The long-term demand picture for silver is strongly bullish because of two distinct drivers: monetary debasement and increased industrial use for the green energy transition.The short-term demand picture could be challenged by economic weakness, a hawkish shift in monetary policy expectations, and a stronger dollar.The supply picture is mixed, with new supply entering over the next few years, before gradually declining.From a technical perspective, silver seems poised to consolidate, before resuming its rise.

PSLV: Going Higher, But Patience Required

In a recent article, I argued the case for investing in physical gold. A combination of historical forces, including de-dollarization, structural inflation and financial repression, are going to be long-term tailwinds for gold over the coming decade. I see gold appreciating significantly against all fiat currencies because of a new important source of demand: central banks. Gold is emerging as the reserve asset of last resort to settle trades outside the dollar system, as the world transitions to a multipolar order.

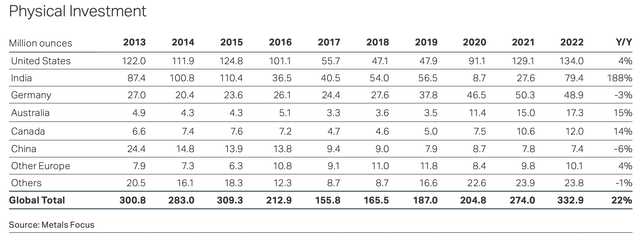

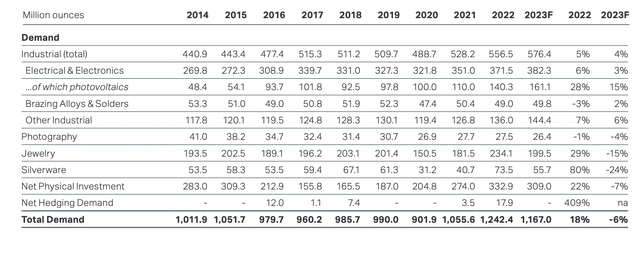

Some of the same considerations also apply to silver, but not all of them. Silver is a monetary metal, though not primarily so. It is not used as a reserve asset: central banks are buying gold, not silver. Nonetheless, investment demand remains an important source of demand. In 2022, silver demand has been estimated at 1,167 million ounces, of which 309 million from investment demand, or roughly 27% of total demand. As can be seen from the following table, investment demand increased 22% compared with 2021, touching an all-time high over the past decade. This was achieved despite monetary headwinds and exceptionally high premia due to a lack of product availability. Inflation fears, the Russia-Ukraine war and weak prices stimulated demand in many countries, with India leading the pack with a staggering 188% increase.

Investment demand is projected to remain strong in the coming years. Silver shares with gold some of the same driving factors. It benefits from macroeconomic uncertainty, lack of faith in the soundness of fiat currencies and monetary debasement. Silver is in fact strongly correlated with gold: the average gold vs. silver correlation over the last decade has been around 0.8. As the mantra goes, silver tends to lag gold in the early stages of a bull market, but also to outperform it due to its greater volatility by the end of it. I suspect that over the next decade, the correlation with gold will continue to be important, but it might be a less important driver of prices. As already mentioned, central banks are going to be major buyers of gold, but not silver, so gold is poised to benefit more than silver from the geopolitical and monetary transformations underway.

However, there exists a completely different reason to be bullish on silver long-term, and it has to do with the green energy transition. Silver is now primarily an industrial metal (accounting for around 70% of total demand in 2022). Industrial demand has been on the rise, increasing more than 30% since 2015. This has been achieved against the backdrop of a secular decline in silver photographic utilization, more than compensated by an increased use in electronics and photovoltaics. It should be remembered that photographic demand used to be the primary source of industrial silver demand up until the early 2000s, reaching its high point in 1999 at over 93 million ounces. It has since declined to only 27.5 million ounces, as digital cameras have become widespread.

On the other hand, silver demand for photovoltaic panels has increased dramatically, from only 48 million ounces in 2014 to 140 million ounces in 2022. The increase in demand has recently accelerated, as the themes of energy security and the energy transition have come to the forefront of political discourse. Demand from photovoltaics increased 28% in 2022, and it is further set to rise another 15% in 2023 to 161 million ounces. This is still only less than 15% of total demand, but it is rising quickly, despite lower silver loadings per photovoltaic cell. It is unclear whether technological progress can continue lowering silver loadings going forward at the same pace.

Summarizing, the long-term demand picture looks bullish. This is because of two distinct drivers: correlation with gold and increased use for industrial purposes (in particular photovoltaic cells, electric vehicles and 5G networks). In the short-term, however, industrial demand could be challenged by economic weakness. Investment demand could be hurt by a hawkish shift in monetary policy expectations and a stronger dollar. This is especially so considering that the dollar appears to be oversold, and the bond market is pricing in unlikely rate cuts this year.

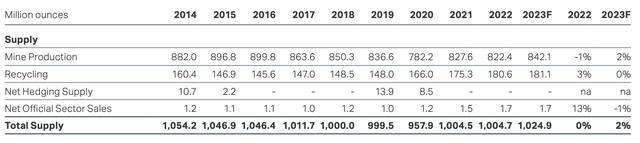

The supply picture is mixed. In 2022, roughly 85% of supply came from mining, the rest mostly from recycling. Recycling has expanded significantly in recent years, but it seems to have reached a plateau. Production from mines has marginally declined, touching a low point in 2020 due to covid disruptions to supply chains. However, it has rebounded strongly, increasing +5.7% YoY in 2021.

In 2022, mining supply was marginally down (-1%). In absolute terms, Peru saw the largest decline (-8.5 million ounces), because of suspension of mining at Buenaventura's Uchucchacua, social unrest and generally lower grades. Another reason for the decline was the lower by-products from lead and zinc mines, especially in China. In fact, 72% of silver supply from mines is a by-product of gold and other industrial metals. China is the biggest producer of both lead and zinc, so silver supply tends to be correlated with Chinese industrial activity. China's recent economic weakness has therefore weighed on silver supply, but also on silver demand, since China is a major producer of photovoltaic panels.

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- The Editors of National Geographic (Author)

- English (Publication Language)

- 112 Pages - 04/02/2021 (Publication Date) -...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

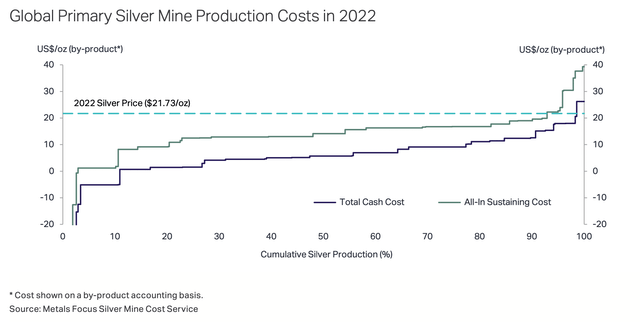

Looking ahead at the next few years, mine production is set for some modest growth. An important batch of new supply will come online in 2023, with Fresnillo's Juanicipio expected to reach full capacity, Kinross' La Coipa ramping up and Gold Fields' Salares Norte being commissioned. Overall, mine supply is forecast to grow 2.4% in 2023. It is doubtful, however, that such a growth rate can be maintained beyond the next 4-5 years. Mine supply remains challenged by geopolitical tensions. For instance, while silver production from Russian miners actually grew in 2022, many have been forced to delay long-term projects because of rising costs and logistical difficulties (for instance, Polyus' Sukhoi Log gold project). Peru's output has also been challenged by political and social unrest, especially after the impeachment of President Pedro Castillo in December 2022, with many operations still suspended. Crucially, production costs have risen significantly because of inflation, squeezing margins and delaying new projects. Part of the global supply curve remains below current spot prices, so higher prices will be needed to incentivize new supply, especially if inflation proves to be structural as I do in fact believe.

Putting everything together, silver posted a big deficit of around 238 million ounces in 2022, due to supply being roughly flat but demand rising. To put this in perspective, the deficits of the last two years are enough to counterbalance the surpluses over the previous 11 years, when silver was modestly oversupplied as photographic use slowed down and production was still ramping up. These deficits are likely to continue going forward, as supply is inelastic and demand has powerful secular tailwinds.

Nonetheless, investors should be cautioned that there is no instantaneous correlation between supply/demand imbalances and price movements. Looking at past data, silver fell in 2013 despite the market being in a deficit, and it rose in 2020 despite the market being oversupplied. Like for other commodities, it takes years of sustained deficits to move prices. This is particularly true for silver. Silver is only in part an industrial metal, so it trades strongly on other factors, including sentiment, monetary policy expectations and geopolitics. In addition, silver has historically suffered from large available inventories. Even if identifiable silver inventories have recently been falling, they remain at high levels. For example, in 2022 inventories at London vaults and CME together accounted for around 1,278 million ounces, more than one and a half times the total annual silver production from mines.

In conclusion, I believe that a long-term allocation to physical silver, along with gold, will prove rewarding. Silver ETFs provide a practical way to do so. I discussed in a previous article the advantages of the Sprott Physical Silver Trust (NYSEARCA:PSLV). Reasons to choose such an ETF over alternatives include its lower costs, high liquidity, redemption mechanism, potential tax advantages, and the fact that the metal is held in fully allocated form outside the financial system.

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

With premia for physical coins and bars still high, it is also interesting to note that PSLV is currently trading at a -2.93% discount to NAV. This is an even higher discount than when I initiated my coverage of PSLV, very close to the point where silver bottomed last year. I see this as a sign that sentiment is far from ebullient in the precious metals sector.

Finally, a word of caution. While my outlook for silver is bullish in the long-term, from a technical perspective silver has just enjoyed a strong run, rising by 35% since October 2022. While the overall trend is up over the coming years, I believe silver will likely consolidate or fall back in the short-term. As evidenced by the year-to-date rally in equity markets, lower volatility, and more dovish monetary policy expectations, I fear there is too much misplaced complacency around. Therefore, I am not a buyer at current levels, but I would be ready to buy if a correction materializes in the next few months.