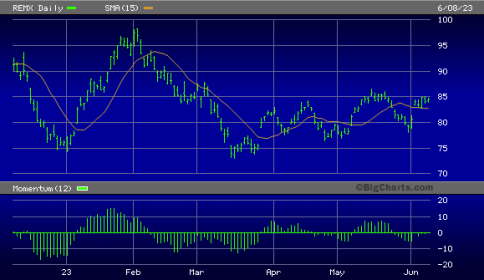

I last wrote about platinum and the abrdn Physical Platinum Shares ETF (NYSEARCA:PPLT) on Seeking Alpha was in early December 2022. Nearby NYMEX platinum futures were at the $1,053 level, with the PPLT ETF trading at $96.24 per share. Ten months later, October platinum futures on the CME’s NYMEX division were trading at $968.70, 8% lower, and PPLT at $88.68 per share declined 7.9%.