Despite the recent turmoil in emerging-markets local bonds, they could be an attractive option based on valuations,” Morningstar said.

One Vanguard offering is the Vanguard Emerging Markets Government Bond Index Fund ETF Shares (VWOB A+).

blog will be used in Mailchimp campaign

Despite the recent turmoil in emerging-markets local bonds, they could be an attractive option based on valuations,” Morningstar said.

One Vanguard offering is the Vanguard Emerging Markets Government Bond Index Fund ETF Shares (VWOB A+).

We’ve broken these down into four pillars: scalability, portability, resiliency, and agility.

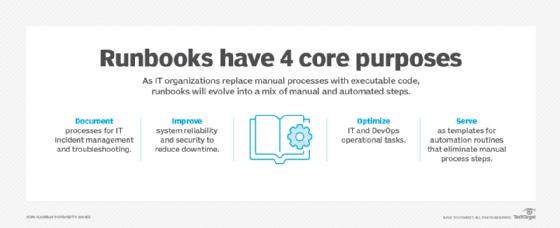

Creating a DevOps runbook that meets these qualities requires a disciplined process of planning, research, writing code — for automated routines — testing, feedback, optimization and updates.

That’s why I think we’re going to see more companies empower their front-line teams to fully manage the customer experience (CX), from identifying and solving CX problems to deploying solutions quickly and integrating lessons learned into future activities

We’re going to see more organizations use ESG objectives as a driver for reinventing their business models, developing new products and services, and offering unique customer and employee experiences.

iM Global Partner Fund Management has launched an actively managed ETF that will provide exposure to various investment asset classes, including equity and fixed income securities, real estate, commodities, currencies, cash, and cash equivalents.

For example, the Simplify Interest Rate Hedge ETF (PFIX) seeks to hedge interest rate movements from increasing long-term interest rates.

You can also use the Amazon Redshift query monitoring rules (QMR) feature to set metrics-based performance boundaries for workload management (WLM) queues, and specify what action to take when a query goes beyond those boundaries.

So, again, getting back to dividend payments, specifically, what I’m looking for this year is, there’s still a few companies out there that I think need to get back to where they were prepandemic as far as paying out the percentage of typical earnings in dividends.

Hybrid work conditions in which employees conduct business from their homes, corporate offices and third party locations are widely considered to be the way in which post pandemic knowledge work will be performed.

However, with emerging markets rate tightening now largely baked into bond prices, exchange traded funds like the VanEck J.P. Morgan EM Local Currency Bond ETF (NYSEArca: EMLC) could be poised to snap out of recent doldrums this year.

15 Funds for 2022 and BeyondHere are some great funds for the long haul.

Enabling applications, including the most business-critical ones, to run in public cloud when they were not built to do so requires a costly and time-consuming refactoring process.

Hybrid multi-cloud, or an IT environment providing unified infrastructure operations and management across private and public clouds, is perfectly poised to help bridge the gap businesses face due to supply chain issues.

BNDW seeks to track the performance of the Bloomberg Global Aggregate Float Adjusted Composite Index, which measures the investment return of investment-grade U.S. bonds and investment-grade non-U.S. dollar-denominated bonds.

Experts Forecast Stock and Bond Returns: 2022 EditionU.S. equity expectations drop further still, but most firms spy better values overseas.