Small-caps equities can make a pronounced move to the upside. This is especially so after the recent interest rate hike pause by the U.S. Federal

Small-caps equities can make a pronounced move to the upside. This is especially so after the recent interest rate hike pause by the U.S. Federal

The iShares Core S&P Small-Cap ETF (IJR) is poised to outperform cash and the broader market, backed by dovish Fed comments and weak jobs data. Small cap stocks, which have underperformed compared to large caps, are expected to rebound due to their current extreme valuation discount. Although challenges exist, like high real yields and slowing economic growth, IJR’s historical growth and favorable valuations present a strong case for investment.

The SPDR S&P 600 Small Cap Value ETF (SLYV) targets equity investments in over 400 value oriented small-cap companies. Despite its diversification across sectors and holdings, SLYV’s sector breakdown, valuation ratios, and past performance do not show significant difference from its parent index, the S&P 600. Due to its high reliance on the price/book ratio and disregard for industry-specific factors while ranking stocks, the ETF mirrors typical weaknesses of value ETFs.

Investors are dealing with geopolitical risk, inflation, and high interest rates that are fueling market volatility. However, this can be managed with strategies like utilizing the American Century Low Volatility ETF (LVOL), an actively managed fund that provides flexible exposure at a 0.29% expense ratio. The fund invests in companies with strong, steady growth and sound fundamentals.

The Pacer US Small Cap Cash Cows 100 ETF (CALF) is a unique investment option that focuses on small-cap firms with high free cash flow yield. It provides growth potential with reduced risks by balancing potential returns and risks through cash flow. The fund outperforms small-cap passive averages and closely competes with large caps, and its investment strategy hinges on free cash flow yield, which is an indicator of a company’s financial health and growth opportunity.

MarketWatch highlights the successful VanEck Morningstar Wide Moat ETF (MOAT), which has consistently outperformed the S&P 500 by targeting companies with long-term competitive advantages, or “economic moats.” The MOAT ETF carefully selects approximately 145 companies identified by Morningstar analysts for their economic moats, which are likely to endure competitive pressures resulting in sustained profitability. The five sources of economic moats identified include switching costs, intangible assets, network effect, cost advantage, and efficient scale.

Persistent high interest rates due to stubborn inflation are negatively affecting small-cap companies, as they increase borrowing costs that these firms struggle to maintain. Despite 2023’s optimism for all equities, small-caps are suffering, as signaled by the Russell 2000 entering negative territory. Unless macroeconomic conditions improve, most notably lower interest rates, the situation is unlikely to change.

VT Bears argue US stocks already have inherent exposure to international markets.VT Bears argue US stocks have historically outperformed and will continue to do so.VT Bulls argue international exposure is important for diversification through a cyclical US Stock Market.VT Bulls argue past performance does not indicate future expectations.

Since 2013, our SPIVA ® Australia Scorecards have shown that the majority of actively managed Australian equity funds have typically underperformed the S&P/ASX 200 . According to the recently published SPIVA Australia Mid-Year 2023 Scorecard, 55% of Australian Equity

IWD invests in value stocks in the Russell 1000 index.A significant portion of its portfolio consists of sectors that are sensitive to the strength of the economy.IWD’s current valuation is towards the high end of its historical average.

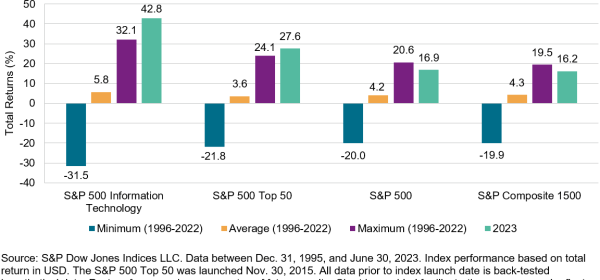

Given that S&P DJI’s indices benefited from having less exposure to Information Technology in 2022, one might expect this helped to explain relative performance in H1 2023. The consequences of Information

The different drivers of relative performance across the cap spectrum have once again demonstrated the importance of index construction and potential impact of stock selection and size exposures. Information

The article discusses my favorite ETFs and self-indexing strategies for investment in this unsure environment. Nicholas Taleb’s Fooled By Randomness is a great introspective book I like to use to check my hubris.Time in the market always trumps timing the market, but be sure to protect your downside with diversification.

Despite the challenges that such an uncertain environment creates for trend following strategies, iMGP DBi Managed Futures Strategy ETF (DBMF) continues to recover from March lows. Since March 24, the fund