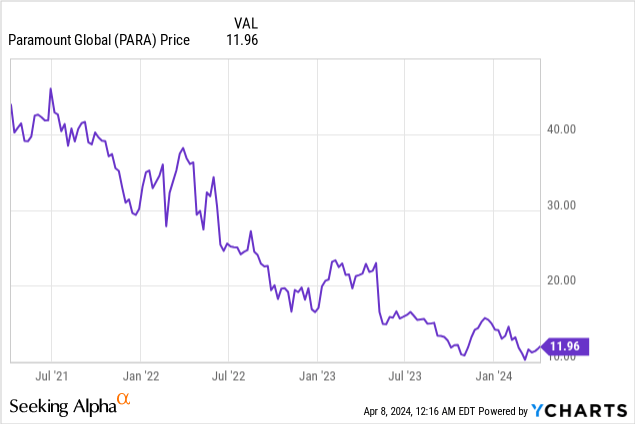

However, given that the assets still retain substantial value and that the share price has fallen so much, the performance rating should now shift from negative to at least neutral/hold.

Higher-than-average share price volatility ought to be expected now.

Introduction

Back on April 3, 2020, in a Seeking Alpha article, I expressed a negative view of the stock performance prospects for Paramount (formerly ViacomCBS).

It's apparent that Shari Redstone, daughter and major inheritor of control of the previously separate (and further back in time combined entities) has decided to seek buyers for the media empire. Control of the empire comes from the voting-class A shares owned by National Amusements, the Redstone holding company.

This was undoubtedly not an easy decision because it's tied up in her family's legacy as cobbled together over many decades by her father, Sumner. Sumner Redstone was by all accounts a very “tough cookie,” probably checking the price of the stock a few times an hour and using this metric as a measuring rod for his sizable life accomplishments.

Data by YCharts

The trouble is that even with the renamed Paramount combination of CBS and Viacom and the installation of a reasonably capable management team headed by Bob Bakish, media industry headwinds have seriously undermined the company's basic cash flows and, accordingly, asset valuations.

First and foremost, Paramount's old Viacom division was highly dependent for earnings and cash flows on the cable network business (e.g., Nickelodeon, Comedy Central, Showtime, etc.). In the good old days that lasted for about three decades, such networks generated margins of maybe 30% and up. But the gravy days ended with the introduction of major competitive streaming services and the acceleration of cable subscriber cord-cutting that began circa 2016 and accelerated into the early 2020s.

Cord-cutting/streaming on the cable side also related to the decline of linear television (broadcasting revenues: 2023 $20.1 B vs 2022 $21.7 B). This led to a less profitable and less valuable division. The best guess is that CBS's profitability, including local stations, will hold steady and improve for a while (especially for the 2024 presidential election year), but after that, it all depends on prospects for the overall economy (questionable in my opinion) and thus demand for advertising.

Despite hits such as Top Gun: Maverick in 2022 Paramount's film studio has also been a disappointment, with operating profits for 2023, 2022, and 2021 reported as – $119 M, +$272 M, and +$207 M, respectively. Labor strikes by the Screen Actors and Writers' guilds adversely affected production at all studios in 2023 and it's likely that studio profitability will for most studios improve in 2025 and 2026.

But this should not be mistaken for a long-term revival of the movie business back to pre-pandemic eras. Domestic box-office attendance has been on a downtrend since the early 2000s and the same seems to be happening in foreign markets. (See my Entertainment Industry Economics, 10th ed. Text for more data.)

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

On streaming, the company started relatively late as compared to Netflix (NFLX) and Disney (DIS) and competition for viewers from rivals such as Warner Bros. Discovery (WBD), and Comcast's Peacock (CMCSA) has been recently intensified by the growing consumers' notion that a household need not subscribe to four or more streaming vendors. Price increases by all of these ought to, of course, further dampen enthusiasm for numerous subscription plans. And an economic recession, if it finally arrives in '25 or '26, will not help stimulate further overall subscriber growth.

Market Considerations and Complications

There have been several potential bidders so far. These include Skydance Media, a sometimes film production partner of Paramount that is mostly interested in the studio and doesn't really want or need a broadcast or cable network. Then there's Apollo, the giant hedge fund that proposed to buy the whole thing for $26 billion, which is a premium above the current share price valuation (rounded to $10 billion but with an addition of about $15 billion in debt).

Then there's a possible conga-line of possible buyers for individual assets that are led by Byron Allen's Allen Media Company and its bid for some or all of the stock, and with a particular interest in some of the cable networks.

Part of the problem with the completion of a sale is the debt load at $15 billion, which despite speculation about Fed rate cuts will need to soon be refinanced at higher rates. At least $1.5 billion in debt, currently at relatively low rates will need to be financed by 2028.

But debt seems the least of the problems, From the outside, Ms. Redstone appears to still be somewhat indecisive and not inclined to sell to funds like Apollo, which are likely to dismember the entire enterprise. The same might be said for the board, which has hired outside consultants, yet which might confuse everyone with conflicting advice.

Then there are the shareholders, major and minor. Major shareholders such as the Gabelli funds reportedly own around 10% of the voting shares and are hurting from the steep price decline. Then also, the class B common holders and their legal and investment advisors are looking for a deal that does not favor Redstone interests with a total valuation that is above that offered to the class B shares.

Reports that PARA may purchase Skydance for $5 billion and then sell a dilutive $3 billion in equity highlight the convoluted and contentious nature of Paramount's financial situation.

Conclusion

No matter how it turns out this entire deal episode will be one for future textbooks and it's far from certain how or when it will end.

All we know from the outside looking in is that it will be contentious, fraught with legal challenges and pitfalls, take a long time to resolve, and be subject to macroeconomic and industry headwinds.

That said, the assets are still of sufficient value and the share price has fallen far enough to consider a neutral rather than a sell rating for patient investors.