The Pacer US Small Cap Cash Cows 100 ETF focuses on small-cap companies with high free cash flow yield, offering growth potential with reduced risks.Small-cap stocks often offer higher potential returns but come with higher risks; the CALF ETF helps investors balance risk and return through cash flow.CALF has outperformed small-cap passive averages and kept up with large caps, making it a notable option in the small-cap space.

Small-cap stocks have been incredibly difficult to invest in passively. With many zombie companies and repeated false momentum signals since 2014 on a relative basis, many traders and investors have given up hope. But there is one approach to small-cap investing which does seem to be working, and which makes a lot of sense, especially at this point in the cycle.

The Pacer US Small Cap Cash Cows 100 ETF (BATS:CALF) offers a unique solution by focusing on companies with a high free cash flow yield. This strategy offers investors the opportunity to capitalize on the growth potential of small-cap companies, while mitigating the inherent risks associated with them fundamentally.

Understanding Free Cash Flow and Its Significance on Small Caps

Free cash flow refers to the cash a company has left after deducting its expenses, interest, taxes, and long-term investments. It's the money that a company has available for activities such as stock buybacks, dividend payments, or mergers and acquisitions.

A high free cash flow yield indicates that a company generates more cash than it requires for its operations, suggesting that it has the financial health to invest in growth opportunities. Hence, companies with high free cash flow yields are often seen as attractive investment opportunities, particularly in the small-cap space.

Small-cap companies are often overlooked by investors, yet they offer a myriad of investment opportunities. These companies, typically valued between a few hundred million dollars and a few billion dollars, may offer higher potential returns than their large-cap counterparts, which are usually represented by indices like the S&P 500 (SP500).

However, investing in small-cap stocks carries its own set of risks. These companies often have fewer financial resources, making them more volatile and potentially risky. The CALF ETF offers investors a chance to gain exposure to this market segment, helping them balance the potential for high returns with the associated risks through the lifeblood of a company – cash flow.

The Pacer US Small Cap Cash Cows 100 ETF

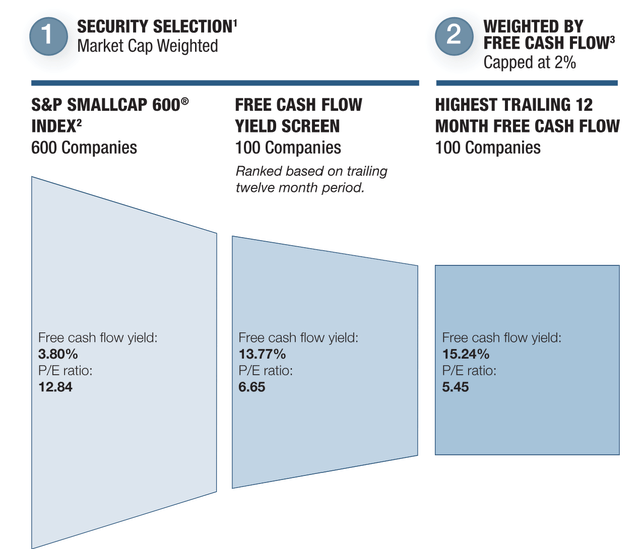

The Pacer US Small Cap Cash Cows 100 ETF offers a unique, rules-based methodology that uses a quality screen to select the top companies in the small-cap universe. The exchange-traded fund focuses on the top 100 small-cap companies with the highest free cash flow yield, providing investors with exposure to quality small-cap companies that are trading at a discount.

This strategy aims to generate long-term capital appreciation by using free cash flow yield to gauge a company's sustainability. This could potentially yield higher returns and more attractive upside/downside capture over time. Each company has a cap of 2% at the time of rebalance, ensuring a balanced portfolio. The ETF is rebalanced and reconstituted quarterly.

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

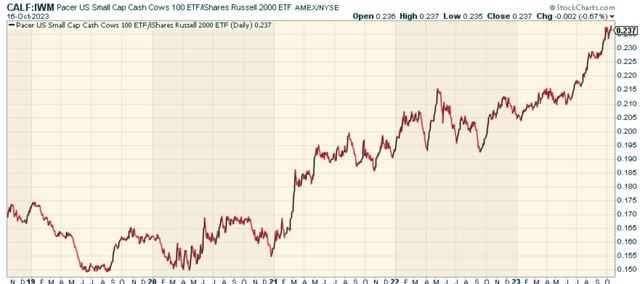

When compared to other small-cap ETFs, CALF stands out due to its focus on free cash flow yield. It has clearly worked. If we look at the price ratio of CALF relative to the iShares Russell 2000 ETF (IWM) over the last 5 years, CALF has meaningfully outperformed small-cap passive averages and kept up nicely with large caps over the last few months.

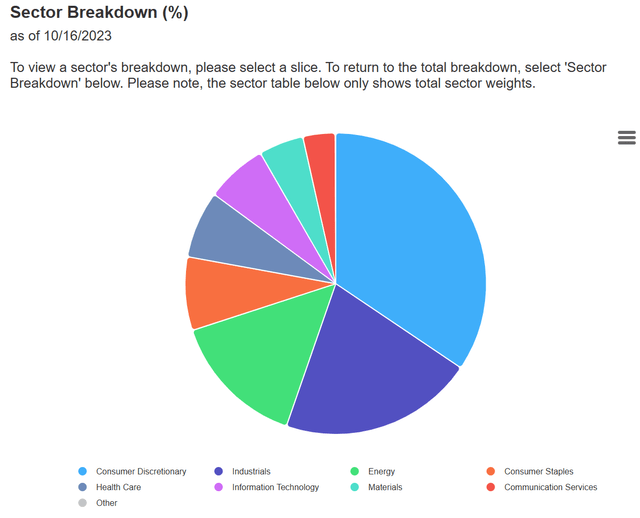

Sector Exposure of CALF

CALF provides exposure to a wide range of sectors, ensuring a diversified investment portfolio. The biggest weighting is in the Consumer Discretionary sector at 34%, with Industrials second at 20%. I like the free cash flow focus when it comes to discretionary stocks, as I suspect that this sector will be the most challenged should a recession be at our doorstep.

This sector allocation might change over time as the ETF is reconstituted and rebalanced quarterly based on the free cash flow yield of companies within these sectors.

The Bottom Line

Investing in small-cap companies can be a profitable endeavor, especially when guided by a well-defined strategy like the one employed by CALF. Given the current economic climate, where rising rates are a continued concern, a cash flow-focused strategy like CALF's becomes all the more appealing. By investing in companies with strong free cash flows, investors are better positioned to weather potential economic downturns and capitalize on growth opportunities when they arise.

Pacer US Small Cap Cash Cows 100 ETF is a good fund, and a notable standout in the small-cap space.