By Ivan Castano

Mexico’s peso continues to enjoy its day in the sun. In May, the currency reached its highest level against the U.S. dollar since 2017, following positive U.S. economic data releases. In the first quarter of 2023, the peso rose more than 7%.

The peso’s strength is nothing new. In fact, it has emerged as the world’s strongest currency over the last several years, thanks largely to capital investment from the United States and China and a tighter monetary policy, according to a report by CME Group Senior Economist Erik Norland.

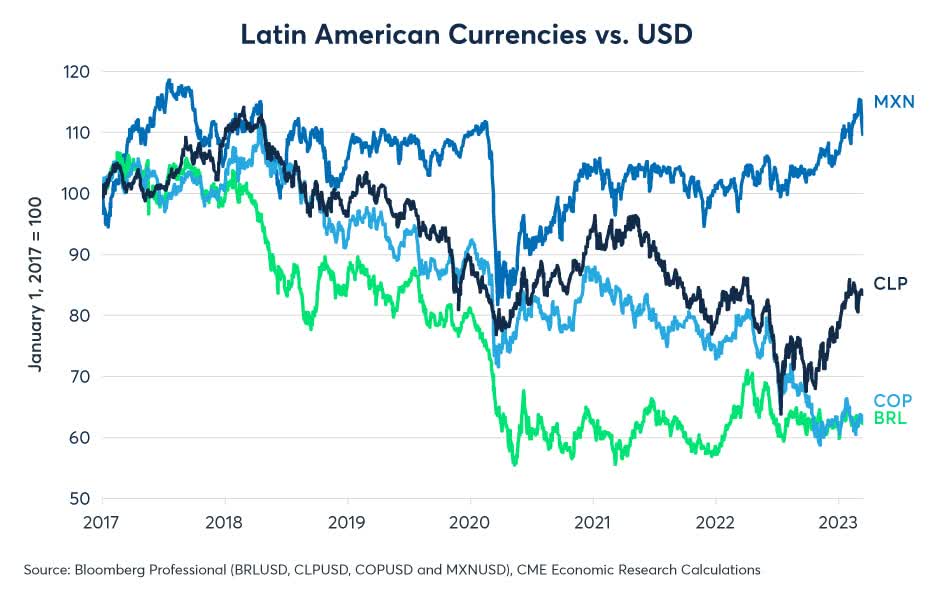

The strong showing does not extend to its counterpart Latin American currencies.

“The overall outlook (for Latin American economies) is abysmal,” said Ed Moya, senior analyst at forex consultancy Oanda, adding that forecasts halving GDP for the region this year, coupled with lingering political uncertainty, could unnerve foreign investors.

Amid this backdrop, the real, Colombian and Argentine peso, and other currencies have either fallen or remained flat against the U.S. dollar in 2023 and could remain pressured throughout the year. “When you talk about Mexico, Brazil and Colombia right now, there is more optimism that Mexico will outperform in the short term while the others will weaken,” Moya added.

Mexico, Latin America’s second-largest economy, will grow 1.7% this year, while Brazil’s GDP will inch up just 1.2%, according to estimates from the International Monetary Fund (IMF). Colombia, meanwhile, will see the sharpest slowdown, with GDP gaining 1.1% versus a nearly 8% jump in 2022. Chile, meanwhile, will contract 1%, while Argentina is expected to see flat growth, according to the IMF.

Backing the rosy outlook for Mexico, Moya said, “There is growing optimism the central bank is nearing peak rates, while the economy has seen a stable rebound from the pandemic and the job market is improving.”

ING analysts echoed that view, noting that Mexico’s currency could benefit from nearshoring trends, such as growing exports to main trading partner, the United States, and a $5 billion investment from electric vehicle (EV) maker Tesla (TSLA), which has announced it will build its next gigafactory in the country.

In the CME Group report, Norland highlights that Mexico’s public debt amounts to 41.6% of GDP, the second lowest rate among countries measured by the Bank of International Settlements. By contrast, public debt is about 58% of GDP in Colombia and 85% in Brazil.

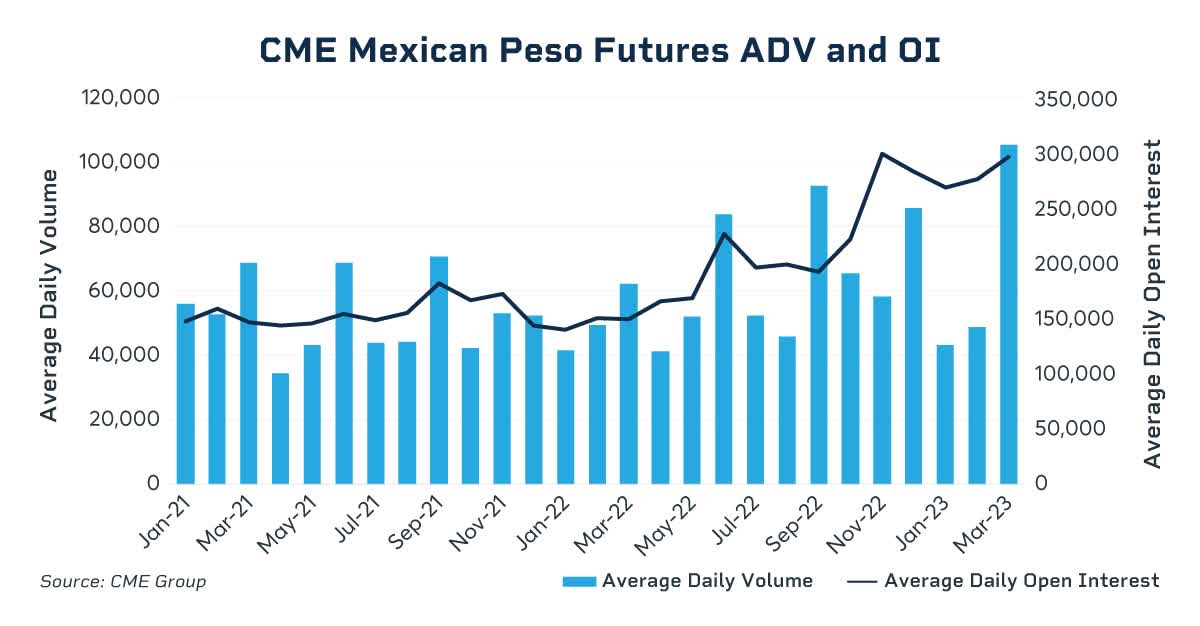

As the peso climbed at the start of the year, CME Group saw record trading in Mexican Peso futures in March, when daily trading volume averaged 105,000 contracts ($2.9 billion notional value). That was up 71% from a year earlier.

Slumping Real

It’s a starkly different story for the real, which hovered around USD/BRL 5 through early May, roughly the same spot as a year earlier.

“Brazil has lingering political concerns, and the economy is not in good shape,” Moya continued. “They also have elevated unemployment of 7.9%, rising inflation and strained finances.”

To curb its ballooning debt (gross debt stands at nearly 80% of GDP) and trim its budget deficit, Brasília recently announced a 9.2% tax on fuel exports and cut local fuel subsidies. Meanwhile, Finance Minister Fernando Haddad called for the new government of President Luiz Ignacio Lula da Silva to slash its 13.75% benchmark interest rate, which he argued is slowing growth. The central bank has opposed the move and held the rate steady at its meeting on May 3.

Adding spice to a heady cocktail, Brazil’s GDP contracted sharply in the fourth quarter, stoking fears of a recession. Analysts at ING blamed the real’s lackluster performance on the volatile political landscape.

“The central bank and politicians are on a collision course,” the analysts said. “The new Lula administration is struggling to balance fiscal constraints with its commitment to help the poor. That same pressure is being brought to bear on the central bank.”

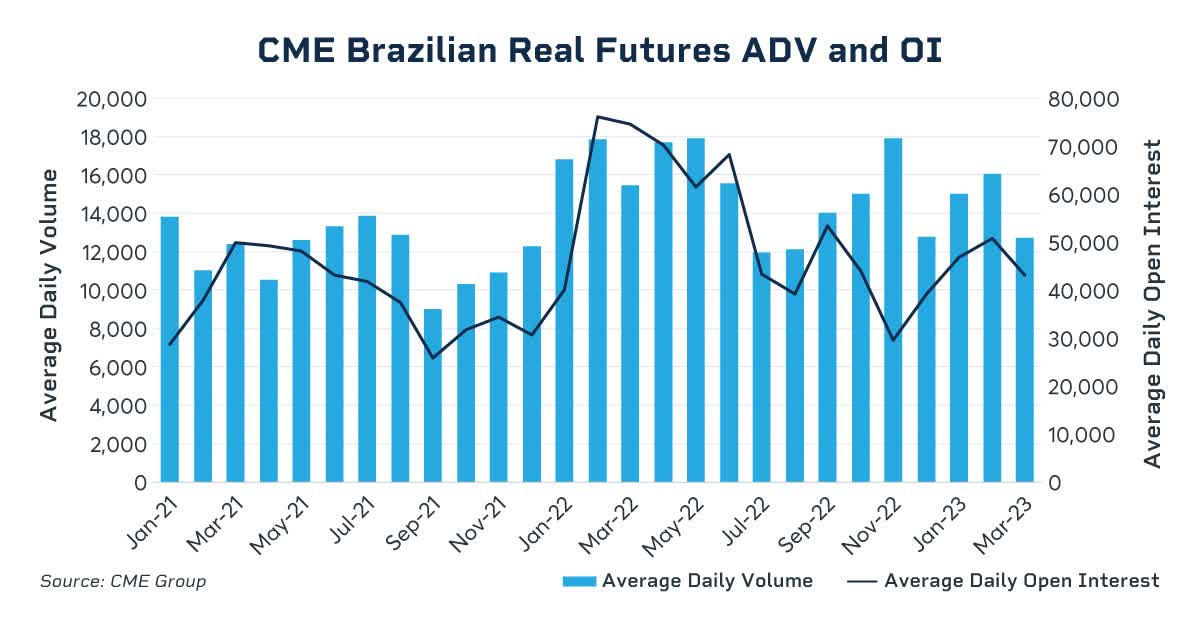

Real futures trading at CME Group has remained steady this year as economic uncertainty surrounds the country. Year-to-date real futures have averaged about 14,000 contracts per day (~$270 million notional).

- NINJA BLENDING ANYWHERE: Blast through frozen...

- LARGE CAPACITY: Makes up to 18 oz. of your...

- PREMIUM COLORS: Choose a color that best fits your...

- EASY TO CARRY: Take your drink on the go with a...

- SIP LID: Easy-open sip lid lets you blend and...

- ALL-IN-ONE BREAKFAST SOLUTION: Start your day off...

- SPACE SAVER: Our compact breakfast maker machine...

- COFFEE MAKER: This coffee maker brews up to 4 cups...

- FAMILY-SIZED GRIDDLE: The large non-stick griddle...

- NOSTALGIA: From designs inspired by early 19th...

In Chile, the world’s largest copper exporter, the currency remained in the 800-850 range through April, down from the 850-1,000 range it saw in the second half of 2022. The currency found lower levels even as copper prices factored in the good news linked to China’s reopening. Chile also faces political headwinds following the defeat of tax reform legislation aimed at supporting President Gabriel Boric’s proposed pension and health system reforms.

In Colombia, falling crude prices and political volatility are hurting the peso, amid a looming cabinet shake-up in new President Gustavo Petro’s administration.

“The dollar could rise further,” said Santiago Moya, a forex analyst at local lender Bancolombia. “There are many political risks. Three ministers were fired recently, and there are concerns of more dismissals. We also have energy, pension and labor reforms that will be decided by year end, and these could trigger nervousness for international investors and capital markets.”

Brightening Outlook?

Jonathan Petersen, senior markets economist at Capital Economics, suggests that the real could reverse its current trajectory under certain conditions.

The real could be helped by expectations that the Federal Reserve will slow its rate hiking campaign, while a firming global economy should fuel investor appetite for risky Latin American assets, according to Petersen. He also expects China’s reopening to bolster demand for Brazil’s top commodities, including soybeans, which are poised for a record harvest in 2023.

Even after years of strong performance, the peso could also see a reversal of fortune.

“The peso has been surprisingly resilient given how much the U.S. economy has slowed and the Fed’s tightening of financial conditions,” said Petersen. “The U.S. would have to avoid recession for the peso’s strength to continue. We also have new risks stemming from the 2024 elections.”

Norland points to Mexico’s inverted yield curve as a sign that its economy’s current direction is not certain to continue, noting that the country’s 3-month rates have consistently been 2.5 – 3% above its 10-year rates.

“In Mexico, as elsewhere in the world, the yield curve has often been a reliable, if imperfect, indicator of acceleration and deceleration in the pace of growth,” he notes.

- Protect Your Kitchen Appliances: This toaster dust...

- Universal Size: two sizes available, S-11.4 ''L x...

- Material: high-quality and durable hemp-like...

- Easy to Use & Clean: There is a hanging rope on...

- Exquisite Gifts: Our bread machine dust cover has...

- Durable metal housing with soft matte premium...

- Dimension: 17.0"x21.2"x12.2" (Length x Width x...

- Large 12.4" glass turntable

- 15 Digital Preset Functions

- Touch-activated display

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Region ETF of Latin America ETF List (1/5): Overview