I last wrote about platinum and the abrdn Physical Platinum Shares ETF (NYSEARCA:PPLT) on Seeking Alpha was in early December 2022. Nearby NYMEX platinum futures were at the $1,053 level, with the PPLT ETF trading at $96.24 per share. Ten months later, October platinum futures on the CME’s NYMEX division were trading at $968.70, 8% lower, and PPLT at $88.68 per share declined 7.9%.

Platinum is a rare precious and industrial metal that continues to frustrate, disappoint, and infuriate investors who buy the commodity with visions of capital appreciation. With silver over $24, gold at the $1,950 level, and palladium over $1,200 per ounce, platinum below $1,000 appears to be a bargain. Sometimes, prices are low for a reason. Platinum has been a compelling investment for years, but the performance has been nothing short of awful.

The dog of the precious metals sector continues to have fleas in September 2023, but even the mangiest financial commodities eventually break their bearish pattern. PPLT at below $100 and platinum under $1,000 per ounce are inexpensive, but there are no guarantees that capital appreciation is on the immediate horizon.

Platinum prices continue to languish- $1,000 has capped the price

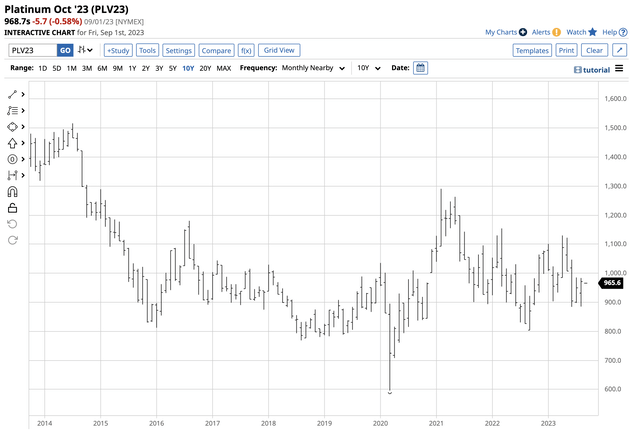

In February 2021, nearby NYMEX platinum futures reached $1,290.60 per ounce after reaching a bottom below $600 in March 2020 as the global pandemic gripped markets across all asset classes. After doubling in less than a year, platinum could not sustain further gains.

The chart highlights the bearish pattern of lower highs in the platinum futures market since the February 2021 peak.

In 2021, nearby platinum futures traded in a $893.60 to $1,290.60 range. In 2022, the price extended lower, with a $804 low and a $1,154 high. Over the first eight months of 2023, platinum has traded inside the 2022 trading band, with a $884 low and a $1,129.80 high. At $968.70 per ounce on September 1, platinum was below the 2023 range’s midpoint, struggling to sustain any rallies above the $1,000 level.

Platinum is rarer and cheaper than gold- The spread remains around a $1,000 discount

In 2022, total platinum mine production was 190 metric tons or just over 6.1 million ounces. At $1,000 per ounce, the value was around the $6.1 billion level. The NYMEX platinum futures market had a total number of open long and short positions of 70,041 contracts on August 31. As each contract contains 50 ounces, the open interest was just over 3.5 million ounces, worth $3.5 billion at the $1,000 per ounce level.

Meanwhile, in 2022, the total gold mine production was 3,100 metric tons or nearly 100 million ounces, making platinum output sixteen times rarer. At $1,960 per ounce, the value was thirty-two times higher at $196 billion. Open interest in the COMEX gold futures market was at 442,643 contracts on August 31, each containing 100 ounces. Open interest of 44.26 million ounces translates to a $86.75 billion value, nearly twenty-five times higher than platinum.

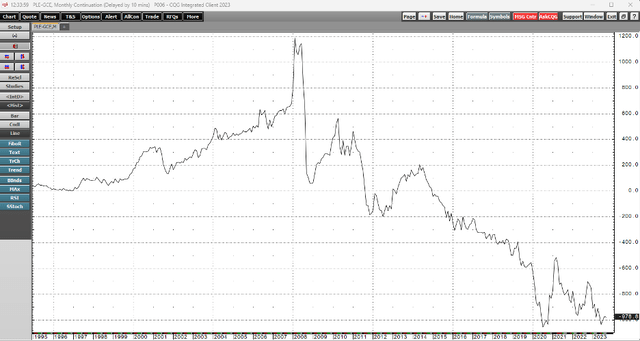

Platinum is a rarer metal than gold. The platinum market’s value and transactional activity make the metal far less liquid than gold. For many years, platinum’s nickname was “rich person’s gold” because it was more expensive than gold. However, platinum has not commanded a premium to gold since late 2014.

The monthly chart of nearby NYMEX platinum futures minus nearby COMEX gold futures shows the bearish pattern of platinum versus gold prices since the early 2008 high when the spread eclipsed a $1,180 per ounce premium for platinum. The spread fell below flat in 2011-2013 and began steadily declining in 2014, reaching an over $1,000 discount to gold in 2020. At close to the $1,000 discount for platinum on September 1, the rare metal remains near the lowest level against gold since the precious metals futures began trading in the 1970s.

A deficit does not matter because of economic concerns

The platinum market has moved into a deficit where the demand exceeds annual supplies.Johnson Mattheyforecasts the 2023 shortfall at 128,000 ounces, the first deficit since 2020 and a significant change from the 2022 740,000-ounce surplus.

Meanwhile,Original Postlatinum-quarterly">the World Platinum Investment Council, a trade association funded by the platinum mining community, projects a 983,000 ounce 2023 deficit, the most significant since 2014 after last year’s 854,000 ounce surplus. Rising investment demand, robust industrial demand driven by glass expansions in China, and strong automotive demand as catalytic converters increasingly use platinum, substituting for more expensive palladium, have caused the deficit. Meanwhile, falling South African mine output because of ongoing electricity shortages and the uncertainty of Russian supplies are weighing on the supply side of platinum’s fundamental equation.

While the supply and demand picture look bullish, rising interest rates, economic weakness in China, and overall uncertainty about the economic landscape have not created the environment for any significant rally in the platinum market.

Production from BRICS countries- Few investors care because they have been burned

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- Elevate Your Vision : An Enhanced Vision Board...

- Experience a new level of quality with our...

- Our vision board kit for women offers hand-picked,...

- Whether it’s a gift vision board for teens,...

- At Lamare, our mission is to help women plan and...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

Economic conditions have not created a bullish environment for platinum prices, but the geopolitical landscape remains an underlying bullish factor that could cause significant supply shortages and higher prices.

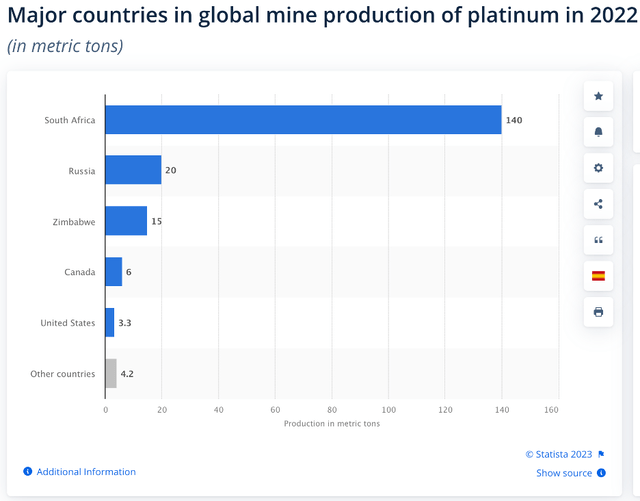

The chart illustrates over 84% of the world’s 190 metric tons of mine supplies in 2022 came from South Africa and Russia. 74% came from the leading producer, South Africa, with Russia producing 10%. The twenty metric tons of Russian production is a byproduct of nickel output in Siberia’s Norilsk region. Given the overall fundamental market tightness, the 643,000 ounces from Russia could become a significant factor.

Moreover, the ongoing war in Ukraine has caused a bifurcation of the world’s nuclear and economic powers. Sanctions on Russia have led to a move towards de-dollarization and the potential for a BRICS currency with gold backing. The BRICS bloc includes Brazil, Russia, India, China, South Africa, and their allies. The BRICS bloc dominates worldwide platinum production. In 2022, China was the world’s leading platinum consumer at 75.1 metric tons, or almost 40% of global mine supplies. Europe was second, consuming 48.6 metric tons, or 25.6% of global production. Meanwhile, the United States consumed 42 tons of platinum in 2022, or 22% of supplies, meaning the U.S. and Europe depend on BRICS output as they consume nearly half the mined platinum annually. The geopolitical landscape threatens those supplies.

While the fundamental case remains compelling, platinum investors have struggled. Platinum’s price action fifteen years ago caused many investors to take the metal off their radar. Platinum reached a record $2,308.80 high in March 2008. Seven months later, the price plunged 67% to a $761.80 low during the global financial crisis. While gold prices also fell during the period, the precious yellow metal dropped 32.9% from $1,014.60 in March 2008 to a $681 low in October 2008. Gold outperformed platinum during the price carnage as it is a much more liquid market that is not susceptible to price gaps. Investors have shunned platinum over the past decade and a half while embracing gold as an investment asset.

Moreover, gold has a far longer history as a financial instrument, and central banks validated gold’s role in the global financial system as they hold gold as a reserve asset, classifying the precious metal as a foreign exchange asset. While Russia may maintain some platinum inventories in reserves, few other countries have strategic stockpiles for financial reasons. Platinum may be precious, but it is primarily an industrial metal.

PPLT is the platinum ETF- Buy on Dips- Platinum will eventually have its day in the bullish sun

Given the strength in gold, silver, and palladium futures markets over the past years, platinum’s price weakness remains an enigma. The profitable approach has been to purchase platinum on price weakness and take profits when the metal looks like it will break out to the upside. Platinum has invariably failed on break-out attempts, but its illiquid nature could one day lead to an upside gap as selling evaporates.

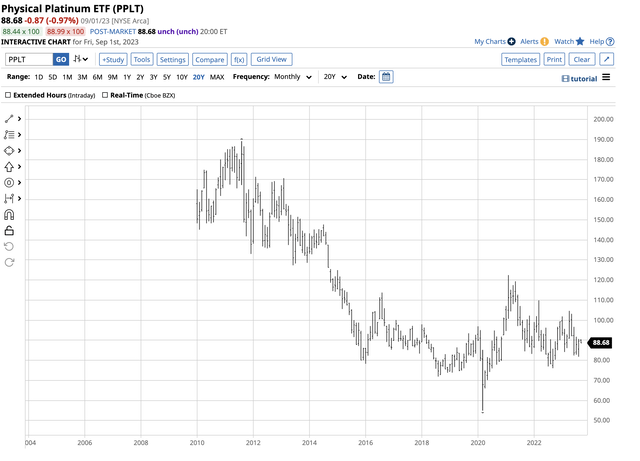

The most direct route for a platinum investment is the coins and bars sold by reputable physical precious metals dealers. The NYMEX futures provide an alternative as they have a physical delivery mechanism. The Aberdeen Physical Platinum ETF product (PPLT) is a liquid alternative to holding platinum metal for venturing into the leveraged and margined futures arena. At $88.68 per share on September 1, PPLT had around $966 million in assets under management. PPLT trades an average of 73,035 shares daily and charges a 0.60% management fee. PPLT owns physical platinum bullion.

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

The chart highlights PPLT’s disappointing price action since its 2010 listing.

Platinum remains the weak link in the precious metals sector, but every dog eventually has its day. The supply-demand deficit, BRICS production domination, and rising demand are compelling reasons to own platinum. Investing in platinum requires patience and perseverance, as it has been dead money for years.