Taking lithium mining’s growth prospects into account, Tibet Resources’ investment in Argentina is a sign of the times. The growth prospects of lithium mining is apparent in one Chinese miner’s big bet in Argentina.

Taking lithium mining’s growth prospects into account, Tibet Resources’ investment in Argentina is a sign of the times. The growth prospects of lithium mining is apparent in one Chinese miner’s big bet in Argentina.

Global X ETFs has completed the conversion of two mutual funds into two actively managed emerging markets ETFs. The Global X Emerging Markets Great Consumer ETF (NYSE Arca: EMC) and the Global X

Inflation remains stubbornly high, and banking strains in the United States and Europe have injected greater uncertainty into an already complex economic landscape. Asia and the Pacific remains a dynamic

“The overall outlook (for Latin American economies) is abysmal,” said Ed Moya, senior analyst at forex consultancy Oanda, adding that forecasts halving GDP for the region this year, coupled with lingering political

By converting these two mutual funds into ETFs, Global X is enabling investors to access professionally managed emerging market strategies while enjoying the benefits of the ETF structure including greater liquidity

If there was a way for the Word file to communicate with PowerPoint to create at least a rough draft with slides, in the proper format, with sources cited…over the course of the year, and within WisdomTree’s research

Despite Brazil’s economic challenges amid rising global interest rates and recession fears, the Direxion Daily MSCI Brazil Bull 2X ETF (BRZU) is up about 10% year-to-date. If inflation eases, that should give bullish

India has also become an increasingly attractive location for multinationals across a wide range of industries, with foreign direct investment inflows (FDI) having reached a new record high of USD 84

As we’ve seen in Table 3, Malaysia, and Thailand (together with China) position themselves in the highest rank of GDP per capita in emerging Asia: being exposed to these countries is essential to capture their future

In the high-beta bucket, our largest overweight positions are in Egypt, Argentina, and Angola, and our largest underweight positions are in Nigeria, Honduras, and Bolivia. In Central and Eastern Europe, the

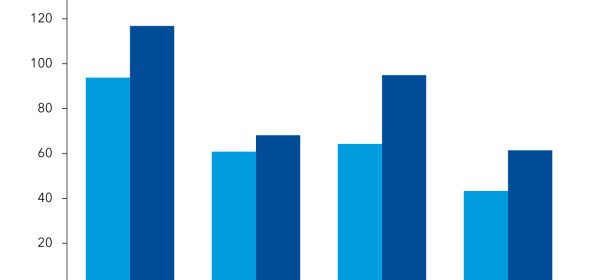

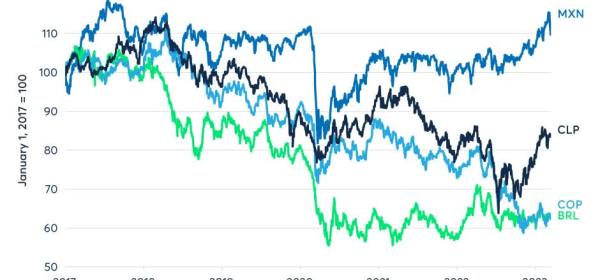

“ Mexico ’s economic activity beat all estimates in January, expanding at the fastest annual pace in five months as the country continues to recover more quickly than expected,”

A deeper consideration of recent policy suggests that a shift might be underway.While the ‘countercyclical policies’ boosted growth, effectively offsetting various economic challenges, they were also riddled with controversy.Slower growth is not necessarily a negative development.

ECH invests in Chilean stocks.The fund is probably at least modestly undervalued, with a net IRR of over 16% possible.However, the fund’s annualized volatility is high as measured by standard deviation. Meanwhile, idiosyncratic risks prevail for ECH shareholders.On balance, I would opt to take a neutral stance on ECH, given the fund’s high level of concentration.

Taiwan’s central bank surprised the market by hiking the policy rate by 12.5bp to 1.875% on 23 March, even though economic data was weak and Taiwan was not suffering