US-listed REITs posted the strongest gain for the major asset classes in last week’s mostly quiet trading, based on a set of ETF proxies.A key headwind for REITs is rising interest rates, which poses competition for the relatively high payout rates for real estate securities.Comparing the major asset classes through a drawdown lens continues to show relatively steep declines from previous peaks for markets around the world.

U.S. REITs Rebound, But Bearish Trend Still Weighs On Sector

US-listed real estate investment trusts (REITs) posted the strongest gain for the major asset classes in last week's mostly quiet trading, based on a set of ETF proxies. A solid gain is welcome news for REITs, which have been sliding for more than a year, but it's debatable if the rally signals an end for the sector's bear market.

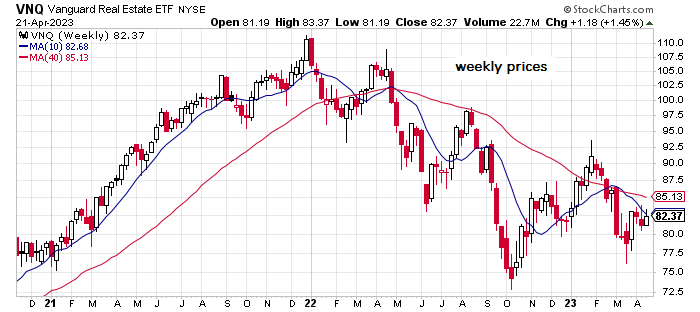

Vanguard Real Estate Index Fund (VNQ) rose 1.5% for the trading week through Friday, Apr. 21. The gain marks the first weekly advance in the past three. The optimistic view for VNQ is that it's in a holding pattern after persistently sliding from its peak in late-2021.

A key headwind for REITs is rising interest rates, which poses competition for the relatively high payout rates for real estate securities. The contrarian view is that REIT prices have adjusted to a world of higher interest rates, and the sector now presents a compelling buy after a sharp correction.

“The starting point for valuations today is already adjusted to reflect higher yields; second, REITs are positioned better today than prior recessions, particularly the Global Financial Crisis,” advises Una Moriarity, a strategist at CenterSquare, in a recent report.

For the trailing one-year period, VNQ's yield is 4.11%, according to Morningstar.com. Meanwhile, the current yield on a 10-year US Treasury Note is substantially lower at 3.57%.

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

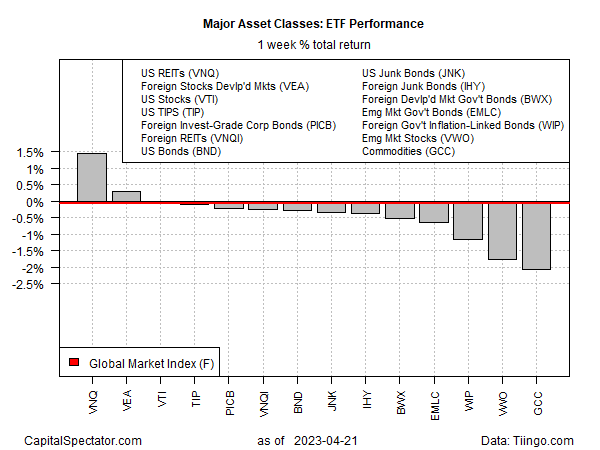

Most of the major asset classes traded in a tight range last week. The downside exceptions: Stocks in emerging markets (VWO) and commodities (GSG) posted relatively sharp losses.

The Global Market Index (GMI.F) barely budged last week, ticking down fractionally. This unmanaged benchmark holds all the major asset classes (except cash) in market value weights via ETFs and represents a competitive measure for multi-asset class portfolio strategies.

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

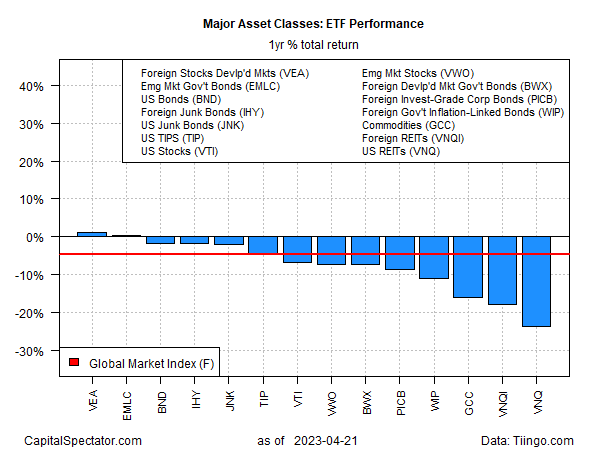

For the one-year window, developed markets stocks (VEA) and emerging markets debt (EMLC) are posting the only gains. The rest of the field, along with GM.F, continue to record losses vs. year-ago prices.

Comparing the major asset classes through a drawdown lens continues to show relatively steep declines from previous peaks for markets around the world. The softest drawdowns at the end of last week: Developed markets stocks (VEA), with a peak-to-trough decline of -8.5%.